2025 is not the end for humanoid robots, but a new starting point. The true fruits of commercialization will be revealed between 2026 and 2027.

Currently, the humanoid robot industry has officially passed the critical stage of transitioning from laboratory demos to industrial validation. As the universal dividends of large model technology spill over, the six core forces of China’s digital economy—Meituan, Tencent, Alibaba, JD.com, Baidu, and ByteDance—have successively entered the field of humanoid robots, the next-generation smart terminals following personal computers, smartphones, and new energy vehicles.

Why Are Internet Giants Entering the Arena Now?

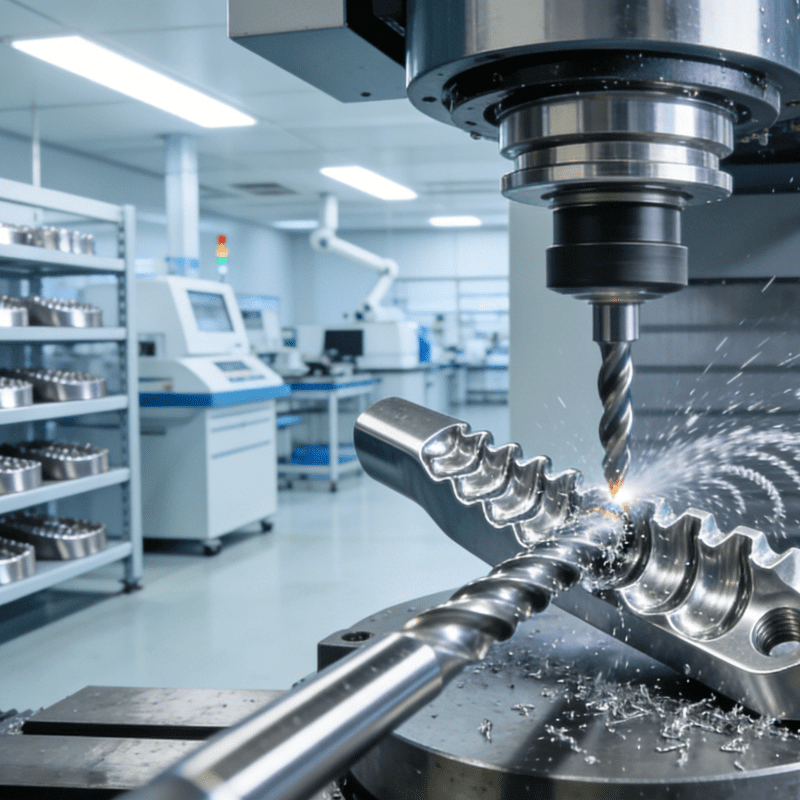

The core driving force behind the collective entry of these giants lies in the dual resonance of the industrial chain’s maturity and the enthusiasm of capital. Over the past decade, the robot industry has been in an awkward predicament of having “a strong physical body but a simple mind”. Although traditional robots developed by Boston Dynamics can perform somersaults, their control logic relies on complex rule-based code, making it impossible to adapt to unknown environments. However, the explosion of generative AI has changed the rules of the game. Large Language Models (LLMs) have equipped robots with a universal “brain”, enabling them to understand natural language and break down complex tasks.

The most intuitive proof of the industry’s popularity is the growth of relevant data. Industry statistics show that the total financing volume of China’s humanoid robot industry exceeded 7 billion yuan in 2024. The financing enthusiasm has further soared since the start of 2025, with the financing volume in January surging by 230% year-on-year, indicating a significant “leap in magnitude” in the industry’s financing market. According to a research report released at the 2nd China Humanoid Robot and Embodied AI Industry Conference in April 2025, the market size of China’s humanoid robot industry is expected to reach 8.239 billion yuan in 2025, accounting for approximately 50% of the global market. This represents a doubling compared to the actual market size of 2.76 billion yuan in 2024. By 2030, the market size is expected to hit 232.63 billion yuan. These record-breaking figures indicate that the industry has moved beyond the initial seed-stage exploration and entered a high-intensity growth period. Companies such as Yushu Technology and Leju Robotics are sprinting towards IPOs.

