Major Financing Rounds by Leading Enterprises Intensify

Large-scale financing has reappeared in the humanoid robot sector! On November 20th, it was reported that Beijing Xingdong Jiyuan Technology Co., Ltd. (referred to as “Xingdong Jiyuan”), a company with the “Tsinghua background”, has completed a Series A+ financing round of nearly 1 billion yuan. This round of financing was led by Geely Capital, with strategic investment from BAIC Industry Investment, and co-investment from Beijing Artificial Intelligence Industry Investment Fund and Beijing Robot Industry Development Investment Fund. Notably, this is the second robot enterprise invested by Geely. The other one is Unitree Robotics, in which Geely, together with Tencent, Alibaba, Ant Group and others, jointly led a Series C financing round of nearly 700 million yuan for Unitree Robotics in June 2025.

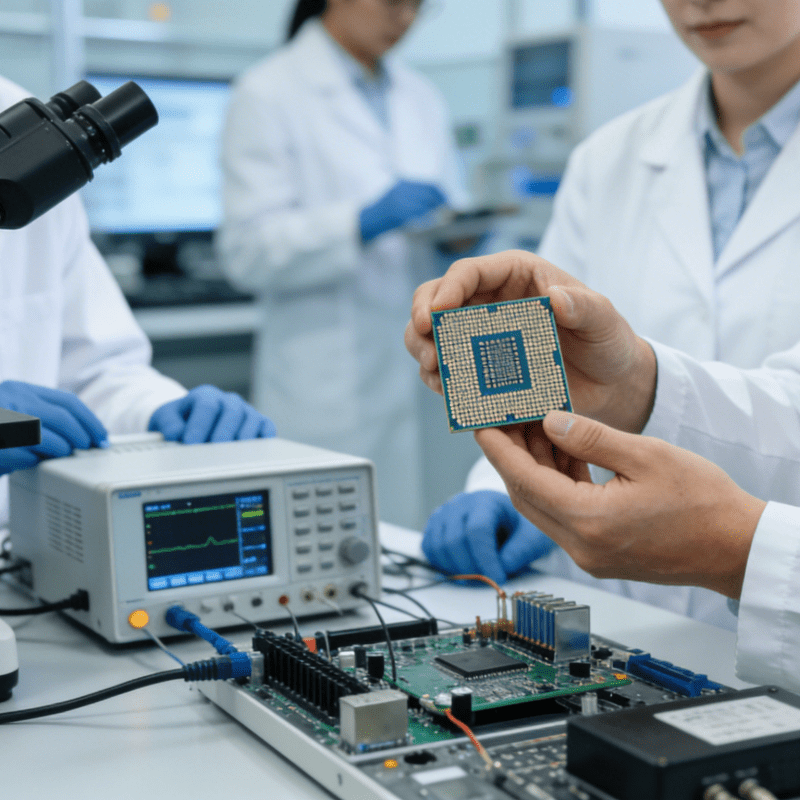

According to the current public information, although the financing amount of Xingdong Jiyuan in this round has not set a new record for a single financing in China’s humanoid robot field, it has still attracted widespread attention from the industry. Xingdong Jiyuan stated that this round of financing will further support the technological iteration and implementation of its end-to-end VLA (Vision-Language-Action) embodied large model “ERA-42”. Founded in August 2023, Xingdong Jiyuan is led by its founder Chen Jianyu, who is a doctoral supervisor and associate professor at Tsinghua University. Chen Jianyu’s academic research at Tsinghua University and the University of California, Berkeley covers robot hardware, mechatronic systems, control algorithms and AI. This interdisciplinary background combining software and hardware has laid a solid foundation for Xingdong Jiyuan to establish a “software-hardware integration” technical route since its establishment.

