Table of Contents

ToggleTariffs Unleash Havoc on the Automobile Manufacturing Industry: Toyota’s Struggles in the Crossfire

In the complex web of global trade, the automotive manufacturing industry is facing unprecedented challenges as tariffs become a powerful yet disruptive force. Amidst this turmoil, Toyota, a titan in the automotive world, finds itself in the eye of the storm, emerging as one of the hardest – hit companies. The escalating trade disputes, particularly those instigated by the United States, have sent shockwaves through the industry, and Toyota’s vast operations, intricate supply chains, and significant presence in the US market make it acutely vulnerable. As the world watches, the impact of these tariffs on Toyota not only shapes the future of this automotive giant but also serves as a barometer for the broader health and stability of the global automobile manufacturing sector.

Toyota Motor Corporation of Japan is the world’s largest automaker. However, as US President Donald Trump initiates a trade war globally, Toyota is expected to become the biggest loser in the automotive industry.

According to a report by Bloomberg, Trump’s tariffs on imported cars and auto parts have forced General Motors, an American automaker, to cut its full-year profit forecast by $5 billion. Ford, another American carmaker, is facing an annual loss of $1.5 billion.

As for Toyota, a Japanese carmaker, its profit has declined by $1.2 billion in just two months. Although this Japanese automaker has not provided the full-year performance data for 2025, it is expected to have an operating income of 3.8 trillion yen in the fiscal year ending in March 2026, which is far lower than analysts’ expectation of 4.7 trillion yen.

