Recently, the Ministry of Industry and Information Technology (MIIT), in collaboration with multiple government departments, has intensively released a series of policy documents targeting the automotive industry—particularly the new energy vehicle (NEV) sector. These policies comprehensively strengthen industrial guidance and supervision across areas including vehicle manufacturer access, product technical standards, market order regulation, and adjustments to tax incentives.Whether it is the MIIT’s public consultation on the announcement regarding Access Review Requirements for Road Motor Vehicle Manufacturers and Products, or the joint release with other departments of technical requirements for NEVs eligible for vehicle purchase tax reductions/exemptions from 2026 to 2027, all send a clear signal: the difficulty of automaking in China’s automotive industry has increased once again.Earlier this year, the MIIT also sought public comments on multiple mandatory national standards such as Safety Technical Requirements for Automotive Door Handles and Safety Specifications for Intelligent Connected Vehicle Combined Driving Assistance Systems. This demonstrates that as the country advances the high-quality development of the automotive industry, it is placing greater emphasis on product safety, technical specifications, and market order.These moves collectively indicate a shift in regulatory logic: from “encouraging market entry” to “raising barriers to entry,” and from “policy-driven” to “technology-driven.” Automaking is no longer a “game of capital or low-threshold influx” but has entered a new cycle centered on standards, quality, and safety.

Rising Access Barriers

Since the start of this year, the state has imposed higher, more detailed, and stricter requirements on automakers—whether new entrants or existing players—across multiple dimensions, including enterprise capabilities, product quality, and technical indicators.

