At the 2025 EVOLUTION Innovation Conference held on October 28, Cheng Peng, CEO of NavInfo, shared an example during his annual speech: Approximately 75% of the supply chain we have built for the automotive industry can be reused in products such as robots, drones, lawnmowers, and floor sweepers.

Amid the rapid expansion of the new energy vehicle (NEV) industry, supply chain enterprises are reaping the dividends of development. Today, more and more enterprises are pursuing “cross-sector reuse” of mature technologies to unlock new growth opportunities, and “embodied intelligence” has emerged as one of the high-profile blue oceans in this context.

Cross-Sector Reuse Potential: 75% Supply Chain Overlap Links Automobiles and Robots

Behind the 75% figure shared by Cheng Peng lies the inherent advantage of the automotive supply chain’s industrial attributes—given that automobiles are among the most complex products in manufacturing. As a key player in the automotive supply chain, NavInfo is undoubtedly one of the first to perceive industry trends (“the duck is the first to feel the warmth of spring water”).

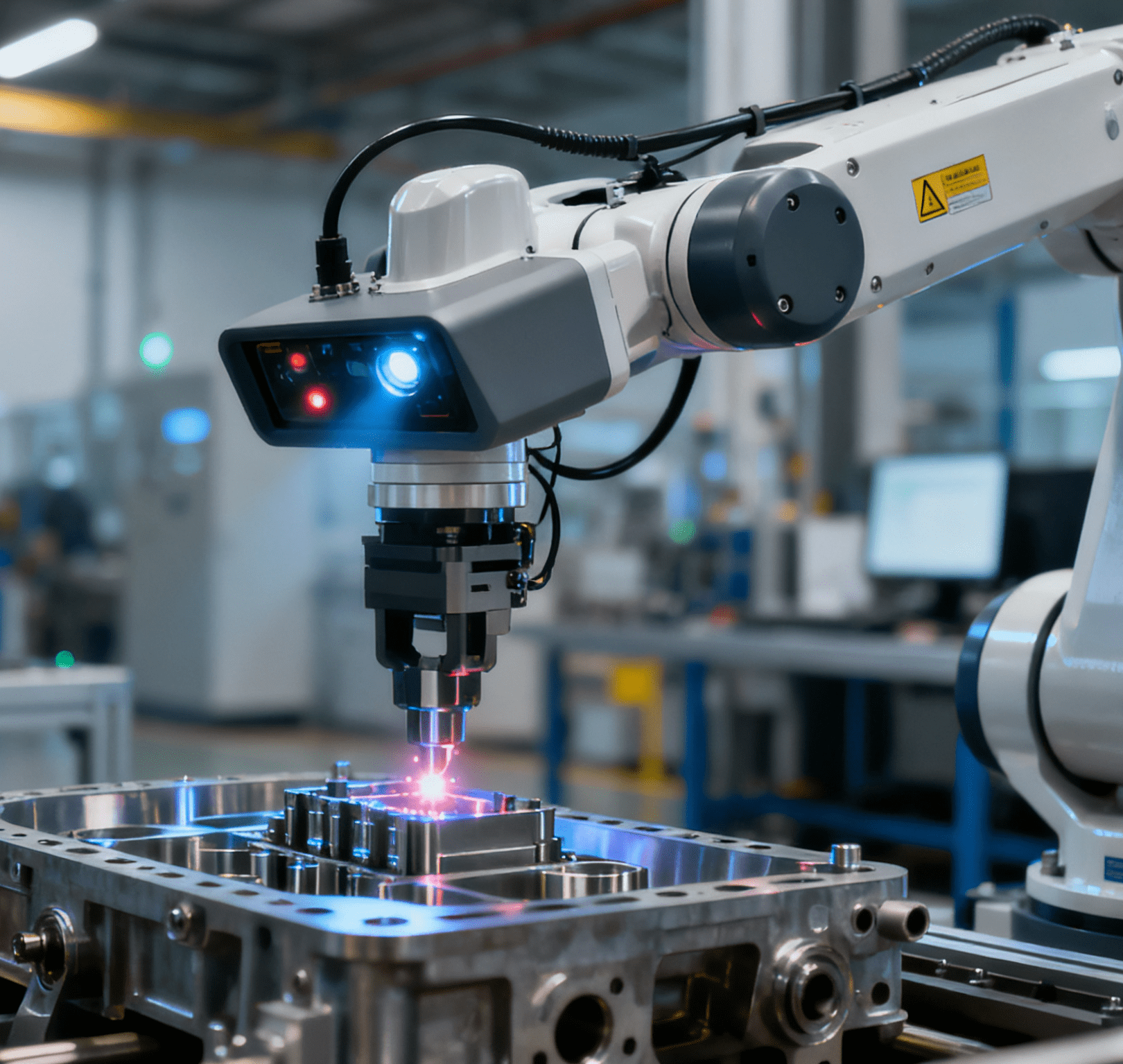

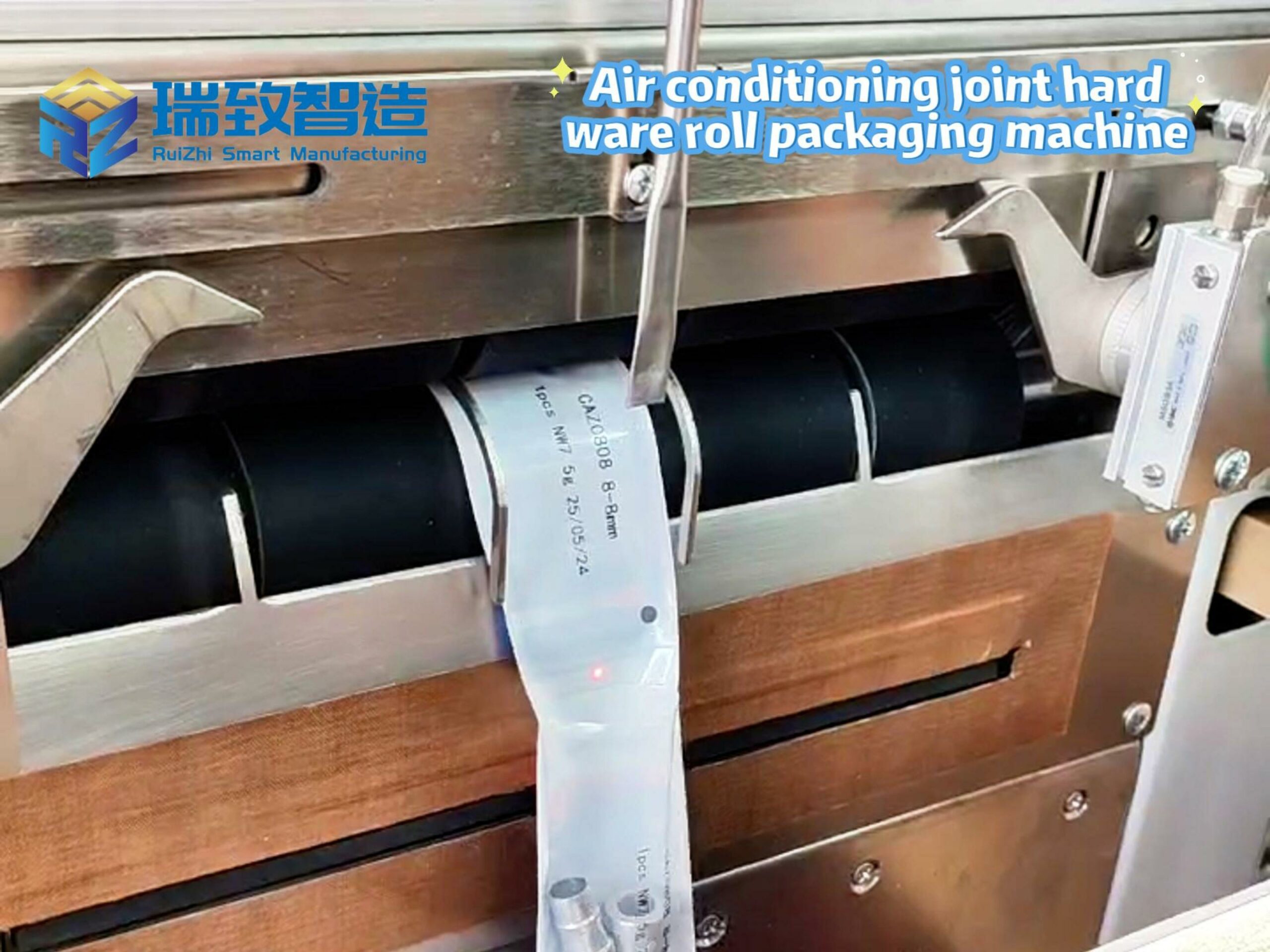

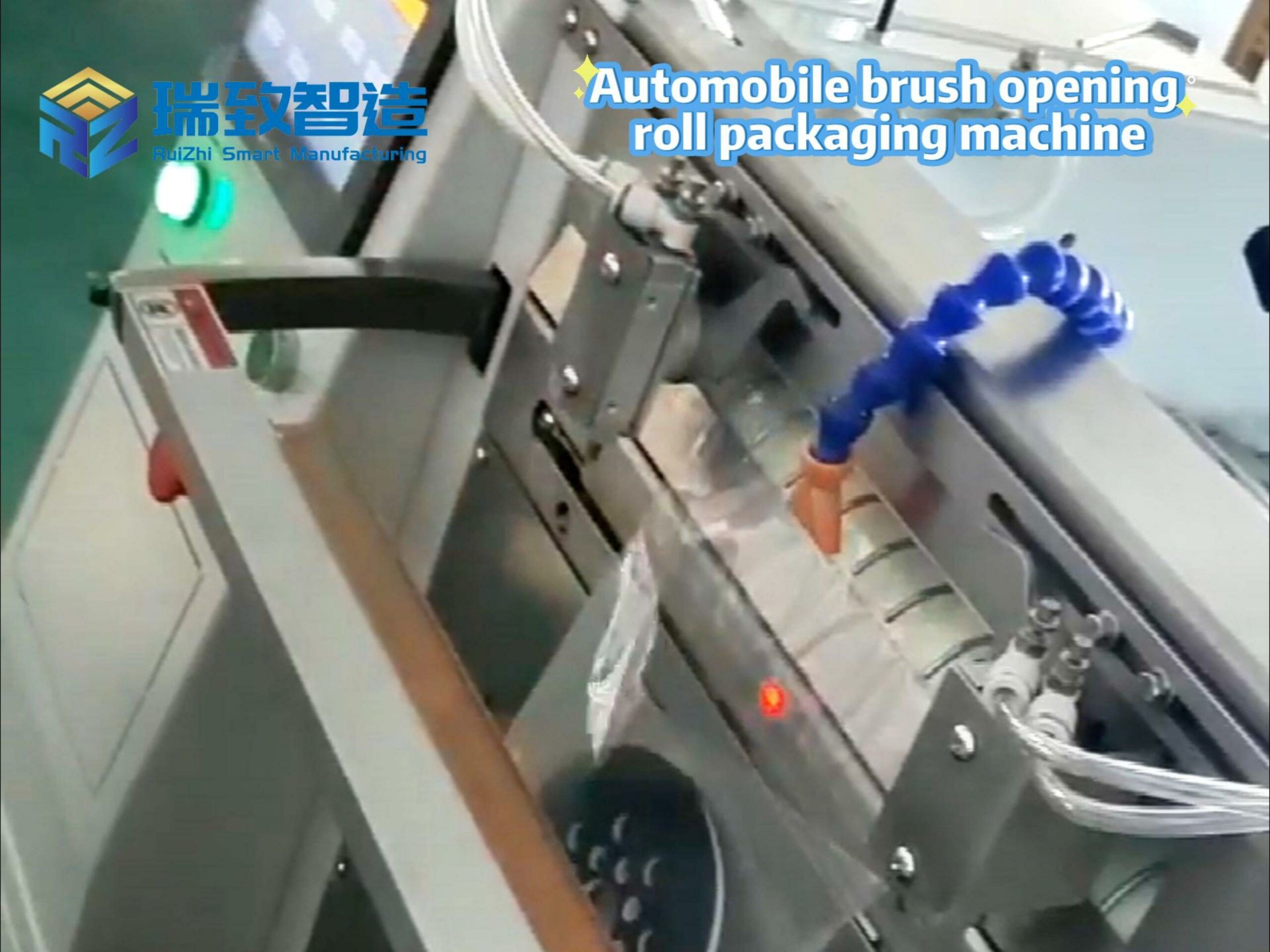

According to Cheng Peng, an average automobile consists of 20,000 parts, and each automaker works with 100 to 400 Tier-1 suppliers, forming the most complex and comprehensive industrial chain in manufacturing. Among these 20,000 parts, NavInfo provides 500 key components, including core products such as chips and modules. Even specialized equipment like fuse assembly machines, which are essential for ensuring the safety and stability of automotive electrical systems, can be repurposed with minor adjustments for assembling precision electronic components in humanoid robots, thanks to their mature automated positioning and assembly capabilities honed in automotive production.

