Looking ahead to 2026, the global manufacturing and automotive industries are undergoing a profound structural transformation. This transformation is not only about technological advancement but also reflects the reshaping of multiple dimensions, including labor forces, trade patterns, energy structures, and industrial layouts. For the manufacturing and automotive sectors, the core of competitive advantage is shifting from mere production efficiency and cost control to the systematic building of resilience and strategic flexibility. Over the next two years, industry leaders need to focus on the following four key trends: the reshaping of labor structures, the rise in trade compliance costs, the evolving tension in energy structures, and the new premium logic brought by “nearshoring manufacturing.”

Reshaping of Labor Structures: From Cost Pressure to Capability Transformation

The manufacturing industry has long relied on sufficient and low-cost labor dividends. However, with the intensification of population aging, the decline in the supply of young labor, and the weakening attractiveness of manufacturing jobs, the traditional model is facing structural challenges. According to data from the National Bureau of Statistics, the average age of blue-collar workers in the manufacturing sector has exceeded 38 years, and this trend is expected to continue rising over the next five years. At the same time, the emergence of new-quality productive forces places higher demands on skill structures— the imbalance between supply and demand for positions such as industrial AI, automated equipment operation and maintenance, and intelligent manufacturing system management is widening.More importantly, unit labor costs (ULC) continue to rise. Wage growth has outpaced productivity growth, further compressing profit margins in labor-intensive industries. Although some enterprises have attempted to improve efficiency through “machine replacement,” overall results remain to be enhanced due to constraints on capital investment capacity and digital management capabilities.To address this challenge, the manufacturing industry needs to accelerate adjustments in three directions:

Build a composite talent system: Promote collaboration between vocational education and the industrial chain, and strengthen the mobility mechanism between skilled workers and engineers.

