When regulatory rules iterate at a “weekly update” pace, enterprise data volume expands exponentially, and compliance teams face the dual pressure of “covering all risks while controlling costs”, the traditional compliance model that relies on manual verification and Excel statistics is already insufficient. The emergence of artificial intelligence (AI) is fundamentally reshaping this situation—it is no longer a concept in science fiction movies, but a “must-have tool” for global enterprises to address compliance challenges today: from financial report compliance verification of listed companies, to due diligence of private equity firms, from anti-bribery monitoring of multinational enterprises, to contract risk screening of small and medium-sized enterprises (SMEs), AI, with its characteristics of “accuracy, efficiency, and scalability”, has become the core driving force for the upgrading of compliance functions.

However, this transformation is not without obstacles. Our research shows that the current application of AI in the corporate compliance field is in a transitional stage “with both opportunities and challenges”: early adopters have reaped the benefits of improved efficiency, but more enterprises are still grappling with implementation difficulties—insufficient policy adaptability, disputes over the transparency of AI decisions, barriers to integration with existing compliance systems, and how to find a balance between “relying on technology” and “controlling risks”.

Adoption Trends of AI in Compliance: Accelerated Penetration Amid Differentiation

The application of AI in compliance functions has moved beyond the “niche pilot” stage and entered the “early phase of large-scale popularization”. However, enterprises of different types and sizes show significant differences in the degree of adoption, reflecting variations in compliance needs, resource reserves, and risk preferences:

Enterprise Type and Scale: Compliance Pressure Determines Adoption Priority

Data shows that the proportion of listed companies (44%) using AI for both compliance and investigation processes is nearly twice that of private enterprises (23%). The core logic behind this difference lies in: listed companies face stricter regulatory disclosure requirements (such as the SEC’s ESG information disclosure and the EU’s Audit Reform Directive), and need to process far more financial report data and transaction records than private enterprises. Manual verification is not only time-consuming (averaging over 200 working hours for a single annual report verification) but also prone to compliance risks due to human errors; in contrast, private enterprises have relatively concentrated compliance scenarios and lower urgency for AI adoption.

Similarly, the AI adoption rate of large enterprises (43%) is far higher than that of private equity firms (10%). The former often have cross-regional and multi-business-line compliance systems (e.g., anti-money laundering monitoring of multinational enterprises needs to cover global branches), requiring AI to achieve “real-time risk scanning”; the latter’s compliance needs are mostly focused on pre-investment due diligence, with a small amount of data per project, which can still be handled by traditional manual work combined with basic tools.

Resource Reserves: The “Positive Correlation Trap” Between Revenue and AI Investment

Revenue level directly determines an enterprise’s ability to invest in compliance AI: among the surveyed enterprises with the highest revenue, 59% have applied AI to compliance and investigation, while this proportion is only 14% for enterprises with the lowest revenue. Large enterprises can not only afford the procurement costs of AI tools (e.g., the annual fee for a compliance-specific NLP platform often exceeds one million yuan) but also possess data governance capabilities—AI’s effectiveness depends on high-quality data. However, SMEs often lack the foundation for “compliance data standardization” (e.g., inconsistent contract text formats, non-digitized historical violation records), making it difficult to exert AI’s effects even if it is introduced.

Time Dimension: Generative AI Triggers a “Two-Year Application Boom”

Among enterprises that have already used AI, 36% have used it for 1-2 years, and 34% for 1 year or less—the growth in AI applications in the past two years is directly related to the boom in generative AI (such as the GPT series and compliance-specific large models). Previously, compliance AI was mostly “rule-based tools” (e.g., fixed keyword screening for contract risks), requiring manual preset logic; generative AI, however, can independently process unstructured data (e.g., summarizing 100,000-word regulatory policies, comparing compliance requirements across different regions), significantly lowering the technical threshold for enterprises and enabling SMEs to get started quickly.

