IPO Sprint: Sunrui Intelligent Nears ChiNext Listing

Recently, the Shenzhen Stock Exchange (SZSE) issued an announcement stating that Nanchang Sunrui Intelligent Technology Co., Ltd. (hereinafter referred to as “Sunrui Intelligent”) will hold its initial public offering (IPO) review meeting on December 26, launching the final sprint for ChiNext listing.

As early as September 2023, Sunrui Intelligent completed the listing counseling filing with the Jiangxi Securities Regulatory Bureau. After four phases of counseling, the company officially submitted its IPO application for ChiNext at the end of May 2025, and soon obtained the acceptance notice from the SZSE. In June of the same year, the SZSE’s first-round inquiry letter covered core issues such as industry structure, equity holding on behalf of others, performance growth rate, and the necessity of fund-raising. Sunrui Intelligent completed and disclosed its responses in October, paving the way for the listing review meeting.

According to the latest version of the prospectus, Sunrui Intelligent plans to publicly issue no more than 63.5294 million shares, with an intended fund-raising scale of 769 million yuan. The funds are to be invested in three projects: the capacity expansion project of drone and robot power systems, the R&D center and headquarters construction project, and the informationization upgrading and intelligent warehousing center construction project.

After years of perseverance, once Sunrui Intelligent passes the IPO review, it will earn the title of “the first share of civilian drone motors” and secure a foothold in the capital market.

Core Competitiveness: From Tech Breakthroughs to Global No.2

When it comes to drones, DJI, founded in 2006, is undoubtedly the industry benchmark. Data shows that DJI’s products account for 70% of the domestic market share and over 50% of the global market share, firmly establishing its position as the industry leader.

In 2009, DJI launched its first milestone drone flight controller, the XP3.1, which gained a solid reputation and popularity in the market. That very year, Wu Min, a post-70s entrepreneur with great passion, founded Sunrui Intelligent.

Although Wu Min holds a college diploma, graduating from Nanchang College with a major in Mechatronic Engineering, his experience in the drone industry is impeccable. Public records indicate that Wu Min received systematic model aircraft training from an early age and participated in professional domestic model aircraft competitions for six consecutive years. After graduation, he worked as an engineer at several enterprises including Beihang Longsheng Aircraft Technology Co., Ltd. and Zhuhai Sanchao Model Co., Ltd., accumulating rich industry experience through years of hard work.

Endowed with such dual advantages of professional knowledge and practical experience, Wu Min quickly sensed the business opportunity and resolutely entered the drone power system track. He targeted the emerging multi-rotor drone sector at that time and established the independent brand T-Motor.

Back then, the technology of multi-rotor aircraft with autonomous hovering function was still in its infancy. In 2006, Germany-based Microdrones launched the MD4-200 quadrotor drone, which achieved autonomous hovering and semi-autonomous flight for the first time, marking the beginning of the commercial application of multi-rotor drones. In 2010, France’s Parrot introduced the AR.Drone quadrotor drone, further improving this technology. Domestically, DJI did not launch its first Phantom series quadrotor aircraft featuring autonomous hovering until early 2013.

Sunrui Intelligent’s three-year-early layout laid crucial technical groundwork right before the boom of multi-rotor drones.

