Transformation Logic: Driven by “Semiconductorization”, Market Scale Continues to Expand

According to a research report by CSC Financial Co., Ltd., driven by the surging demand for orthogonal backplanes and the upgrading of Cowop technology, PCBs will become increasingly semiconductor-like in the future, with their value volume poised for steady growth. As a core foundational component for data centers and computing equipment, printed circuit boards (PCBs) are encountering a new round of upgrading requirements in terms of technical specifications and production capacity. Data shows that the scale of China’s PCB market is expected to hit 433.321 billion yuan in 2025, accounting for over 50% of the global market share. By 2029, this scale is projected to expand to 554.51 billion yuan. At present, domestic enterprises are actively tapping into the capital market to secure resources for development.

Capital Practices: Intensive IPOs of Leading Enterprises, Consolidating Industrial Competitive Advantages

On November 28, 2025, Wus Printed Circuit Co., Ltd. (hereinafter referred to as “Wus PCB”) formally submitted an application for listing on the Main Board of the Hong Kong Stock Exchange, with CICC and HSBC Bank serving as joint sponsors. As a provider of PCB solutions for the data communication and intelligent automotive sectors, Wus PCB—already listed on the Shenzhen Stock Exchange—will complete the construction of its “A+H” dual capital platform if this listing is successfully implemented, emerging as another dual-listed enterprise in China’s PCB industry.

Its disclosed Q3 2025 financial report demonstrates robust performance growth: in the first three quarters, the company achieved an operating revenue of 13.512 billion yuan, a year-on-year increase of 49.96%; its net profit attributable to shareholders reached 2.718 billion yuan, up 47.03% year on year. In addition, the disclosed 2025 semi-annual report indicates that the company’s core PCB business generated an operating revenue of 8.152 billion yuan, representing a year-on-year growth of 57.20%.

According to statistics from Frost & Sullivan, based on revenue for the 18-month period ending June 30, 2025: Wus PCB ranks first globally in PCB revenue for the data center sector, holding a 10.3% global market share; it also tops the global ranking for PCBs with 22 layers and above, accounting for a 25.3% global market share; moreover, its PCB revenue for switches and routers leads the world, with a 12.5% global market share. These figures not only consolidate Wus PCB’s dominant position in the global high-end PCB market but also provide strong value support for its listing on the Hong Kong Stock Exchange.

On November 18, Dongshan Precision Manufacturing Co., Ltd. (hereinafter referred to as “Dongshan Precision”) formally filed an application for listing on the Main Board of the Hong Kong Stock Exchange, steadily advancing the development of its “A+H” dual capital platform.

As stated in the prospectus, Dongshan Precision is an innovation-driven enterprise focusing on intelligent manufacturing with a global vision. Its core businesses encompass the global design, production and sales of printed circuit boards (PCBs), precision components, touch panels, liquid crystal display modules and optical modules.

In terms of market position, Dongshan Precision has evolved into a leading player in the global PCB industry. According to Frost & Sullivan’s statistics based on 2024 revenue, the company has become the world’s largest PCB supplier for edge AI devices and the second-largest global supplier of flexible printed circuits (FPCs), ranking among the top three in the global PCB industry overall. Notably, the PCB business serves as the company’s most crucial revenue pillar.

To consolidate and expand this advantage, Dongshan Precision keeps increasing investment in high-end production capacity. In July 2025, the company’s board of directors approved its Hong Kong subsidiary to invest no more than 1 billion US dollars (approximately 7.2 billion yuan) in constructing a new PCB project, focusing on meeting the rapidly growing demand for servers and AI hardware.

This listing on the Hong Kong Stock Exchange will help Dongshan Precision further broaden its financing channels, deepen its international operations, and consolidate its favorable position in the global PCB industry.

On October 24, Chaoying Electronic Circuit Co., Ltd. (hereinafter referred to as “Chaoying Electronics”), which mainly focuses on automotive electronic PCBs, was officially listed on the Main Board of the Shanghai Stock Exchange. The company’s core business is the R&D, production and sales of printed circuit boards (PCBs), and it is also one of the few domestic enterprises equipped with the mass production capacity of multi-order HDI and any-layer interconnection HDI automotive electronic boards.

Amid the profound electrification and intelligent transformation of the automotive industry, Chaoying Electronics’ breakthroughs in high-end technologies and its mass production capabilities have not only established a solid competitive moat for the company but also significantly raised the localization level of China’s PCB industry chain in key areas.

Strategic Outlook: Anchoring “Semiconductorization” to Seize the High Ground of the Global Value Chain

The successive progress of “A+H” listings by Dongshan Precision and Wus PCB, together with the successful A-share listing of Chaoying Electronics, collectively outline a clear strategic vision for China’s PCB industry: enterprises are actively leveraging the financing, resource integration and brand enhancement functions of the capital market to accelerate the transformation and upgrading towards a technology-intensive and capital-intensive “semiconductor-like” model.

