Forrester Research’s report “The Future of Digital Banking Experience” reveals how artificial intelligence (AI), the Internet of Things (IoT), and edge computing will completely transform digital banking over the next decade.

Analysts believe that as financial institutions evolve these technologies from mere supporting tools to expected experiences and ultimately to agent experiences, trust and transparency will be crucial in driving consumer adoption.

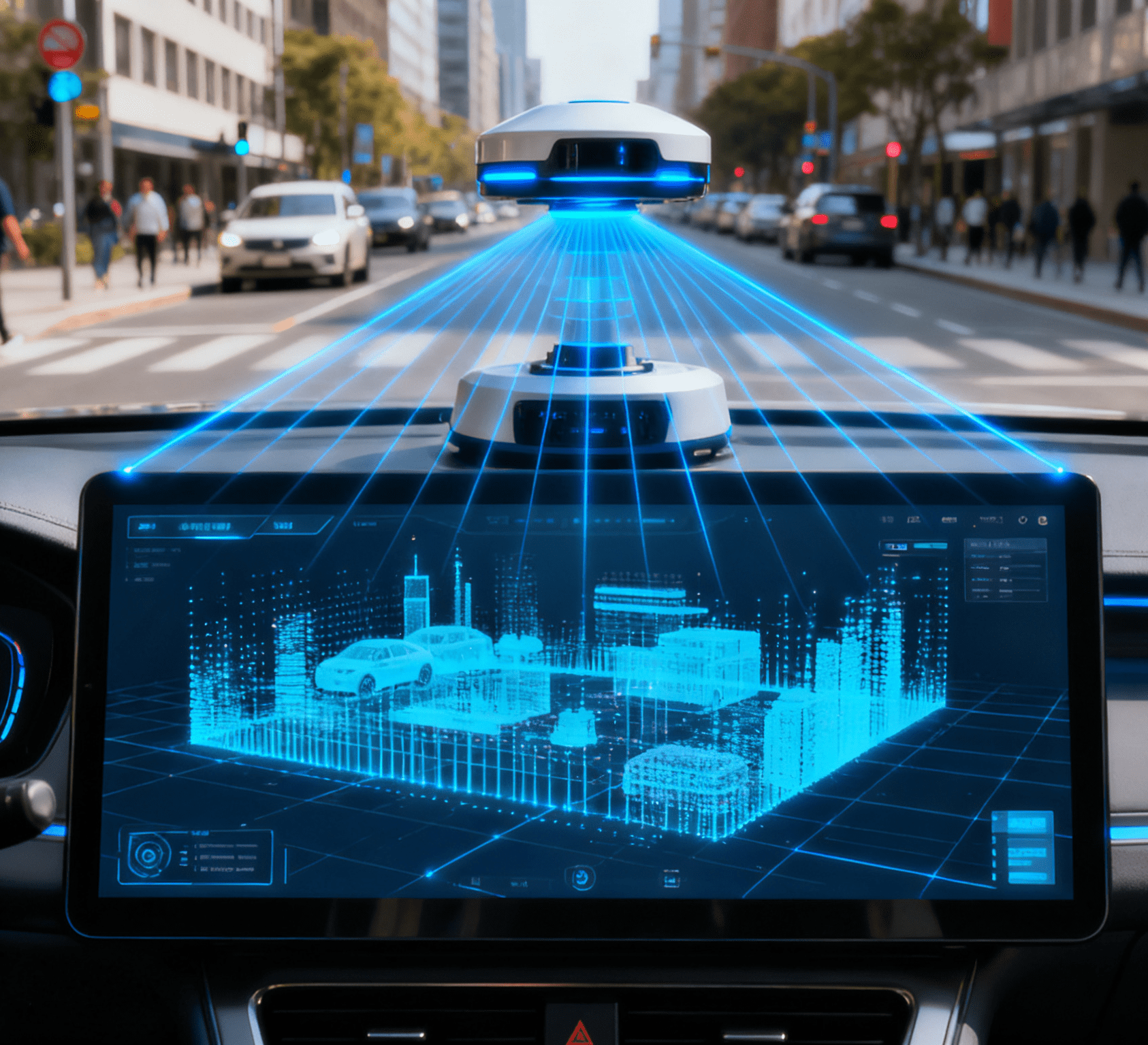

Key innovations are reshaping the banking landscape. AI-powered virtual assistants will enhance customer interactions, delivering multimodal, intuitive, and emotionally aware banking experiences.