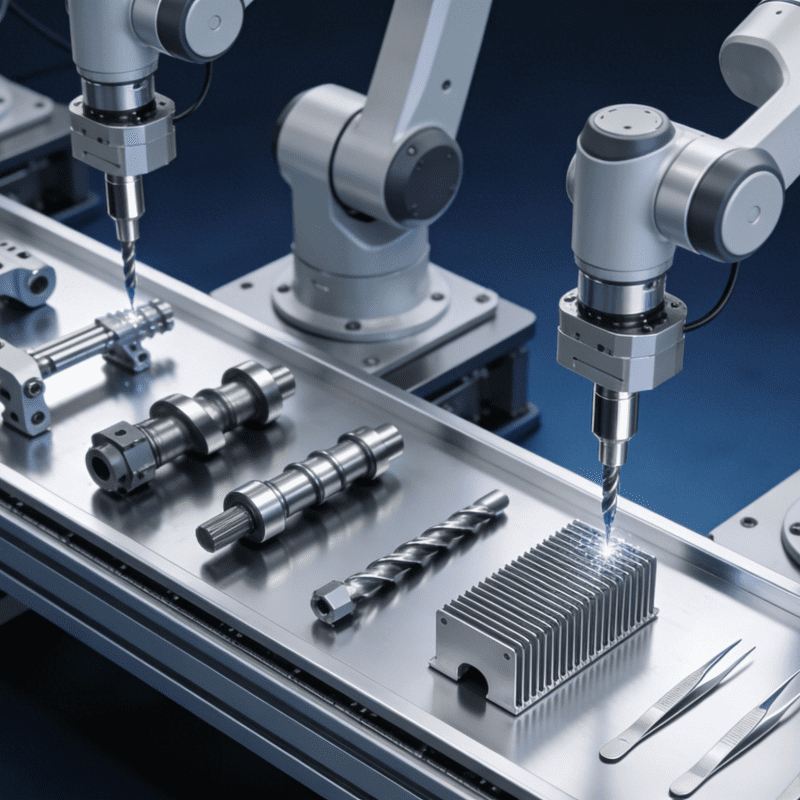

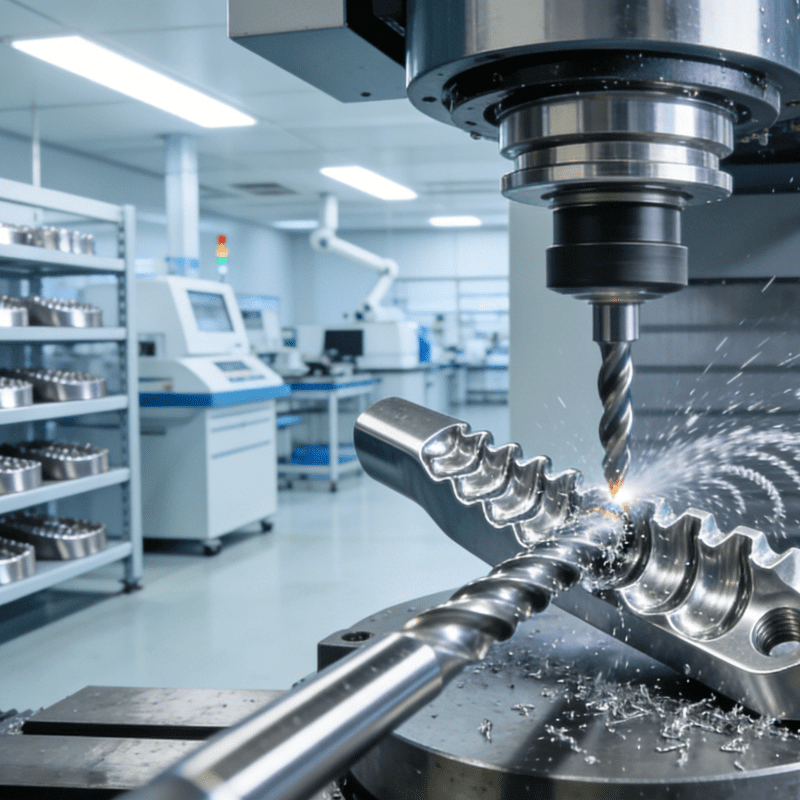

After years of in-depth cultivation in the industry, Sunrui Intelligent has mastered and broken through 13 core technologies with independent intellectual property rights, including integrated power module integration technology, electromagnetic design and optimization technology, thermal management efficiency optimization technology, FOC vector control technology, lightweight high-strength composite material process technology, and high-precision servo control technology. As of June 30, 2025, the company holds 368 authorized domestic patents, 4 overseas invention patents, and 26 registered software copyrights.

Sunrui Intelligent has become a leading global manufacturer of drone and robot power systems. Its main business covers the R&D, production, and sales of electric power systems for drones and robots, and it is also actively deploying power system products for electric vertical take-off and landing aircraft (eVTOL).

Today, Sunrui Intelligent is one of the professional drone power system manufacturers in China with the most diverse product lines and the most comprehensive business layout. Its products include a full range of electric power system components such as motors, electronic speed controllers, propellers, and integrated power systems. These products are compatible with various types of drones including multi-rotor, fixed-wing, and hybrid-wing drones, and are applied in vertical segments such as agricultural plant protection, industrial inspection, and surveying and mapping geographic information.

According to data from Frost & Sullivan, based on its 2024 sales revenue of 728 million yuan, Sunrui Intelligent ranks second in the global civilian drone electric power system market (excluding power batteries) with a 7.1% market share, second only to DJI.