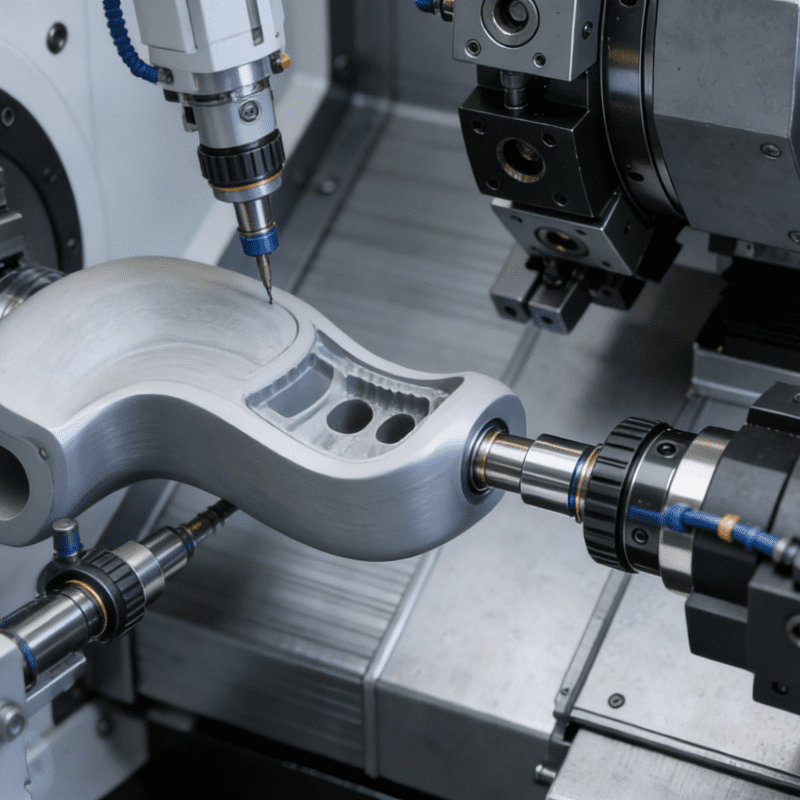

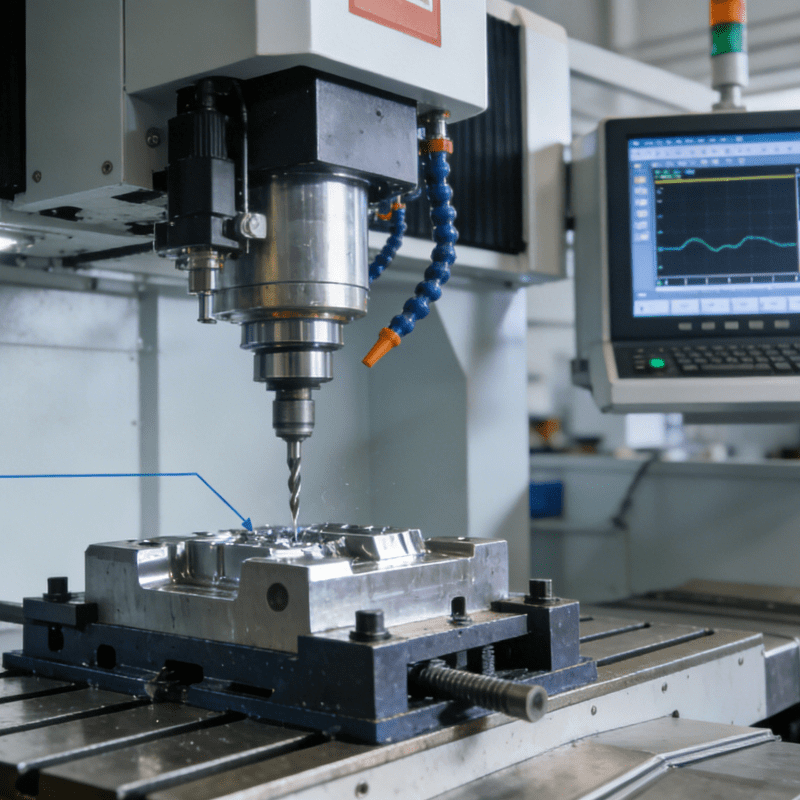

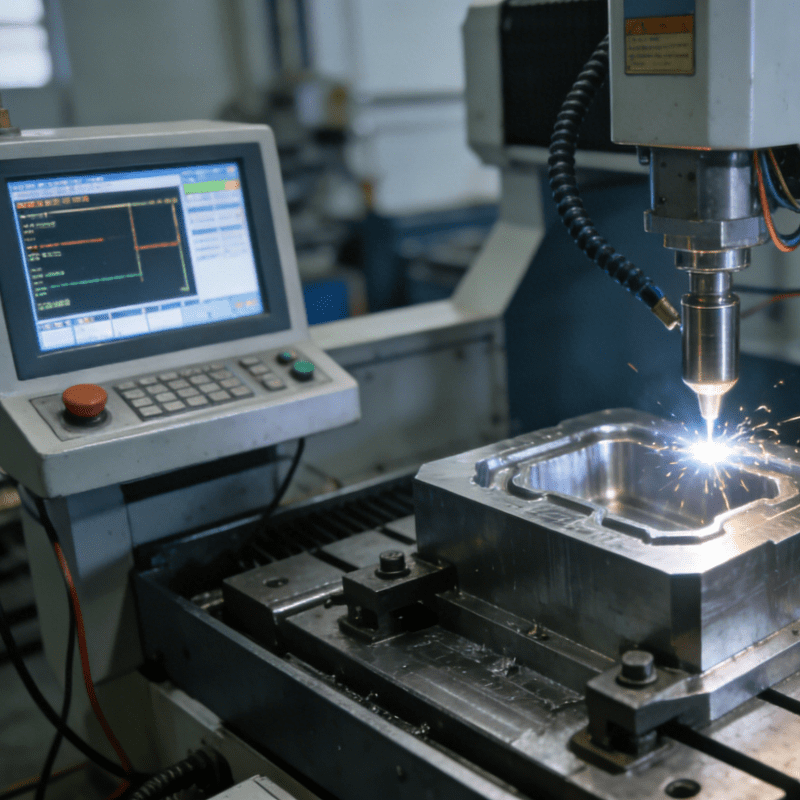

Although Toyota has increased its domestic car production in the United States to more than half of its US sales, the company still relies on imports for its major auto parts and vehicle models, with an annual import volume of about 1.2 million vehicles. The production of these parts often involves advanced equipment such as Auto Parts Assembly Machines, which are crucial for ensuring the precision and efficiency of part manufacturing. However, the tariffs on imported auto parts mean higher costs not only for the parts themselves but also for the potential investment and operation of related assembly machines. This has made Toyota a target of the White House. On April 2, when Trump delivered a “Liberation Day” speech in the Rose Garden, he named this Japanese automaker and complained that Toyota sells one million cars made abroad in the United States.

