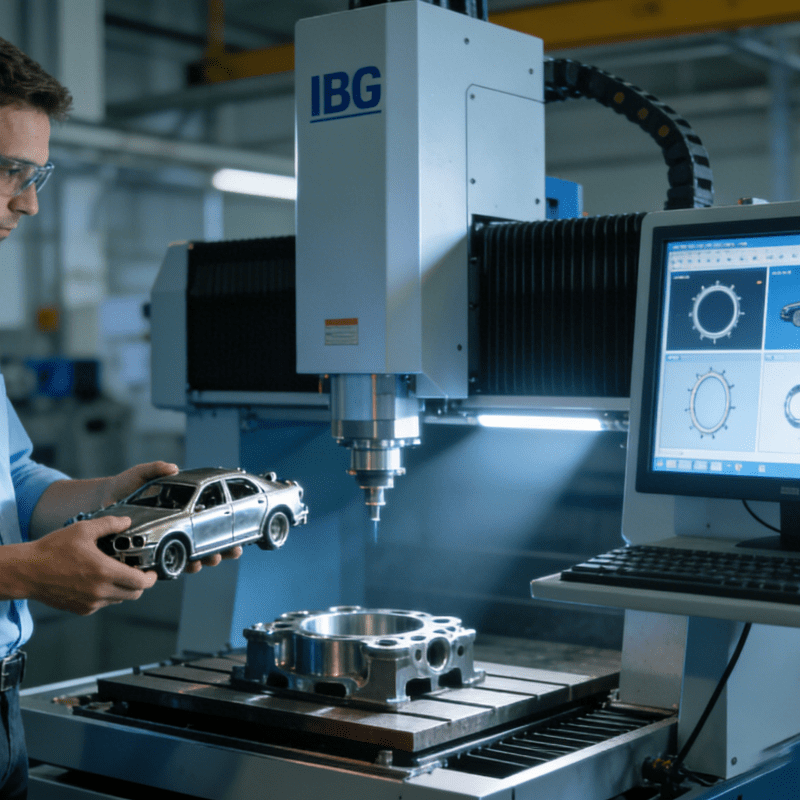

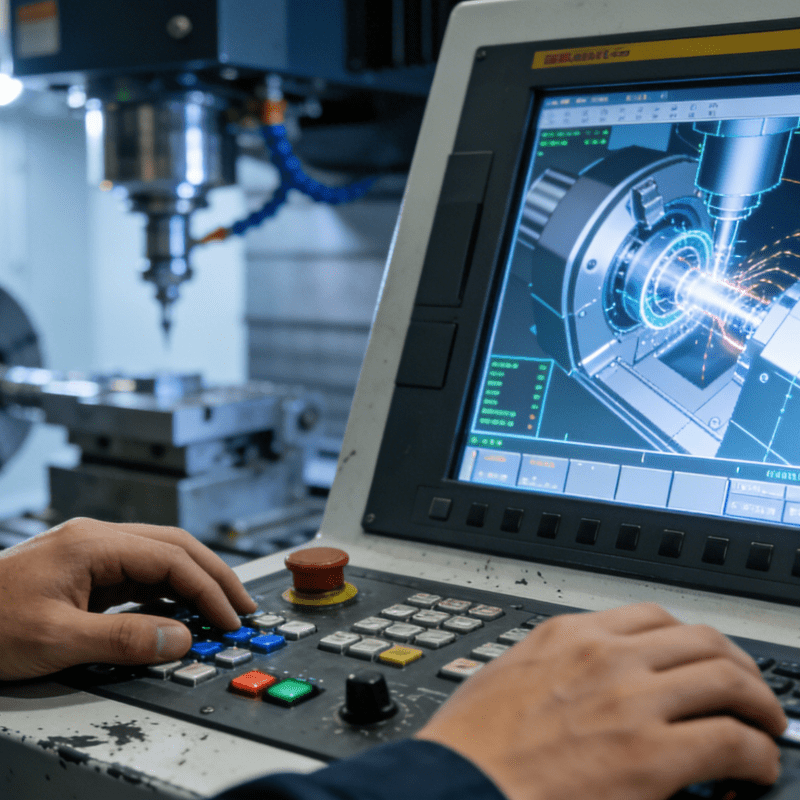

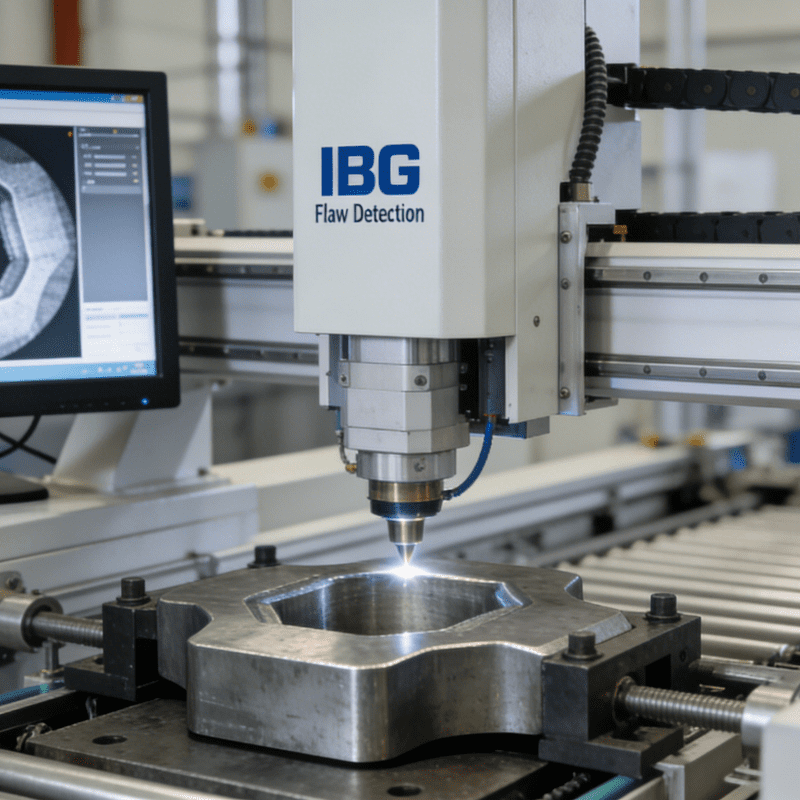

For domestic AI chips, 2025 is undoubtedly a historic window of opportunity. The explosive performance of Cambricon vividly proves that the domestic AI chip industry is ushering in a new development opportunity! From the training of large Internet models to the intelligent upgrading of industrial scenarios, the application boundaries of domestic AI chips are constantly expanding. Even in core links of precision manufacturing such as the Injection Molded Parts Automated Assembly System with Auto-Loading, real-time optimization of production parameters and fault prediction have been realized by integrating domestic AI chips, further promoting the in-depth integration of “AI + manufacturing”.

On the evening of August 26, 2025, Cambricon released its 2025 half-year report. The report shows that in the first half of 2025, the company achieved a revenue of 2.881 billion yuan, a year-on-year increase of 4347.82%; the net profit attributable to shareholders of the parent company reached 1.038 billion yuan, turning from a loss to a profit year-on-year. In addition, both the total profit and the net profit after deducting non-recurring gains and losses also turned from losses to profits year-on-year.

Regarding the significant improvement in performance, Cambricon pointed out that in the first half of 2025, the demand for artificial intelligence computing power continued to rise. Relying on the core advantages of its artificial intelligence chip products, the company has continuously deepened technical cooperation with leading enterprises in cutting-edge fields such as large models and the Internet. Through technical cooperation to promote the implementation of applications, and expanding the market scale through the implementation of applications, the company’s operating revenue has achieved significant growth. At the same time, the company has continued to maintain high-intensity R&D investment, with R&D expenses in the first half of the year reaching 456 million yuan, an increase of 2.01% compared with the same period last year.

However, Cambricon’s “comeback battle” is not an accident!

As early as the first quarter of this year, Cambricon showed a strong growth momentum. In that quarter, the company achieved a revenue of 1.111 billion yuan, a year-on-year increase of 4230.22%; it also achieved a positive quarterly net profit after deducting non-recurring gains and losses for the first time, demonstrating its significant profit potential. Entering the second quarter, this growth trend continued, making the overall performance in the first half of the year particularly outstanding.

