Overall Performance: Steady Growth with Q3 Acceleration

On October 23, Kangsite released its quarterly report for the third quarter of 2025. In the first three quarters of the year, the company achieved an operating revenue of RMB 394 million, representing a year-on-year growth of 9.99%. The net profit attributable to shareholders of listed companies was RMB 94.3247 million, with a year-on-year increase of 5.49%. The net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses stood at RMB 88.6771 million, up 7.59% year-on-year. The basic earnings per share was RMB 0.44.In the third quarter alone, the company’s operating revenue amounted to RMB 148 million, a year-on-year rise of 22.2%; the net profit attributable to shareholders was RMB 40.2 million, up 30.7% year-on-year; the net profit attributable to shareholders after deducting non-recurring gains and losses was RMB 38.04 million, with a year-on-year growth of 36.2%; and the earnings per share (EPS) was RMB 0.1892. By the end of the third quarter, the company’s total assets reached RMB 1.403 billion, an increase of 5.2% compared with the end of the previous year; the net assets attributable to shareholders of listed companies were RMB 1.271 billion, up 6.4% from the end of the previous year.

Market & Business Performance: Dual-Drive from Domestic and International Markets

International Market: Recovery Driven by Regional Diversification

In the international market, the operating revenue in the first three quarters was RMB 192.6589 million, a year-on-year growth of 8.7%, among which the revenue in the third quarter increased by 21.5% year-on-year. The main reasons for this include: under the promotion of the launch of China-US economic and trade talks and the accelerated diversion of the company’s non-US market orders to the Singapore operation center, the impact of the high base caused by large orders in the US regional market during the same period and the tariff policy has gradually weakened. During the reporting period, the growth rate of the US regional market, which was severely affected, recovered from -11.0% at the end of March to 2%; the growth rate of the Europe/Middle East/Africa regional market rose from -7% to 14%.

Domestic Market: Steady Growth with Scenario Expansion

In the domestic market, the operating revenue in the first three quarters was RMB 201.3327 million, a year-on-year increase of 11.3%, with a year-on-year growth of 22.9% in the third quarter. The main factor is that the domestic market orders grew steadily, and the revenue confirmation accelerated starting from the third quarter. On the demand side, the company mainly focused on stabilizing and increasing revenue by meeting the needs of industries such as metrology testing and electric power. At the same time, relying on the advantages of its core pressure products, it rapidly increased its market share in industries such as instruments and sensors, and expanded into more application scenarios.

