On November 6th, Joyson Electronics was officially listed on the Main Board of the Hong Kong Stock Exchange, completing the establishment of its “A+H” dual-capital platform structure.This move is not only a crucial milestone in the company’s development but also marks Joyson Electronics’ official entry into the international capital market, injecting new impetus into its globalization and intelligent strategies.

H-Share Listing Deepens Global Strategy, Highlighting International Advantages

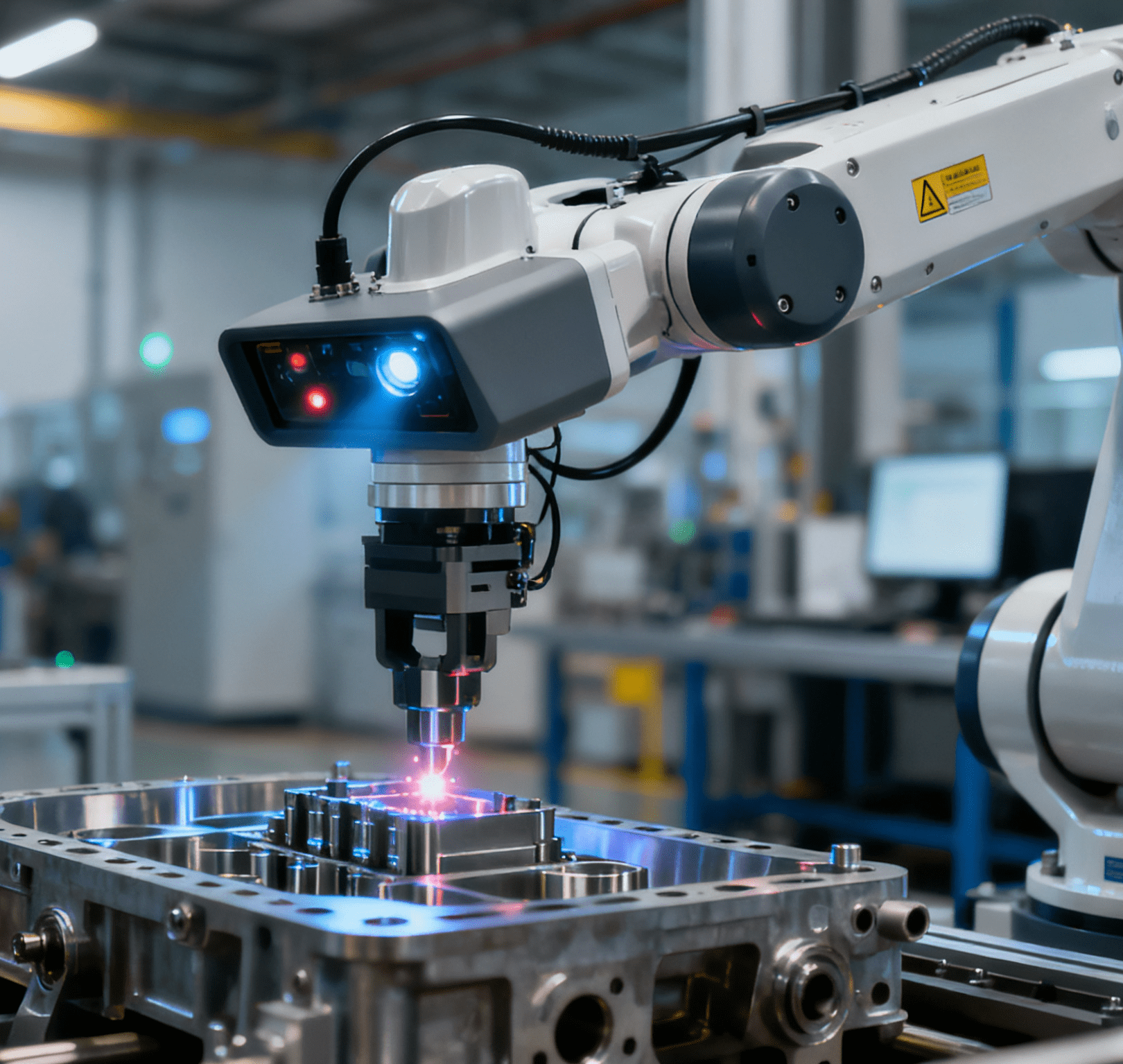

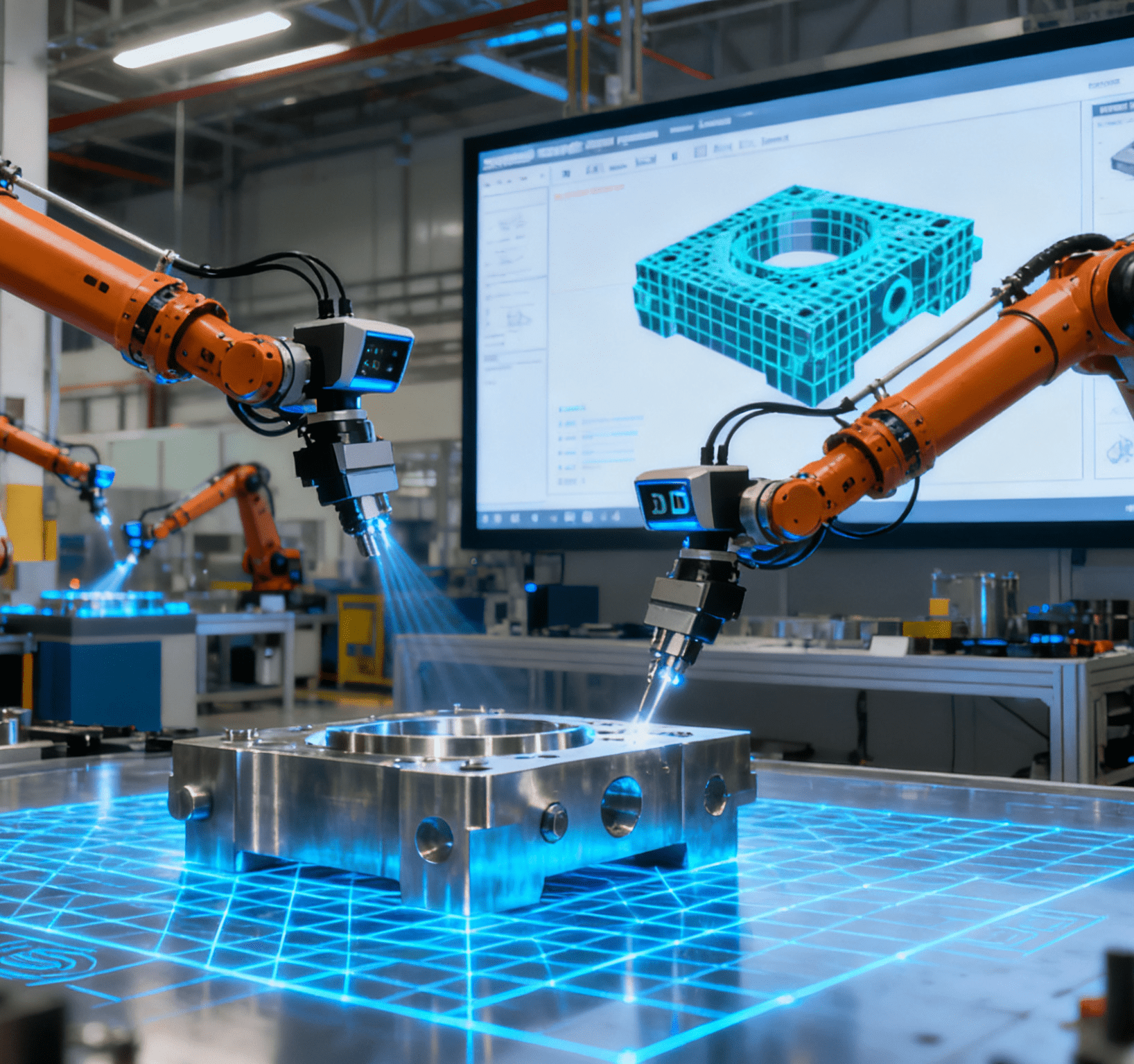

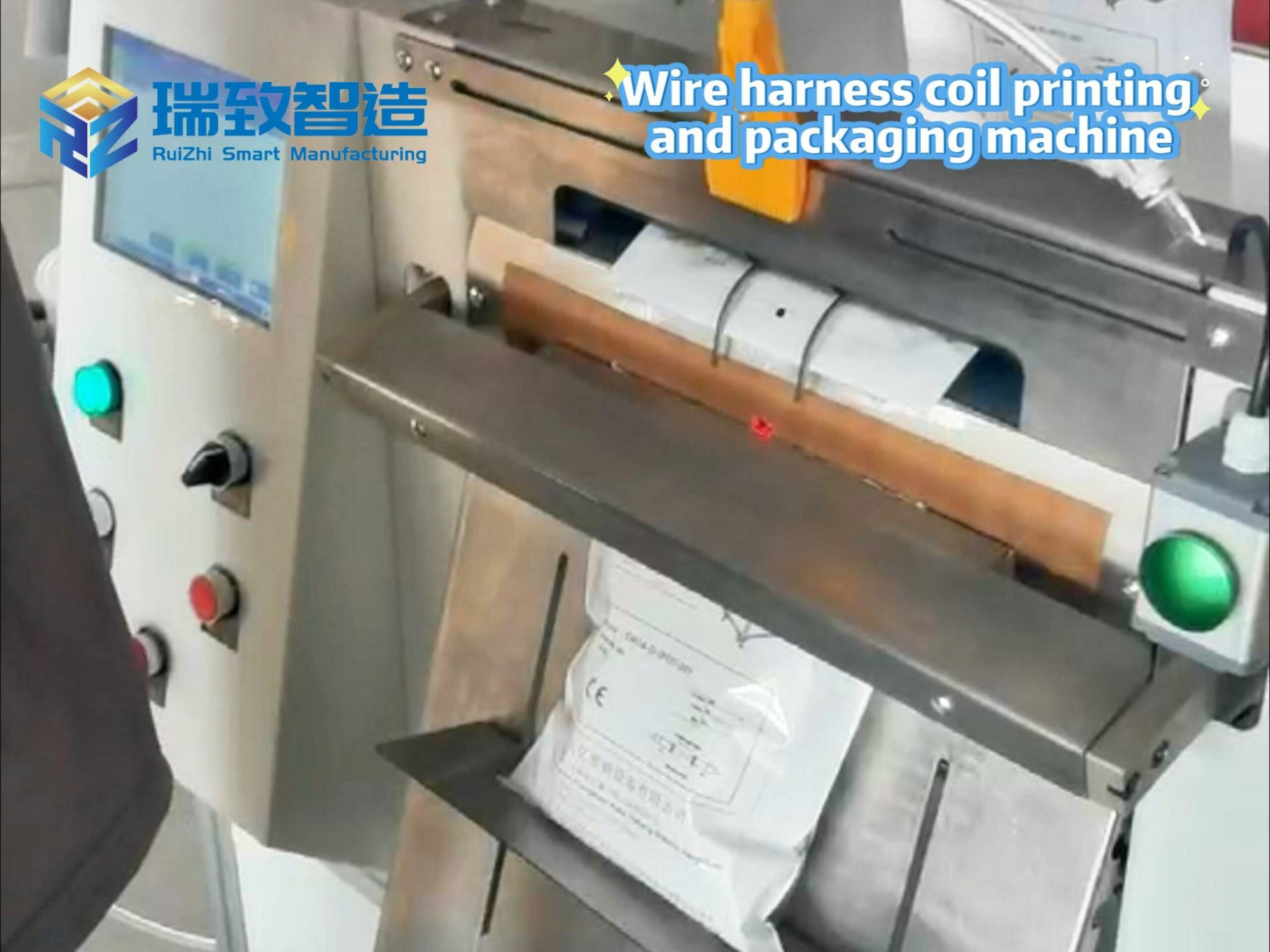

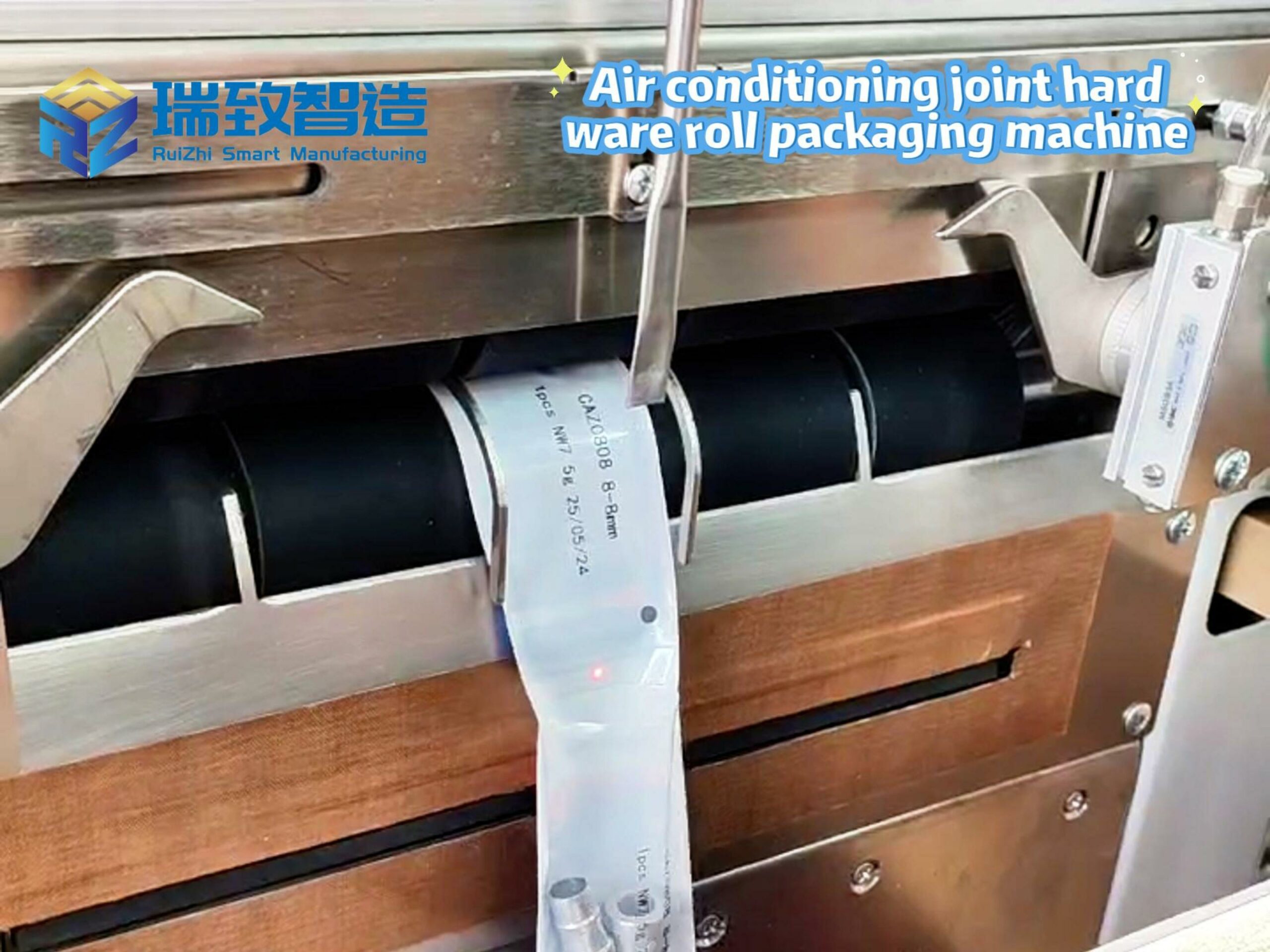

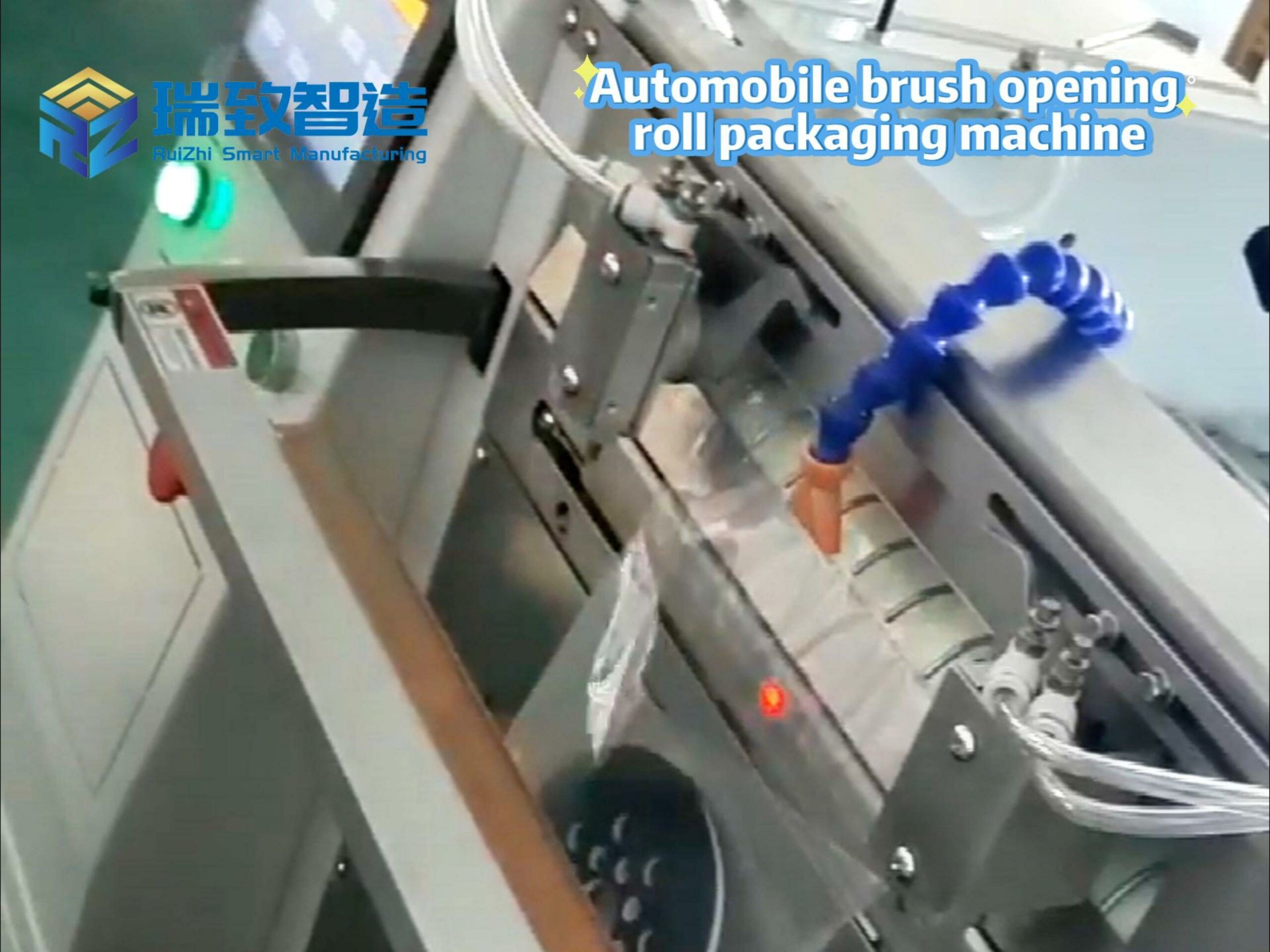

The successful listing of H-shares signifies that Joyson Electronics’ globalization strategy has entered a deepening phase. With “Local for Local” as its core strategy, the company not only supports the