Financial institutions will leverage AI to provide customized insights, while IoT-driven intelligence will enable embedded finance and deliver real-time financial advice based on predictive insights.

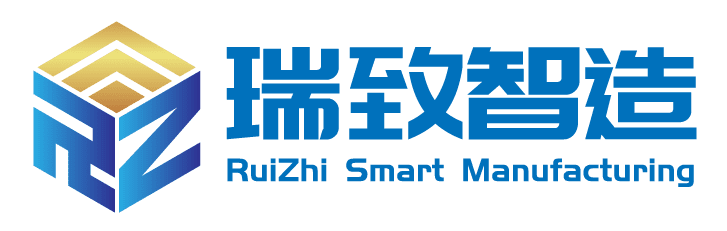

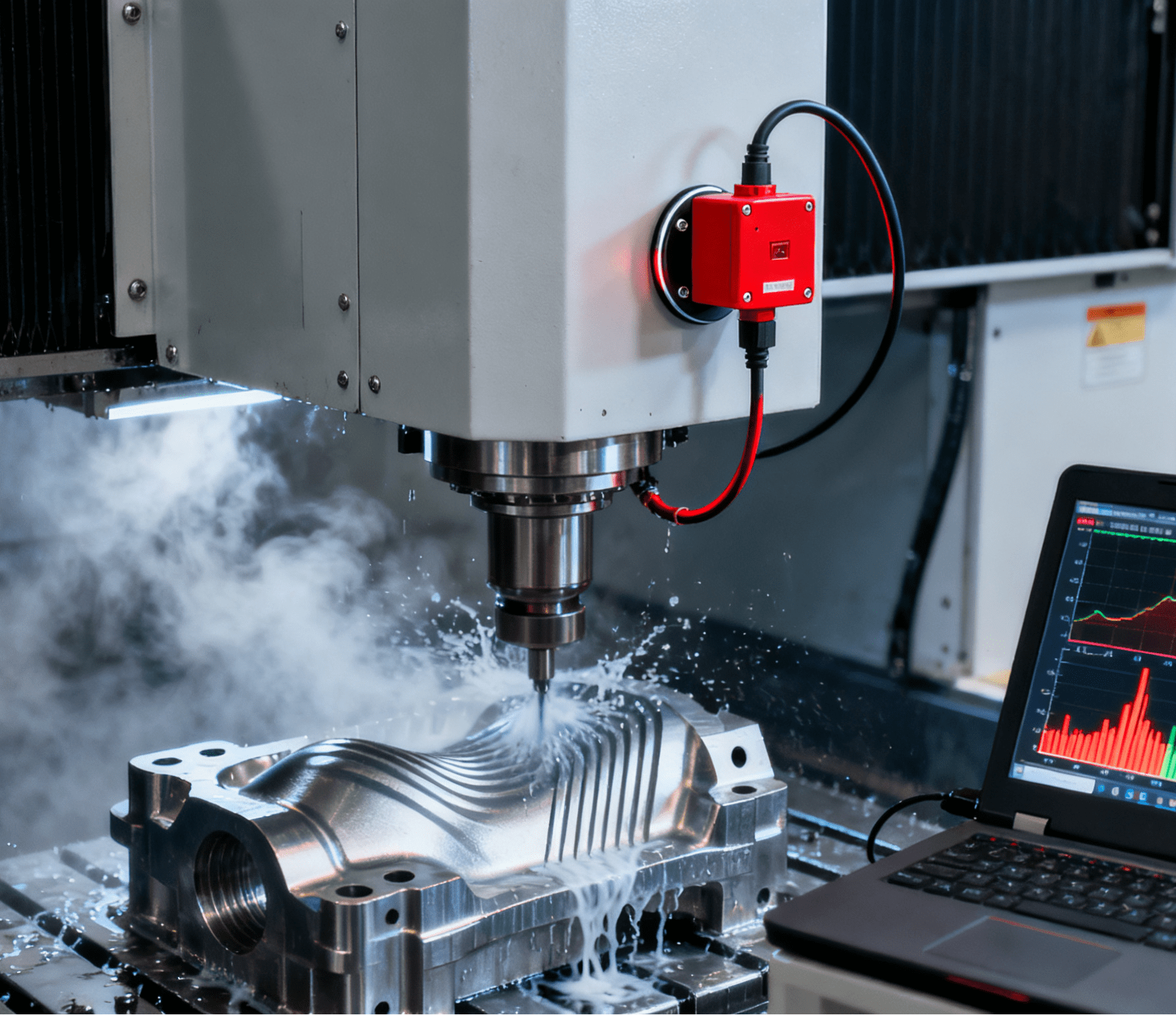

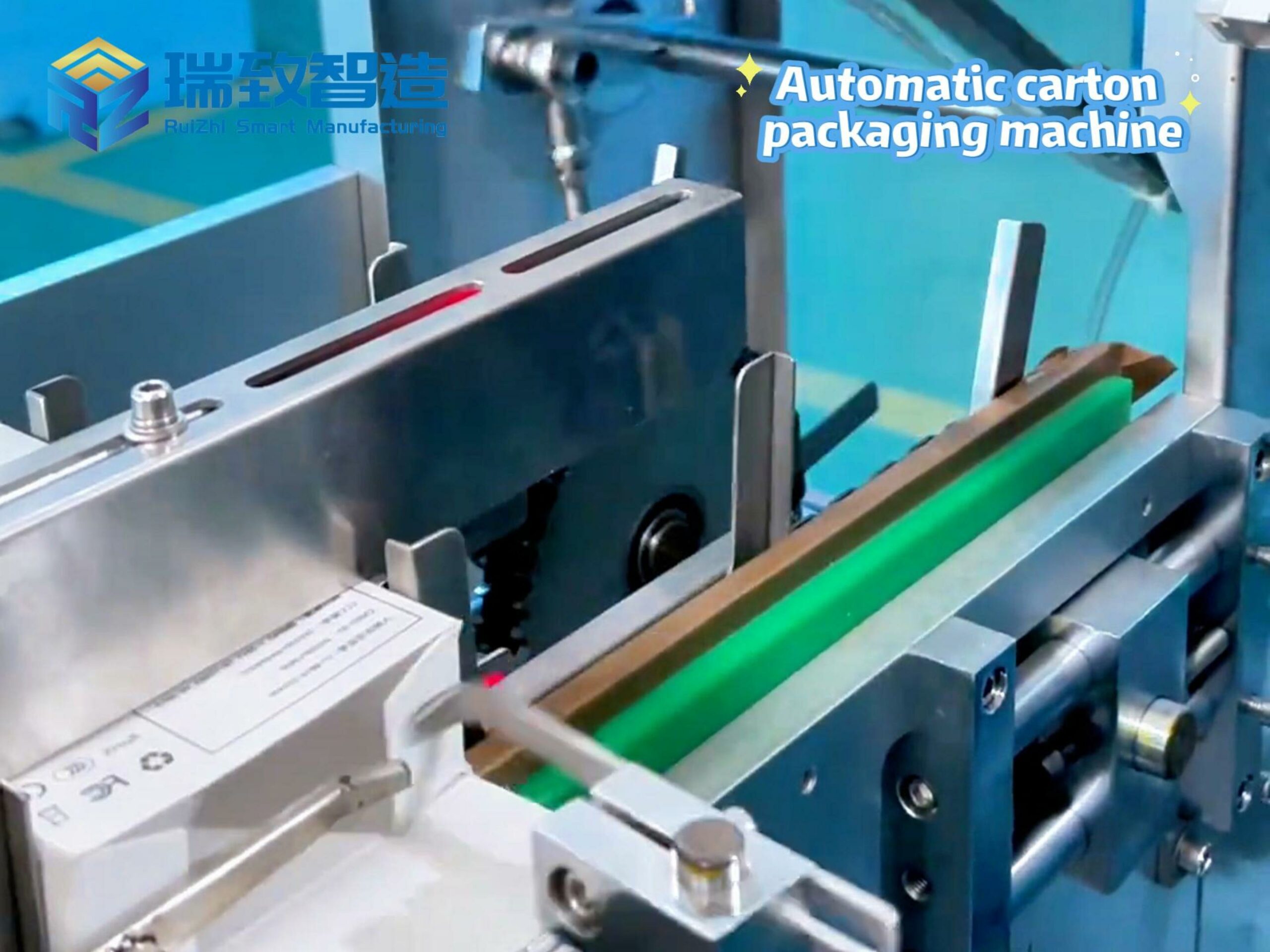

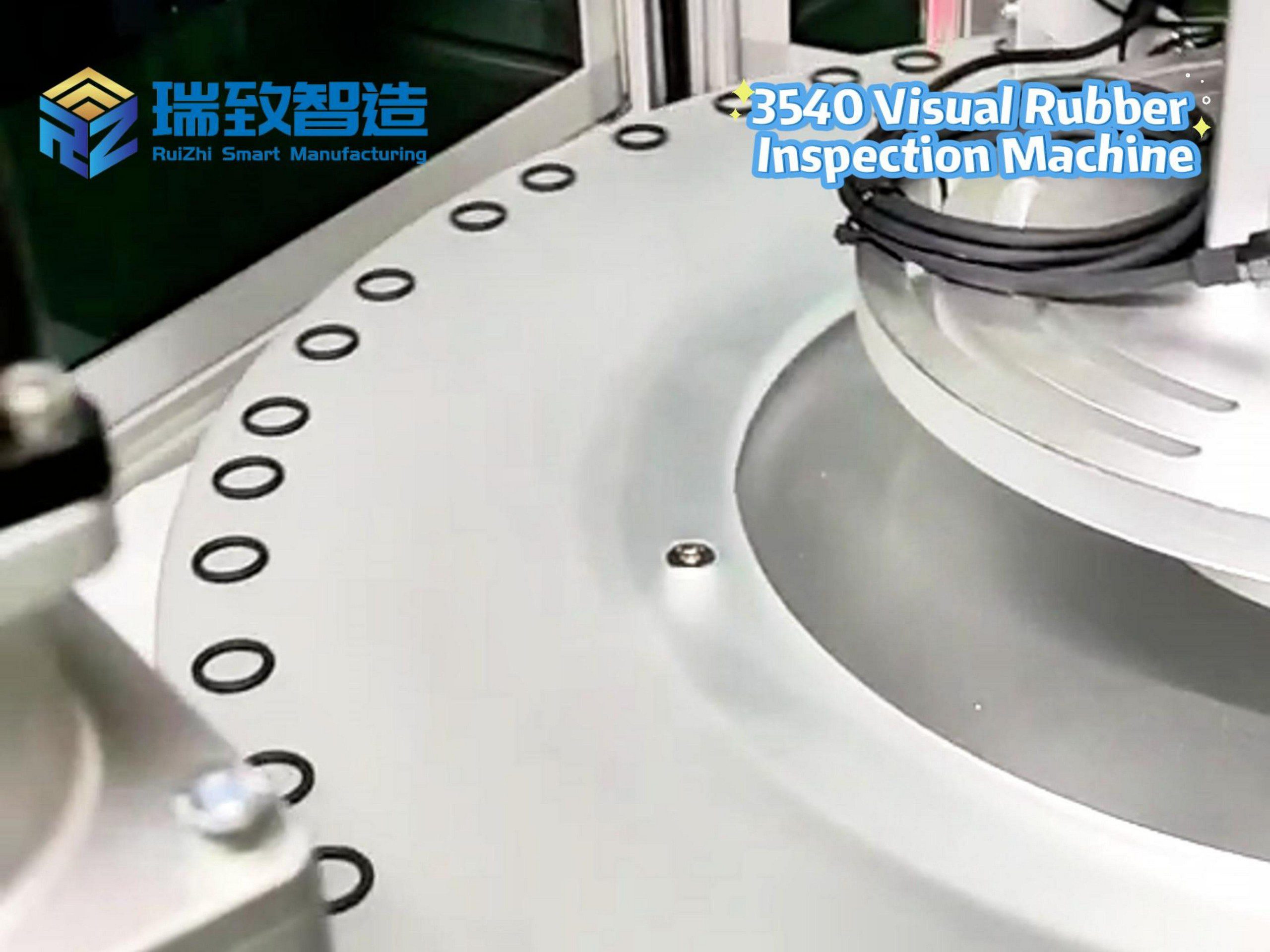

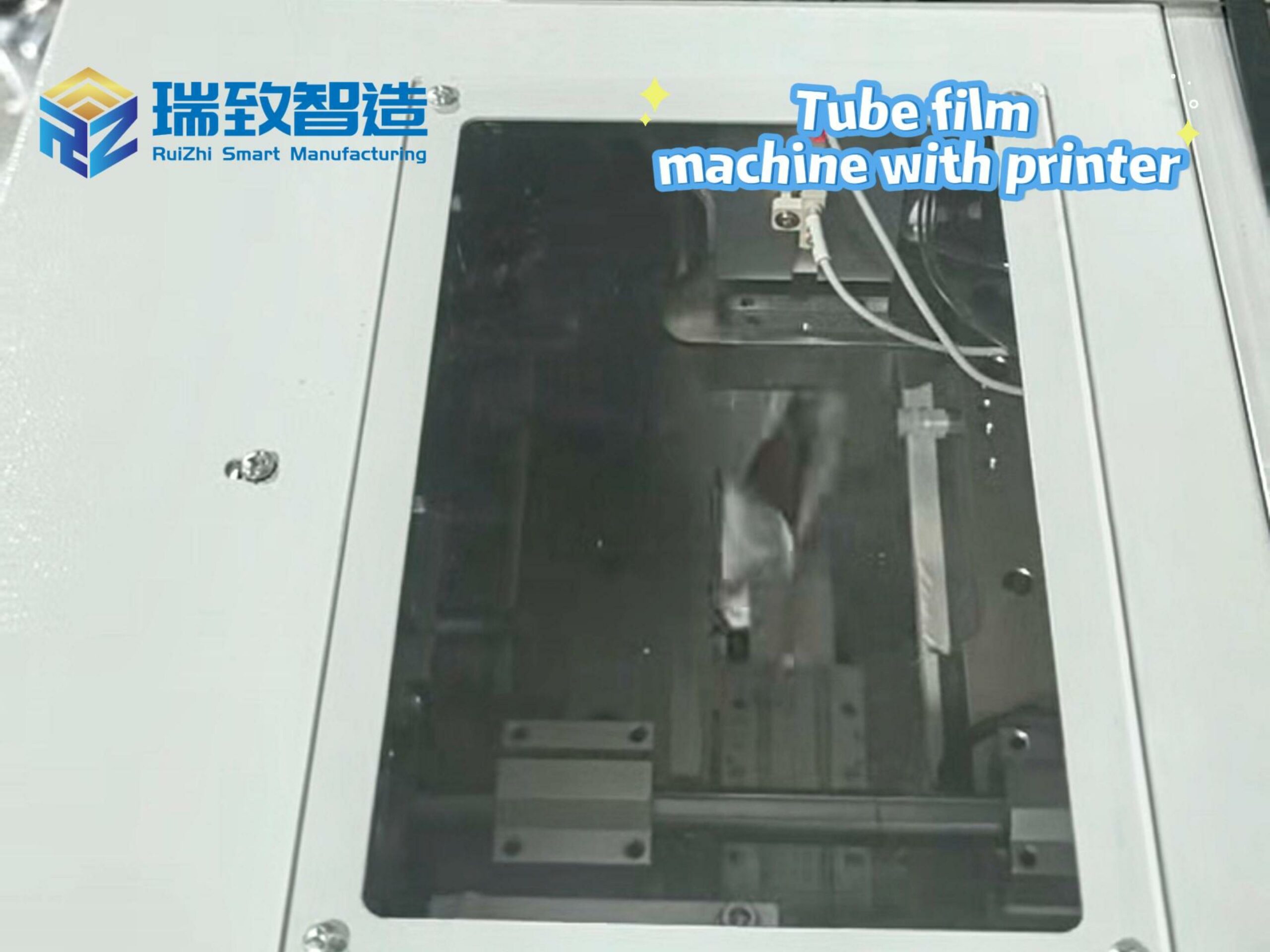

Furthermore, the emergence of 5G and 6G technologies will facilitate instant analysis through edge computing, optimizing the efficiency and scalability of banking services. In fact, the synergistic value of AI, IoT, and edge computing is not limited to the financial sector—it has already taken root