In early 2024, a leading global automaker faced a crisis: a sudden tariff hike in a small Southeast Asian country—hardly a headline-grabbing event—sent its wiring harness costs spiking by 18% in six weeks. The company’s risk team had been monitoring major geopolitical news (trade wars between superpowers, large-scale conflicts) but missed this “quiet” policy shift, highlighting a stark reality for today’s supply chain leaders: the landscape of geopolitical risk has fundamentally transformed, and old playbooks no longer work.

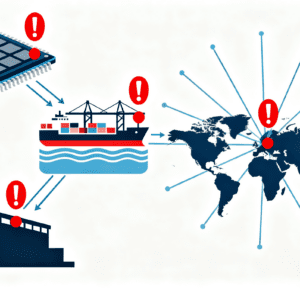

A generation ago, in the early 1990s, supply chains were anchored to a handful of dominant economies—the U.S., EU, and Japan—with predictable trade flows and minimal cross-regional volatility. Today, that stability is gone. According to the IMF and World Bank, emerging markets led by the BRICS+ bloc (Brazil, Russia, India, China, South Africa) now contribute nearly one-third of global output, while no single economic bloc holds a majority share. This multipolar world brings unprecedented complexity: dozens of active conflict zones (from the Red Sea to Eastern Europe), escalating tensions between major powers, and threats that ripple from a supplier’s factory in Vietnam to a warehouse in Chicago. Compounding this is the explosion of open-source information—news alerts, social media chatter, government advisories—that floods decision-makers with noise, making it harder than ever to separate what matters from what doesn’t. To thrive now, supply chain leaders must rethink how they gather, analyze, and act on risk intelligence: the key is no longer just collecting data, but forging a partnership between human judgment and AI to filter signal from chaos.

Better Signals Beat Bigger Headlines

For decades, supply chain teams relied on country risk reports from organizations like the World Bank or OECD. These reports are thorough—but by the time they’re published (often 3–6 months after data is collected), they’re obsolete in a world where a tweet from a head of state or a midnight policy tweak can upend a supply chain. To fill this gap, many turned to “headline monitoring”: tracking breaking news to stay agile. But this approach has a fatal flaw: it prioritizes noise over nuance.

Take 2023, for example: a viral tweet from a European politician criticizing a tech company dominated global news cycles for 48 hours, but had zero impact on the company’s semiconductor sourcing. Meanwhile, a little-noticed regulation in Malaysia requiring foreign manufacturers to use 30% local components by 2025 forced a U.S. electronics firm to restructure its supply chain at a cost of $22 million—all because the team missed the signal amid the headlines.