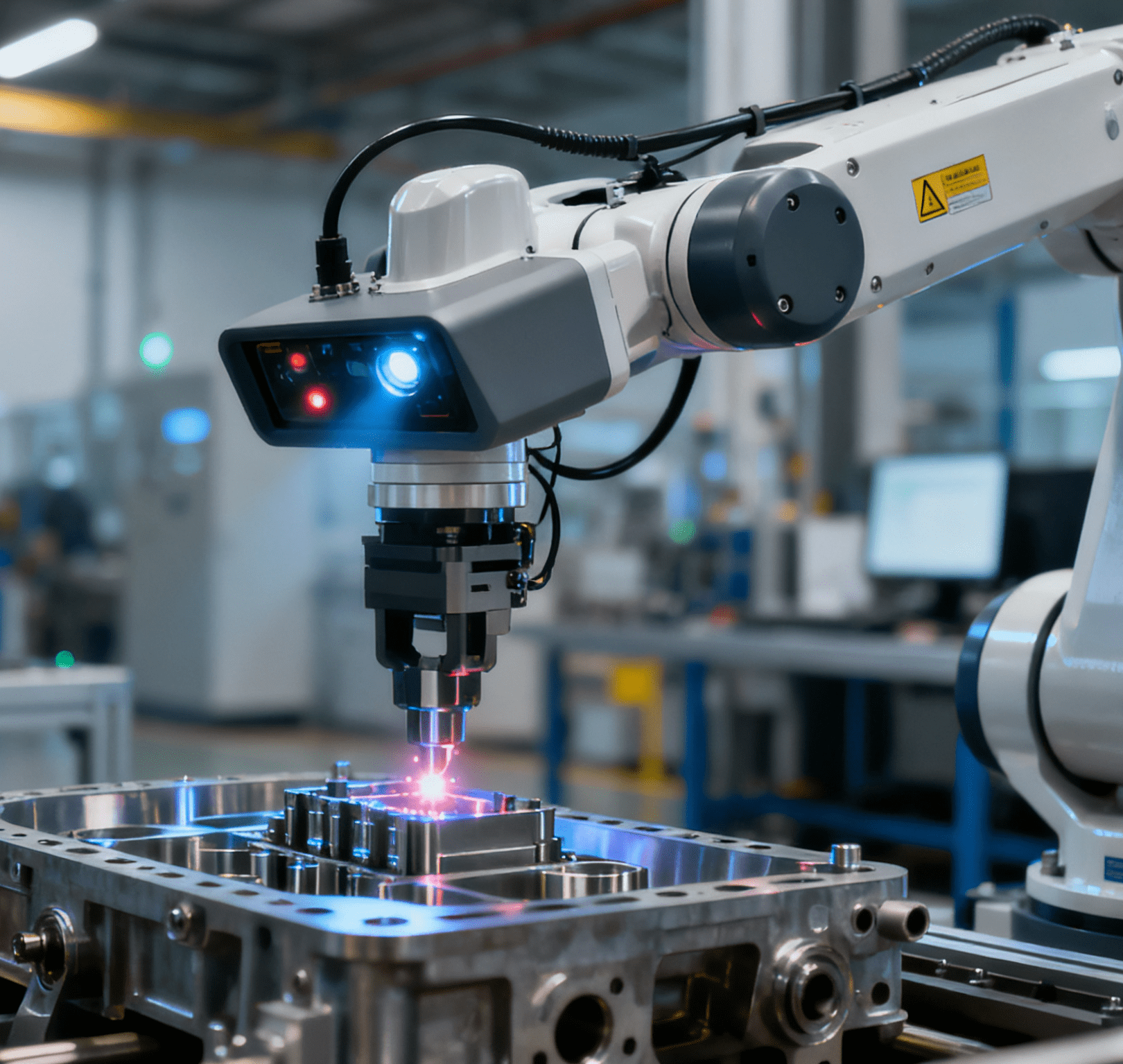

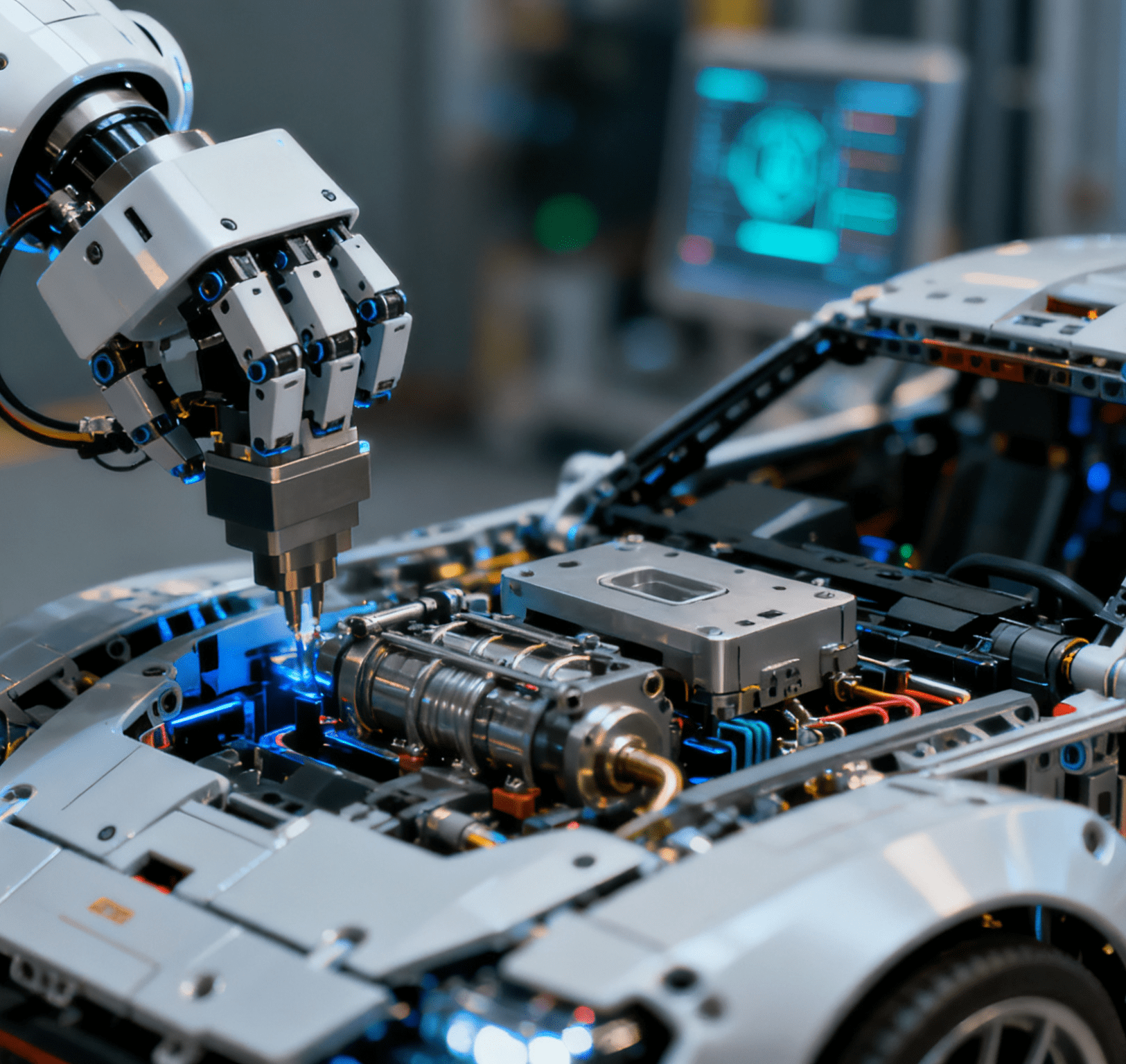

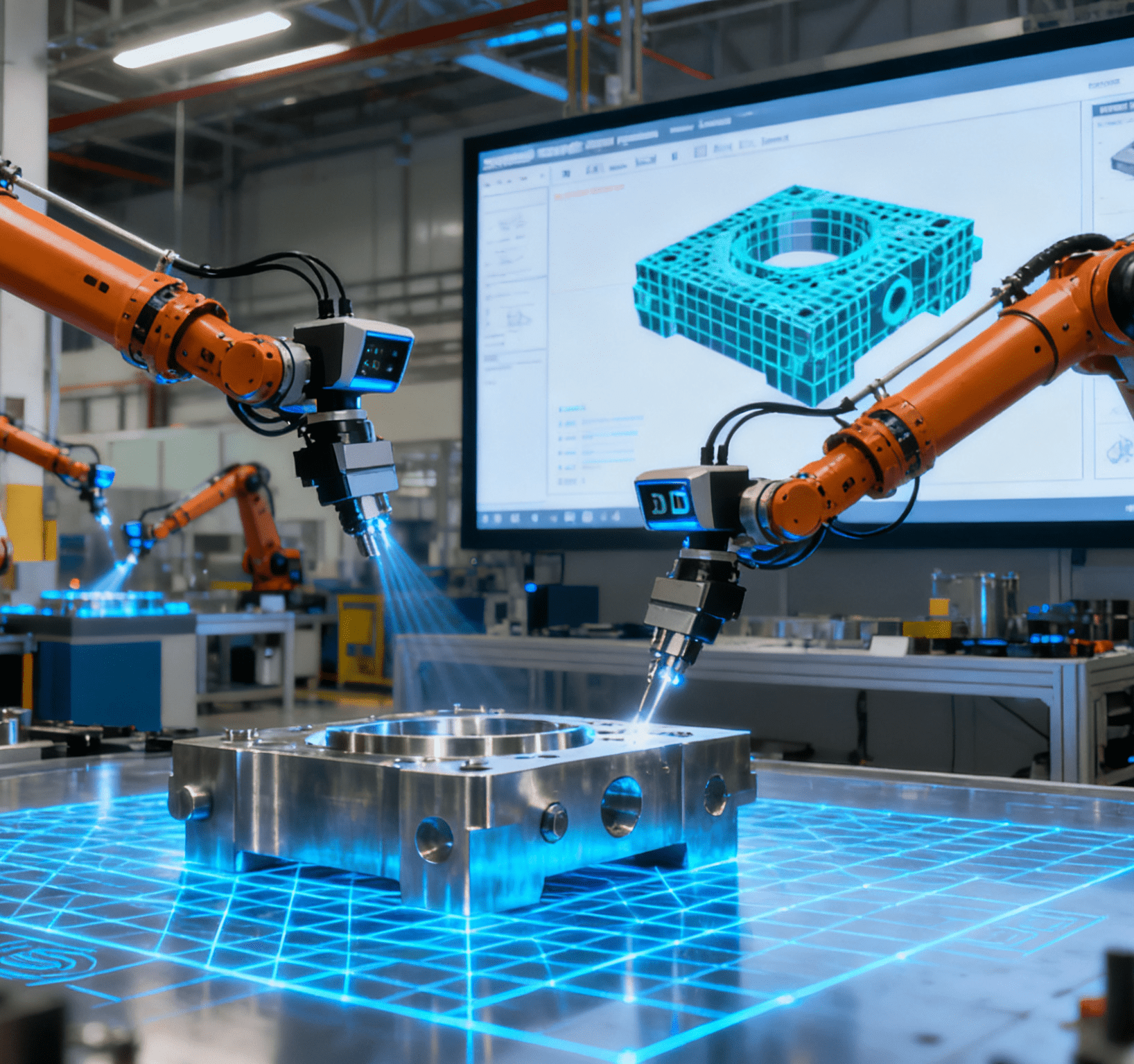

Structural cost reduction centered on automation: Encourage small and medium-sized manufacturing enterprises to adopt modular automation solutions to lower the threshold for technology adoption—especially Automatic%20Injection-Molded%20Part%20Feeding%20And%20Assembly%20systems, which can realize end-to-end automation from feeding of injection-molded components to precise

assembly, significantly reducing labor dependence and improving assembly consistency.

Digital-driven production optimization: Use data collection and AI analysis to improve production line efficiency and realize a new “human-machine collaboration” production model.