intelligent upgrading of the local automotive industry but also reversely exports technologies and products proven successful in the Chinese market to overseas regions, forming a two-way empowerment mechanism.As its global business expands, Joyson Electronics continues to advance the localization adaptation of technologies and deepen strategic cooperation with partners such as Momenta, Qualcomm, and Horizon Robotics. Together, they promote the implementation of advanced technologies—including integrated cockpit and autonomous driving systems, and combined driving-parking solutions—in more regional markets. Such open innovation centered on core technologies lays a solid foundation for the company to continuously secure large-scale global orders.An international operation network serves as a key support for business expansion. As of April 2025, the company has established over 25 R&D centers and more than 60 production bases worldwide, covering core markets in Asia, Europe, and North America. This layout enables localized collaboration with customers and supply chain integration.The global footprint has brought significant financial returns. In 2024, overseas sales accounted for 74.7% of Joyson Electronics’ total revenue. Its gross profit margin continued to improve, rising by approximately 3 percentage points year-on-year to around 17.8% in the first half of 2025, underscoring the effectiveness of its globalization efforts.In terms of customers, Joyson Electronics has covered over 100 global automotive brands, including the top 10 domestic and international vehicle manufacturers. It has ranked first in China’s Top 100 Multinational Companies and the Transnational Index for four consecutive years. According to a Frost & Sullivan report, Joyson Electronics ranked 41st among global automotive