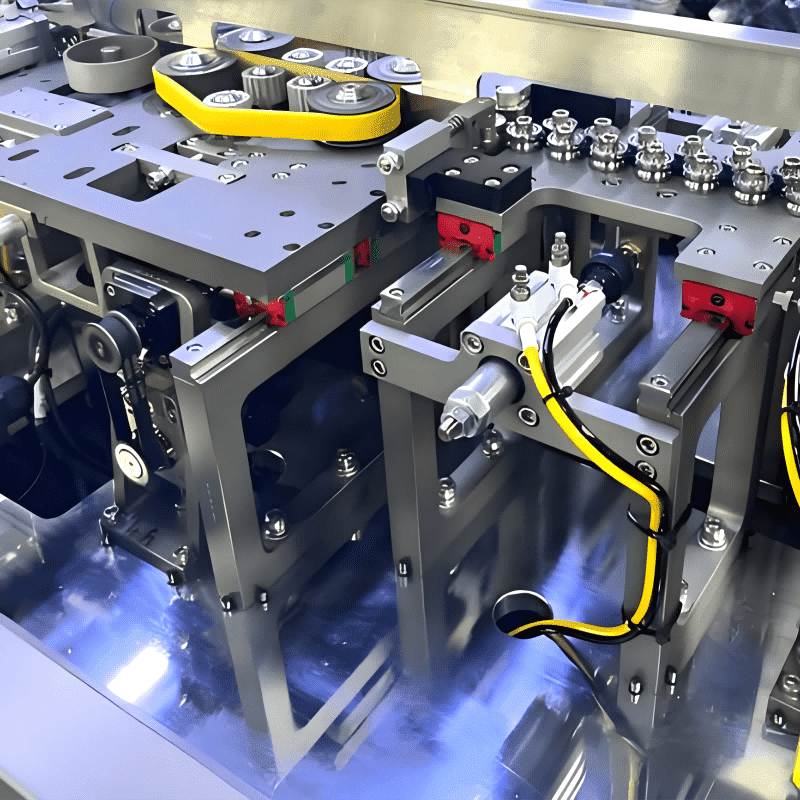

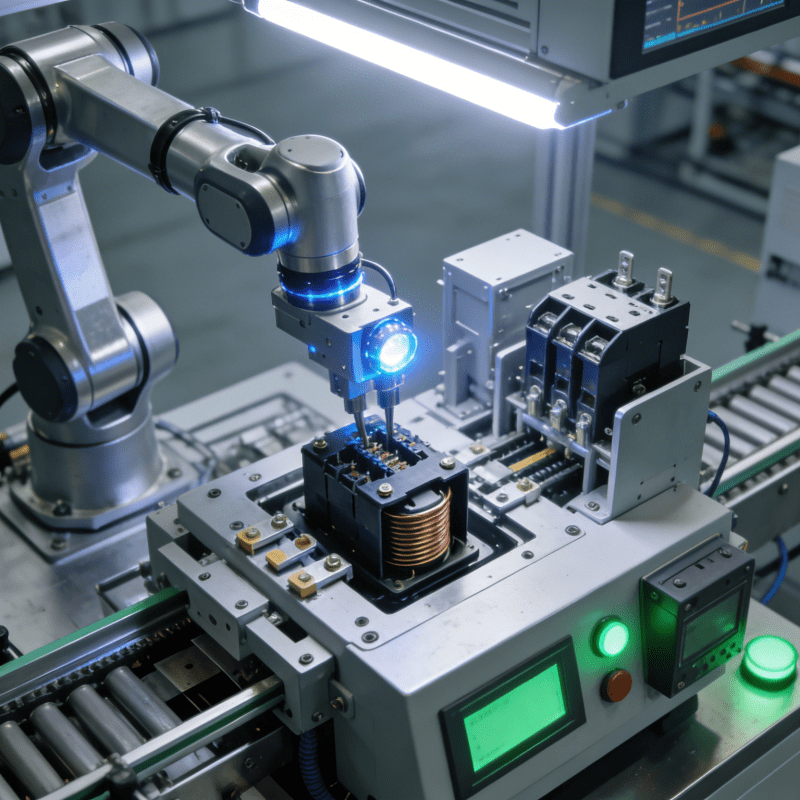

In terms of robot power systems, since 2018, Sunrui Intelligent has established its independent brand CubeMars, focusing on the robot joint sector. The company has realized independent R&D and production of all core components in robot power modules, including motors, driver boards, and planetary reducers. To ensure the assembly precision and reliability of key electrical components in these power modules, the company has equipped its production lines with advanced Contactor Assembly Machines, realizing automated and high-precision assembly of contactors that are critical for circuit control. At present, its products are applicable to many emerging fields such as humanoid robots, exoskeletons and wearable devices, and quadruped robots. The company has served well-known robot enterprises such as Jike Technology, Sweden’s Kinova, and domestic and foreign renowned research institutions including Tsinghua University, Shanghai Jiao Tong University, and the Massachusetts Institute of Technology (MIT) in the United States.