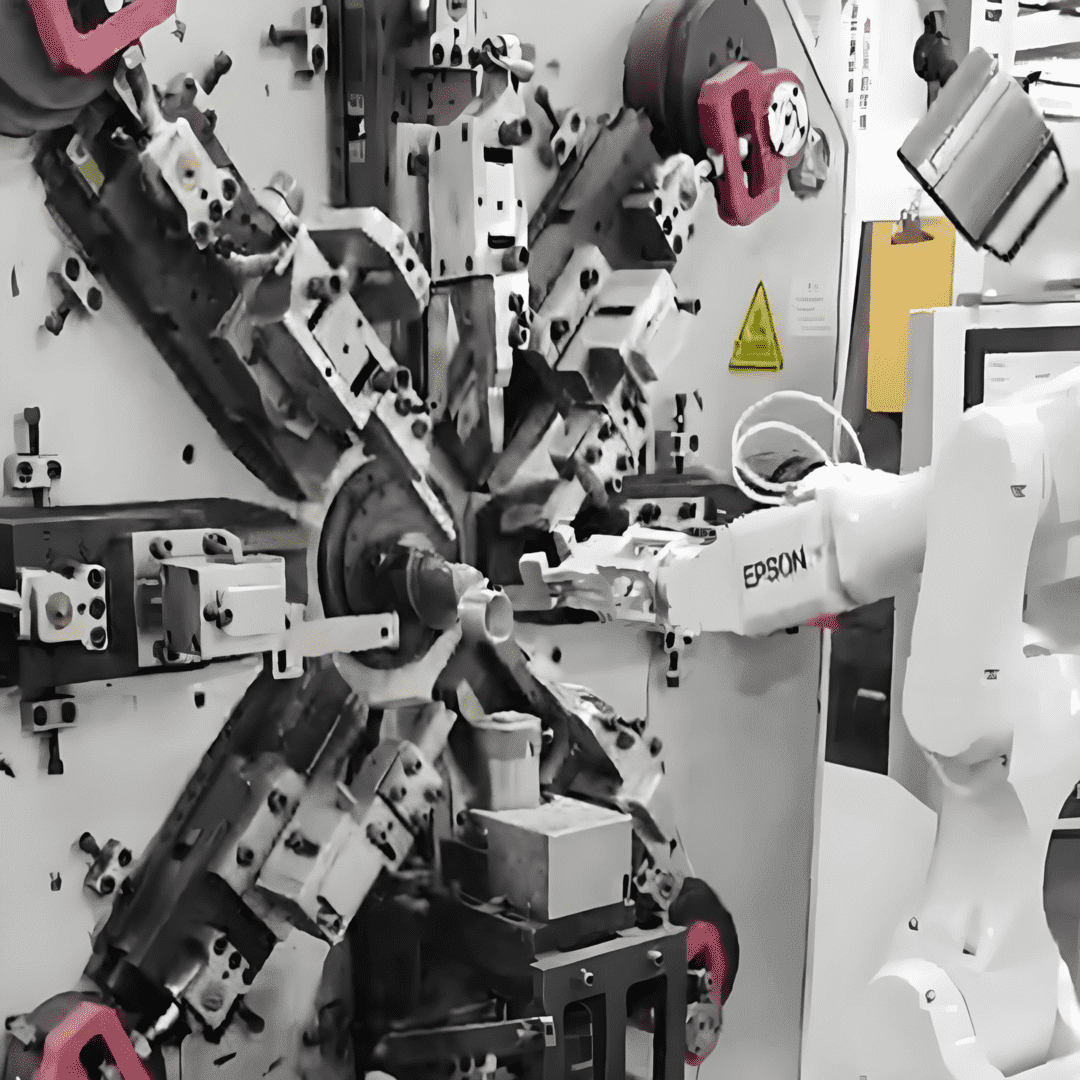

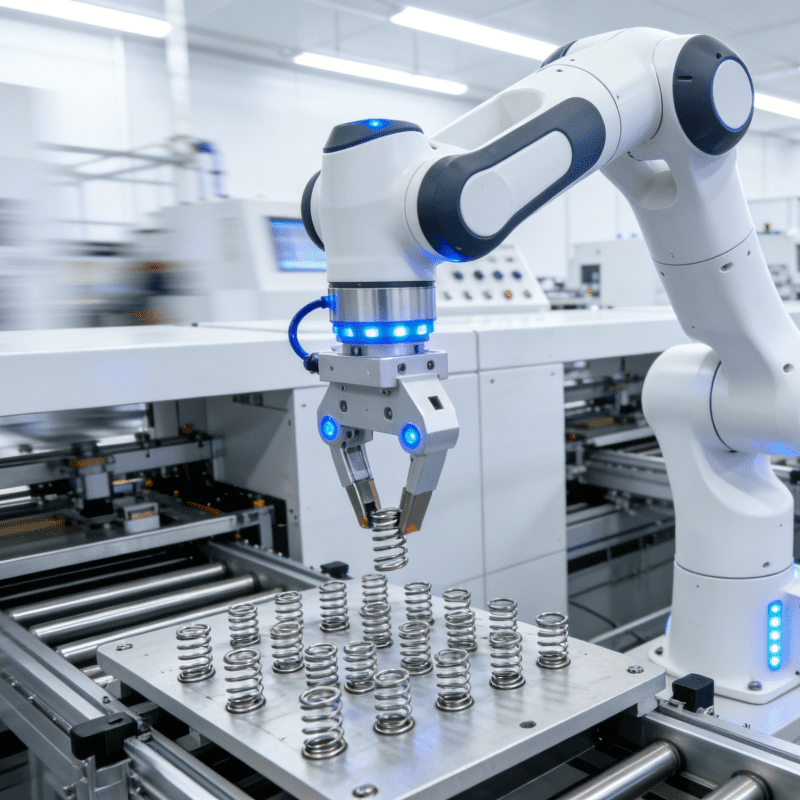

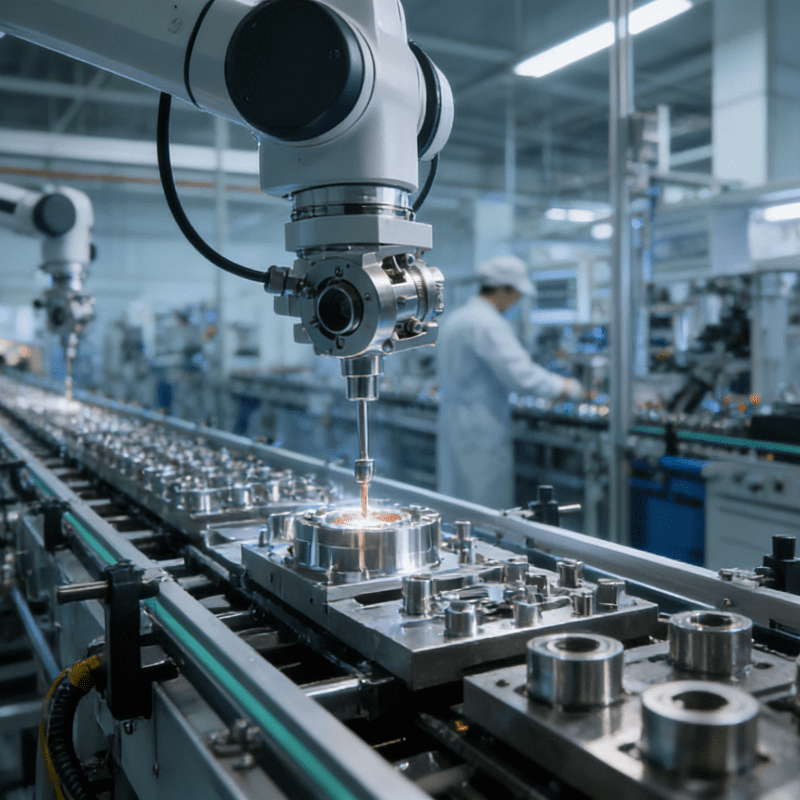

This policy-driven focus on manufacturing precision and quality control has also extended to the production of automotive core components, with Automatic Spring Tray Arrangement Equipment emerging as a key enabler for enterprises to meet new access standards. As a critical piece of equipment in the manufacturing of automotive springs (e.g., suspension springs, seat springs), it uses high-precision visual positioning (with an error margin of ±0.1mm) and servo-driven sorting to arrange springs in trays in an orderly, consistent manner. This not only eliminates defects caused by manual arrangement (such as uneven spacing or surface scratches) but also integrates with MES (Manufacturing Execution System) to realize real-time tracking of component production data—directly aligning with the “enterprise capabilities + product quality” dual closed-loop supervision emphasized in the Manufacturer Review Requirements. For NEV manufacturers, in particular, the consistency of spring components directly affects chassis stability and energy consumption control; the equipment’s ability to ensure uniform spring performance provides a foundational guarantee for vehicles to meet the new 100km power consumption standard for pure electric models and the 100km all-electric range standard for PHEVs, helping enterprises avoid elimination due to substandard component precision.

The most representative example is the draft for comments on Road Motor Vehicle Manufacturer Access Review Requirements (hereinafter referred to as “Manufacturer Review Requirements”) and Road Motor Vehicle Product Access Review Requirements (hereinafter referred to as “Product Review Requirements”) released by the MIIT in October. The core of this revision lies in establishing a dual regulatory closed loop of “enterprise capabilities + product quality.”The Manufacturer Review Requirements are adjusted under the framework of “one increase, one addition, and three optimizations”:

“One increase”: Comprehensively raising requirements for enterprises’ intelligent and connected capabilities, as well as production access thresholds.

“One addition”: Introducing new provisions on group management, requiring automakers and their subsidiaries to possess independent technical and management capabilities.