Business Segments: Core Business Stabilizes, Digital Business Surges

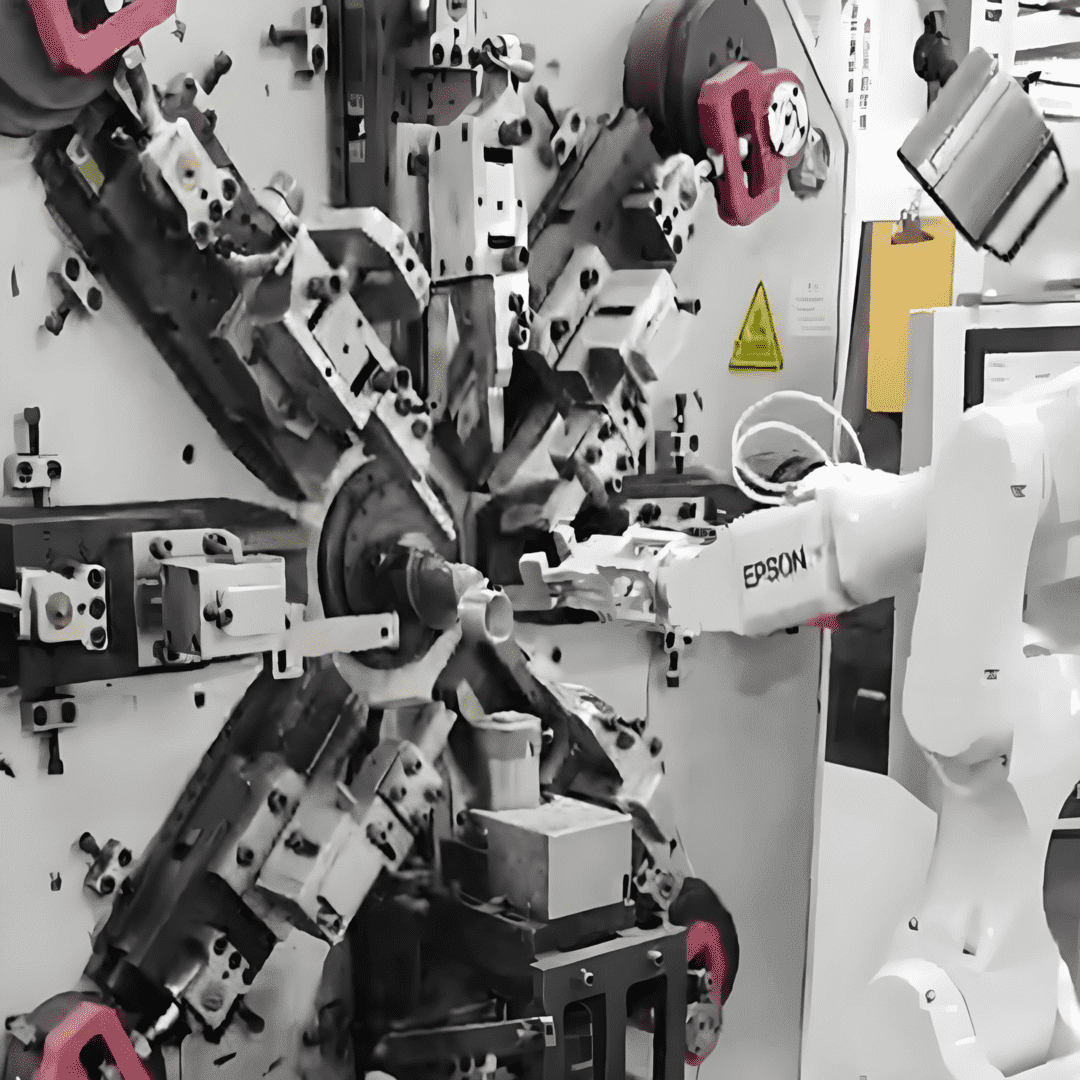

For the main business of calibration and testing products, the operating revenue in the first three quarters was RMB 375.4914 million, a year-on-year growth of 9.4%, of which the revenue in the third quarter increased by 20.9% year-on-year. This is mainly due to the company’s continuous promotion of product structure optimization through intelligent and automated pressure calibration and testing products, thereby improving efficiency. Notably, the integration of the 4 – Axis Robotic Frame Pick – up System into the production line has further enhanced manufacturing precision and throughput. This system, with its high flexibility and accurate positioning capabilities, streamlines the assembly process of core components such as pressure sensors and calibration modules, reducing manual intervention and error rates while shortening production cycles—directly contributing to the core business’s efficiency improvement and capacity expansion.For the digital platform business, the operating revenue in the first three quarters was RMB 14.0431 million, a year-on-year growth of 36.0%, with a year-on-year increase of 77.0% in the third quarter. The main reason is that some projects were accepted and included in revenue during the reporting period.

Cost, Investment & Cash Flow: Healthy Structure with Sufficient Momentum

The comprehensive gross profit margin in the first three quarters was 65.4%, with a year-on-year fluctuation of 0.8%. The main reasons are that the company gave full play to the advantages of the Singapore operation center, resulting in a decrease in the tariff amount of main business products and an improvement in lean management capabilities.The R&D expenditure in the first three quarters was RMB 57.6842 million, a year-on-year growth of 17.9%, among which the expenditure in the third quarter increased by 19.7% year-on-year. This is mainly due to the increase in R&D personnel salaries and material costs. The total R&D investment was RMB 61.1759 million, accounting for 15.5% of the total operating revenue, with a year-on-year fluctuation of -2.6% in the proportion of total investment. During the reporting period, the company further optimized resource allocation and improved R&D efficiency, and the total investment was within a reasonable range.The administrative expenses in the first three quarters were RMB 45.1457 million, a year-on-year growth of 18.4%, of which the expenses in the third quarter increased by 30.0% year-on-year. The main factors include the increase in staff salaries, the service fees for the upgrading of the digital management system, and the increase in the construction expenses of laboratories of overseas subsidiaries.The sales expenses in the first three quarters were RMB 61.6257 million, a year-on-year growth of 3.7%, with a year-on-year increase of 13.4% in the third quarter. The main reasons are that the company accelerated the team building of the Singapore operation center, optimized the allocation of marketing resources for the expansion of emerging industries in China, and increased the marketing efforts for digital business.The US trade tariffs and freight costs borne by the company were RMB 16.5547 million, a year-on-year decrease of 30.1%. The main reason is that during the period of high tariffs, the company mainly sold the existing stock products of the US operation center for orders in the US region; at the same time, the proportion of non-US orders undertaken by the Singapore operation center increased rapidly to 39.5%.The net cash flow from operating activities in the first three quarters was RMB 137.8267 million, an increase of RMB 34.5918 million year-on-year, mainly due to the collection of previous accounts receivable at home and abroad.

Company Profile

Kangsite is a high-end testing instrument enterprise integrating mechatronics, software algorithm development and precision manufacturing. Its main business covers the R&D, production and sales of digital testing instruments, as well as auxiliary testing digital platforms. The company has provided high-performance and high-reliability pressure, process signal, temperature and humidity testing product solutions for global users, helping users realize the verification and analysis of product, technology and process parameters. The company’s testing products mainly include professional solutions such as digital pressure gauges, intelligent pressure calibrators, automatic pressure calibrators, intelligent pressure generators, intelligent pressure controllers, pressure verifiers, intelligent dry-body furnaces, intelligent temperature measuring instruments, intelligent precision thermostats, intelligent precision verification furnaces, automatic temperature and humidity verification systems, intelligent process calibrators and high-precision DC digital multimeters.

What is the market price of a continuous motion multi-piece special-shaped machine?