Hidden Costs of Trade Compliance: From Passive Response to Strategic Transparency

Against the backdrop of increasingly complex global trade patterns, manufacturing and automotive enterprises are facing significantly greater compliance pressure. Beyond traditional tariffs and quotas, emerging requirements such as rules of origin, supply chain traceability, and the Carbon Border Adjustment Mechanism (CBAM) have become core issues that enterprises must address.For manufacturing enterprises, the transparency and traceability of the supply chain for exported products have become new thresholds. Markets such as the EU, the United States, Japan, and South Korea are requiring suppliers to provide full-chain data, from raw material sources and production processes to carbon emission paths. This forces enterprises to fully upgrade their information systems, ERP, and supply chain management platforms to support bill of materials (BOM)-level traceability capabilities.Nevertheless, while this series of compliance investments increases costs in the short term, they bring systematic benefits in the long run:

Data transparency improves supply chain visibility, helping identify risk nodes;

Refined management promotes optimization of inventory turnover and capacity allocation;

Digital collaboration enhances strategic stickiness with upstream suppliers and downstream customers.

In the future, enterprises with high compliance transparency and verifiable carbon emission capabilities will gain greater bargaining power and market trust in the reorganization of international supply chains.

Widening Energy Gaps: The “Growth Bottleneck” for Manufacturing

The manufacturing industry is a major energy consumer in China, accounting for approximately 40% of the country’s total energy consumption. With the rapid development of intelligent manufacturing, industrial internet, and new energy vehicle industries, industrial electricity demand continues to rise. However, energy supply-demand gaps and electricity price fluctuations in some regions are becoming important constraints on enterprises’ capacity expansion and investment layout.Particularly in industrial concentration areas such as the Yangtze River Delta, Pearl River Delta, and Bohai Rim, the imbalance between electricity supply and demand and peak load pressure has become increasingly prominent. On the other hand, although the installed capacity of clean energy is growing rapidly, supporting energy storage and grid dispatching capabilities still have structural lag, forming an “energy structural gap.”Over the next three years,manufacturing enterprises need to transform from energy consumers to energy managers:

Build distributed energy systems: Deploy rooftop photovoltaics, wind energy, and energy storage facilities to achieve partial self-sufficiency.

Digitalize energy efficiency management: Realize dynamic energy efficiency optimization through energy consumption monitoring systems and AI dispatching.

Industrial park collaboration: Explore “park-level energy management platforms” to achieve energy sharing and load balancing among multiple enterprises.

Energy issues are becoming one of the core topics in corporate governance. Energy strategy is no longer just a cost item but a key variable related to production safety and growth potential.

Rise of “Nearshoring Premium”: New Logic for Supply Chain Reconstruction

In recent years, driven by geopolitics, transportation costs, and sudden risks, the manufacturing industry has been forming a new global layout logic—”nearshoring manufacturing” or “localized production.” In the Chinese market, this trend manifests in two paths: “regional agglomeration of domestic supply chains” and “localized factory construction in overseas markets.”For the domestic market, enterprises are accelerating the construction of regional collaboration networks such as “Eastern Data and Western Computing” and “Southern Manufacturing and Northern Supply.” Through supply chain relocation, industrial co-construction, and park intensification, they aim to achieve a comprehensive balance of cost, speed, and risk.In the international market, Chinese automotive and equipment manufacturing enterprises are actively deploying production bases in Southeast Asia, the Middle East, and Central Europe to cope with trade barriers and localization policy requirements. The resulting new logic of “proximity to the market equals proximity to competitiveness” is known as the “proximity premium.”However, this trend also brings challenges: high capital expenditure, policy uncertainties in different regions, and increased complexity of cross-border supply chain collaboration. Enterprises need to strike a balance between global production integration and regionalization strategies. By enhancing intelligent manufacturing and supply chain digital capabilities, they can achieve the strategic goal of “flexible layout and controllable costs.”

Conclusion: Embracing Uncertainty with Strategic Resilience

Over the past few years, China’s manufacturing and automotive industries have experienced multiple tests, including the impact of the pandemic, supply chain fluctuations, and technological iteration. 2026 will be a crucial year for industrial repositioning.Enterprises need to shift from “cost-driven” to “value-driven,” and from “short-term response” to “long-term planning,” to build systematic advantages that combine technological competitiveness, compliance capabilities, and energy security.The leading enterprises of the future will not only be those with the highest production efficiency but also those that can maintain strategic clarity and quickly adjust directions amid uncertainty. True competitiveness will stem from early deployment in response to structural trends and continuous adaptation to complex environments.

What is the market price of a continuous motion multi-piece special-shaped machine?