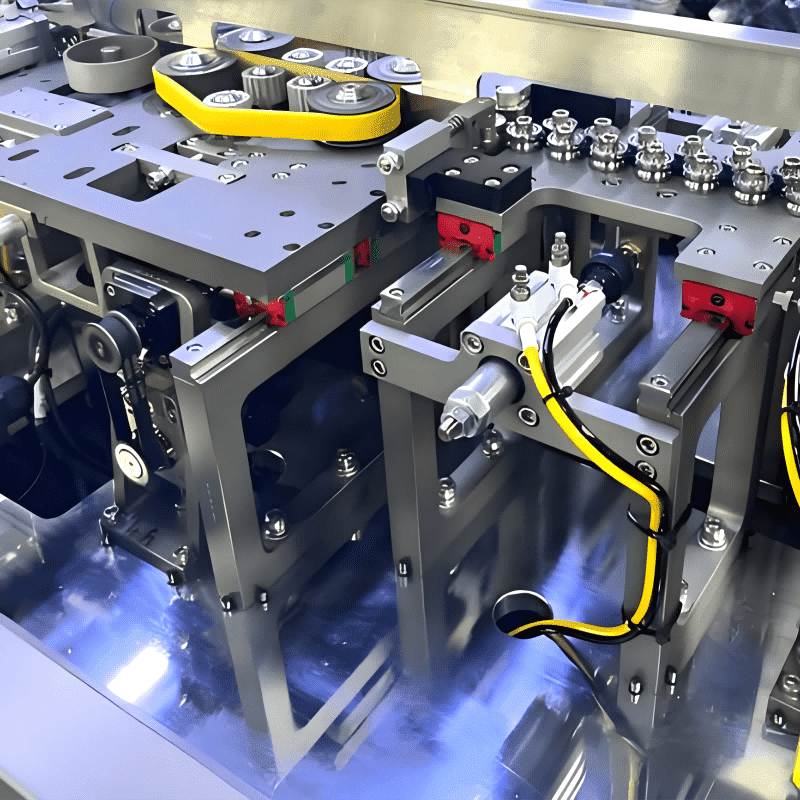

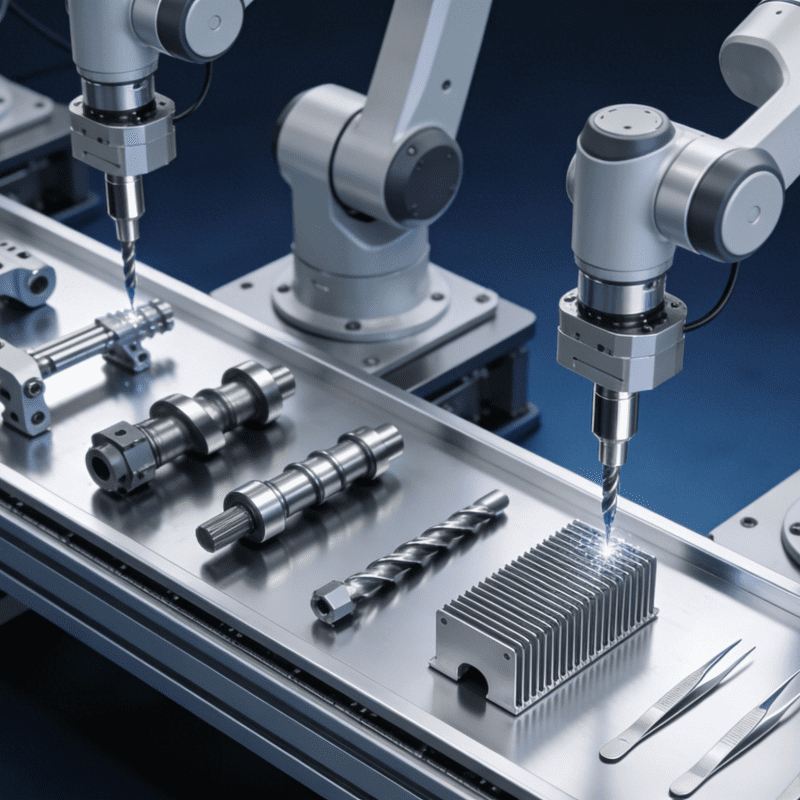

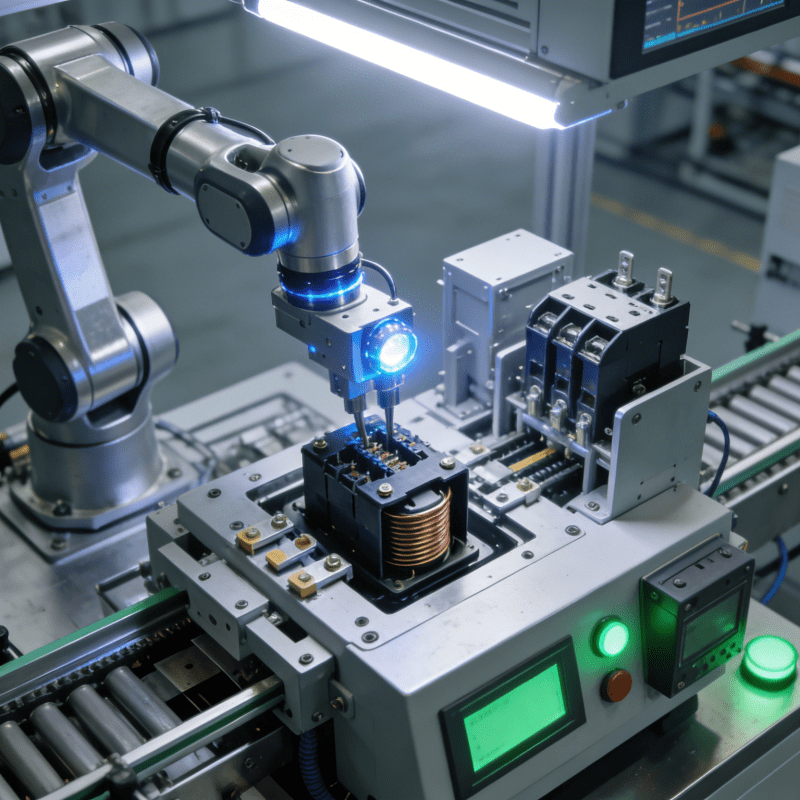

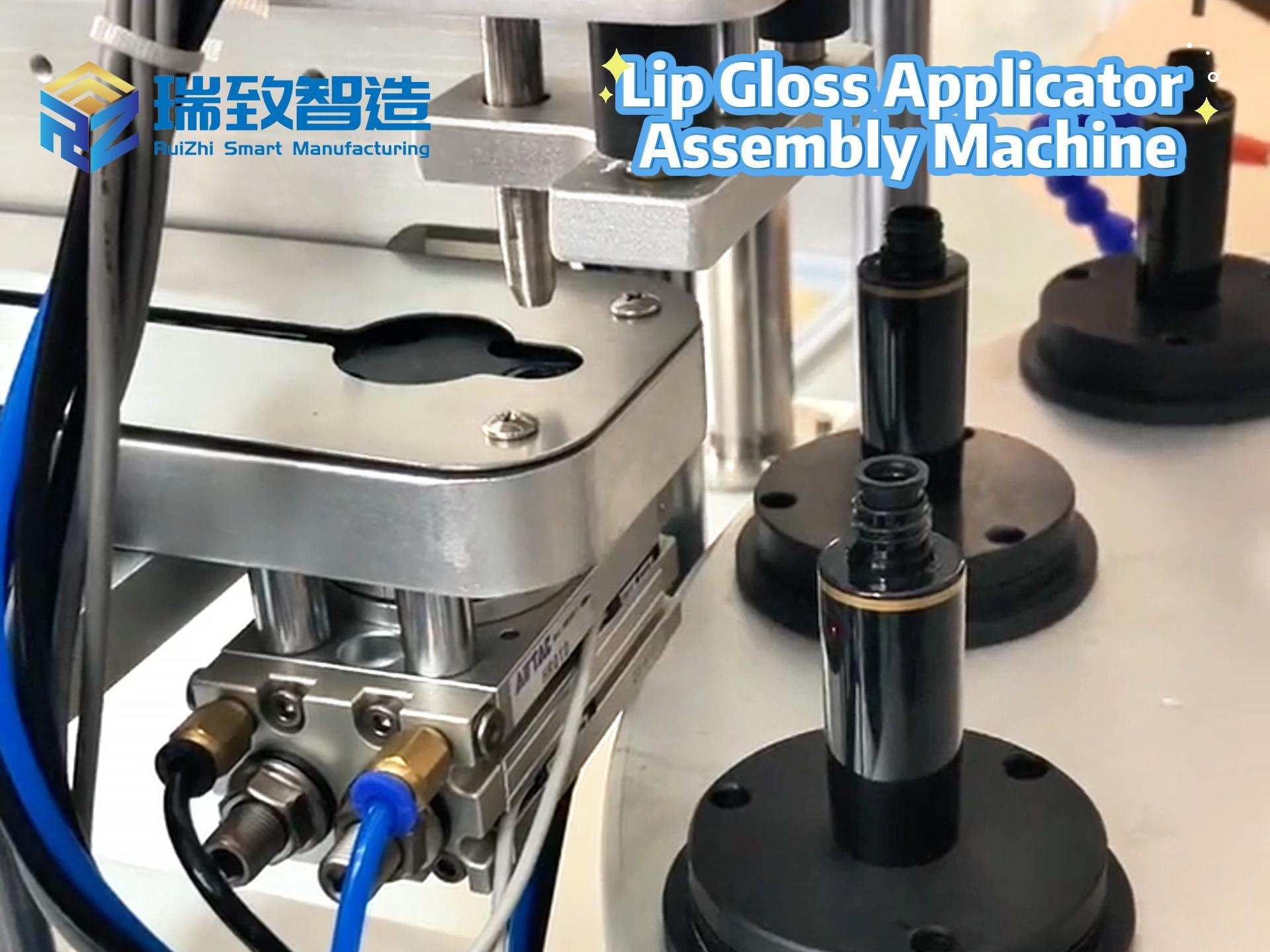

At present, the industrial chain is in a crucial phase of advancing from the “laboratory” to “industrial validation”. In the upstream sector, local manufacturers including Green Harmonic and Inovance Technology have gradually broken the overseas monopoly on the three core components—reducers, servo motors, and controllers. In the midstream sector, hard-tech unicorns represented by Yushu Technology (valued at 8 billion yuan) have achieved global leadership. In 2024, the sales volume of humanoid robots accounted for 30% of its total sales, and the projects won in the first five months of 2025 were close to the full-year level of 2024. In the downstream sector, automobile manufacturing, 3C electronic assembly, and logistics and warehousing have become the first application scenarios to adopt humanoid robots. Currently, the 4 – Axis Robotic Small Product Assembly System has been widely used in 3C electronic assembly for fixed-process operations such as component fitting and screw locking, while humanoid robots are expected to break through the limitations of fixed workflows, realizing flexible assembly of multi-variety and small-batch products in this field.

