As a new benchmark emerges in the tech landscape of Hong Kong stocks, the strength of Chinese technology is gaining global capital attention. On December 9, the Hong Kong Exchanges and Clearing Limited (HKEX) made a major announcement of the first batch of constituent stocks for the “HKEX Tech 100 Index”. UBTECH Robotics (Stock Code: 09880.HK), hailed as the “first stock of humanoid robots”, was successfully selected.

The “Entry Ticket” to the Index

The “Passport” to Hard Tech Strength

The “Tech 100” Index launched by HKEX is by no means an ordinary list. It adopts R&D intensity, innovation capability and industry representativeness as its core screening criteria. Constituent stocks must meet stringent requirements such as “R&D expenditure accounting for no less than 3% of revenue in the past two years” and “average daily turnover exceeding HK$20 million”. Additionally, all constituent stocks are eligible for the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect programs, directly connecting mainland and international capital markets. UBTECH’s inclusion is, in essence, an authoritative endorsement of its “technological value” by the capital market.

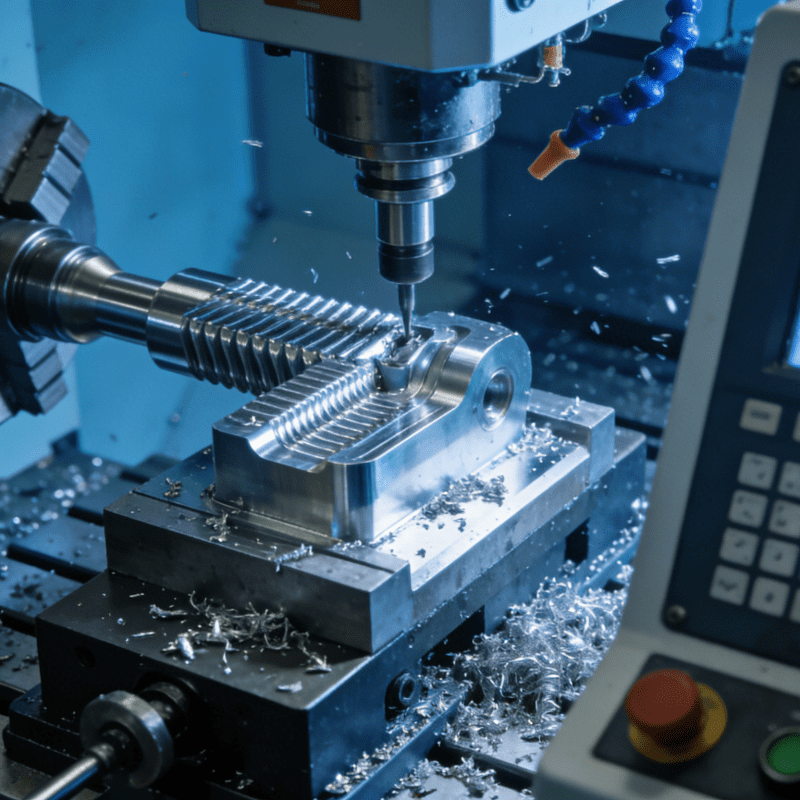

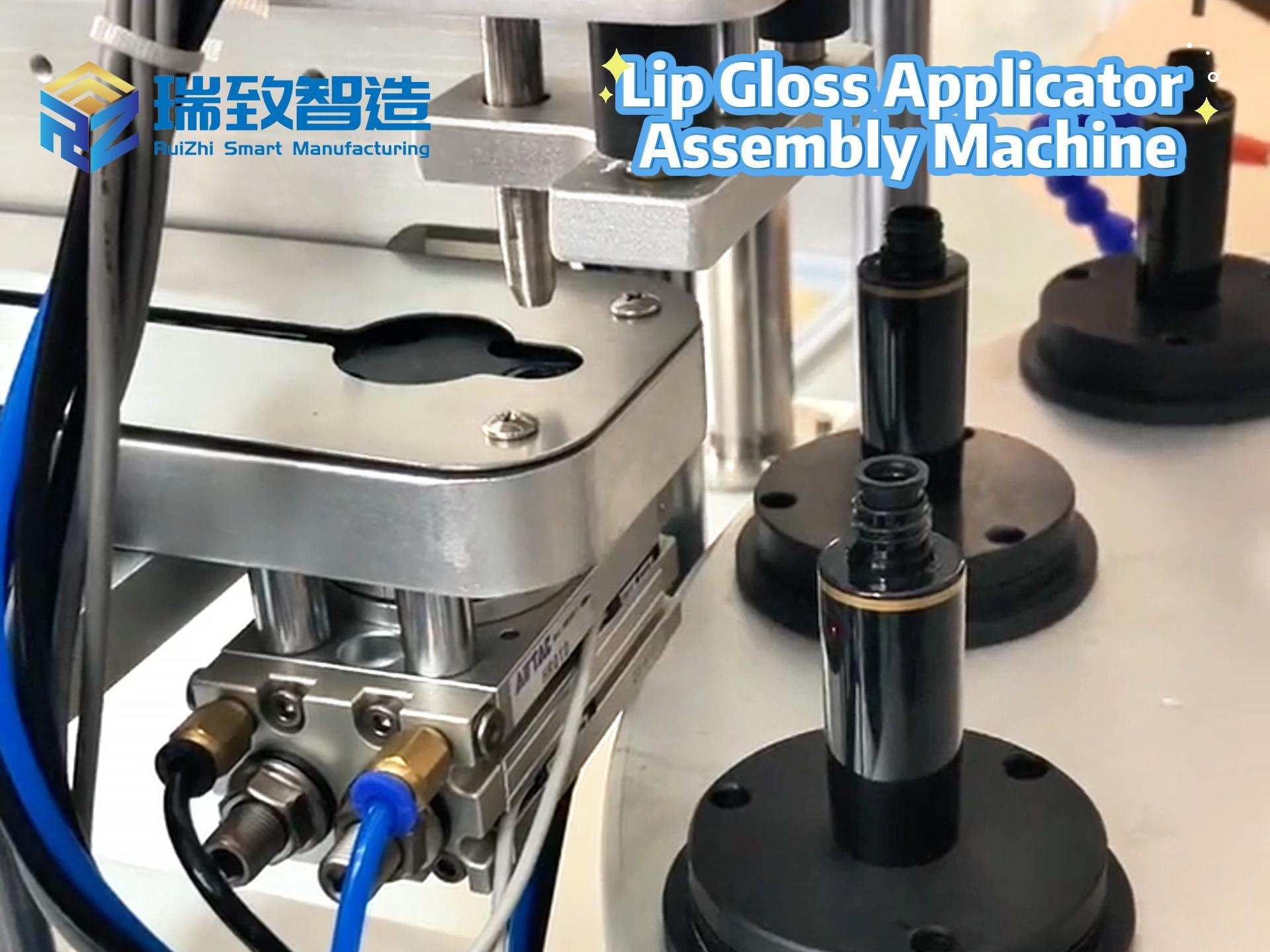

As one of the very few enterprises worldwide mastering the full-stack technology of humanoid robots, UBTECH has accumulated a large number of patents for its independently developed servo joints, motion control algorithms, and key industrial automation components such as the Automatic Circlip Feeding System. This system, integrated into its Walker series robots, enables high-precision, automated assembly of automotive components by precisely delivering circlips to target positions with minimal human intervention—greatly enhancing production line efficiency and consistency. Its Walker series robots have completed multi-robot collaborative training and 7×24-hour continuous operation verification in automobile factories, which exactly reflects the “lab-to-production line” transformation capability valued highly by the “Tech 100” Index.

For enterprises, inclusion in this index means direct access to incremental capital attention. E Fund Management has been approved to launch an ETF tracking this index, which will bring stable institutional capital inflows to UBTECH, attract in-depth research on the humanoid robot track by international capital, and unlock room for valuation re-rating.

Order Verification

The “Touchstone of the Market” for Technological Value

The rigorous screening of the index ultimately needs to be supported by solid market results, and the intensive large-value orders recently secured by UBTECH serve as the strongest evidence. On December 10, the company disclosed an enterprise order worth over RMB 50 million for AI large models, with the core delivered product being Walker S2, the world’s first industrial robot with autonomous battery swapping. The order not only includes hardware supply, but also opens up underlying interfaces to support partners in achieving deep integration of “AI large models + robot bodies”. This technology collaboration model is exactly the core rigid demand in industrial scenarios.