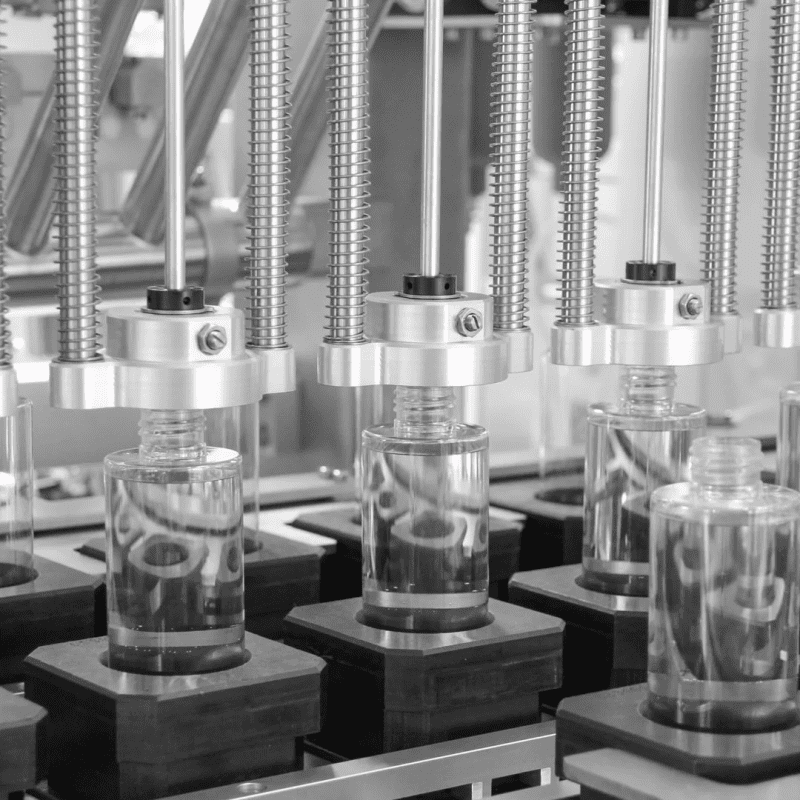

The same “signal blindness” hit the (sanitary ware) industry in 2024: a global Flush Button Assembly Machine (which assembles the tactile and electronic components of bathroom flush buttons) in Vietnam ground to a halt for 3 days, causing $500,000 in daily losses. The root cause? Its core supplier of plastic 卡扣 (clips) for flush buttons—based in Thailand—was caught off guard by a local environmental agency’s new rule (published only on a regional government website, not mainstream news) requiring all plastic parts to pass additional biodegradability testing before export. The company’s risk team, focused on Thailand’s national tariff changes, never spotted the rule—until shipments were held up at customs, leaving the assembly machines idle.

The lesson is clear: meaningful risk intelligence isn’t found in the loudest stories, but in the “quiet” data points—quantifiable trade policy shifts, regional regulatory changes, local labor trends—that shape long-term supply stability. When leaders focus on these signals, they move from reacting to crises (e.g., scrambling to find a new supplier after a ban) to proactively optimizing (e.g., rerouting logistics before a tariff takes effect, or diversifying vendors in high-risk regions).

The Risk Intelligence Trifecta: Human, Data, AI in Sync

Managing geopolitical risk today isn’t just about hiring more analysts or buying better software—it requires a synergy of three elements: human oversight, interoperable data, and AI/ML-powered detection. These aren’t competing tools; they’re complementary pillars that address each other’s gaps.

Human oversight: The “context filter”

Local analysts—with native language skills, deep regional knowledge, and trusted local networks—are irreplaceable. For example, an analyst in Mexico City can distinguish between a short-term labor protest (a transient shock) and a sustained push for new labor laws (a systemic risk) in ways a remote team in New York cannot. They verify rumors (e.g., “Is that export ban in Indonesia real, or a draft?”), interpret cultural nuances (e.g., how a political election in India might impact state-level manufacturing permits), and ensure AI-generated alerts are grounded in real-world reality—not just data patterns. This human judgment is the foundation of reliable risk intelligence.

Interoperable data: The “visibility layer”

Supply chains are global webs, but too often data is siloed: geopolitical risk reports sit in one system, supplier maps in another, and commodity prices in a third. Interoperable data fixes this by weaving these streams into a single “knowledge graph”—for instance, linking a drought in Brazil (weather data) to a coffee roaster’s supplier (supply chain map) and rising coffee futures (commodity data). This integration uncovers hidden vulnerabilities: a 2024 analysis by a global retailer found that unrest in Kenya (geopolitical data) threatened 12% of its European textile supply—thanks to a Kenyan yarn supplier that fed into a Turkish factory, which then shipped to Germany. Without interoperable data, this chain would have remained invisible.