parts enterprises in terms of revenue in 2024 and is also the world’s second-largest supplier in the automotive safety sector.In deepening its global layout, the company has continuously optimized its production capacity structure, phased out inefficient factories, and increased regional production concentration—adopting Automatic feeding equipment for small metal sheets in key manufacturing bases to enhance processing precision and production line efficiency for core components like automotive safety parts and robot structural parts. Citigroup analysis points out that its decentralized overseas layout has effectively reduced risks associated with single tariff policies and enhanced operational resilience.Furthermore, Joyson Electronics’ global capabilities are extending to the robotics business. It has already delivered key components in bulk to a leading robotics enterprise and launched cooperation with another overseas robotics company on logistics and delivery robots, demonstrating its potential for cross-sector expansion.

Surge in Intelligent Orders, Robotics Business Emerges as New Growth Driver

Amid the wave of automotive electrification and intelligence, Joyson Electronics has gradually established a “Automotive + Robotics Tier 1” dual-driver model. Its business covers key areas such as intelligent cockpits, advanced driver assistance systems (ADAS), connected systems, and power and body domain control. It has also launched integrated solutions including integrated cockpit-driving domain controllers and central computing units (CCUs).2025 has become a breakout year for Joyson Electronics’ intelligent business. Financial data clearly reflects this trend: in the first half of 2025, the company achieved operating revenue of RMB 30.347 billion, a year-on-year increase of 12.07%;