This order is by no means an isolated case. In November alone, UBTECH successively won orders including a RMB 143 million project for a humanoid robot data collection and training center in Jiujiang, a RMB 264 million project at a border port in Guangxi, and a RMB 159 million data collection center project in Zigong. These achievements have proven from the side that the company’s products have passed industrial-grade reliability verification—exactly the “technology commercialization capability” that the “HKEX Tech 100” Index values most.

Behind the Dual Recognitions

A Clear Signal for Track Value

From being included in the MSCI China Index in November to joining the “HKEX Tech 100” Index in December, the dual capital recognitions within just one month have further consolidated UBTECH’s value.

There are vivid cases proving the driving effect of inclusion in authoritative indices on enterprises’ trading volume. Just last month, immediately after UBTECH was included in the MSCI China Index, its after-hours trading volume reached nearly HK$1.6 billion within a few minutes, with the full-day cumulative trading volume exceeding HK$3.1 billion—a threefold surge compared with the previous day, bringing a significant boost to trading volume.

UBTECH’s inclusion in the “HKEX Tech 100” Index will undoubtedly replicate or even amplify this effect: institutional investors such as index funds and quantitative funds will follow up with allocations, bringing sustained and stable capital inflows to the stock and further boosting trading activity.

Significance for the Track

Setting a “Value Benchmark” for Humanoid Robots

UBTECH’s selection into the “HKEX Tech 100” Index goes far beyond the scope of the company’s own development—it has established a clear value evaluation standard for the entire humanoid robot track. Previously, the industry was rife with products focusing on technological showmanship but detached from actual demand. The logic behind the “HKEX Tech 100” Index’s choice of UBTECH is clear: focusing on hardcore enterprises that can truly solve industrial pain points and have mass production capabilities.

From a market perspective, this selection not only conveys recognition for a single enterprise, but also sends a clear signal that the Hong Kong stock market has included humanoid robots in its core tech assets. This signal has made “solving actual demand and possessing commercialization capability” the core value anchor of the track, injecting solid long-term confidence into the long-term development of the entire industry.