Strategic Implication Behind the Appointment: Laying the Groundwork for Automation Business Spin-Off

Honeywell has announced the appointment of Peter Lau as President and CEO of its Industrial Automation business, succeeding Lucian Boldea who is set to depart. While this may seem like a routine management change, it is actually a deliberate arrangement for future business layout. It is not only a key move for Honeywell to respond to the global wave of manufacturing intelligence but also a crucial step in paving the way for its strategy of focusing on core automation business after the spin-off in 2026.

Appointment Details: Peter Lau to Take Over the Automation Business in October

On August 22, 2025, Honeywell announced that Peter Lau would be appointed President and CEO of the Industrial Automation business, replacing the outgoing Lucian Boldea. The appointment will take effect on October 15, 2025.

Unconventional Resume: “Internal Experience + External Perspective” Aligns with Intelligent Transformation Needs

As the industrial automation sector undergoes a paradigm shift from “equipment control” to “intelligent decision-making,” Honeywell’s personnel appointment reveals its new strategic arrangement for the automation division. Peter Lau previously served as President of Honeywell’s Safety, Fire, and Electrical Products business, leading three of the company’s global businesses. During his tenure at Honeywell, he led the transformation from “hardware-centric to software-driven solutions,” which perfectly aligns with the core development direction of “digitalization and intelligence” in current industrial automation.

Resume Breakdown: Accumulated Compound Experience in Industrial Automation

In his most recent role as CEO of FARO Technologies, Peter Lau led FARO’s strategic transformation. Through “operational excellence” and “customer-driven innovation,” he successfully drove the company’s strategic shift, ultimately leading to the company’s successful acquisition. This kind of compound resume combining “internal experience and external perspective” is rare in Honeywell’s history. An analysis of his career trajectory shows that from his roles at General Electric and Hubbell to his work in 3D measurement at FARO, every step of Peter Lau’s career has been rooted in fields highly relevant to industrial automation, particularly in the commercialization of technology he led at FARO.

CEO’s Statement: Highlighting Core Expectations for Automation Business Growth

Vimal Kapur, Chairman and CEO of Honeywell, directly emphasized the strategic intent of this appointment: “Peter’s deep industry knowledge, passion for the business, and strong track record of driving performance growth will drive innovation and create value for customers.” Behind this comment lies Honeywell’s earnest expectation for the accelerated growth of the industrial automation business after the spin-off.

Strategic Resonance: Personnel Adjustment Deeply Linked to the 2026 “Three-Way Split” Plan

This personnel adjustment is by no means an isolated event; it is deeply aligned with Honeywell’s major “three-way split” strategy announced in February. According to the group’s plan, after the spin-off is completed in the second half of 2026, three independent public companies will be formed, focusing on automation, aerospace, and advanced materials respectively.

Mission of the Automation Business: Inheriting a Century of Legacy, Focusing on Smart Manufacturing and Energy Transition

Among these, the automation business is highly anticipated—it will not only inherit Honeywell’s century-long legacy in industrial control but also leverage the Honeywell Forge IoT platform and Accelerator operating system to build new advantages in tracks such as smart manufacturing and energy transition.

Proactive Streamlining: Divesting Non-Core Assets to Focus on Core Automation Tracks

Judging from relevant actions, strategic adjustments have already been initiated in advance. Honeywell recently launched a “strategic alternative assessment” for the Productivity Solutions and Services (PSS) and Warehouse and Workflow Solutions (WWS) businesses under its industrial automation segment. This move is interpreted as a clear signal to “divest non-core assets and focus on high-growth areas.”

Core Focus: Three Core Segments of the Automation Business After the Spin-Off and Technology Implementation