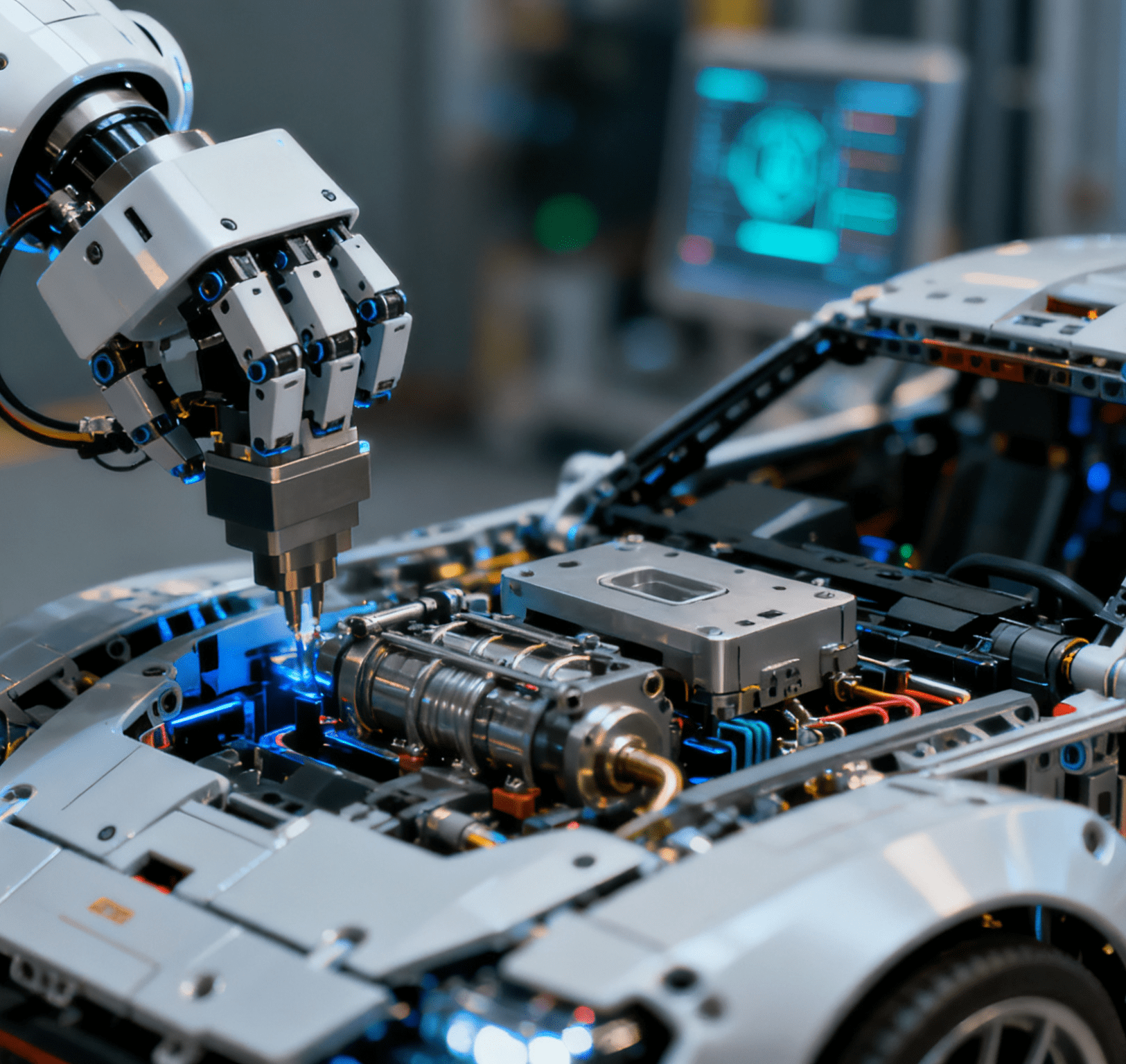

net profit attributable to shareholders was RMB 708 million, a year-on-year increase of 11.13%; and the overall gross profit margin rose to 18.2%, an increase of 2.6 percentage points year-on-year—all indicators reflecting the continuous optimization of its product structure.According to forecasts from Guohai Securities, from 2025 to 2027, Joyson Electronics’ net profit attributable to shareholders will maintain high-speed growth, reaching RMB 1.558 billion, RMB 1.831 billion, and RMB 2.127 billion respectively, with projected year-on-year growth rates of 62%, 18%, and 16%.The core driver of performance growth comes from the automotive intelligent business. In the first half of 2025, Joyson Electronics secured new orders totaling approximately RMB 31.2 billion, of which orders related to new energy vehicles accounted for over 66%.Joyson Electronics not only obtained its first mass-production order for regional controllers (supporting over 1 million vehicles of a self-owned brand) but also won intelligent global projects from two leading brand automakers. It will provide these clients with products such as central computing units integrating ADAS, intelligent connectivity, and intelligent cockpit functions, with a total lifecycle order value of approximately RMB 15 billion. In October, the company secured an additional RMB 5 billion in orders for ADAS domain controllers and in-vehicle multi-screen systems, demonstrating high recognition of its technical capabilities from customers.Outstanding market performance is inseparable from continuous technological investment. Facing industry transformation, Joyson Electronics continuously drives innovation in technologies such as ADAS, intelligent cockpits, and new energy management. The JaySpace+ immersive cockpit launched at the Shanghai Auto Show, as well as the integrated cockpit-driving solution developed in cooperation with Dongfeng Motor and Horizon Robotics, have entered the mass-production stage—highlighting the company’s strong ability to implement technologies.Building an open and cooperative industrial ecosystem is a key support for Joyson Electronics to accelerate innovation. The company has established