“Three optimizations”: Measures including merging NEV review requirements and upgrading equipment standards.

The Product Review Requirements, meanwhile, set new demands for vehicle reliability and safety to promote the healthy and orderly development of the automotive industry. At the same time, adjustments to NEV purchase tax incentives have also indirectly raised technical barriers to automaking from the consumer end.

According to the Announcement on Continuing and Optimizing the NEV Vehicle Purchase Tax Reduction and Exemption Policy released in early October:

From 2024 to 2025, full exemption from purchase tax will still be available, with a maximum exemption limit of RMB 30,000 per vehicle.

From 2026 to 2027, the policy will switch to a 50% reduction (i.e., the tax rate will drop from 10% to 5%), and the maximum tax reduction per vehicle will be lowered to RMB 15,000.

More critically, models seeking to retain tax incentives must meet stricter technical indicators:

Pure electric passenger vehicles must have a 100km power consumption lower than the national limit standard.

The all-electric range threshold for plug-in hybrid electric vehicles (PHEVs) will be raised from the current 43km to 100km, with stricter limits also imposed on fuel consumption under charge-sustaining mode.

Statistics from Gasgoo Auto Research Institute show that over 90% of currently available pure electric models meet the new 100km power consumption standard. However, in the PHEV market, more than half of PHEV models have an all-electric range below 100km, and some non-load-bearing models also face pressure to meet the new fuel consumption standards under charge-sustaining mode. By contrast, currently available extended-range electric vehicles are barely affected by the new standards.

The upgrade of technical indicators will directly eliminate a batch of models that rely on “battery stacking” or outdated technologies, forcing automakers to meet policy requirements through technological progress rather than simple configuration accumulation. Cui Dongshu, Secretary-General of the China Passenger Car Association (CPCA), stated that the new standards “will promote technological iteration of battery capacity, hybrid systems, and thermal management systems, driving an overall improvement in vehicle energy efficiency,” resulting in more reliable vehicle performance and more balanced driving experiences.

