Redefining Financial Reporting: How Intelligent Automation Transforms Back-Office Operations

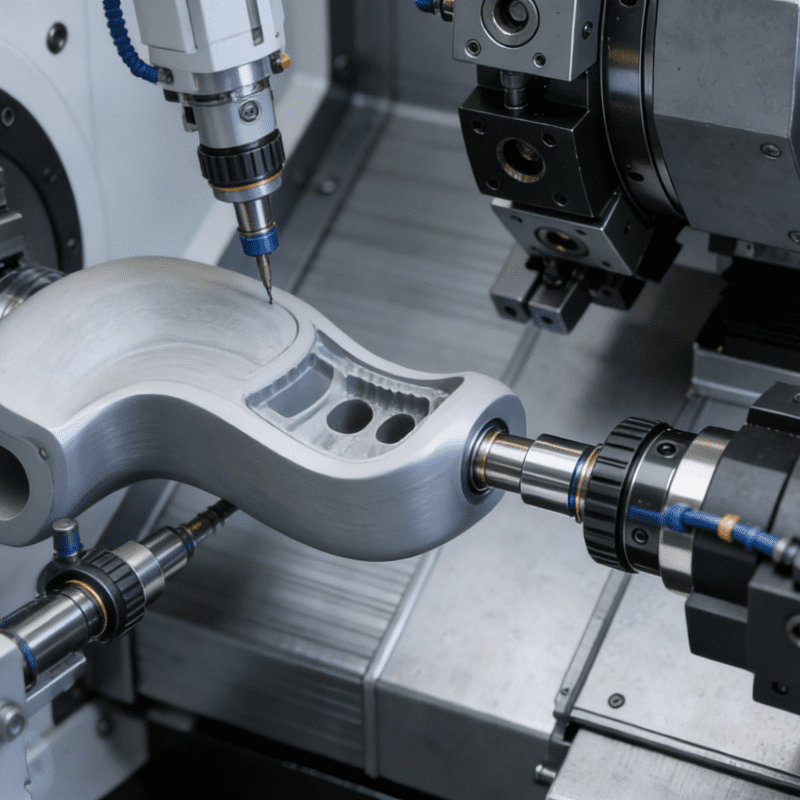

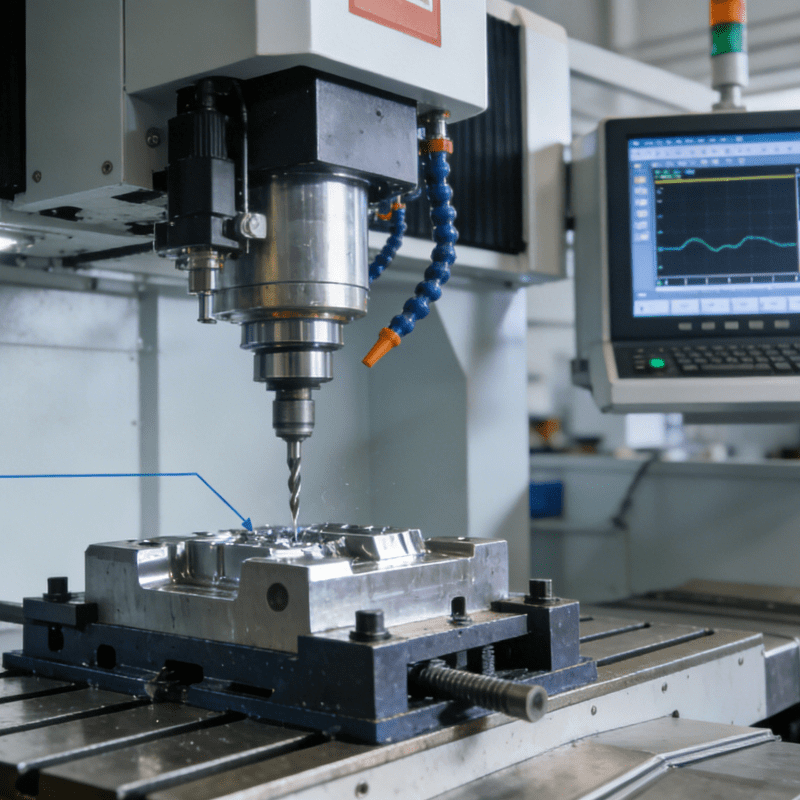

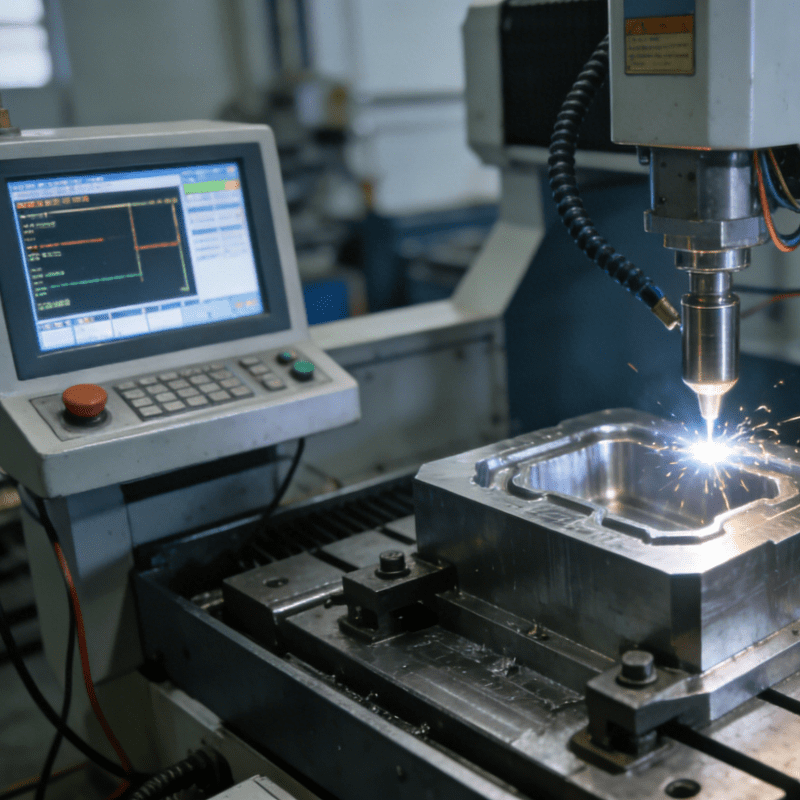

In an era where industrial automation and automation equipment have revolutionized manufacturing and supply chains, the financial sector is undergoing its own transformation—driven by intelligent automation. As expert Siva Prasad Marri notes, the marriage of AI and machine learning (ML) is not just optimizing financial reporting; it’s reimagining how businesses derive value from data. No longer confined to rule-based systems, modern financial back offices are adopting adaptive frameworks that mirror the efficiency of industrial workflows, yet operate with the precision of advanced automation equipment.

From Manual Labor to Intelligent Workflows

Gone are the days of tedious, error-prone manual data entry in financial statement preparation. Just as industrial automation replaced repetitive factory tasks, intelligent automation now streamlines financial processes. AI-integrated systems automate data extraction from invoices, ledgers, and ERP platforms, reducing manual processing time by 80% and accelerating month-end closings by 40%. This isn’t merely about speed; it’s about transforming the financial department from a reactive unit to a strategic hub. By minimizing lag between data collection and reporting, businesses gain real-time insights—comparable to how automation equipment optimizes production cycles—to adapt swiftly to market shifts.

AI-Driven Data Mastery: Beyond Traditional ETL

At the core of this revolution lies AI-powered data aggregation, a step beyond traditional Extract-Transform-Load (ETL) systems. These intelligent platforms don’t just move data; they validate it in real time, reconcile discrepancies with 45% fewer errors, and reduce verification times by 75%. Imagine a financial ecosystem where disparate data sources—CRM, IoT devices, and legacy systems—are unified into a single, dynamic dashboard, much like how industrial automation integrates sensors and machinery into a cohesive production line. For finance teams, this means pivoting from operational firefighting to proactive analysis, identifying cost-saving opportunities through multidimensional ML models that traditional tools could never achieve.

Anomaly Detection: AI as the Financial Watchdog