In the industry, Cambricon, together with Huawei Ascend and Baidu Kunlun Core, is known as the “Troika” in the field of domestic AI chips. As a listed company in the field of intelligent chips, Cambricon has been committed to technological innovation and product R&D to meet the market demand for high-performance and low-power AI chips. Its products are widely used by server manufacturers and industrial companies, providing sufficient computing power for complex AI application scenarios in fields such as the Internet, finance, transportation, energy, electric power, and manufacturing. Whether it is supporting risk modeling in the financial industry or enabling high-precision visual inspection and dynamic production line scheduling of the Injection Molded Parts Automated Assembly System with Auto-Loading, it has demonstrated the reliable performance of domestic AI chips in industrial-grade scenarios and promoted the empowerment of artificial intelligence in industrial upgrading.

Relevant data shows that Cambricon’s shipments of cloud chips were approximately 25,000 units in 2024, and as of the first quarter of 2025, the estimated shipments of Cambricon’s cloud chips exceeded 31,000 units. In addition, according to Goldman Sachs’ forecast, the shipments of Cambricon’s cloud chips are expected to exceed 1 million units by 2028.

According to the plan announced by Cambricon, it will invest 4.5 billion yuan in the R&D of AI chips and software in the next three years, with an average annual investment of 1.5 billion yuan, to continuously maintain its leading position in terms of technology.

For domestic AI chips, 2025 is undoubtedly a historic window of opportunity. The explosive performance of Cambricon vividly proves that the domestic AI chip industry is ushering in a new development opportunity!

According to a Bernstein report, China’s AI chip market scale is expected to reach 38 billion US dollars in 2025. Among them, the sales volume of domestic chips is expected to grow from 6 billion US dollars in 2024 to 16 billion US dollars, with a growth rate of 112%, and the market share will increase from 29% to 42%.

At present, the performance and maturity of domestic AI chips are steadily improving, moving from “usable” to “easy to use”.

When technical preparations meet urgent market demand and strong policy promotion, the industrial boom is an inevitable result! Cambricon is the best example.

It can be predicted that with the strong support of national policies, the rapid growth of market demand, and the close cooperation of enterprises in the upper and lower reaches of the industrial chain, the domestic AI chip industry will usher in a broader development prospect. It can not only support the innovation of upper-layer applications in the digital economy but also provide core computing power support for the intelligent transformation of real industries such as the Injection Molded Parts Automated Assembly System with Auto-Loading. At the same time, more enterprises similar to “Cambricon” will contribute more to the prosperity and development of China’s economy.