In fact, Cheng Peng is far from alone in holding this view

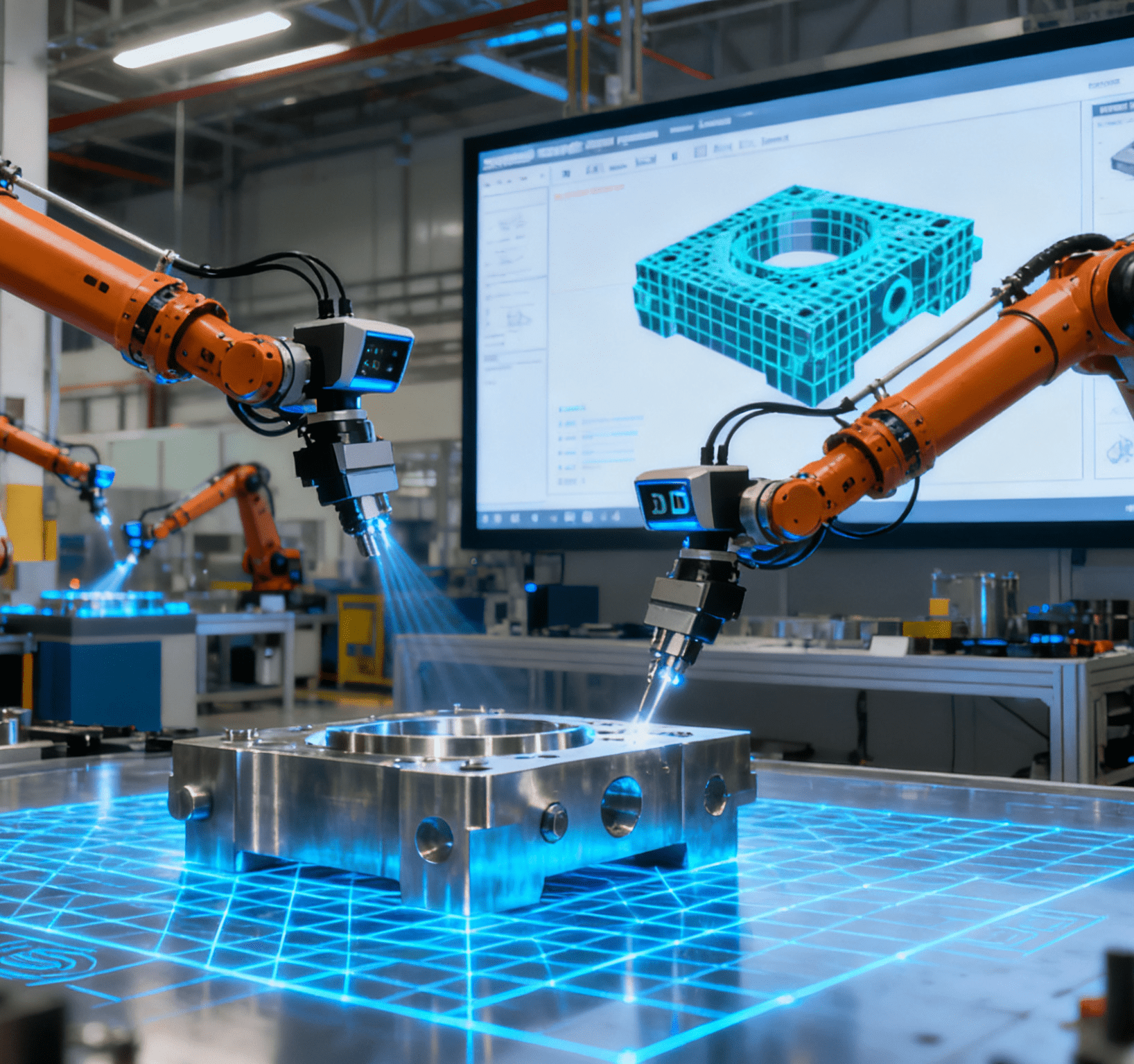

In September this year, Zhang Yongwei, Chairman of the China EV100, publicly stated in a media interview that intelligent vehicles, intelligent robots, and low-altitude aircraft—dubbed the “three core pillars of integrated intelligence”—are inherently characterized by shared technological roots, interconnected industrial chains, and integrated applications.

