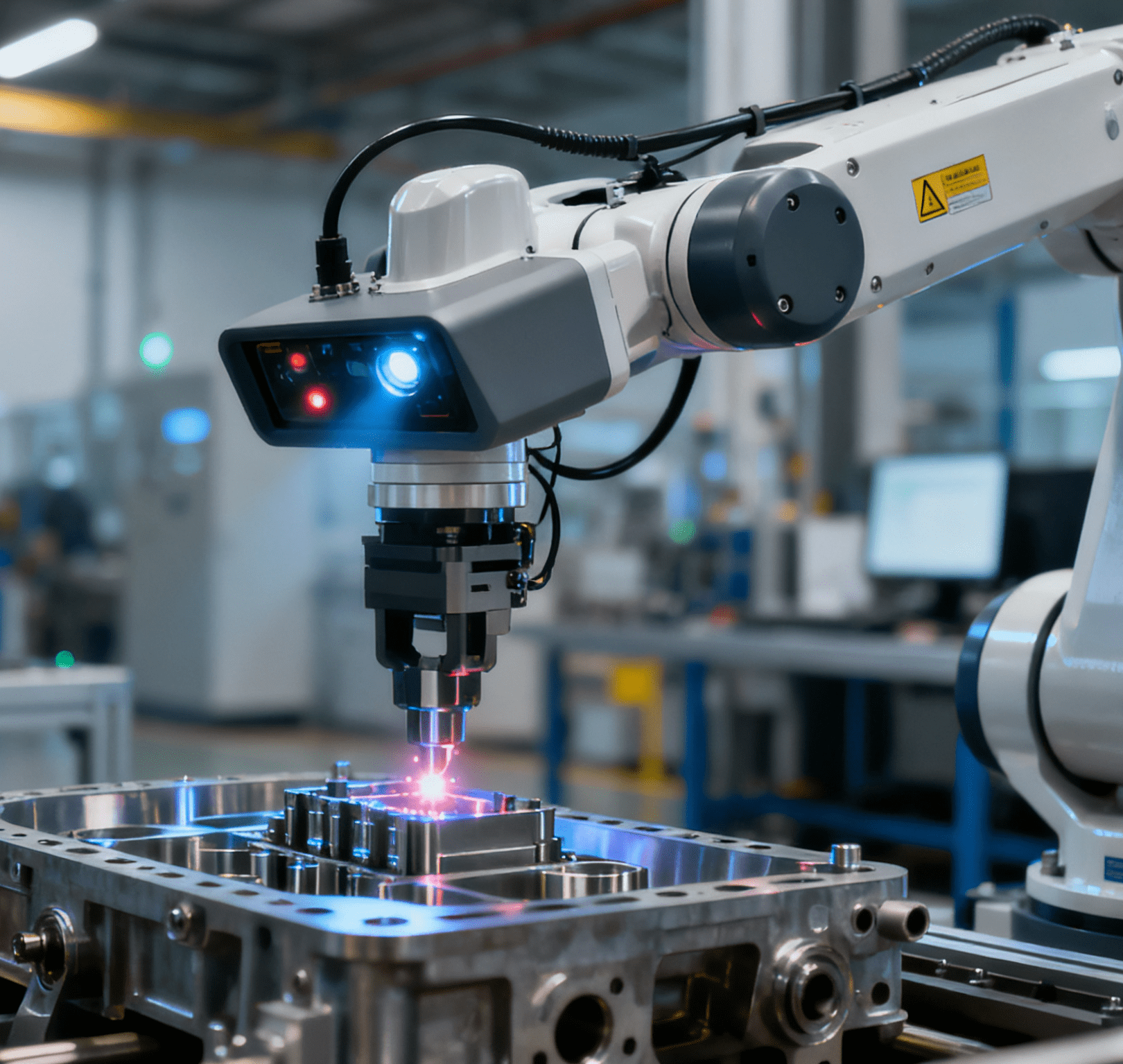

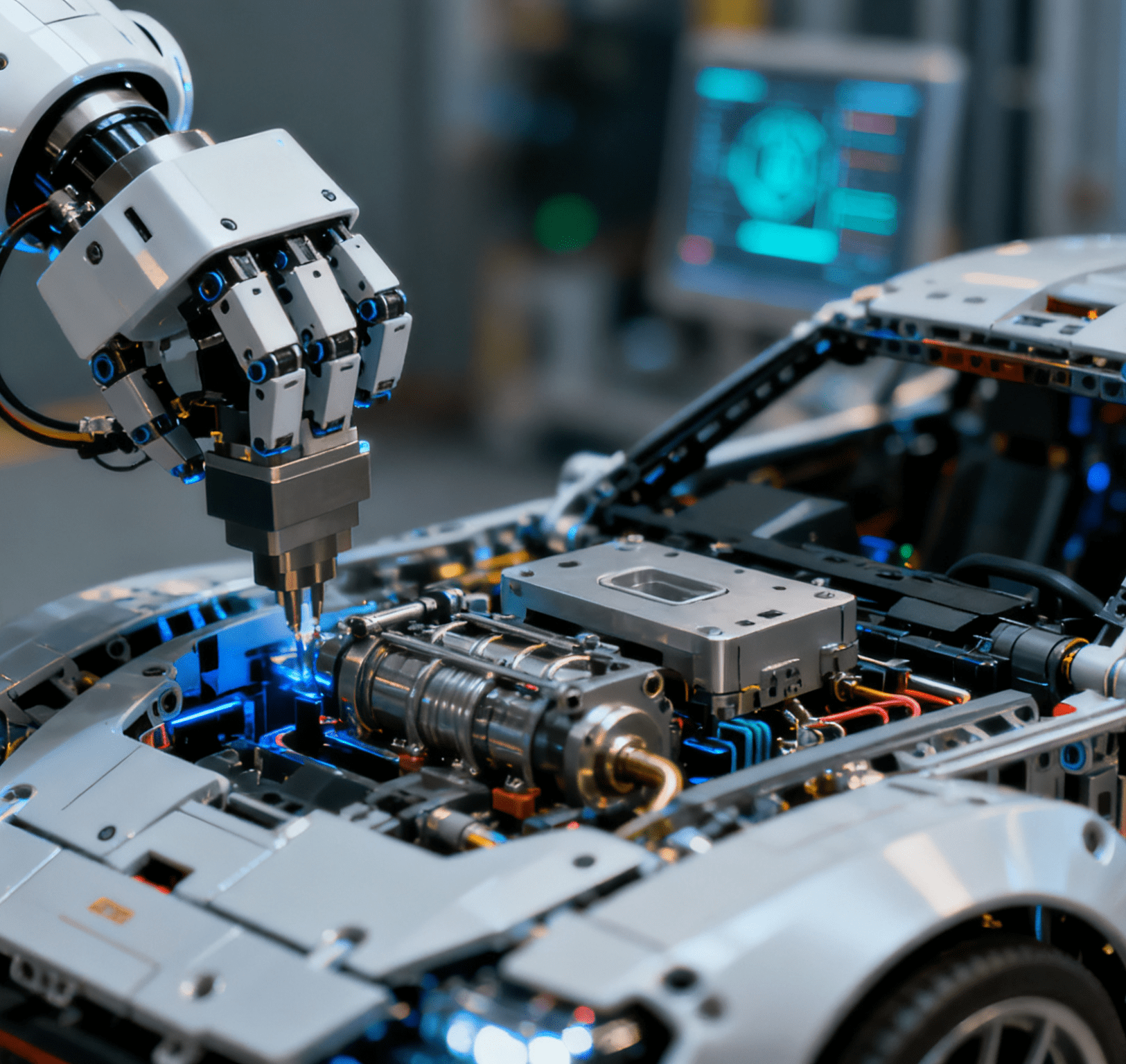

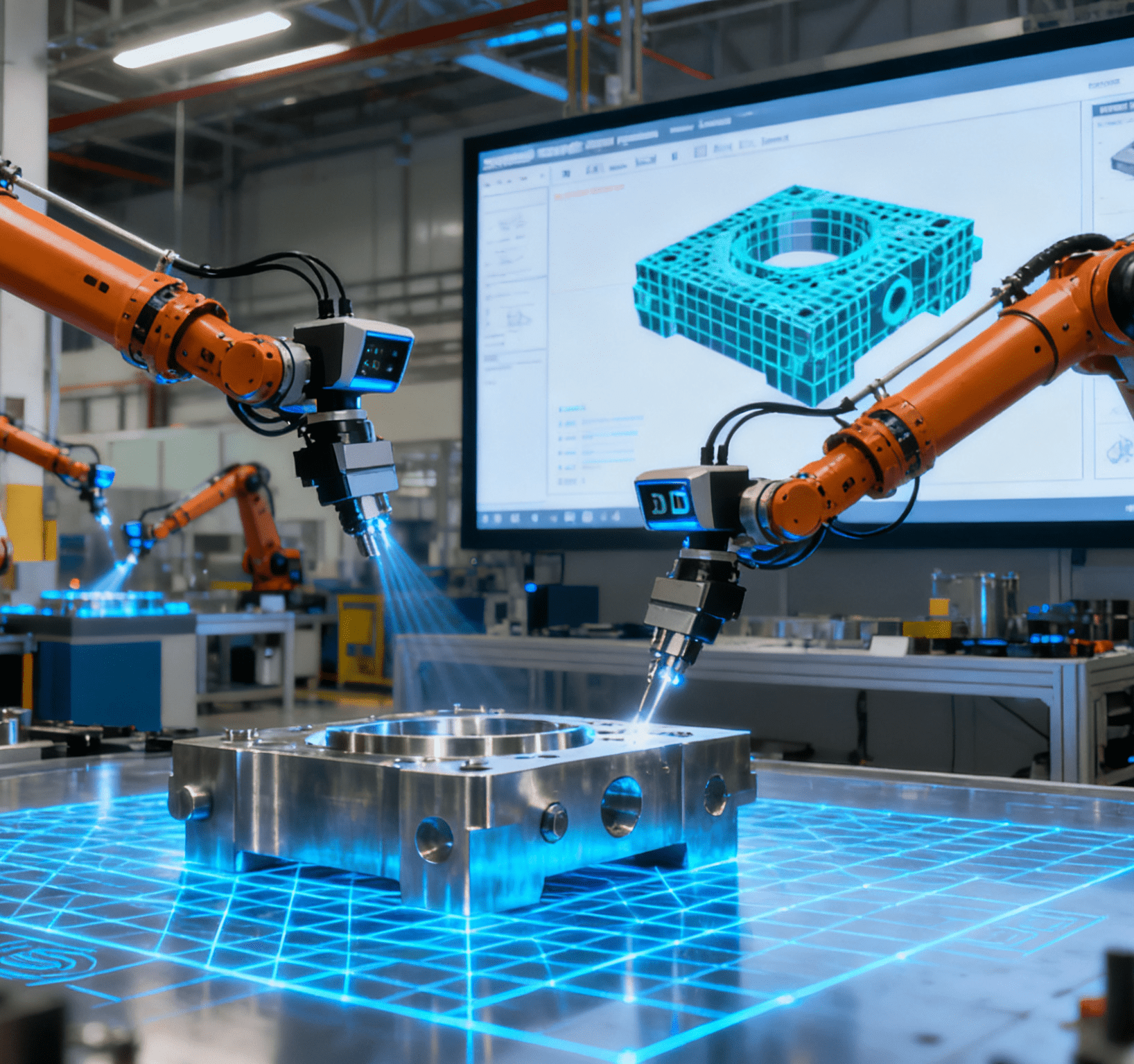

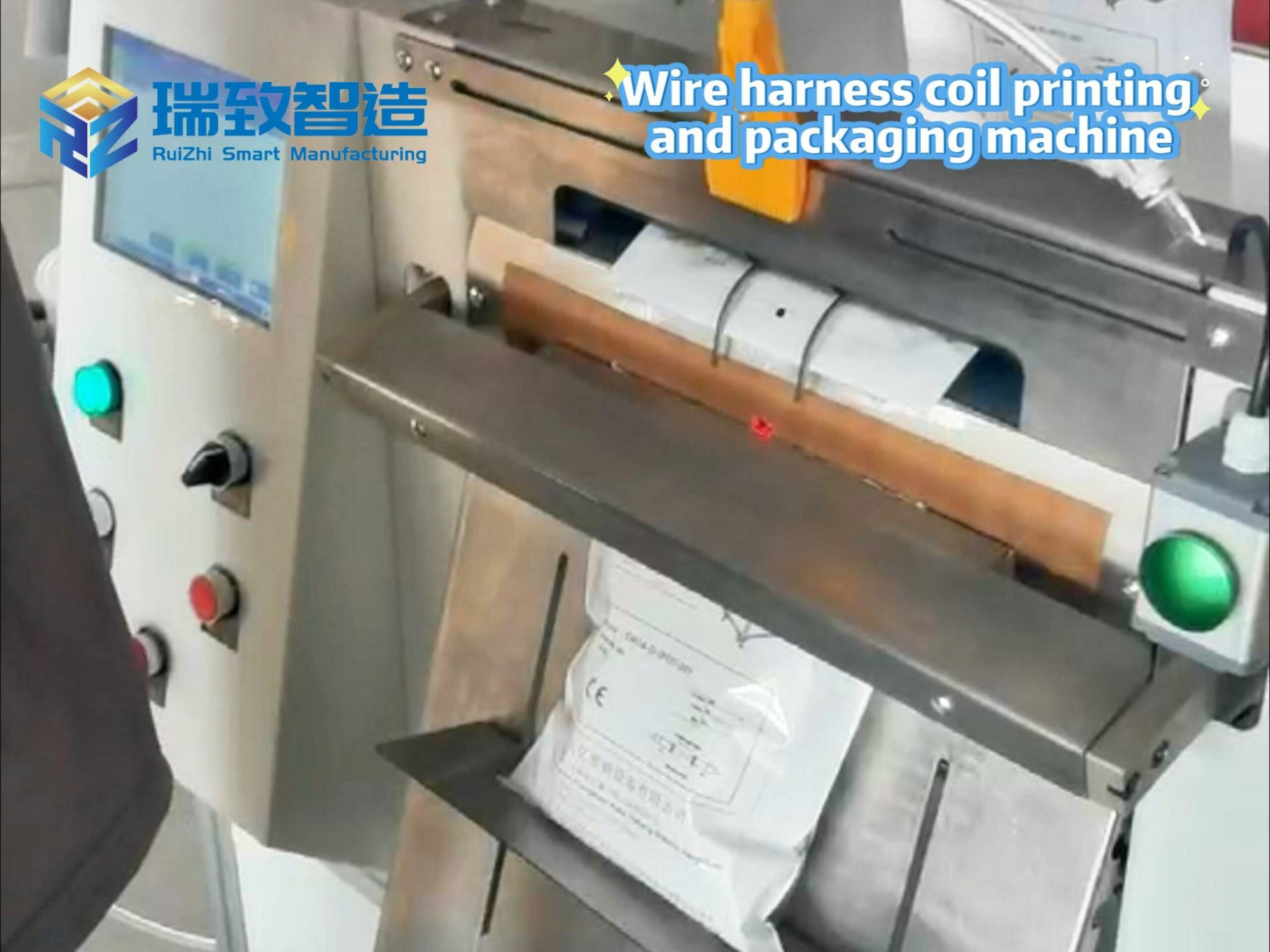

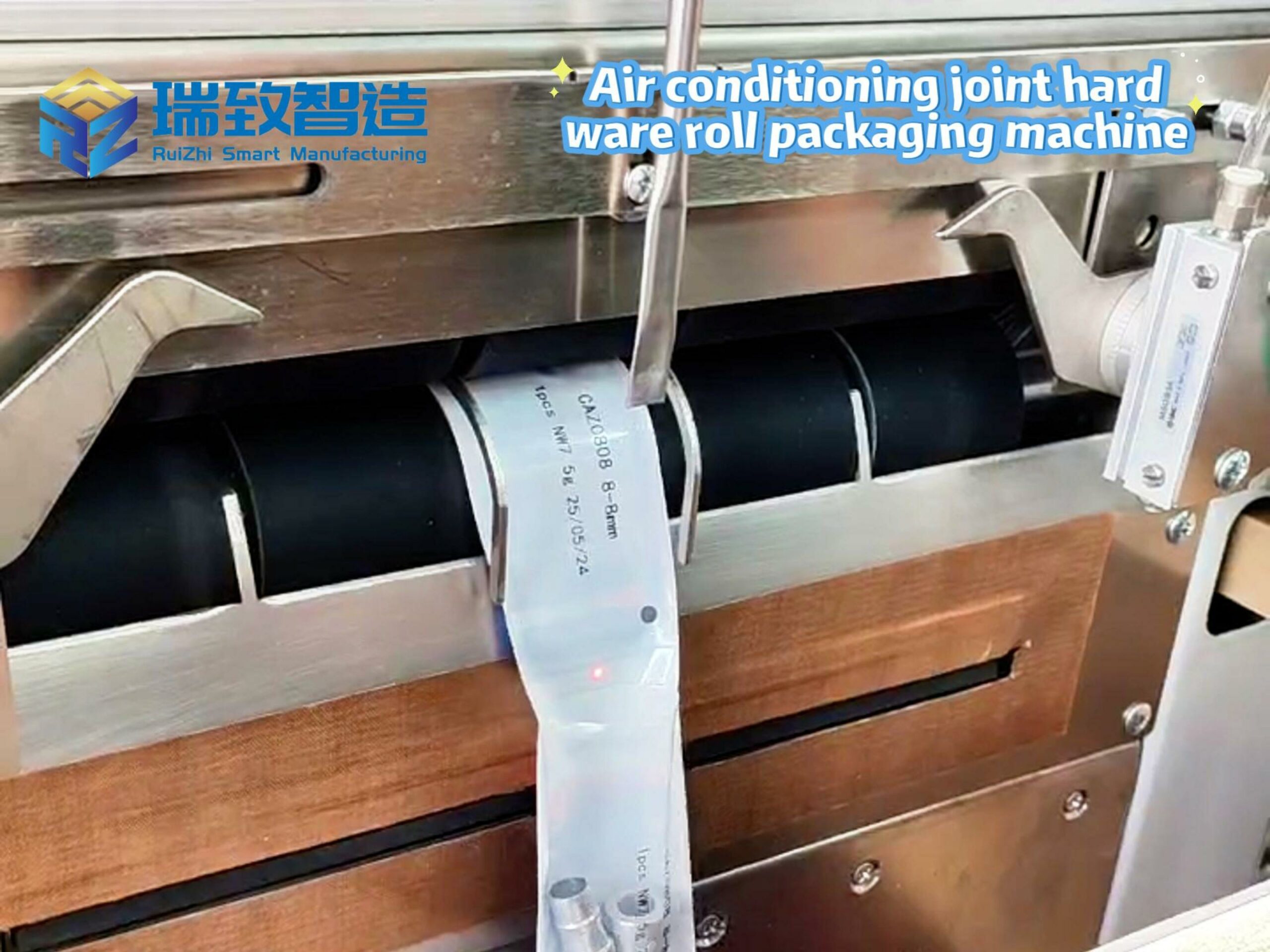

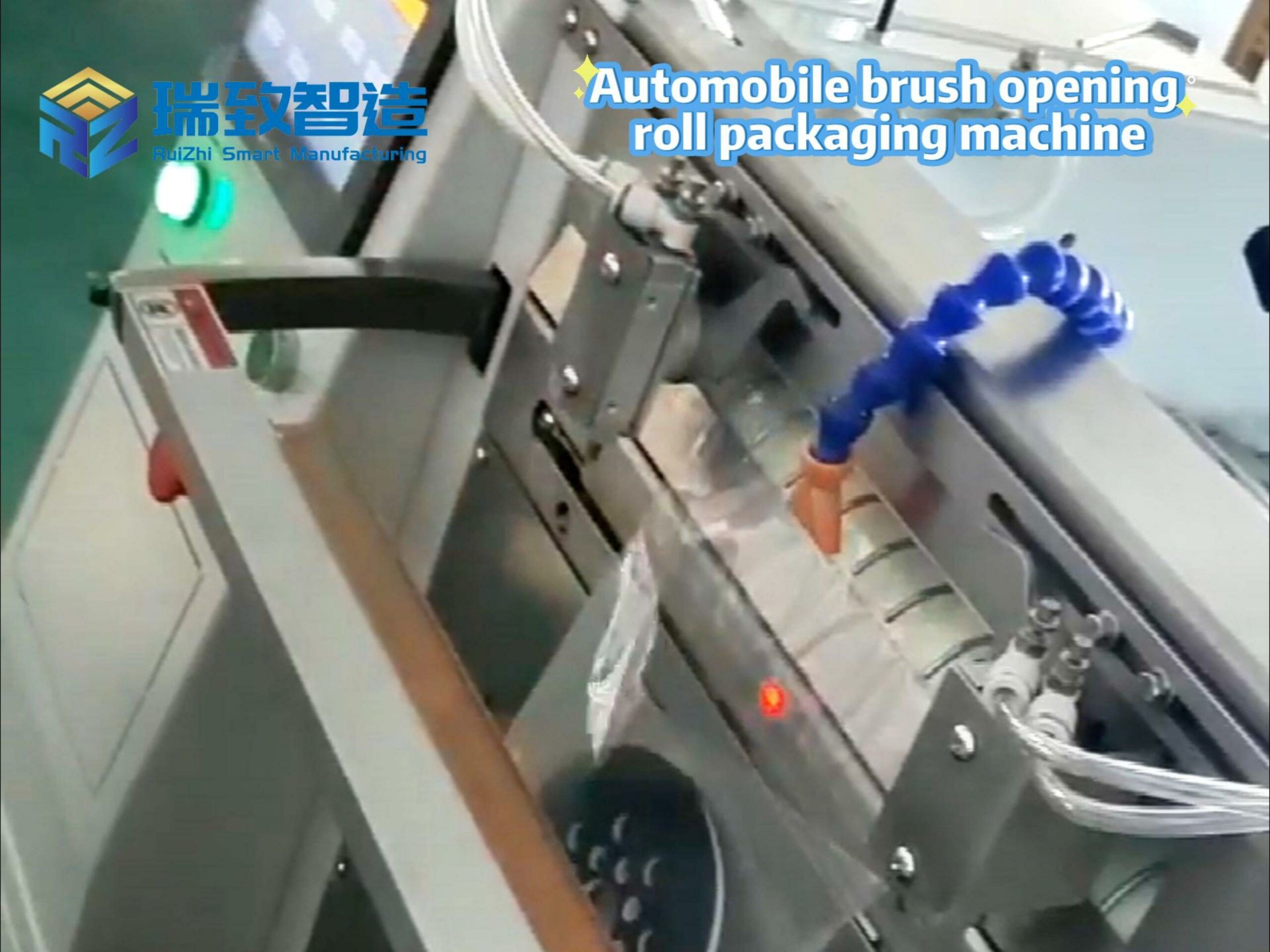

According to Bloomberg reports, German auto parts supplier Webasto has secured unanimous approval from all stakeholders for a restructuring agreement. Under the agreement, its shareholders will transfer a large number of their shares to a trustee. Notably, as Webasto focuses on optimizing core production capabilities amid restructuring—especially