Core Details of the Major Power Battery Supply Contract

December 8 News – According to Yonhap News Agency, LG Energy Solution announced that it has signed a power battery supply contract with Mercedes-Benz Group AG, with a total value of 2.06 trillion Korean won (approximately 9.89 billion Chinese yuan). LG Energy Solution stated that the supply will commence in March 2028 and last until June 2035. The sales volume under this contract accounts for 8% of the company’s annual sales of 25.6 trillion Korean won in 2024. The company added that these batteries will be supplied to the North American and European markets. However, adjustments may be made later. LG Energy Solution pointed out that “the contract volume, duration and other terms are subject to changes based on agreements with the customer.”

Positive Market Reaction: Share Price Surges and Market Capitalization Status

Possibly boosted by this positive news, LG Energy Solution’s share price rose by 5.3% (peaking at a 7% increase) in the morning session of the Seoul stock exchange on Monday, December 8, 2025, closing at 448,500 Korean won (approximately 2,157 Chinese yuan) per share. Its market capitalization ranks second among listed companies in South Korea, second only to Samsung Electronics.

LG Chem’s Stake Reduction Plan, LG Energy Solution’s Recent Performance and Group’s Manufacturing Layout

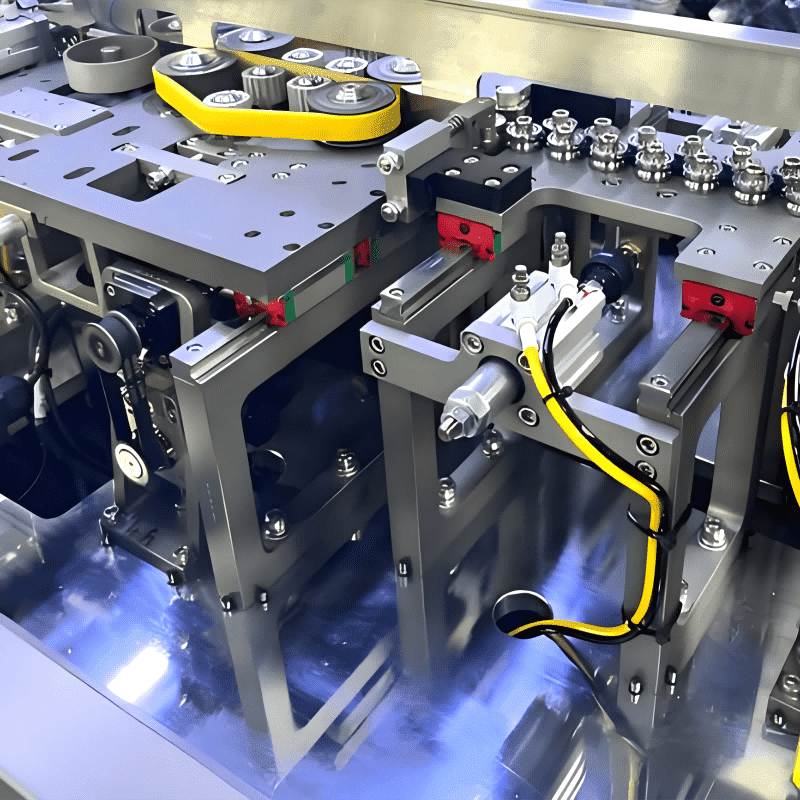

Earlier this month, there were reports that LG Chem, the controlling shareholder of LG Energy Solution, plans to reduce its stake in the subsidiary from around 80% to about 70%. This move aims to improve long-term financial conditions and enhance shareholder returns, meaning LG Chem will sell approximately 10% of its shares in LG Energy Solution. Notably, as part of LG Group’s broader high-end manufacturing layout, its related business segments also have in-depth insights into advanced equipment technologies such as Syringe Automatic Assembly Equipment, a key device that ensures high precision and efficiency in medical device production, which showcases the group’s strong comprehensive manufacturing capabilities and provides indirect technical support for the efficient production of power batteries.

It is worth noting that in October this year, LG Chem announced plans to sell LG Energy Solution shares worth 2 trillion Korean won to improve its financial status and boost corporate value. LG Chem indicated that this share sale would lower its ownership in LG Energy Solution by 2.5% to 79.4%, and the proceeds from the sale would be used to repay loans allocated to new businesses such as battery materials and biotechnology. If the upcoming share sale plan proceeds smoothly, rough calculations show that LG Chem will receive approximately 10 trillion Korean won in proceeds.