Research data released by China EV100 shows that upstream, midstream, and downstream links of the automotive industry chain can be deeply connected with the industrial chains of intelligent robots and low-altitude aircraft, with over 60% of the automotive chain usable for the intelligent robot and low-altitude aircraft industries.

A research report by Guosen Securities also pointed out that certain components of vehicles and humanoid robots share commonalities, resulting in a high degree of supply chain overlap. This presents an opportunity for enterprises in the automotive sector to upgrade their businesses. For instance, vehicles already contain numerous actuators (e.g., electronic brake systems, electric drive systems), which are expected to be extended for use in robots.

He Xiaopeng, Chairman of XPeng Motors, also publicly noted: “70% of the technological reserves of automakers can be directly reused in robots.”

Industry Layout: Automakers and Supply Chain Enterprises Race for Embodied Intelligence

In reality, the automotive industry and embodied intelligence are closely linked fields, with high similarities in key industrial chain links such as sensing, decision-making, execution, and new energy-powered systems.

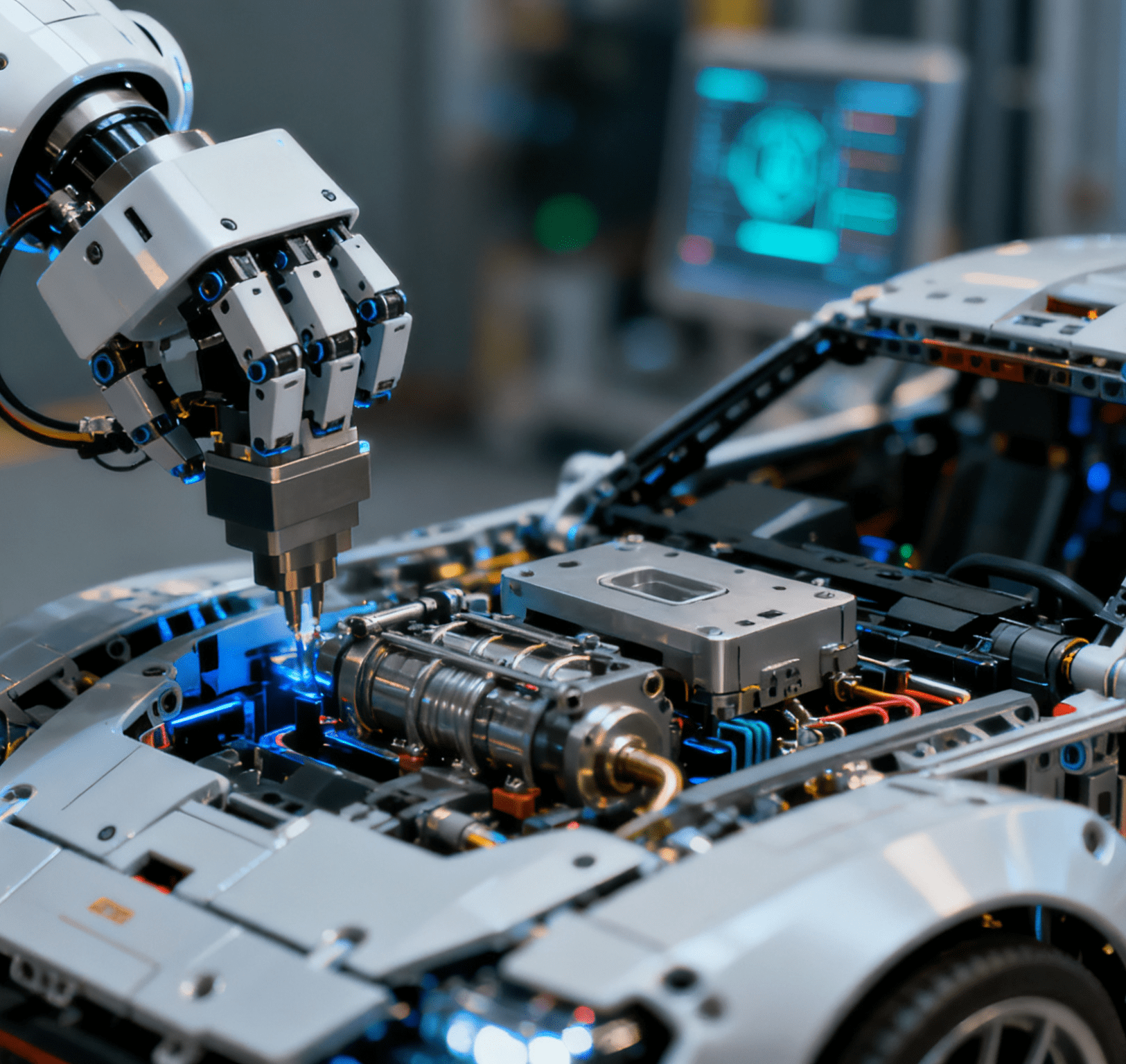

Furthermore, in terms of applications, automakers themselves can provide optimal scenarios for implementation—for example, Tesla’s Optimus was initially used in gigafactories. In terms of AI capabilities, driven by end-to-end large models, intelligent vehicles are expected to achieve mass production and real-world application earlier than legged robots. The perception-control algorithm foundations and hardware engineering capabilities accumulated in driving scenarios also provide strong reference value for automakers transitioning to robot manufacturing.

Currently, numerous automakers are accelerating their layout in the embodied intelligence track. Enterprises such as GAC Group, XPeng Motors, and BYD are either independently developing humanoid robots or collaborating with traditional robot companies like UBtech to accelerate the implementation of embodied intelligence in the automotive industry.

Supply chain enterprises are also keeping pace. For example, Horizon Robotics spun off its robot division to formally establish “Digua Robotics”—an embodied intelligence company; RoboSense is actively expanding into the robot industry to develop a second growth curve, among other moves.

Technological Adaptation: Automotive Chips Poised for Seamless Shift to Embodied Intelligence