Accuracy is non-negotiable in finance, and AI serves as an unblinking watchdog. ML models trained on historical transactions detect anomalies with 90% accuracy, far surpassing rule-based systems. These algorithms learn to recognize patterns shaped by seasonality, market trends, or even fraudulent activity, much like automation equipment uses sensors to detect mechanical irregularities in real time. Visual tools enhance this further: color-coded alerts and dynamic dashboards transform raw data into intuitive insights, reducing false positives and allowing teams to focus on genuine risks. The result? Financial integrity is fortified, and compliance becomes a byproduct of intelligent design, not manual oversight.

Query Optimization: Speed Meets Strategic Agility

Traditional financial systems often stall under complex queries, but AI-driven optimization changes the game. Self-learning algorithms restructure database queries, cutting processing time by 75%—a feat akin to how industrial automation reduces downtime through predictive maintenance. Smart indexing and parallel computing enable real-time access to vast datasets, turning batch reporting into dynamic analytics. The financial benefits are tangible: 30–40% reductions in infrastructure costs and ROI within 14 months. For CFOs, this means allocating resources to innovation rather than maintenance, positioning finance as a driver of digital transformation.

Visualization and Foresight: The Future of Financial Strategy

AI doesn’t just look at the past; it peers into the future. Interactive dashboards, designed for both analysts and C-suite stakeholders, increase insight identification by 70%, making financial data accessible to non-technical teams. More importantly, predictive analytics—powered by historical and real-time data—improve forecast accuracy by 25–30%, alerting businesses to cash flow risks weeks in advance. This is intelligent automation at its peak: not just automating tasks, but augmenting human judgment with foresight, much like how industrial systems use predictive analytics to optimize production schedules.

Conclusion: The Finance Function Reimagined

As Siva Prasad Marri underscores, the adoption of intelligent automation in financial reporting is more than a technological upgrade; it’s a paradigm shift. By emulating the efficiency of industrial automation and the precision of automation equipment, finance teams evolve from data custodians to strategic enablers. They no longer merely report on performance—they predict it, influence it, and drive business agility in an era defined by data.

The message is clear: In a world where every industry is being reshaped by intelligent systems, financial reporting must not just keep pace—it must lead. By embracing AI and ML, organizations can transform their back offices into hubs of innovation, where data is not a burden but a catalyst for growth. The future of finance is here, and it’s powered by the same principles that have revolutionized industry: automation, intelligence, and the relentless pursuit of efficiency.