Notably, multiple “landmark large orders” have emerged in 2025. China Mobile’s 124 million yuan humanoid robot procurement order was split between AgiBot (78 million yuan) and Yushu Technology (46.05 million yuan). UBTECH Robotics has partnered with more than ten automobile manufacturers and secured over 500 orders. Leju Robotics delivered its 100th full-size humanoid robot to BAIC Off-Road. Meanwhile, the mass production and delivery progress of humanoid robots have accelerated significantly: AgiBot has rolled out a total of 1,000 units (including 731 bipedal models and 269 wheeled models); Yushu G1 was priced at 99,000 yuan in May and entered mass production; Leju Robotics’ orders in Q1 2025 increased by 200% year-on-year; and the orders for Songyan Power’s N2 model have exceeded 2,000 units. These developments demonstrate that B-end procurement has shifted from “proof-of-concept” to “large-scale deployment”, and the production capacity on the supply side is maturing at an accelerated pace.

It is precisely seeing the opportunity brought by the maturing industrial chain and improving supply chain that internet giants have heavily invested in this track. Different from the competition for traffic in the mobile internet era, the core logic behind the giants’ entry this time lies in the technological convergence of Embodied AI. As LLMs showcase universal reasoning capabilities, internet enterprises are attempting to extend their advantages in software and algorithms to the physical world and build the next generation of smart terminals.

Distinct Strategic Differences Among the Six Internet Giants

Against this backdrop, the six internet giants have formed distinct strategic orientations based on their respective business foundations and technological accumulations.

Meituan and JD.com: “Battle for Logistics Capacity” – Focusing on Scenarios

For Meituan and JD.com, humanoid robots are not merely technological reserves but strategic necessities to address the structural labor shortage. It is observed that both enterprises have adopted a pragmatic approach of “exchanging scenarios for technology” and “exchanging capital for time”.

Baidu: Building an Ecological Foundation – Focusing on Model Empowerment

In essence, the competition in the robot industry is a contest of model capabilities. Whoever masters the top-tier cognitive models can occupy the high-profit links in the industrial chain.

Baidu has adopted a model of in-depth cooperation with hardware manufacturers. By integrating its ERNIE Bot large model into robot bodies such as UBTECH Walker S, Baidu is committed to solving the problem of robots’ “understanding and planning” capabilities. In addition, through Baidu Ventures, Baidu has continuously invested in innovative enterprises like Vita Dynamics. Its layout in the collection and annotation of high-quality embodied data is also intended to seize the source of data for future robot training.

