To seize the development opportunities in the capital market, a number of technology enterprises among the “Hangzhou Six Dragons” have recently accelerated their listing processes. The “Hangzhou Six Dragons” refer to Unitree Robotics, DeepSeek, Game Science, Shapr3D, BrainCo, and CloudMinds. As representative enterprises in the technology sector, they have provided crucial support for technological breakthroughs in relevant fields and the construction of industrial ecosystems in China through their core technologies and innovative practices, demonstrating the innovative strength of Chinese technology enterprises in the global technological competition and their responsibility for national technological development.

Unitree Robotics Completes IPO Tutoring

Recently, the IPO tutoring status of Unitree Robotics was updated to “tutoring acceptance,” with CITIC Securities as the tutoring institution. As Unitree Robotics completes its IPO tutoring, the “first stock of humanoid robots” is about to be born.

Unitree Robotics is a world-renowned civilian robot company specializing in the independent R&D, production, and sales of high-performance general-purpose legged/humanoid robots and dexterous robotic arms for consumer and industrial sectors. It has accumulated profound technological expertise, patents, and market experience, established high industry barriers, and is deeply loved by the public for its relatively affordable prices.

In August 2025, at the first World Humanoid Robot Games, Unitree Robotics won four gold medals (in the 1500m, 400m, 100m obstacle race, and 4×100m events), which is inseparable from its continuous technological innovation and breakthroughs. It is believed that Unitree Robotics will bring us more surprises in the future.

CloudMinds Completes Joint-Stock Reform

CloudMinds is a technology-driven high-tech company focused on application implementation. It mainly researches, develops, and produces quadruped robots and humanoid robots, with a focus on embodied intelligence technology, which it applies to multiple fields such as industry, electric power, fire protection, and security.

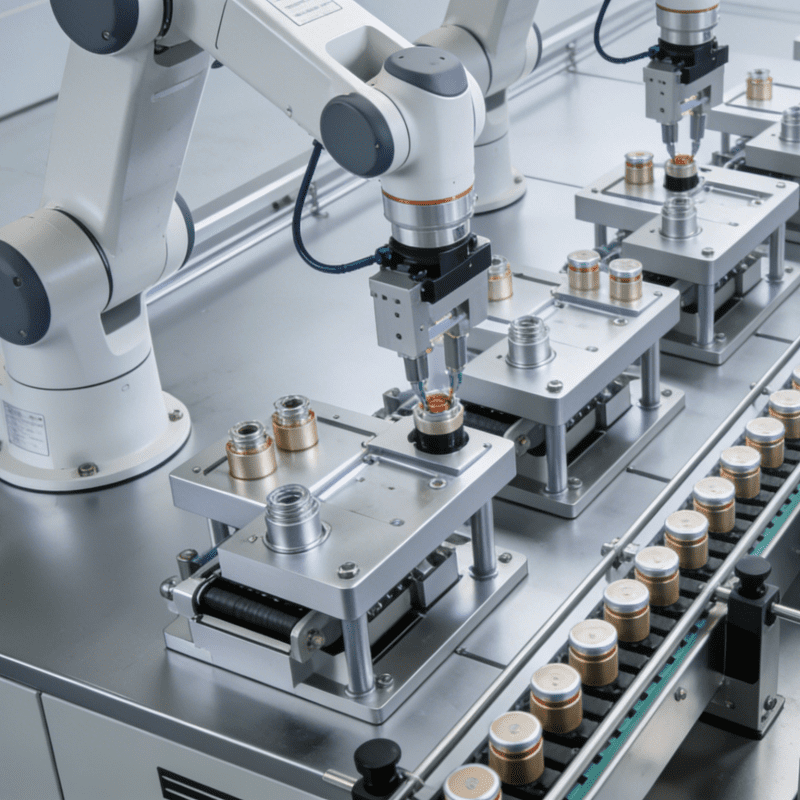

Notably, leveraging its profound embodied intelligence technology, CloudMinds has extended its technological advantages to the R&D of precision automation equipment—its independently developed nebulizer assembly machine integrates robotic dexterous manipulation, AI visual inspection, and real-time quality monitoring. This equipment realizes fully automated assembly of nebulizer air nozzles, atomizing cores, and shell components, increasing production efficiency by over 50% compared to traditional semi-automatic lines and controlling the one-time qualification rate at 99.8%, effectively meeting the strict quality requirements of the medical and consumer electronics sectors for nebulizer products.

In early November, CloudMinds completed its joint-stock reform, officially changing its name from “Hangzhou CloudMinds Technology Co., Ltd.” to “Hangzhou CloudMinds Technology Co., Ltd. (Joint-Stock).” In response to this, a relevant person in charge of CloudMinds told the media, “This joint-stock reform is mainly due to the company’s development needs and to complete the corresponding preliminary preparations.”

Shapr3D Updates Prospectus

Founded in 2011, Shapr3D is committed to becoming a world-leading spatial intelligence service provider and accelerating the integration of artificial intelligence into the physical world. Its core business focuses on “spatial digitalization,” mainly serving industries related to spatial design such as architecture, home furnishings, commercial decoration, real estate, and commercial display. Its core advantage lies in the deep integration of AI into the design process, launching functions such as AI intelligent design, AI-generated renderings, and AI material replacement.

On November 6, Shapr3D launched SpatialTwin, an industrial AI twin platform, at the 2025 World Internet Conference, focusing on the large-scale implementation of embodied intelligence in the industrial sector. Wu Kailiang, Senior Vice President of Shapr3D, introduced that SpatialTwin can build a full-link service system covering factory design and planning, simulation verification, intelligent operation and maintenance, and embodied robot simulation training, aiming to reshape the human-machine collaboration model in industrial manufacturing scenarios.

In August 2025, Shapr3D updated its prospectus and submitted a listing application to the Stock Exchange of Hong Kong for the second time. In the prospectus, Shapr3D stated that as the company’s business continues to grow, it is expected to benefit from improved economies of scale, which will have a positive impact on its long-term profitability.

Conclusion

On May 16, 2025, the China Securities Regulatory Commission (CSRC) officially announced the implementation of the revised Administrative Measures for Material Asset Restructuring of Listed Companies. This revision, by adjusting the payment mechanism, can meet the needs of listed companies to flexibly adjust the number of shares to be paid based on the subsequent operating conditions of the target assets. Especially in the context of large fluctuations in the valuation of technology-based enterprises, it fully protects the interests of listed companies.

Driven by both policy support and technological innovation, the listing processes of many enterprises among the “Hangzhou Six Dragons” are being comprehensively accelerated, and they are making active preparations for listing on the capital market. As an important representative force in China’s technology sector, these enterprises actively seize development opportunities and continuously promote technological R&D and the transformation of achievements. With their solid innovative capabilities, they continuously help optimize and upgrade the industrial structure, inject new momentum into the high-quality development of the economy and society, and continue to empower the creation of a better life.

Disclaimer

The purpose of publishing this information on this site is to disseminate more information and is unrelated to the site’s stance. We also solemnly remind all readers that the stock market is risky and investment requires caution. This article shall not be used as a reference or basis for any investment decisions.