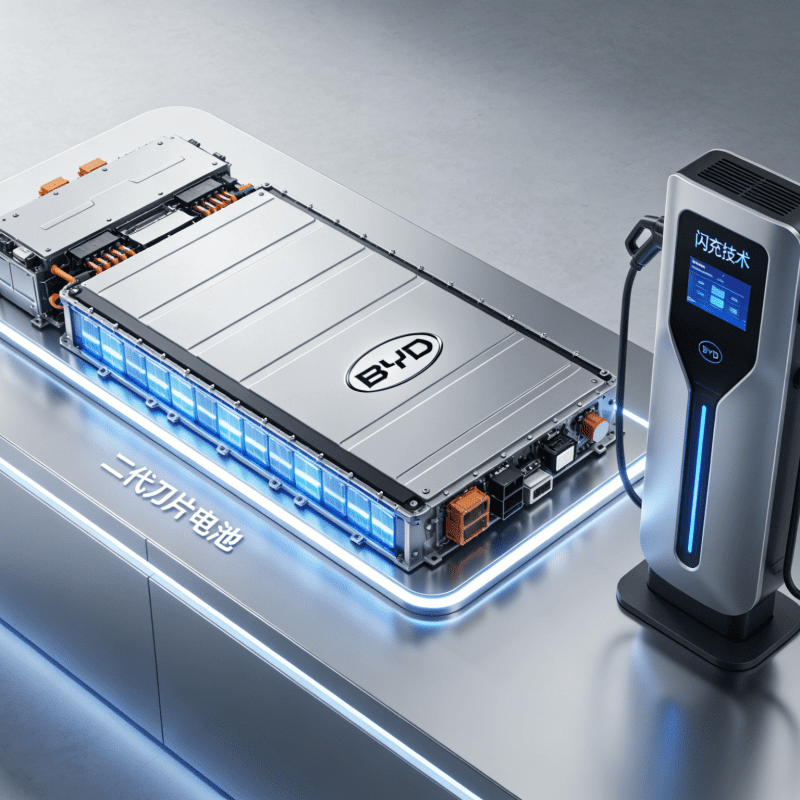

Previously, Galaxy General Robotics and X Square Robotics have also completed financings of 1.1 billion yuan and 1 billion yuan respectively. In June 2025, Beijing Galaxy General Robotics Co., Ltd. (referred to as “Galaxy General Robotics”) announced the completion of a 1.1 billion yuan financing round. This round was led by CATL (a listed company) and Puquan Capital, with follow-up investments from Beijing Robot Industry Fund, CDB Sci-Tech Innovation (a subsidiary of China Development Bank), and GGV Capital. The financing will be used for technological R&D and the promotion of industrialization and implementation. It is worth noting that this is also the highest record for a single financing in China’s embodied intelligence/humanoid robot field based on current public information. In September 2025, X Square Robotics, an embodied intelligence company, completed a Series A+ financing round of 1 billion yuan, which is at the same level as Xingdong Jiyuan’s financing in this round. This round was led by Alibaba Cloud and Guoke Investment, with follow-up investments from CDB Financial, Sequoia China and Keytone Ventures. Existing shareholder Meituan Strategic Investment made an over-subscribed follow-up investment, while Lenovo Star and Junlian Capital continued to increase their investments. X Square Robotics is one of the earliest domestic companies to deploy end-to-end embodied intelligence large models. Its independently developed “WALL-A” series of models is committed to enabling robots to perceive, reason and act under a unified framework like humans. This round of financing will also be mainly used for the continuous training of general embodied intelligence basic models and the R&D and iteration of hardware products.

Industrial Capital Emerges as the Core Investment Driver

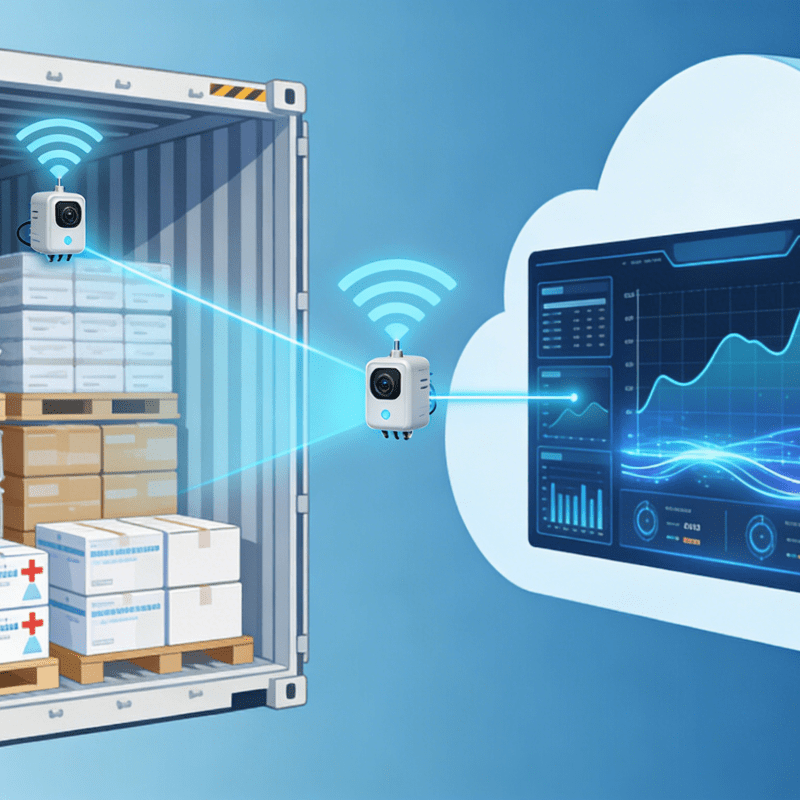

From these large-scale financing rounds, it is not difficult to see that what is driving the rapid development of these “robot upstarts” is no longer traditional venture capital, but industrial enterprises from fields such as automobiles, new energy and technology. This shift reflects that capital’s key consideration lies in the synergy and application potential between humanoid robot technology and existing industrial ecosystems—automotive giants (Geely, BAIC), new energy leaders (CATL), and tech conglomerates (Alibaba Cloud, Tencent) are betting on the sector’s integration with their core businesses.