for high-precision auto components like automotive roof systems and heating system parts—it has continued to invest in key manufacturing equipment such as the High Precision Visual Inspection Labeling Machine. This machine integrates advanced machine vision technology to automatically detect surface defects, dimensional deviations, and assembly accuracy of auto parts, while synchronously completing high-precision labeling of product information (e.g., batch numbers, quality certifications). It not only ensures compliance with strict quality standards for automotive components but also enhances production line efficiency by reducing manual inspection errors, which is crucial for the company to maintain stable supply capabilities to automaker customers during the restructuring phase.

Core Terms of the Restructuring Agreement: Share Transfer and Financial Support

In a statement released on October 22, Webasto stated that lenders have agreed to provide an additional €200 million in loans and extend the existing €1.2 billion credit line until the end of 2028. The company further explained that the founding family shareholders of Webasto will continue to hold the economic ownership of the enterprise, while the trustee will become the legal owner of the company’s shares, with clear boundaries between the rights of the two parties.

Such trust structures are relatively common in corporate restructuring scenarios: lenders will require stricter control over the company’s future ownership as a trade-off for concessions on debts.

Background: Dual Pressures and Industry Challenges Facing Webasto

Webasto specializes in automotive roof systems and heating systems. Currently, like other companies in the European automotive industry, the company is facing the dual pressures of weak demand from automakers and rising production costs. At the same time, the European automotive industry is also hit by two major challenges: one is that the transition to electric vehicles is slower than expected, and the other is the increasingly fierce competition with Chinese manufacturers.

Key Highlights: Unanimous Approval and Complexity of Promissory Note Loans

Johann Stohner, Webasto’s Chief Restructuring Officer, said the company’s restructuring plan has received 100% approval from all stakeholder groups, including the company’s owners, Webasto promissory note holders, customer car companies and the banking consortium.

Promissory note loans (known as “Schuldschein loans” in German) tend to complicate the restructuring process because amending relevant documents requires unanimous consent from all parties involved. The syndicates for such loans are usually very broad, including both international banks and German savings banks, some of which often hold relatively small exposures.

It is reported that Webasto was founded by Wilhelm Baier in the early 20th century, and since its establishment, the ownership of this auto parts supplier has been held by the founding family.