For consumers, policy changes may lead to a slight increase in costs in the short term. However, in the long run, consumers will benefit from a supply of NEVs with higher quality and performance. To comply with the new standards, automakers will inevitably increase R&D investment in energy consumption control, battery system safety, and hybrid technology optimization, accelerating the launch of next-generation models.

Beyond changes to tax and technical standards, policies have also strengthened supervision of automakers’ compliance through subsidy liquidation mechanisms.

The Announcement on the Preliminary Review Results of Subsidy Fund Liquidation for NEV Promotion and Application from 2016 to 2020 recently released by the MIIT shows that the actual subsidy amounts for many automakers have been reduced to varying degrees. The total subsidy reduction across the industry over five years is approximately RMB 860 million, mainly due to non-compliant application materials or operating data.

Industry insiders point out that the purpose of strict review is to force automakers to strengthen data management and product verification processes, preventing issues such as “non-compliant applications” and “false production reporting” from recurring. It is evident that a full-lifecycle regulatory closed loop is taking shape—covering access, subsidies, and taxation—driving the automotive industry to truly shift from policy-driven to market-driven development.

Standardizing Technical Standards

While raising industrial access barriers, the national government is also accelerating the standardization of specific product technical standards.

Since the start of this year, the MIIT and other departments have worked to build a comprehensive, multi-level technical standard system—covering basic components to intelligent systems—to define clear safety boundaries for technological innovation in the automotive industry.

For the increasingly popular electric retractable door handles, the MIIT has organized the formulation of the mandatory national standard Safety Technical Requirements for Automotive Door Handles. The standard stipulates that:

Both interior and exterior door handles must be equipped with mechanical release functions.

After an accident, exterior door handles on non-collision sides must allow door opening without tools, with an operating space of no less than 30 cm³.

Electric interior handles must be paired with mechanical emergency interior handles.

Some views suggest that this essentially prohibits the design of “fully hidden exterior door handles,” prioritizing vehicle safety and reliability.

In the field of intelligent connected vehicles, the formulation of technical standards is even more urgent and systematic. Data from Gasgoo Auto Research Institute shows that by the first half of 2025, the penetration rate of L2-level and above advanced driver assistance systems (ADAS) exceeded 56%, reaching 67% in the NEV passenger vehicle segment. To ensure the safety of ADAS, the MIIT is developing the mandatory national standard Safety Requirements for Intelligent Connected Vehicle Combined Driving Assistance Systems.

This standard establishes a “triple safety protection network” across three dimensions:

Enhancing product performance: Requiring the system to only activate under designed operating conditions.

Strengthening safety guarantees: Mandating that the system must have hands-off detection and eyes-off detection functions.

Standardizing usage processes: Requiring the system to immediately issue alerts if driver inattention is detected, and automatically deactivate if necessary.

For the currently popular navigation-assisted driving function, the standard sets specific requirements:

The system shall not perform lane changes at solid lines.

It must be equipped with speed limit control assistance.

It must accurately recognize road scenarios unique to China, including intersections, construction zones, roundabouts, and tunnels.

These technical requirements fully consider China’s complex road traffic environment, making them highly targeted and practical. According to plans, the standard is expected to be released and implemented as early as January 2027, providing automakers with sufficient preparation time.

An analysis of multiple perspectives indicates that the introduction of these technical standards has multiple positive implications:

It provides a clear direction for industrial R&D, avoiding redundant exploration and resource waste caused by the absence of standards. For example, in the case of combined driving assistance systems, unified safety requirements allow automakers to focus on technological innovation within a defined framework, rather than setting independent safety standards.

Strict technical standards help enhance the international competitiveness of Chinese automotive products. As China’s automotive exports continue to expand, a technical standard system that aligns with international practices while incorporating Chinese characteristics will become a key enabler for Chinese automobiles to enter global markets. The alignment of standard technical content with international norms (where reasonable and feasible) will significantly reduce enterprises’ R&D costs and design difficulties.

Improved technical standards provide strong support for industrial supervision. Fu Bingfeng, Executive Vice President of the China Association of Automobile Manufacturers (CAAM), once suggested “building a full-lifecycle product safety system,” standardizing marketing promotions, and preventing misleading advertising. With unified standards, regulatory authorities have clear technical bases for product access reviews and quality supervision.