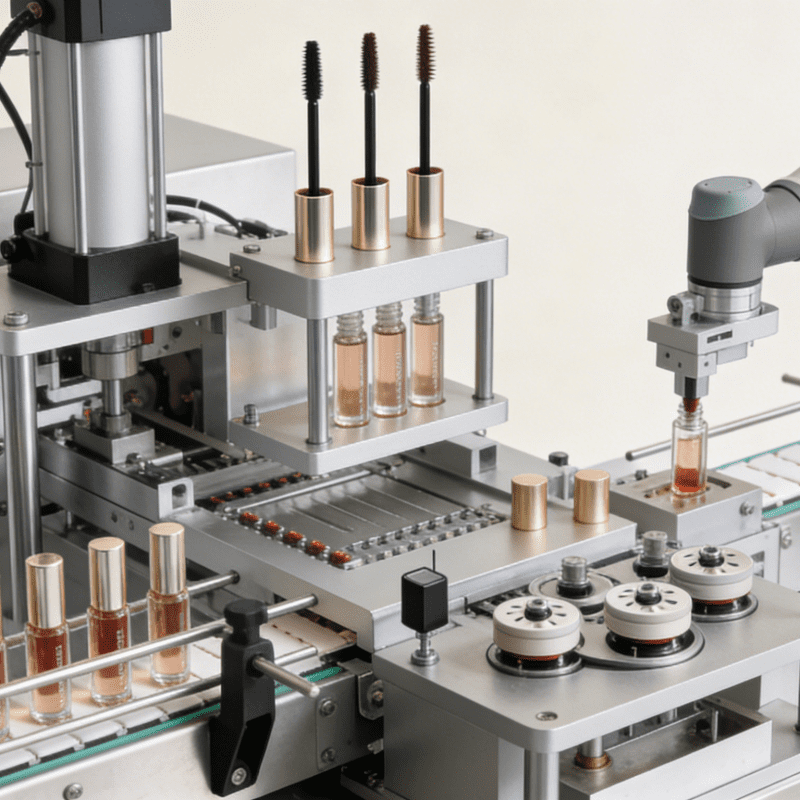

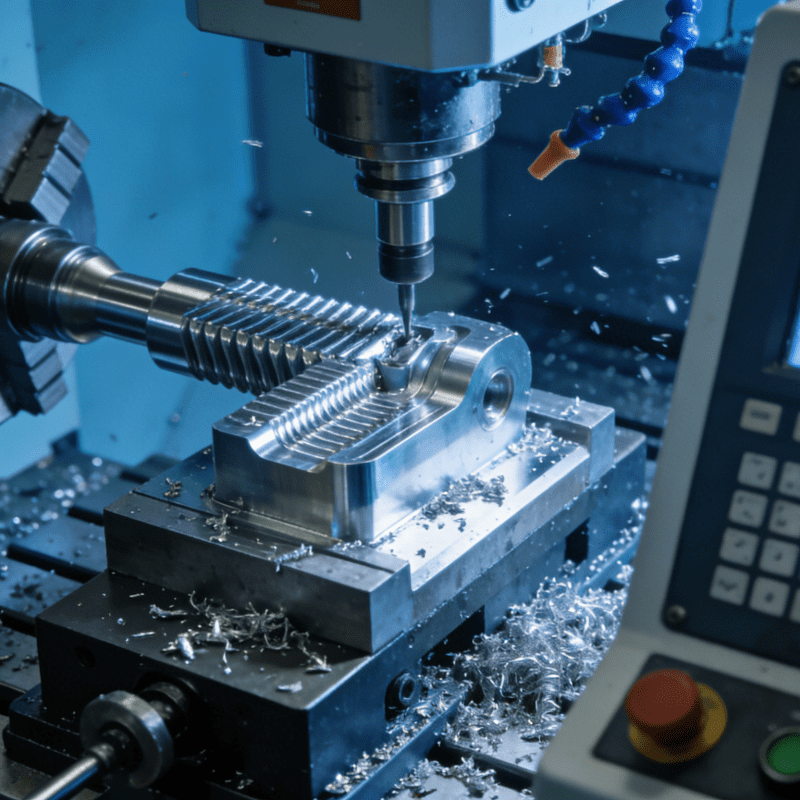

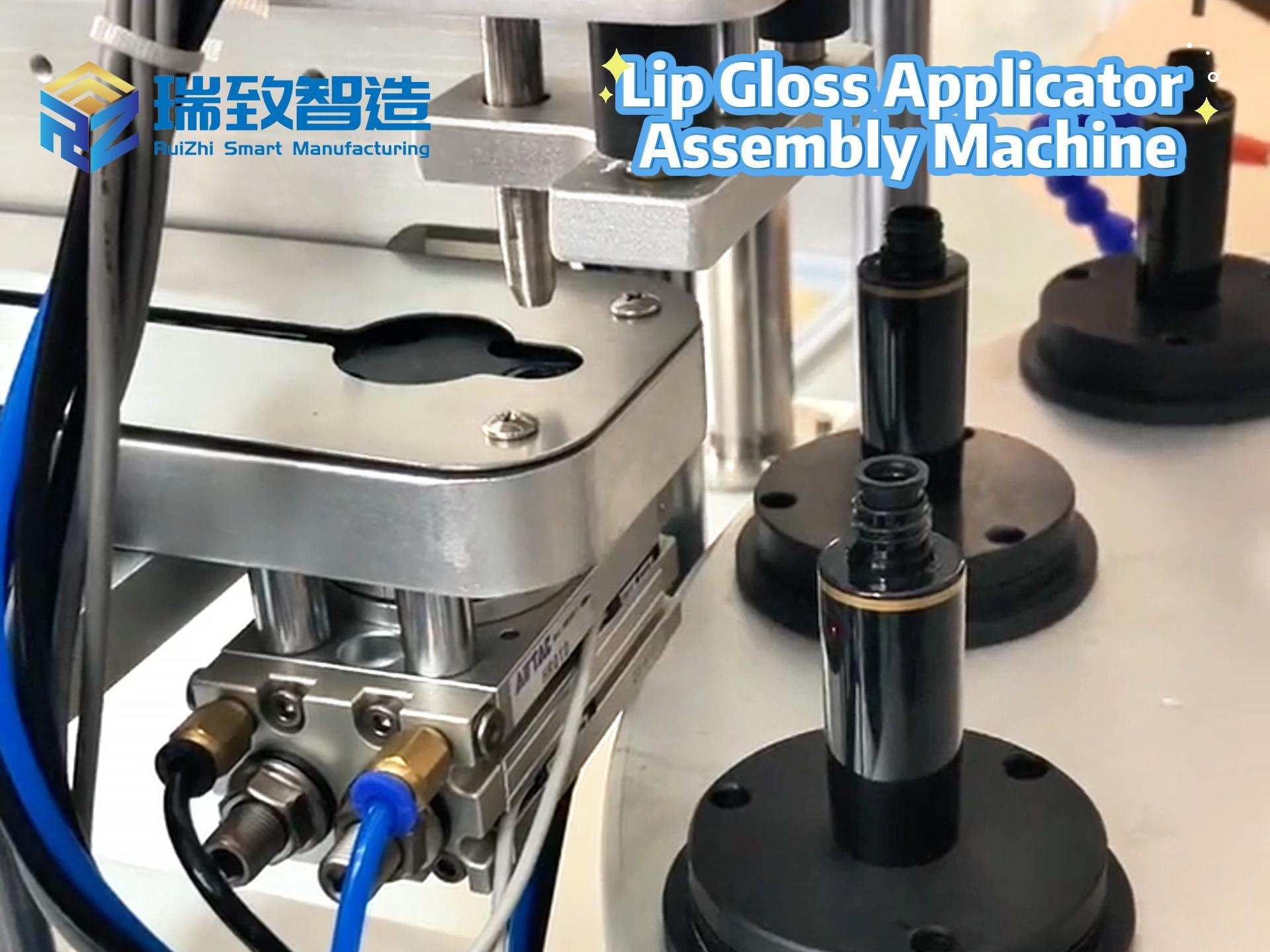

Notably, the upgrading of high-end medical equipment such as Syringe Automatic Assembly Equipment has become a new growth driver for the PCB industry. As medical devices pursue higher precision, automation and reliability, the demand for high-density, high-temperature-resistant and miniaturized PCBs has surged—requirements that align perfectly with the “semiconductor-like” transformation direction of domestic PCB enterprises. Domestic PCB manufacturers have achieved key breakthroughs in special materials and precision processing technologies, providing core component support for the localization of Syringe Automatic Assembly Equipment, which not only expands the application boundaries of the PCB industry but also strengthens the synergy of the domestic high-end manufacturing industrial chain.

Looking ahead, driven by the continuous explosive growth of downstream demands in sectors such as AI, new energy vehicles and high-end medical equipment, as well as the enhanced collaborative effect of the domestic industrial chain, China’s PCB industry is expected to achieve more breakthroughs in high-end segments and occupy a more core position in the global value chain.

What is the work done using automated equipment and machines called?