Table of Contents

ToggleMeet the Newest Member of Private Equity’s Investment Committee: Intelligent Automation

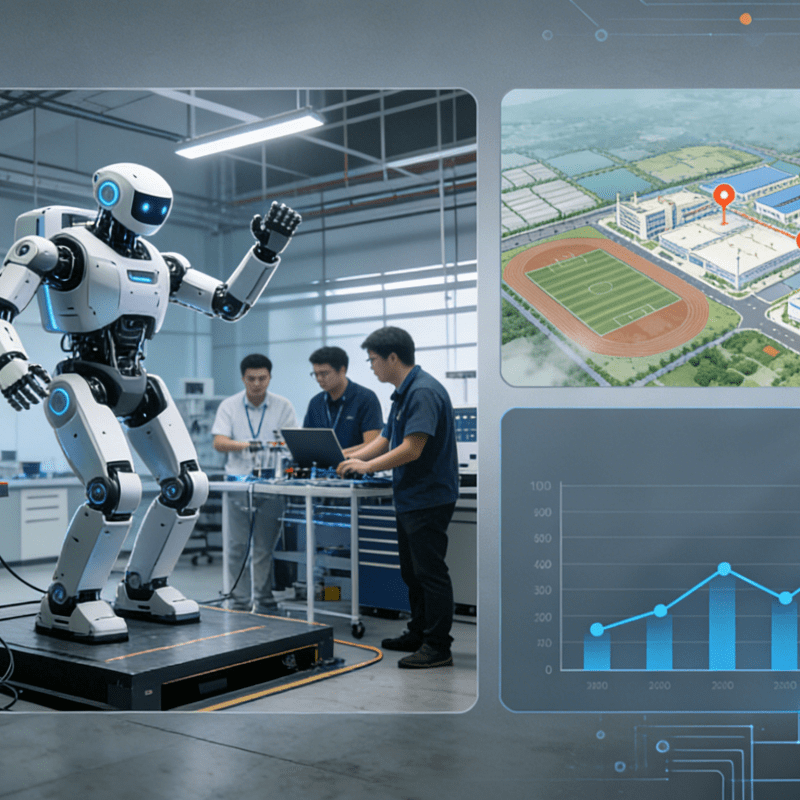

In the boardrooms of private equity, a non-human member is claiming a seat at the investment committee table—one that leverages intelligent automation to reshape decision-making. Industry leaders predict AI bots are on the cusp of joining these elite groups, not as tools but as voting members. “This isn’t just future talk,” says Alexander Schmitz of Bain & Company. “We’re already building AI agents that act as peers to human investors, blending automation equipment-grade data processing with strategic insight.” The implication? A paradigm shift where industrial automation’s efficiency meets Wall Street’s high-stakes dealmaking.

AI as a Strategic Partner in Deal Flow

Traditional investment committees rely on human intuition, but AI brings something revolutionary: the ability to parse terabytes of data like a precision automation equipment system. Brenda Rainey of Bain notes, “Humans have experience, but AI can analyze every deal in a firm’s history to find success patterns—like a factory machine calibrating itself for optimal output.” Take the client experimenting with AI in board meetings: by transcribing discussions and flagging key themes, the technology acts as a supercharged note-taker, turning conversations into actionable intelligence.

The Dual Edge of Intelligent Automation in Finance

On one hand, AI eliminates biases that plague human decision-makers. Overconfidence or recency bias? Neutralized by algorithms rooted in historical performance. On the other, it processes real-time market data, news sentiment, and financials at speeds impossible for teams—think of it as the intelligent automation equivalent of a high-frequency trading system, but for private equity due diligence.

Challenges: From Data Factories to Explainable AI

Yet integrating AI into investment committees mirrors the hurdles of implementing industrial automation in complex factories. Data quality is king: flawed inputs turn AI into a “garbage in, garbage out” machine. Security is equally critical—sensitive deal data in AI systems demands fortress-like cyber protections. Then there’s the “black box” problem: deep-learning models must evolve from opaque engines to transparent collaborators, explaining decisions like a human partner would.

Conclusion: When Wall Street Meets the Automation Age

The rise of AI in investment committees isn’t about replacing human expertise; it’s about augmenting it with intelligent automation’s scale. As Alexander De Mol observes, the most successful firms will treat AI not as a tool, but as a colleague—one that processes data like automation equipment, but relies on human judgment to navigate unquantifiable risks.

This shift demands a new ecosystem: AI systems trained on clean data, regulated for transparency, and embedded in workflows like digital partners. The future investment committee might have eight humans and one AI bot, but the real magic lies in their collaboration—where industrial automation’s precision meets human intuition to shape deals that drive both profit and progress. In the end, it’s not AI versus humans; it’s AI plus humans—a partnership that could redefine private equity for the automation era.