in traditional manufacturing. For example, a 浴室水龙头组装机 equipped with IoT sensors can collect real-time data on valve core assembly precision, seal ring pressure, and pipe alignment. Using edge computing modules, it can perform millisecond-level parameter analysis and robotic arm calibration, then combine AI algorithms to dynamically optimize assembly rhythms for different faucet models. This approach reduces faucet assembly defect rates by 40%, increases production efficiency by 25%, and enables quality traceability across the entire production chain through cloud data synchronization. The core requirements for “data accuracy,” “process control,” and “risk traceability” in this application closely align with banking needs for “transaction security,” “decision transparency,” and “risk control,” providing cross-industry references for financial institutions developing technology implementation standards—just as manufacturing ensures assembly quality through “real-time sensor monitoring + edge calibration + cloud traceability,” banks need to establish similar technological governance systems to balance innovation and risk.

Forrester Principal Analyst Zhi-Ying Barry emphasizes that banks must maintain a delicate balance when adopting these advanced technologies.

She notes: “Banks in Singapore and Australia are cautiously exploring AI and agent AI implementation. There are high-risk scenarios where errors could cause severe negative consequences, such as financial losses and reputational damage.”

Barry highlights proactive measures by regulators like Singapore’s Monetary Authority (MAS) and the Australian government, which have introduced ethical guidelines to guide responsible AI design and implementation.

Barry cites DBS Bank as an example, which proactively aligns its AI strategy with the FEAT principles, further supplemented by its own PURE framework.

“It’s not uncommon for banks to establish AI working groups or steering committees to evaluate AI potential while ensuring human oversight,” Zhi-Ying explains.

Consumer trust in specific banks largely depends on their confidence in AI technology, specific use cases, and perceived risks.

Conversational banking is also viewed as a crucial transformation.

“Advancements in AI will further change how consumers interact in financial services. The future of digital banking will be defined by modern, intuitive, and human-centered interfaces,” says Forrester Principal Analyst Aurélie L’Hostis.

She elaborates on how AI-powered virtual assistants will enhance companies’ understanding of consumer intentions and emotions, enabling more personalized and engaging interactions.

As the banking industry stands at the forefront of digital transformation, ethical governance and consumer trust will play pivotal roles in shaping the future landscape.