Zhang Yongwei stated, “When developing emerging industries such as intelligent robots and low-altitude economy, a more viable path to success—compared to working in isolation—is to adopt a ‘convergence’ mindset and promote integrated and coordinated development of these three industries.”

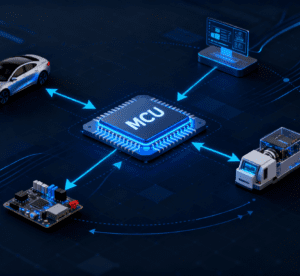

“When developing automotive chips, we found that many MCUs (Microcontroller Units) actually require the integration of edge AI to achieve more optimized and efficient local data processing. In building the automotive supply chain, we have accumulated a range of capabilities, such as MCU design, foundational edge AI expertise, and numerous motor drive algorithms,” a relevant person in charge of Telink Semiconductor—a wholly-owned subsidiary of NavInfo—revealed to Gasgoo at the 2025 EVOLUTION Innovation Conference. “These capabilities can be seamlessly adapted when transferred to embodied intelligence applications.”

The person in charge further noted that for Telink Semiconductor, the first step is to refine these capabilities and implement them in automotive applications, with future plans to extend them to embodied intelligence. He added, “Seamless adaptation of automotive chips to embodied intelligence may be achieved around 2030.”

It is reported that NavInfo has received a large number of cross-sector demands—exceeding expectations—from fields such as two-wheelers, autonomous small vehicles, robots, and embodied intelligence. For example, devices require “dual-eye” vision for map recognition and positioning, as well as the ability to sense joint postures and angles; all of these functions can be realized through positioning + inertial navigation technology.

Market Momentum: Financing Boom and the Road Ahead for Technological Reserve

Currently, embodied intelligence is gaining significant momentum, and the industry has reached a consensus that this massive market is on the verge of explosive growth. According to statistics from Gasgoo, nearly 30 financing deals were publicly disclosed in China’s embodied intelligence and robot sectors in September, with the known financing amount approaching RMB 4 billion. Subsequently, financing in the embodied intelligence track has exhibited several notable features: leading enterprises continue to secure multiple rounds of follow-up investments, emerging enterprises are flocking to the market, and financing activity is flourishing across various sub-tracks.

In the short term, enterprises in the embodied intelligence track are still competing to build up technological and capability reserves, and large-scale implementation is not yet imminent. Therefore, automotive chip enterprises still need to accumulate technologies in the automotive sector and wait for the right opportunity to expand into embodied intelligence.