From R&D Focus to Industrialization Race: A New Phase of Competition

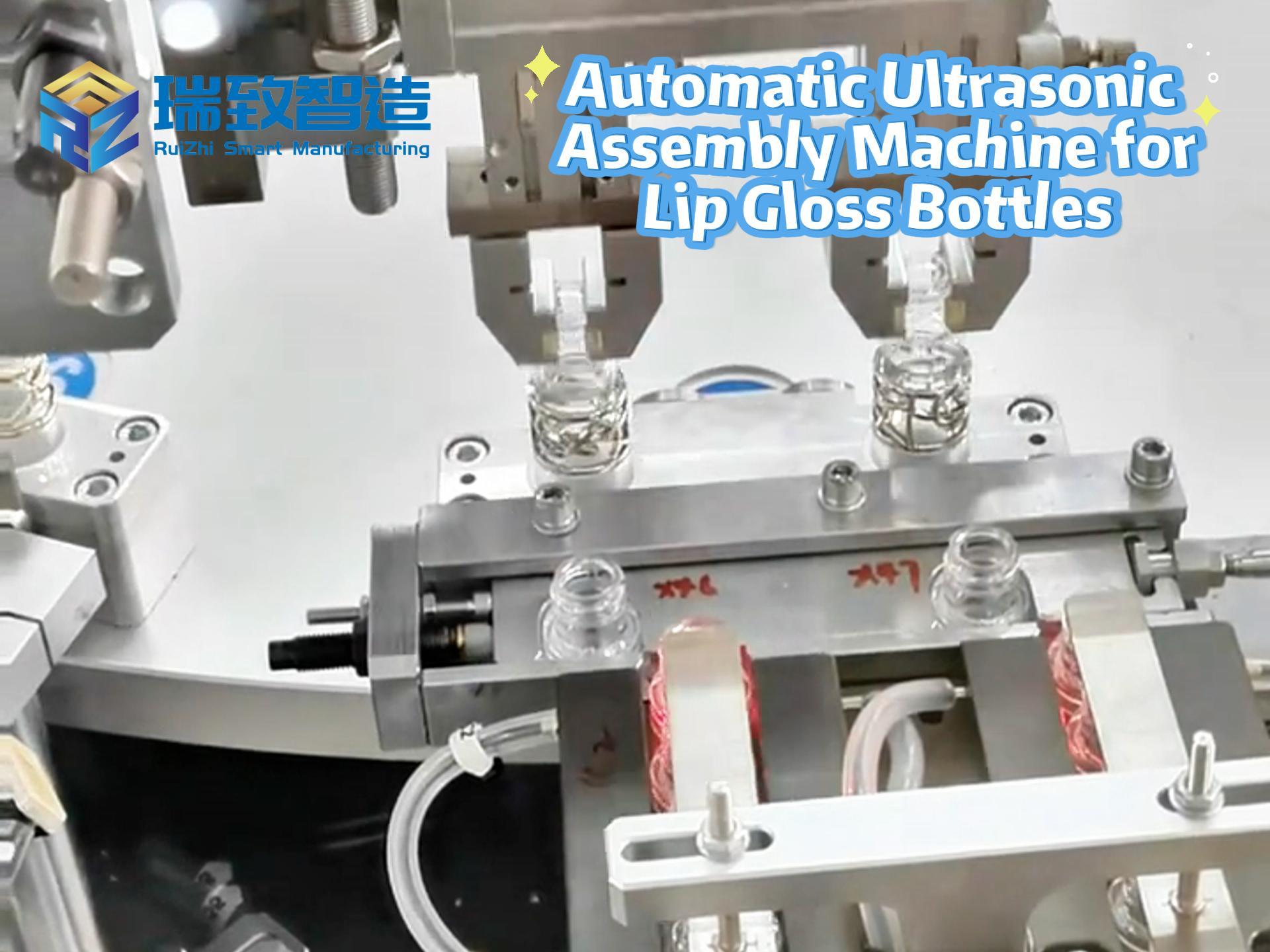

The influx of industrial capital marks that competition in the humanoid robot field has entered a new stage—shifting from pure technological R&D to a race for industrialization and commercial implementation. Financing funds are predominantly allocated to two core areas: iterative upgrading of key technologies (such as embodied large models like ERA-42 and WALL-A) and R&D of hardware products, including the optimization of critical component production equipment like contactor assembly machines. As a key part of the robot’s electrical control system, contactors require high-precision assembly to ensure stable power transmission and operational reliability; advanced contactor assembly machines are therefore becoming a focus of hardware R&D investment, helping enterprises improve production efficiency, reduce assembly errors, and lay a solid foundation for the sector’s transition from laboratory prototypes to market-ready solutions.