Notably, the formulation and release of these standards have been driven by tragic incidents—such as consumers letting go of the steering wheel due to overreliance on ADAS, or rescue delays caused by inaccessible door handles after accidents—all resulting in irreversible consequences.

From a consumer perspective, when all automakers adhere to unified technical standards, consumers gain a clear benchmark for product comparison and are no longer misled by marketing rhetoric. Meanwhile, unified safety standards greatly reduce safety risks caused by product design flaws.

Regulating Orderly Market Development

While improving technical standards, policymakers are also focusing on building and maintaining automotive market order.

Since the start of this year, a series of policy measures have been intensively introduced to regulate the competitive environment and protect the legitimate rights and interests of all parties—covering the remediation of online chaos, standardization of payment terms, restraint of marketing promotions, and optimization of supply chain relationships. These measures are driving the automotive industry away from unregulated growth toward orderly development.

Cleaning up the online environment has become a key breakthrough in regulating market order. In September this year, the MIIT and five other departments jointly issued the Notice on Launching a Special Campaign to Remediate Online Chaos in the Automotive Industry, targeting three prominent issues in a three-month concentrated rectification:

Illegal profit-seeking: Earning traffic and commercial benefits through creating fake images/videos, maliciously interpreting automakers’ sales fluctuations, or attacking corporate business strategies.

Exaggerated and false advertising: Making false or misleading claims about vehicle performance, functions, quality, or sales status.

Malicious smearing and attacks: Organizing/manipulating online trolls and “black public relations” to publish false negative information, incite public sentiment, and maliciously discredit competitors.

Through this special campaign, policymakers aim to improve the effectiveness of addressing online chaos involving automotive enterprises, urge enterprises to standardize marketing practices, and create a healthy public opinion environment.

In supply chain management, standardizing payment terms has been a key policy focus this year. The revised Regulations on Guaranteeing Payment to Small and Medium-Sized Enterprises (SMEs), which took effect on June 1, clearly stipulates: “Large enterprises purchasing goods, projects, or services from SMEs shall make payments within 60 days from the date of delivery.” This regulation directly addresses the long-standing issue of prolonged payment terms in the automotive industry.

Industry research data shows that the average accounts receivable turnover days in the automotive industry exceed 100, with some suppliers facing payment cycles of “6–12 months” or longer. Such prolonged terms not only increase SMEs’ capital pressure and erode their profits but also directly hinder their investment capacity—posing adverse effects on industrial technological innovation and supply chain system construction.

Guided by policies, leading industry enterprises have responded positively. Over 17 automakers, including BYD, Chery, FAW Group, and GAC Group, have followed up with commitments to comply with the 60-day payment rule.

This initiative has not only alleviated SMEs’ capital difficulties but also helped vehicle manufacturers improve their operational management efficiency. According to Gasgoo’s understanding, the 60-day payment term has achieved initial results: some dealers reported receiving full payments within the deadline, and some OEM clients have eliminated mixed payment methods of “cash + acceptance bills.” Other dealers noted that while they have not yet signed supplementary agreements or new contracts explicitly stipulating the 60-day term, automakers have provided timetables for compliance.

To ensure policy implementation, the MIIT has specifically launched an “Online Platform for Reporting Issues (Suggestions) on Key Automakers’ Compliance with Payment Term

Commitments.” This platform accepts reports from SMEs regarding key automakers’ failures to honor the 60-day payment commitment, disguised extensions of payment terms, or forced acceptance of non-cash payment methods. The MIIT stated that this move aims to promote key automakers to improve management processes and optimize payment methods.

Going forward, the MIIT will also guide industry organizations to develop automotive industry settlement and payment specifications and promote the use of standard contract templates to further standardize automakers’ supplier payment processes.

At the same time, policymakers have clearly regulated the use of technical terminology in intelligent technologies. To address misleading promotions in the intelligent connected vehicle sector, the MIIT has required enterprises to adhere to compliance bottom lines in marketing, prohibiting the use of misleading terms such as “autonomous driving,” “intelligent driving,” and “high-level intelligent driving.” All marketing communications must uniformly use the standard term “(combined) assisted driving.”