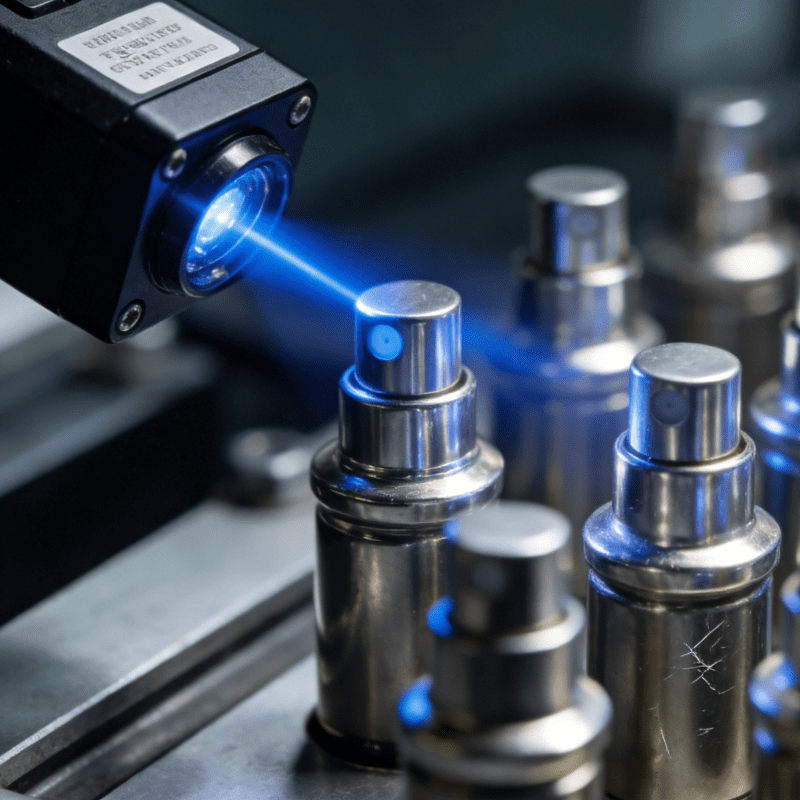

AI/ML detection: The “scale engine”

No human team can monitor 10 million media sources, 500+ regulatory bodies, and 1,000+ suppliers in real time—but AI can. Intelligent systems sift through this volume to spot patterns: rising mentions of “export restrictions” in South Korean tech news, or a spike in labor strike reports near Vietnamese electronics hubs. Crucially, AI doesn’t replace humans; it amplifies them. For example, an AI tool might flag a potential ban on rare earth exports in Mongolia, then pass that signal to a local analyst to verify and contextualize. The AI handles scale; the human handles judgment.