The impact of huge tariffs reflects that, as the United States and Japan launch bilateral trade negotiations, the company has decided to maintain the prices at its US dealerships and the production volume of its 11 US factories. The bilateral negotiations started in February this year, and it is still unclear when an agreement will be reached.

After announcing the latest financial results last Tuesday (the 6th), Koji Sato, President of Toyota Motor Corporation, said that when it comes to tariffs, the details are still very uncertain, and it is difficult to take measures or measure the impact.

Ryosei Akazawa, Japan’s trade negotiator and Minister of Economic Revitalization, revealed at the end of April that according to calculations by corporate executives, an unnamed Japanese car manufacturer is currently losing about $1 million per hour due to the impact of tariffs. Japanese government officials refused to provide more details, but this loss rate is not far from Toyota’s expected loss of $1.2 billion calculated based on 730 hours per month.

Since April 3, most imported cars entering the United States will be subject to a 25% tariff. After May 3, most auto parts will also face tariffs. Although there are some executive orders to prevent the tariffs from doubling, considering that the United States is the largest market for Japan’s top five automakers, even a small increase in tariffs will have a huge impact on the profits of these companies.

Hiroshi Namioka, Chief Strategist of T&D Asset Management, said that it is very difficult for Japan to reduce the tariffs on cars exported to the United States. At the same time, the automotive industry is too important for Japan, so it cannot simply comply with the will of the United States.

Some Japanese atomakers have already coped with the severe new trade environment by changing their global manufacturing layout. Nissan has suspended its US orders for SUVs made in Mexico; Honda has transferred the production of some vehicle models from Japan to the United States; and Mazda has stopped exporting a model produced at a joint factory with Toyota in Alabama to Canada.

A spokesperson for Toyota Motor Corporation stated that the company will maintain its current operations, continue to be committed to reducing fixed costs, and closely monitor the actions of the US authorities, including tariffs.

Toyota has invested a large amount of money to expand its business in the United States, including spending $13.9 billion to build a new battery factory in North Carolina. At the same time, the company is also committed to maintaining its extensive production bases in Japan. Akio Toyoda, Chairman of the company, has repeatedly promised to produce at least 3 million cars in Japan every year.

Last year, Toyota produced 3.1 million cars in Japan, accounting for about one-third of its global total production. In 2024, Toyota’s global sales reached 10.8 million vehicles. The US market accounted for slightly less than one-fourth of its global sales. Half of the cars sold in the United States are produced locally, another 30% come from neighboring countries Canada and Mexico, and about 281,000 cars are imported from Japan.

Toyota has become the target of the Trump administration, which means that this automaker largely depends on the results of the US-Japan trade negotiations. However, Toyota has refuted the criticism from the White House. A spokesperson pointed out that since 2020, the company has committed to investing nearly $21 billion in the United States, almost twice the amount committed during Trump’s first term. Toyota also mentioned that the number of direct jobs it has created in the US manufacturing industry has increased from 25,000 in 2016 to 31,000.

The Road Ahead: Uncertainty and Resilience in Toyota’s Tariff – Plagued Journey

As the dust continues to settle on the far-reaching effects of tariffs in the automotive industry, Toyota stands at a crossroads, its future hanging in the balance. The company’s struggles in the face of these trade barriers are a stark reminder of the unpredictable nature of global commerce and the significant impact that political decisions can have on even the most established and powerful corporations.

Toyota’s fate now hinges largely on the outcome of the ongoing US-Japan trade negotiations. Every delay, every negotiation stance, and every potential agreement or impasse holds the power to either alleviate the company’s financial woes or exacerbate its challenges. Despite the adversity, Toyota has shown remarkable resilience, with its commitment to maintaining operations, reducing costs, and continuing to invest in both the US and Japanese markets.

The automotive industry as a whole is watching closely, as Toyota’s experience serves as a cautionary tale and a source of potential inspiration. The company’s efforts to adapt its manufacturing strategies, balance its global production footprint, and advocate for more favorable trade conditions will likely shape how other automakers navigate similar tariff – induced storms in the future. In an era where the global economy is more interconnected than ever, the saga of Toyota in the tariff – ridden landscape is not just a story of one company’s battle; it is a microcosm of the broader challenges and opportunities that lie ahead for the entire automobile manufacturing industry as it grapples with an ever – changing trade environment.