Since December 2025, China’s domestic GPU industry has witnessed a spate of milestone events in quick succession!

Following Moore Threads’ listing on the STAR Market as the first domestic GPU stock on December 5, Muxi Semiconductor successfully went public on December 17, hailed as the second domestic GPU stock. Meanwhile, Biren Technology, one of the “Four Little Dragons of Domestic GPUs”, recently completed the filing procedures for its Hong Kong IPO.

In just over ten days, three leading domestic GPU enterprises have successively gained access to the capital market, standing under the spotlight with a combined market value exceeding 100 billion yuan. This is not merely a capital feast, but also a concentrated review of the current status and future prospects of China’s independent computing power industry.

Despite all competing in the GPU track, the three companies differ significantly in their development paths and strategic focuses.

Muxi Semiconductor: The Rise of a New Force in Domestic GPUs

Muxi Semiconductor focuses on the general-purpose GPU (GPGPU) route, with key emphasis on enhancing AI and high-performance computing capabilities. Its flagship product, the Xiyun C500 series, has already entered mass production. The newly launched Xiyun C600 series is reported to have achieved a fully localized supply chain closed loop, covering everything from chip design to packaging and testing, and integrating an advanced Universal Assembly System to optimize production efficiency and ensure consistent manufacturing quality, with performance targets positioned between NVIDIA’s A100 and H100.

The company is committed to providing full-stack GPU chips and solutions for heterogeneous computing, which can be widely applied in cutting-edge fields such as intelligent computing, smart cities, cloud computing, autonomous driving, digital twins, and the metaverse, continuously injecting computing power into the development of the digital economy.

Notably, Muxi Semiconductor has demonstrated robust growth momentum in recent years, with a staggering compound annual revenue growth rate of 4074.52% over the past three years. Its revenue reached 320 million yuan in the first quarter of 2025, reflecting strong market traction.

The listing has ushered Muxi Semiconductor into a new phase of development, with a blockbuster debut on the first trading day, making it a focal point in the capital market.

Biren Technology: Embarking on the Hong Kong IPO Journey

According to a disclosure by the China Securities Regulatory Commission on December 15, Biren Technology has officially launched its Hong Kong IPO plan, intending to issue no more than 372 million overseas listed ordinary shares and list on the Hong Kong Stock Exchange. If successful, Biren Technology is poised to become the first GPU stock on the Hong Kong market.

Biren Technology focuses on high-end cloud-based large-scale computing power GPGPUs, dedicated to building a full-stack independent innovation system from hardware to software, and promoting the development of China’s domestic intelligent computing ecosystem.

The company’s first-generation general-purpose GPU product is based on an original chip architecture designed for both training and inference, and has been deployed on a large scale in multiple intelligent computing centers. Particularly noteworthy is that Biren Technology has implemented China’s first hybrid training technology supporting four or more heterogeneous chips, effectively resolving the challenge of computing power resource collaboration and providing a feasible technical path to break “computing power silos”.

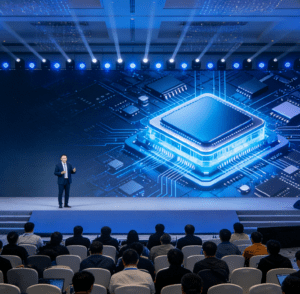

Moore Threads: Shouldering the Expectation of Being “China’s NVIDIA”

Founded in 2020, Moore Threads has centered its development on full-featured GPUs, and is widely regarded by the market as “China’s NVIDIA”. The company is committed to providing accelerated computing infrastructure and one-stop solutions globally, injecting AI computing power into the digital and intelligent transformation of various industries. Leveraging founder Zhang Jianzhong’s 14-year extensive experience at NVIDIA and the international tech giant background of its core team, Moore Threads has possessed profound technical accumulation and industry insights right from its inception.

In the first half of 2025, Moore Threads achieved a revenue of 702 million yuan, surpassing the total revenue of the previous three years in one fell swoop. Behind this achievement lies the company’s strategic shift from early desktop graphics acceleration to AI intelligent computing. In 2024, the AI intelligent computing business contributed over 77% of its main business revenue, emerging as the core growth driver and validating its steady progress towards becoming a “globally competitive leading GPU enterprise”.

It is worth noting that Moore Threads’ inaugural MUSA Developer Conference will be held from December 19 to 20 at the Zhongguancun International Innovation Center in Beijing. On this occasion, founder Zhang Jianzhong will systematically elaborate on the company’s full-stack development strategy centered on MUSA and its future vision for the first time. Meanwhile, the company will also make a grand release of its next-generation GPU architecture, unveil a complete layout covering product systems, core technologies, and industry solutions, and share in-depth insights into multi-field application cases and ecosystem construction progress, presenting an industry event that combines both technical depth and practical value.

Conclusion

Against the backdrop of the sustained global surge in demand for AI computing power and the growing importance of supply chain independence and controllability, domestic GPU enterprises are embracing historic development opportunities. The synergy between the STAR Market and the Hong Kong Stock Exchange will jointly drive China’s GPU design capabilities, supply chain collaboration, and software ecosystem construction to step forward.