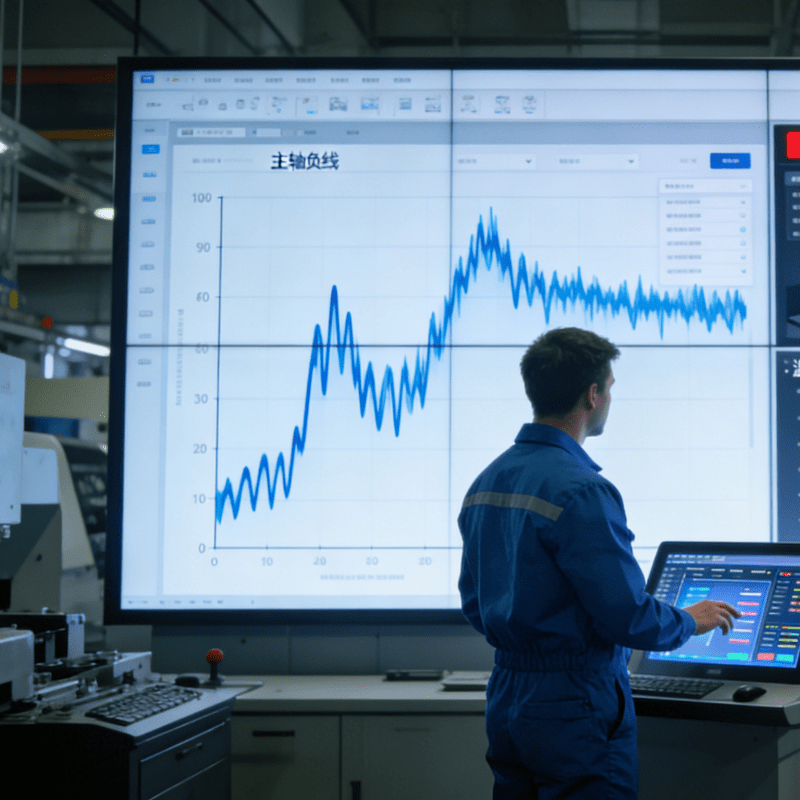

Notably, high-revenue enterprises demonstrate a “long-term investment advantage”: 46% of high-revenue enterprises have used AI for 2-5 years, far exceeding the 11% of low-revenue enterprises. These enterprises not only use AI to handle basic tasks but also explore “AI + compliance strategies” (e.g., predicting regulatory trends, dynamically adjusting compliance frameworks), forming a positive cycle of “data accumulation → model optimization → effect improvement”.

Core Motivations for AI’s Entry into Compliance: Beyond “Cost Reduction and Efficiency Improvement” to “Value Reconstruction”

Enterprises’ adoption of AI is not blind following, but stems from the “practical pain points” of compliance functions—when manual work can no longer cope with the triple pressure of “massive data + complex rules + cost reduction”, AI becomes a “must-choose” solution. Its motivations can be summarized into three core aspects:

Solving the “Time Dilemma”: From “Post-Event Remediation” to “Real-Time Response”

73% of surveyed enterprises list “saving time” as the primary motivation. Taking contract compliance review as an example, traditional manual review of a 50-page cross-border contract takes 8-10 hours, while AI tools (such as compliance platforms integrated with NLP) can complete “risk clause marking + reminder of missing compliance clauses” in 15 minutes, improving efficiency by 32 times. More importantly, AI can achieve “real-time monitoring”: a U.S. technology company uses AI to monitor employees’ overseas business travel reimbursements. Once potential anti-bribery risks such as “excessive entertainment expenses” or “undeclared gifts” are detected, real-time alerts can be triggered to prevent risks from evolving from “embryonic stage” to “violation incidents”.

Alleviating “Cost Pressure”: Replacing “Manpower Stacking” with Technology

71% of enterprises mention “cost saving”—the labor cost of compliance teams has been rising year by year (the average salary increase of global compliance talents reached 18% in 2024), while AI can replace more than 60% of repetitive work, such as document classification, basic risk screening, and data aggregation for compliance reports. After introducing AI, a multinational retail enterprise reduced the “supplier compliance verification” that originally required a 10-person team to 3 people (responsible for reviewing AI results and analyzing complex risks), saving more than 4 million yuan in annual labor costs.

Unleashing “Talent Value”: Transforming Compliance Personnel from “Executors” to “Strategists”

The ultimate value of AI lies in freeing compliance personnel from “mechanical work” and focusing on higher-value tasks. As the head of the Ethics and Compliance Department of a U.S. company said: “In the past, we spent 80% of our time organizing regulatory documents and verifying data. Now AI does these tasks, allowing us to devote more energy to studying ‘how the newly introduced carbon tariff policy affects supply chain compliance’ and ‘how to build a compliance culture covering all business lines’—this is the true value that compliance functions should have.”

