Apple is accelerating adjustments to its global supply chain layout. A senior official from India’s Ministry of Electronics and Information Technology (MeitY) revealed that Apple has begun negotiating partnerships with Indian local enterprises, planning to have them produce specialized equipment required for iPhone assembly. This move aims not only to strengthen India’s local supply chain but also to directly address delays in importing equipment from China.

Import Delays Force Supply Chain Adjustments, Putting iPhone 17 Production Capacity Under Pressure

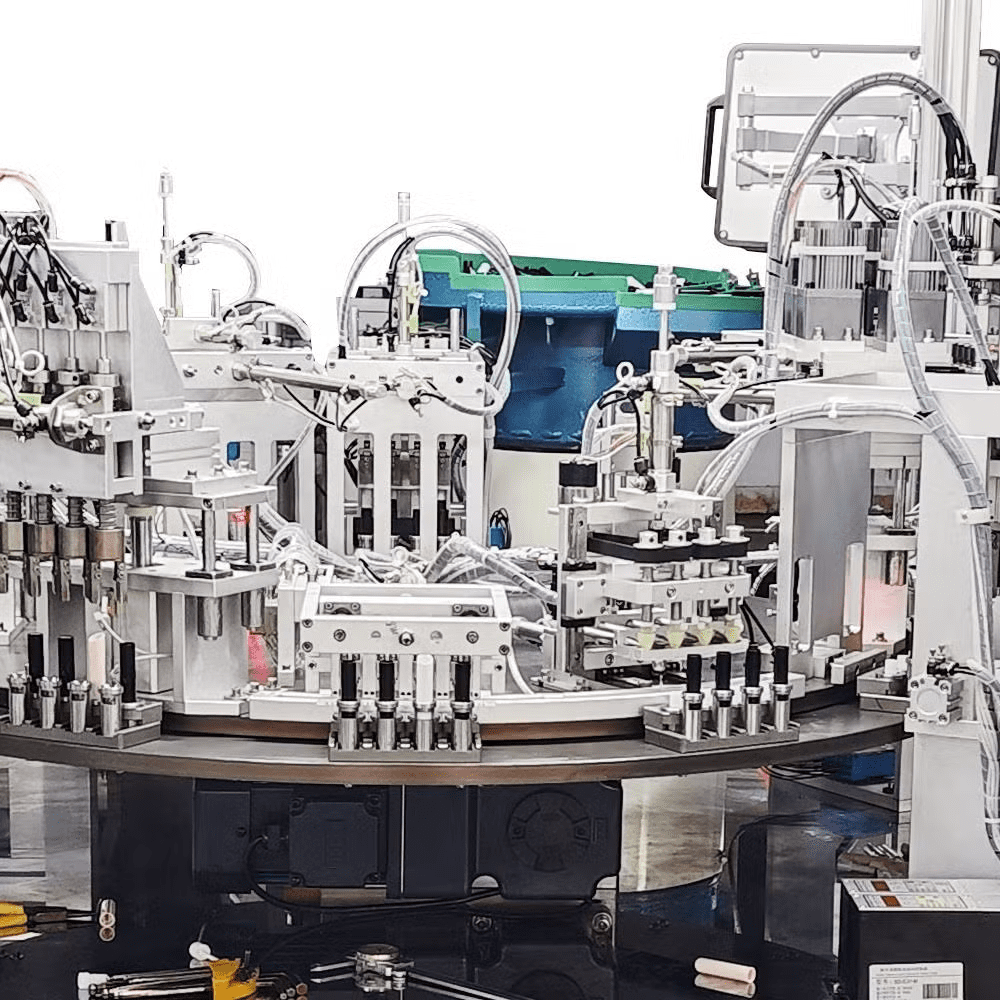

In recent years, Apple has repeatedly faced delivery delays in importing high-precision assembly equipment from China, including specialized machinery for components alignment, screen lamination, and performance testing. This issue is particularly prominent during the preparation phase for mass production of new-generation products. It is reported that Apple’s iPhone 17 series (including Pro and Pro Max models), scheduled for global release in September-October 2025, relies on such specialized equipment for precision assembly. Unstable equipment supply could directly affect the launch schedule of the new products.

“The efficiency of China’s supply chain was once an industry benchmark, but recent logistics bottlenecks and production scheduling issues have forced Apple to reassess supply chain resilience,” industry analysts noted. Shifting to local procurement in India is essentially Apple’s attempt to find a new balance between ‘efficiency’ and ‘stability’ — by localizing equipment production, it can shorten supply chain response cycles and reduce reliance on a single region.

Foxconn and Tata Electronics Expand Production, Surging Demand for Equipment

Foxconn and Tata Electronics, Apple’s two core contract manufacturers in India, are simultaneously advancing the construction of new production lines, directly driving up demand for specialized assembly equipment. Foxconn’s factory in Chennai has launched its third-phase expansion, aiming to increase iPhone daily production capacity to 500,000 units. Tata Electronics, on the other hand, is building a new plant in Gujarat, focusing on assembling high-end models.

Historically, equipment procurement for Apple’s contract manufacturers was mostly handled through Apple’s subsidiaries. For example, in July 2024, Foxconn’s Indian subsidiary reportedly purchased production equipment worth $33 million from Apple Operations Ltd. However, this shift to Indian local enterprises marks Apple’s first attempt at a “localized procurement + global standards” model on the equipment supply side.

Technical Hurdles Remain: Indian Enterprises Need to Overcome High-Precision Challenges

Despite clear cooperation intentions, Indian local equipment manufacturers still face significant challenges. Apple’s precision requirements for assembly equipment are extremely stringent — for instance, the lamination error between the screen and the body must be controlled within 0.01 mm, and battery welding equipment must have micron-level temperature control capabilities. The industry generally believes that Indian capital equipment manufacturers need technical support from Apple or its global core suppliers (such as China’s Han’s Laser and Japan’s Fujikoshi), including process standard sharing and equipment debugging training, to meet Apple’s quality system.

“This is not simply ‘OEM production’ but a deep transfer of technical capabilities,” a of an Indian enterprise involved in the negotiations stated. Apple has proposed a phased cooperation plan: initially, Indian enterprises will produce standardized components, gradually transitioning to complete assembly equipment. The entire process may require 12-18 months of technical adaptation.

Production Capacity Target: Striving for $40 Billion Output Value Within Two Years

If localized equipment production is realized, Apple’s iPhone production capacity in India is expected to achieve leapfrog growth. Data shows that India’s iPhone output value reached $22 billion in the 2024-2025 fiscal year (FY25). If it can meet global market demand (including all U.S. demand), this figure may surge to $40 billion within the next 1-2 years. Even under conservative estimates, India’s iPhone output value will stabilize in the $30-32 billion range by the 2026-2027 fiscal year (FY27).

This shift will not only consolidate Apple’s position in the Indian market (India became Apple’s fastest-growing major global market in 2024) but also be regarded as a key step for India to become a “global electronics manufacturing hub.” By undertaking core links in Apple’s industrial chain, Indian local enterprises are expected to accumulate high-end manufacturing experience and drive the upgrading of the entire electronics industry.

Disclaimer: HDFC SKY has made every effort to ensure the accuracy and rigor of the news and market-related content compiled and presented. However, inadvertent omissions or errors may occasionally occur. If you have any questions about the content or need to point out discrepancies, please write to content@hdfcsec.com. The information in this article is for reference only and does not constitute any investment advice.