cooperation with enterprises including Momenta, Qualcomm, Horizon Robotics, Horizon Robotics (Black Sesame Intelligence), and Huawei to jointly advance the R&D and commercialization of cutting-edge technologies such as integrated cockpit-driving systems and combined driving-parking solutions. For example, its cooperation with Momenta to secure over RMB 1 billion in ADAS domain controller orders from a self-owned brand is a successful case of ecosystem collaboration.In the field of core chips, the company adheres to a dual-track strategy: on the one hand, it cooperates with multiple domestic chip enterprises; on the other hand, it makes strategic investments in ADAS chip companies. It has completed on-vehicle testing of high-level domain controllers based on this platform, gradually enhancing its independent control capabilities in key links.As a “ballast stone” for performance, the automotive safety business continues to contribute stable cash flow. In the first half of 2025, it achieved operating revenue of RMB 18.977 billion, with a gross profit margin rising to 15.93%. Joyson Electronics innovatively integrates automotive safety products with electronic technologies, launching solutions such as full-set safety systems for zero-gravity seats, the new “J” series platform-type gas generators, and next-generation optically enhanced seatbelts—continuously improving the level of intelligent safety technologies.The robotics business, as Joyson Electronics’ second growth curve, is developing rapidly. Leveraging its accumulated experience in automotive electronics and high-end manufacturing, the company has laid out core components including robot global domain controllers, AI head assemblies, energy management systems, sensor kits, and lightweight robotic bodies.In terms of market expansion, the company has established cooperation with leading overseas enterprises as well as domestic companies such as DeepRobotics, Galaxy General, and RIVR, with some products already in bulk delivery. The strategic cooperation with DeepRobotics in the first half of the year will further promote in-depth collaboration between the two parties in areas such as robot “brain systems” (both primary and secondary) and key components.

