This private placement will further enhance Orbbec’s technological R&D capabilities and manufacturing capabilities, helping it form differentiated competitive advantages in multiple segmented markets.

On July 31, Orbbec (688322) disclosed the “2025 Annual A-share Stock Offering Prospectus to Specific Objects (Declaration Draft)”, planning to raise no more than 2.187 billion yuan through non-public issuance of stocks. The investment projects of this private placement focus on the construction of a robot AI vision and spatial perception technology R&D platform, the construction of an AI vision sensor and intelligent hardware manufacturing base, and supplementary working capital.

Since its establishment, Orbbec has been committed to the research and application of 3D visual perception technology, building a full-stack technical system covering six technical routes: structured light, iToF, dToF, binocular, LiDAR, and industrial 3D measurement, forming a closed loop of “chip-algorithm-hardware-solution-ecology”. The company’s products are widely used in biometrics, AIoT, robots and other fields, serving more than 1,000 customers, including industry leaders such as Ant Group.

In recent years, Orbbec’s R&D investment has continued to increase, with cumulative R&D expenses reaching 931 million yuan from 2022 to the first quarter of 2025. Although the company achieved a single-quarter profit in the first quarter of 2025, it is still in the profit recovery stage overall, and the cash flow from operating activities has not yet achieved continuous net inflow. Therefore, financing through the capital market to enhance the company’s capital strength has become an important support for Orbbec’s current strategic advancement.

Orbbec plans to raise a total of no more than 2.187 billion yuan in this private placement. After deducting issuance expenses, the funds will be used for the following three projects: 1. The robot AI vision and spatial perception technology R&D platform project, with a planned investment of 1.796 billion yuan; 2. The AI vision sensor and intelligent hardware manufacturing base construction project, with a planned investment of 190 million yuan; 3. Supplementary working capital, with a planned investment of 200 million yuan.

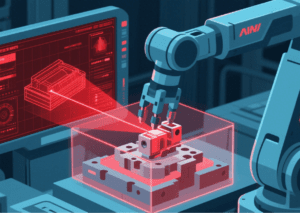

Among them, the robot AI vision and spatial perception technology R&D platform project is the core direction of this private placement. The project aims to build an AI visual perception technology platform for future robot applications, enhancing the company’s technical capabilities in 3D visual perception algorithms, spatial modeling, environmental understanding, etc. With the rapid development of humanoid robots, autonomous driving, intelligent manufacturing and other fields, high-precision and real-time visual perception systems have become core competitive elements. Through the implementation of this project, Orbbec is expected to further consolidate its technical advantages in the field of robot visual perception.

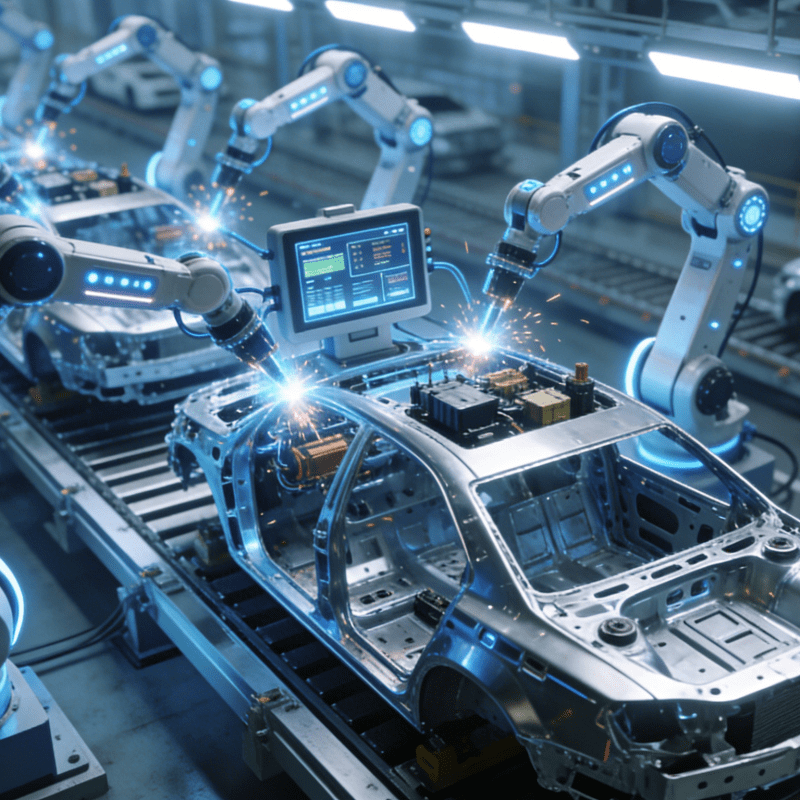

In addition, the AI vision sensor and intelligent hardware manufacturing base construction project will enhance the company’s independent control capability in the core hardware manufacturing link and strengthen the stability of the supply chain. After the completion of the project, it will effectively improve the company’s mass production capacity and delivery efficiency, meeting the increasing demand of downstream customers for high-performance 3D vision sensors.

Supplementary working capital will help optimize the company’s financial structure, alleviate the financial pressure caused by R&D investment and market expansion, and provide stable financial support for the company’s future business growth.

This private placement will further enhance Orbbec’s technological R&D capabilities and manufacturing capabilities, helping it form differentiated competitive advantages in multiple segmented markets. For example, the company has realized the replacement of products from Japan’s Keyence in laser triangulation technology, and has achieved high-precision detection applications in the supply chains of customers such as BYD and CATL. With the advancement of the raised investment projects, the company is expected to achieve large-scale applications in more scenarios such as industrial testing and service robots.

At the same time, the private placement will also help the company cope with the characteristics of the current 3D visual perception industry, such as rapid technological iteration and large R&D investment. As 3D visual perception technology is in a stage of rapid development, enterprises need to continuously invest a lot of resources in technological updates and product iterations. If the company cannot maintain sufficient R&D investment, it may be at a disadvantage in technological competition. Therefore, financing through the capital market will help the company maintain its leading technological advantages and ensure its core position in the industry.

AI automatic assembly line

Changes in the advantages of AI automatic assembly lines