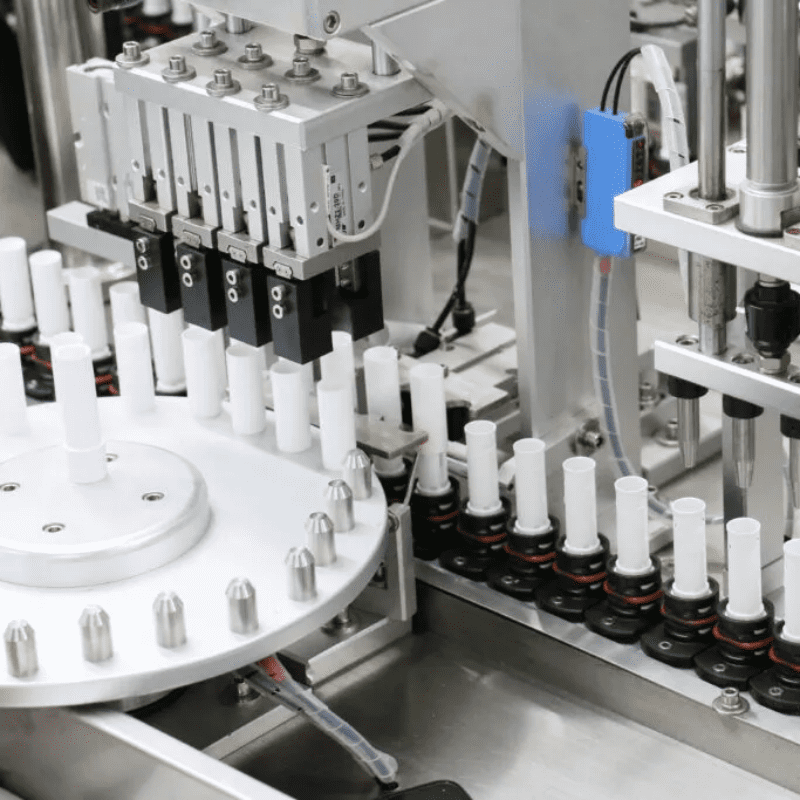

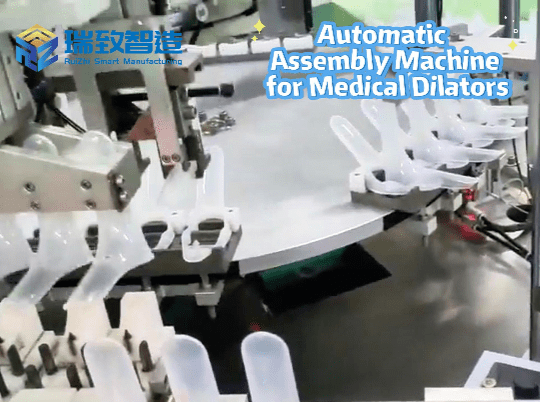

After the spin-off, the automation business will focus on three core segments: Building Automation, Process Automation, and Technology & Industrial Automation, forming a more concentrated resource allocation and a more flexible decision-making chain. In the Technology & Industrial Automation segment, its product portfolio continues to strengthen coverage of precision manufacturing scenarios. For example, the Automatic Quick-Connect Parts Assembly Machine launched for industries such as automotive electronics and home appliance assembly can integrate the real-time data monitoring and AI optimization capabilities of the Honeywell Forge platform. It achieves an assembly accuracy of ±0.01mm for quick-connect components and a 40% improvement in assembly efficiency compared to traditional equipment. Meanwhile, through continuous analysis of equipment operation data, it can early warn of mechanical wear risks and reduce equipment failure rates by 35%, serving as a typical case of Honeywell’s “hardware + software + data” integrated solution implemented in smart manufacturing scenarios.

Financial Foundation: 2024 Performance and $25 Billion Investment Support the Transformation

From a financial perspective, this transformation has a solid foundation. Honeywell achieved $38.498 billion in sales in 2024, a year-on-year increase of 5%, with automation-related businesses contributing a stable profit stream. More importantly, the company plans to invest at least $25 billion in 2025 in high-return capital expenditures and value-adding acquisitions, with these resources focusing on technology R&D and ecosystem building for the automation business.

Era’s Challenge: Three Profound Transformations in the Industrial Automation Sector

Peter Lau is not just taking over a business unit; he is taking the helm of a strategic highland at the forefront of technological revolution. Currently, the industrial automation sector is experiencing three profound transformations: the integrated application of artificial intelligence and robotics has spawned adaptive manufacturing models; the demand for sustainable development has driven the surge of green automation solutions; and industrial IoT platforms have become new competitive barriers.

Technological Core: Accelerating Integration of AI Capabilities into Traditional Automation Products

Facing industry changes, Honeywell needs to accelerate the integration of AI capabilities into traditional automation products to strengthen its competitiveness in intelligent decision-making.

Industry Microcosm: Industrial Giants Enter the “Era of Strategic Focus”

From an industry perspective, this leadership change marks the entry of industrial automation giants into the “era of strategic focus.” As established industrial groups such as Honeywell and General Electric streamline their businesses through spin-offs, the remaining core automation businesses must find a more precise balance between technological innovation and commercial returns.

Strategic Restructuring: Three Major Positioning Shifts for the Automation Business

Behind this personnel change is Honeywell’s redefinition of the value logic of industrial automation. Under Peter Lau’s leadership, the business may undergo three major strategic shifts: transforming from an “equipment supplier” to an “integrated solution provider,” shifting from “product-driven” to “data-driven,” and moving from “single technology” to “ecosystem synergy.” These three shifts will profoundly change the market positioning of Honeywell’s automation business.

Conclusion: Resonance Between Honeywell’s Innovation and Industry Transformation

Peter Lau’s “return” and the subsequent transformation are not only Honeywell’s self-innovation but also a microcosm of the entire industry seeking new coordinates amid the wave of smart manufacturing.