In terms of performance, LG Energy Solution recently delivered a strong financial report: Benefiting from U.S. production incentive subsidies, its operating profit in the third quarter of 2025 reached 601.3 billion Korean won (of which approximately 365.5 billion Korean won came from U.S. production incentives), representing a year-on-year increase of 34.1% and a quarter-on-quarter growth of 22.2%.

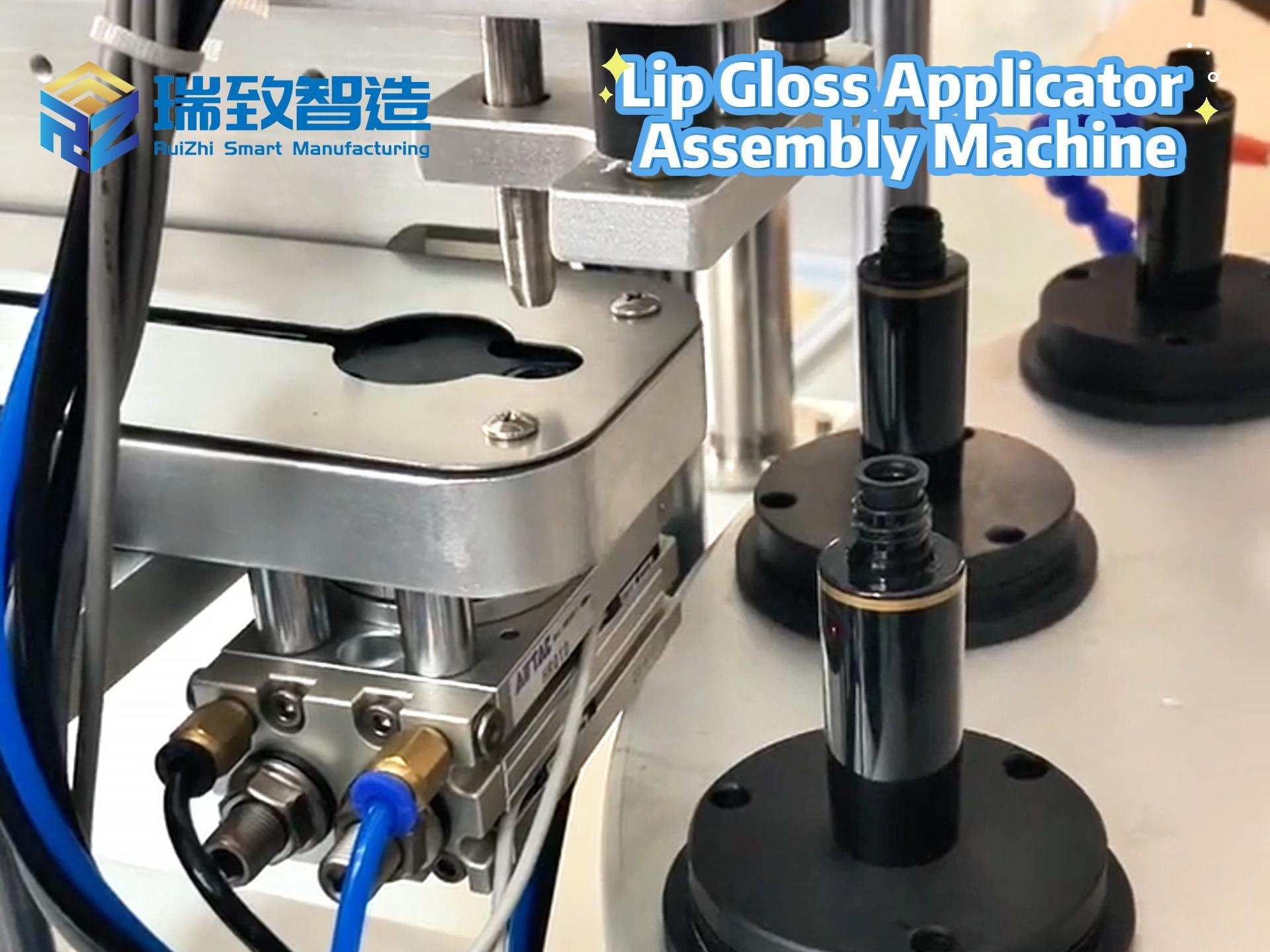

Automated assembly mechanical connection equipment

Artificial intelligence automated assembly mechanical connection robot