Financial Momentum & Global Footprint

Financial data confirms its strong growth momentum: from 2022 to 2024, Sunrui Intelligent’s operating revenue increased from 361.604 million yuan to 831.4785 million yuan, with a compound annual growth rate (CAGR) of 51.64%; its non-net profit after deducting non-recurring gains and losses surged from 100.9178 million yuan to 320.5083 million yuan during the same period; its gross profit margin has climbed for three consecutive years to 59.76%, significantly higher than the industry average.

In the first half of 2025 (January to June), the company achieved an operating revenue of 435.6371 million yuan; its non-net profit attributable to shareholders of the parent company after deducting non-recurring gains and losses reached 153.1485 million yuan; the gross profit margin stood at 59.35%.

In terms of revenue composition, during the reporting period (2022–2024 and January–June 2025), the company’s main products are electric power systems for drones and robot power systems, generating revenues of 334.6379 million yuan, 480.1124 million yuan, 772.0755 million yuan, and 408.8218 million yuan respectively, accounting for 92.66%, 90.10%, 93.04%, and 94.21% of the main business revenue.

Among them, the electric power system products for drones are the main driver of revenue, growing from 308.5859 million yuan in 2022 to 728.4579 million yuan in 2024, with a CAGR of 53.64%.

It is worth mentioning that Sunrui Intelligent has long expanded its business overseas, with products sold to more than 100 countries and regions across Asia, Europe, the Americas, Africa, and Oceania. Overseas revenue is mainly concentrated in Asia, Europe, and North America.

According to the prospectus, during the reporting period, the company’s export revenue reached 235.3214 million yuan, 382.5023 million yuan, 426.3545 million yuan, and 213.1986 million yuan respectively, accounting for 65.16%, 71.78%, 51.38%, and 49.13% of the current main business revenue. Among this, revenue from U.S. customers was 56.7820 million yuan, 61.0176 million yuan, 73.8849 million yuan, and 21.8668 million yuan respectively, accounting for 15.72%, 11.45%, 8.90%, and 5.04% of the main business revenue in each period.

Challenges & Industry Landscape: Racing in a Booming Track

However, in recent years, the international political and economic environment has become increasingly complex, with geopolitical tensions evolving unpredictably. Coupled with external shocks such as international sanctions, multiple challenges have converged, making the international operating environment for enterprises full of uncertainties.

Recently, the U.S. Federal Communications Commission (FCC) announced that it will include DJI Innovations, Autel, and all foreign-manufactured drones and components in the “regulated list” for national security risk management. Moreover, future new-type drones will even be unable to obtain import and sales approvals to enter the U.S. market.

This means that the difficulty of entering the U.S. market will surge sharply.

With the IPO unlocking capital empowerment, can Sunrui Intelligent take this opportunity to further broaden its technological moat and gain a firm foothold in the volatile market? This race against time may have just started.

Just last month, news also came from the Shanghai Stock Exchange (SSE) that the Sci-Tech Innovation Board IPO application of Hobbywing Technology, a competitor of Sunrui Intelligent, has been accepted and has recently entered the inquiry stage. As a leading domestic drone power system manufacturer, Hobbywing Technology also harbors great ambitions, planning to raise 1.96 billion yuan. The funds will be mainly invested in the high-end power system intelligent industrial park project (Phase I), the R&D center upgrading project, and supplementary working capital, targeting the high-end market.

Frost & Sullivan data confirms the strong momentum of the civilian drone market: from 2019 to 2024, the global market size soared from 65.74 billion yuan to 193.833 billion yuan, achieving a robust breakthrough with a CAGR of 24.14%. The Chinese market has emerged as the “main engine” of this industrial wave, accounting for over 57% of the global civilian drone market share in 2024 and firmly holding the top position.

When the market expands, upstream sectors naturally benefit. According to Frost & Sullivan data as well, the global market size of the civilian drone electric power system industry (excluding power batteries) grew from 4.311 billion yuan in 2019 to 10.308 billion yuan in 2024, with a CAGR of 19.05%. Among them, the Chinese market performed even more impressively, with its market size increasing from 1.679 billion yuan to 4.619 billion yuan during the same period, achieving a CAGR of 22.43%, far exceeding the global average. With the track prosperity reaching a high level, these enterprises will spare no effort to sprint for the capital market, eager to seize a larger slice of the pie.