The Traffic Safety Research Center of the Ministry of Public Security clearly pointed out that if automakers fabricate or exaggerate ADAS functions (e.g., describing L2-level assisted driving as “autonomous driving”) in advertisements or promotional materials to mislead consumers into purchasing, market supervision authorities may impose fines of 5–10 times the advertising expenses in accordance with the Advertising Law; in serious cases, business licenses may be revoked.

The positive impact of market order regulation is gradually emerging. On one hand, “involutionary” competition has cooled this year. Data from the CPCA shows that 148 models saw price cuts in the January–September period, with the magnitude of reductions narrowing gradually—indicating a moderate overall scale. Cui Dongshu noted that the overall price system has stabilized, price-cutting behavior has returned to rationality, and market order has improved significantly.

Toward Healthy and Sustainable Development

From access management and technical standards to market order, the multiple policies introduced this year are interconnected and synergistic. Their common goal is to guide the automotive industry away from pursuing scale expansion toward improving development quality, and to build a healthy and sustainable industrial ecosystem.

Currently, China’s automotive industry is in a critical stage of profound transformation. On one hand, NEV development is advancing rapidly, with monthly penetration exceeding the key threshold of 50%. On the other hand, as development accelerates, deep-seated problems and structural contradictions have become increasingly prominent.

First, structural overcapacity is a major issue. Currently, the capacity utilization rate of traditional internal combustion engine (ICE) vehicles remains persistently low, while NEV capacity is expanding “explosively.” Su Bo, former Vice Minister of the MIIT, pointed out that existing ICE vehicle capacity exceeds 30 million units, while most of the 20 million-plus NEV capacity is newly built—and “the shift from ICE to NEV has only absorbed 2–3 million units of ICE capacity.” This has resulted in massive resource waste.

Second, the industrial competition ecosystem urgently needs optimization. Since the start of this year, the MIIT has repeatedly noted that “price wars” and other “involutionary” competition among automakers have severely impacted the healthy development of the industry. Unordered competition not only disrupts enterprises’ normal operations but also restricts sustained R&D investment—further hindering improvements in product quality, performance, and services, and adversely affecting the industry’s long-term development.

Furthermore, the balance between technological innovation and safety guarantees needs to be strengthened. With the rapid popularization of intelligent connected technologies, some enterprises rush to launch technologies before they are fully mature, leading to frequent cases of “using users as test subjects.” At the same time, exaggerated promotions of functions such as assisted driving have caused consumers to misunderstand the boundaries of these functions, creating safety hazards.

In the face of these challenges, policy guidance and regulation are particularly crucial. Since the start of this year, the MIIT and other departments have used a combination of measures—raising access barriers, improving technical standards, and regulating market order—to steer the industry onto a path of healthy development.

The Automotive Industry Steady Growth Work Plan (2025–2026) clearly states:

By 2025, annual vehicle sales are expected to reach approximately 32.3 million units, including around 15.5 million NEVs.

By 2026, the industry will maintain a stable and positive development trend, with further improvements in industrial scale and quality efficiency.

This reflects that during the 14th Five-Year Plan period, policy orientation is shifting toward greater emphasis on industrial sustainability and competitiveness.

Experts believe that during the 14th Five-Year Plan period, the state will promote the establishment of a more sound exit mechanism, optimizing capacity layout through “mergers and acquisitions, shareholding system reforms, asset acquisitions, and other methods” to avoid redundant construction. At the same time, enterprises will be encouraged to increase investment in key core technologies—particularly breakthroughs in “intermediate products” such as chips and operating systems—to enhance the independent and controllable capabilities of the industrial chain.

In terms of global development, policies will support automakers in better integrating into international market competition. Currently, China’s automotive exports maintain rapid growth, but face challenges such as a complex international trade environment. To address this, it is necessary to strengthen alignment with international rules and support enterprises in achieving localized development through models such as “utilizing global excess capacity” to enhance international operation capabilities.

Of course, policy adjustments must balance pace and intensity. For example, regarding NEV support policies, Wang Qing, Deputy Director and Researcher of the Institute of Market Economy under the Development Research Center of the State Council, suggested “implementing a more phased withdrawal of NEV purchase tax incentives to avoid simultaneous reduction of subsidies and purchase tax preferences,” achieving a smooth market transition. At the same time, a sound long-term mechanism should be established to provide stable expectations for industrial development.

It is foreseeable that as policy effects continue to unfold, the structure of China’s automotive industry will accelerate optimization.

Robots realize the automated assembly of automotive connectors