Meanwhile, Baidu is focusing on enhancing the application capabilities of large models in robot scenarios. In field tests in automobile manufacturing scenarios, robots equipped with Baidu’s large model have demonstrated the ability to decompose complex voice commands, verifying the core role of large models in embodied AI.

ByteDance and Tencent: Breaking Through at the Bottom – Focusing on Algorithmic Technology

Tencent and ByteDance have chosen a more fundamental path with higher technological intensity, aiming to break through the limits of physical control through algorithmic innovation.

Tencent has leveraged its strengths in game engines and simulation technologies to focus on bridging the “Sim-to-Real” gap. In July 2025, Tencent, in conjunction with Futian Laboratory, launched Tairos, an open platform for embodied AI, at the World Artificial Intelligence Conference (WAIC). Defined as the “intelligent hub” for robots, this platform includes multimodal perception models and planning large models, enabling robots to undergo millions of low-cost training sessions in virtual environments.

Tencent’s open platform for embodied AI has attracted the access of many leading hardware manufacturers such as Yushu Technology, Leju Robotics, and Yuejiang Robotics. By building a standardized software foundation, Tencent aims to lower the threshold for robot development and promote the prosperity of the entire ecosystem. In terms of investment, public information shows that Tencent also invested in key projects such as AgiBot, Yushu Technology, and CloudWhale Robotics in the first half of 2025 and launched multiple rounds of additional shareholdings.

ByteDance is the latest entrant and has adopted an aggressive strategy centered on the end-to-end technical route. Relying on the computing power and talent reserves accumulated in recommendation algorithms, ByteDance has established a high-level robot team led by Li Hang, the former director of Huawei Noah’s Ark Laboratory, and the team size is expanding rapidly.

ByteDance’s talent acquisition strategy has demonstrated strong execution. The annual salary for its publicly recruited robot-related positions ranges from 950,000 to 1.2 million yuan. It has quickly assembled top talents with its strong financial strength, causing a stir in the industry. Furthermore, ByteDance plans to invest over 12 billion US dollars in AI infrastructure in 2025, fully reflecting its strategic emphasis on this track.

ByteDance’s main research direction directly targets end-to-end control algorithms. This is a disruptive technical route that attempts to enable neural networks to directly map sensor data to motor control signals, eliminating the reliance on traditional rule-based control. In October 2024, ByteDance released its second-generation robot large model GR-2, which underwent generative training on 38 million internet video clips and 50 billion tokens. In multi-task learning tests covering 105 different desktop tasks, GR-2 achieved an average success rate of 97.7%.

ByteDance’s advantage lies in its massive computing power and data processing capabilities accumulated from recommendation algorithms, placing it at the forefront of the industry in solving the challenges of robots’ hand-eye coordination and generalized operations.

Conclusion

Although the joint efforts of capital and major giants have driven the rapid development of the industry, the humanoid robot sector still faces two core challenges. Firstly, there is a disconnect between cost control and the coordination of software and hardware. Despite domestic supply chains having conquered core components such as reducers and motors, reducing costs by 30% – 40%, the cost of high-performance complete machines remains high, and the latency in real-time response coordination between large models and hardware still needs optimization. Secondly, there is a shortage of high-quality physical interaction data. Unlike text data, real-world data involving force control and tactile sensations is extremely scarce. This explains why giants like Alibaba and Tencent are actively developing synthetic data and simulation platforms. In the future, whoever can take the lead in acquiring massive training data at low cost will be able to develop smarter robots.

Nevertheless, these challenges are being resolved one by one. As analyzed in this article, internet giants have formed a clear division of labor based on their respective strengths: Meituan and JD.com focus on scenarios and channels; Alibaba and Baidu concentrate on ecosystem and infrastructure development; ByteDance and Tencent delve deep into algorithms and technologies. This division of labor is not a simple upstream-downstream relationship but an in-depth collaboration and integration centered on the three major systems of robots—”brain, small brain, and limbs”. This open and collaborative ecological structure will be the key path for China’s humanoid robot industry to compete for global leadership. According to the plan of the Ministry of Industry and Information Technology, by 2027, the humanoid robot industry will accelerate its large-scale development. Relevant products will be deeply integrated into the real economy and become an important new engine for economic growth.