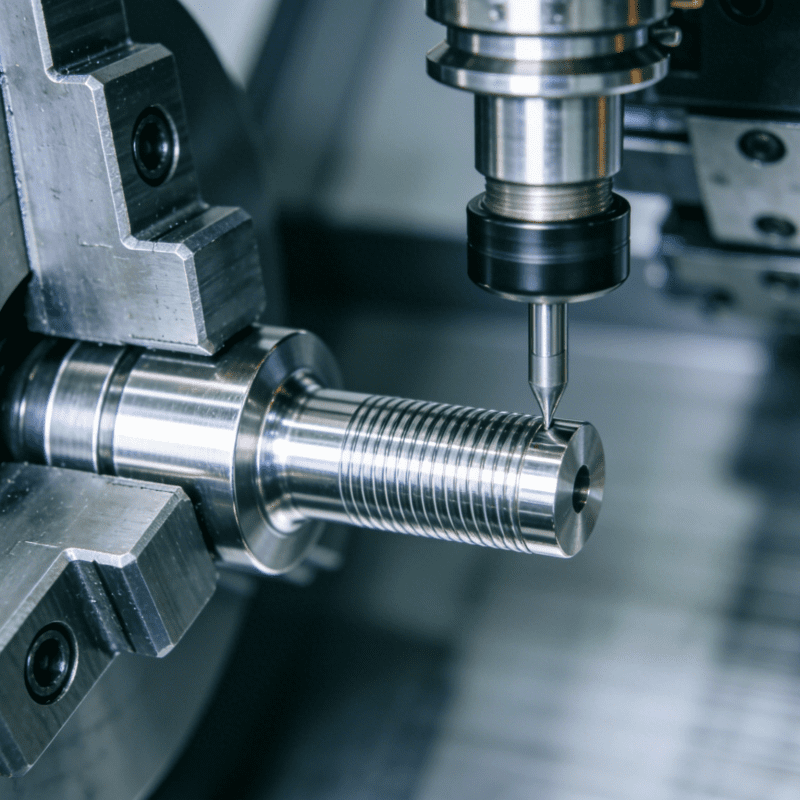

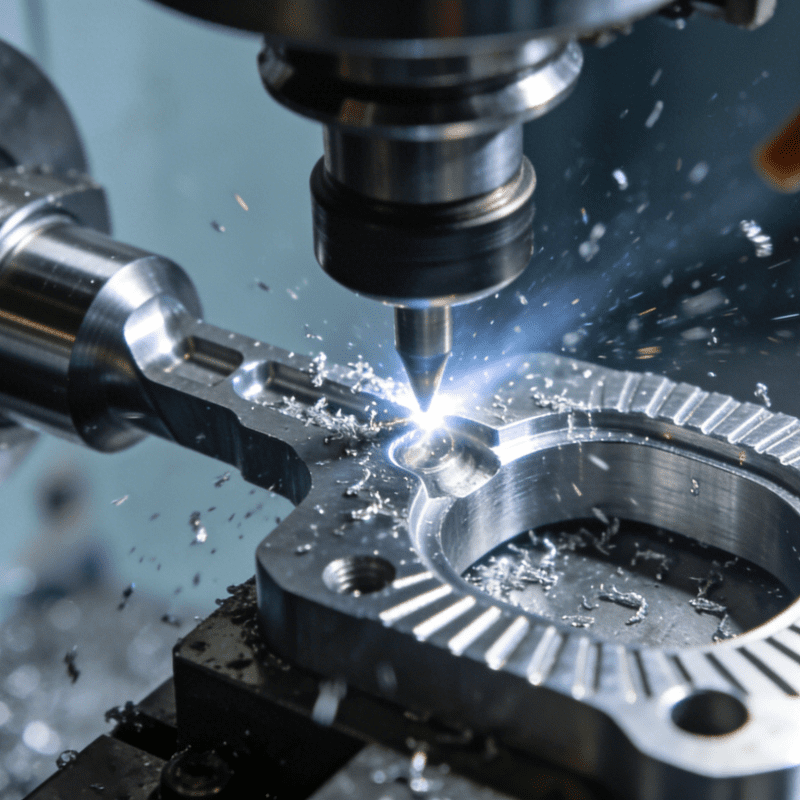

Semiconductors: A Case Study in Trifecta Power

Few industries embody supply chain fragility like semiconductors—and few illustrate the value of the human-AI-data trifecta better. A single chip relies on 1,000+ specialized inputs: raw materials from Australia (lithium), wafer production in Taiwan, and advanced machinery from the Netherlands (ASML’s lithography tools). A single disruption—say, a 7.0 earthquake in Taiwan (which halted 30% of global wafer production in 2024) or a U.S. export ban on AI chips to China—can cripple industries from auto to tech.

Here’s how the trifecta works:

Human analysts: A team in Taipei knows which wafer fabs are most vulnerable to earthquakes (and have backup power) vs. those that aren’t—context AI can’t capture.

Interoperable data: A semiconductor firm’s knowledge graph links Taiwanese fabs to its U.S. chip designers, Chinese assembly plants, and automotive customers—revealing that a 10-day fab shutdown would delay 2 million cars.

AI detection: An ML model monitors Taiwanese seismological data, U.S. export policy updates, and ASML’s production schedules—alerting the team to a potential delay in lithography tool deliveries 6 weeks before it hits headlines.

This synergy turned a potential crisis into a proactive fix: the firm shifted some production to a Japanese fab, renegotiated delivery timelines with automakers, and avoided a $450 million loss.

From Risk to Resilience: The New Supply Chain Playbook

The old supply chain mantra was “efficiency first”; the new one is “resilience through human-AI collaboration.” A growing number of forward-looking companies are already putting this into practice:

A global consumer goods firm used its human-AI-data model to predict a Suez Canal disruption in late 2024 (via AI-monitored shipping lane tensions and local analyst insights), rerouting 20% of its cargo to alternative routes and saving $30 million.

A pharmaceutical company used interoperable data and AI to track raw material supplies across 20 countries, avoiding a shortage of a key vaccine ingredient when a Indian supplier faced regulatory delays.

These examples aren’t anomalies—they’re the future. As the multipolar world grows more complex, and information overload worsens, supply chain resilience won’t come from more data or smarter AI alone. It will come from weaving human judgment (context, nuance) with interoperable data (visibility, connections) and AI (scale, speed) into a seamless system.

In this new era, geopolitical risk isn’t a threat to be managed—it’s an opportunity to build competitive advantage. The supply chains that thrive won’t just survive disruptions; they’ll anticipate them—because they’ve mastered the art of working with both human insight.