Dual-Capital Platform Unlocks Growth Space, Intelligent Electrification Layout Faces Valuation Reassessment

Joyson Electronics’ successful listing on the Hong Kong Stock Exchange has officially established its “A+H” dual-capital platform. This strategic move has injected new capital impetus into its global development and significantly enhanced the company’s comprehensive competitiveness amid the global automotive industry transformation.Against the backdrop of evolving global trade patterns and growing demand for supply chain localization, the H-share listing will strongly drive Joyson Electronics to deepen its “Local for Local” localization strategy. Relying on Hong Kong’s international capital platform, the company can allocate global funds more flexibly to support the upgrading of overseas R&D systems and the optimization of production bases—including improving production efficiency at overseas bases (such as in the Philippines) and accelerating the construction of a globally collaborative cloud-based supply chain system.The automotive industry is currently in a critical phase of intelligent and electrified transformation, with accelerated technological iteration and an unsettled competitive landscape. Joyson Electronics already has first-mover advantages in areas such as intelligent cockpits, ADAS, and integrated cockpit-driving systems.

The funds raised from this H-share listing will focus on the R&D and commercialization of next-generation intelligent automotive solutions, helping the company accelerate technology implementation during this critical window period and consolidate its technological leadership.As industry boundaries become increasingly blurred, Joyson Electronics has proactively positioned itself as an “Automotive + Robotics Tier 1” and actively laid out the emerging robotics sector. The H-share listing provides the company with more sufficient capital support, enabling it to systematically transfer its accumulated capabilities in automotive electronics, domain controllers, and energy management to rapidly expand in the robotics track and build a second growth curve.Underpinning these layouts is the company’s sustained high-intensity R&D investment. Joyson Electronics invests over RMB 3 billion in R&D annually, with a cumulative investment of over RMB 24 billion since 2018. The H-share listing has created a more diversified capital supplement channel, allowing the company to maintain financial stability while continuously increasing investment in cutting-edge technologies to safeguard its long-term competitiveness.In addition, listing on Hong Kong’s international financial center will help Joyson Electronics further integrate into the global capital market and enhance its brand influence and voice. As a representative of China’s internationalized automotive parts enterprises, its overseas revenue accounts for over 70%. The H-share platform is not only a financing window but also an important bridge for deepening industrial collaboration and capital cooperation with global partners.As the company’s in-depth layout in the automotive intelligent sector and the value of its new robotics track gain market recognition—coupled with improved liquidity and increased attention brought by the H-share listing—its valuation system holds significant potential. Market analysis points out that, relying on its unique technology transfer capabilities, Joyson Electronics is emerging as a key component assembly supplier in the robotics field, and its strategic value is expected to undergo a market reassessment.

Conclusion

Joyson Electronics’ listing on the Hong Kong Stock Exchange marks a new phase in its globalization and capitalization process. Driven by the “Industry + Capital” dual engine, the company is expected to further consolidate its global competitiveness in the automotive safety and electronics businesses while accelerating the cultivation of the robotics sector as its second growth curve. The synergistic effect of the A+H platform will provide solid support for its continued leadership in the intelligent automotive and robotics fields, creating long-term value.