Application Scenarios of AI in Compliance: From “Text Processing” to “Risk Prediction”, Still in the Early Exploration Stage

Currently, the application of AI in compliance still mainly “leverages the advantages of natural language processing (NLP) and generative AI”, focusing on high-frequency, repetitive text-related tasks. However, some leading enterprises have begun to extend to “in-depth risk mining”, including compliance management for core production equipment like the Robotic Irregular-Shaped Metal Part Removal System—a key device in automotive, aerospace, and heavy machinery industries for handling non-standard metal components (e.g., engine casings, curved structural parts). Since its operation involves strict safety compliance (to avoid equipment damage or worker injuries) and quality compliance (to prevent product defects that violate industry standards), enterprises have turned to AI to plug compliance gaps in its use: AI-powered 3D vision modules on the robot real-time compare the actual disassembly path with regulatory safety protocols (such as ISO 10218 for industrial robot operation), automatically alerting if the robot deviates from safe operating ranges (e.g., excessive force that may crush parts or pose collision risks); meanwhile, AI integrates the robot’s operation data (e.g., torque, clamping force, working hours) into the enterprise’s compliance platform, generating traceable reports to meet regulatory requirements for production process oversight (such as the EU’s CE certification standards for machinery). For example, a German automotive component manufacturer reduced compliance incidents related to irregular metal part handling by 35% after adopting this AI-integrated system, as AI not only predicts potential risks (e.g., component deformation caused by improper grasping) but also provides auditable data for regulatory inspections, eliminating the “proof gap” that often arises in manual compliance reviews.

Core Application: Text Processing Becomes the “First Breakthrough”

The most mature scenarios are concentrated in “unstructured text processing”: 88% of enterprises use AI to summarize compliance documents (such as regulatory policy interpretations and internal compliance manuals), and 85% use AI to review evidence documents during investigations (such as emails, contracts, and chat records). The emergence of generative AI has further upgraded this capability—a European financial institution uses a compliance-specific large model to automatically convert the complex clauses of the EU’s General Data Protection Regulation (GDPR) into “10 operating guidelines for customer service teams” and generate the first draft of “user data authorization agreements”, significantly shortening the time for policy implementation.

Potential Space: The Leap from “Basic Processing” to “Risk Prediction”

Although basic applications have become popular, the adoption rate of more complex AI scenarios (such as abnormal transaction data detection and personalized recommendation for compliance training) is still less than 30%, reflecting that most enterprises are still in the “AI Compliance 1.0 Stage”. Nevertheless, some enterprises have shown forward-looking vision: the legal team of a Mexican company uses AI to analyze compliance violation cases over the past 3 years, combined with real-time business data, to identify “uncommon risks” (e.g., “third-party suppliers evading bidding compliance by ‘splitting orders'”), increasing the risk identification rate by 25%; a Chinese internet company uses AI to customize compliance training content for new employees—pushing courses based on positions (e.g., sales positions focus on anti-commercial bribery, technical positions focus on data security), increasing the training pass rate from 78% to 95%.

Unignorable Risks: Drawing a Line Between “Convenience” and “Controllability”

The versatility of AI also brings new challenges: first, the “decision black box”—for example, AI marks a transaction as “high risk” but cannot clearly explain the basis for the judgment. If a compliance dispute arises, it is difficult for the enterprise to provide evidence; second, “content reliability”—generative AI may fabricate “non-existent regulatory clauses” (i.e., the “hallucination phenomenon”), which will directly lead to violations if used in compliance reports; third, “over-reliance”—some teams completely hand over complex risk analysis (such as compliance due diligence for cross-border mergers and acquisitions) to AI, ignoring the necessity of manual review.

In response, leading enterprises have begun to establish “AI Compliance Usage Specifications”: such as setting a “dual review mechanism for AI output” (technical teams verify logic, compliance experts verify content), and restricting AI’s independent decision-making power in “high-risk scenarios” (such as signing major contracts, regulatory declarations), to ensure that technological innovation does not cross the bottom line of compliance.

Conclusion: AI Reshaping Compliance—Opportunities Ahead, Needing “Governance” for Escort

AI is transforming compliance functions from “cost centers” to “value centers”: it can not only solve the traditional pain points of “low efficiency, high cost, and incomplete coverage” but also help enterprises avoid risks in advance and adapt to regulatory trends through data insights, becoming an “escort” for business development. However, currently, this field is still in a critical stage “with both opportunities and challenges”—some enterprises have built compliance advantages through AI, while more enterprises are still coping with the difficulties of “difficult technology implementation, low risk controllability, and insufficient resources”.

In the future, the release of AI’s value in compliance will no longer depend on the “advanced nature of a single tool”, but on the collaboration of “technology, governance, and talents”: enterprises need to establish an “AI compliance governance framework” (clarifying usage boundaries and risk control processes), cultivate compound talents who “understand both compliance and technology”, and actively participate in the formulation of industry standards (such as evaluation indicators for AI compliance tools). Only in this way can AI truly become a “core competence” of compliance functions rather than a “risk hidden danger”.

For enterprises, the AI revolution in the compliance field is no longer a question of “whether to participate”, but “how to participate in the correct way”—finding a balance between efficiency and risk, and making technology serve the essential goal of compliance: safeguarding the long-term value of the enterprise and building a sustainable compliance ecosystem.