2025 was a pivotal year for China’s battery industry to emerge from in-depth restructuring and achieve a strategic turnaround. Its most notable feature was the explosive growth in energy storage demand against the backdrop of stabilized demand for new energy vehicles, driving full-capacity production and sales across the entire industry. This shift, coupled with improved supply and demand structures, directly led to a resurgence of supply-demand mismatches, pushing the prices of key materials such as lithium hexafluorophosphate up by more than 240% within the year and triggering an industry-wide wave of locking in production capacity through long-term agreements.

In terms of technological routes, the industry adopted a pragmatic approach of diversified competition and parallel development. Semi-solid-state batteries were put into demonstration vehicle applications, all-solid-state batteries entered a phase of orderly engineering research and development, and sodium-ion batteries achieved commercialization in specific scenarios, laying a solid foundation for industry transformation in 2026.

On the policy front, the anti-involution drive ran throughout the year. Policies and the industry worked in synergy—from regulating lithium ore mining to curbing low-price competition—driving the industry to shift from the model of “trading price for volume” to “value return”.

Looking ahead to 2026, Vke Lithium Battery Network believes that a new upward cycle for the lithium battery industry has commenced, ushering in a comprehensive recovery and a profound transformation driven by supply-demand rebalancing, technological innovation, policy regulation and value return. China’s battery industry is expected to present eight most anticipated highlights in 2026:

- Value Return: The Industry Enters a “Structural Seller’s Market”

The fundamental adjustment of supply and demand is the core driving force for the industry’s recovery in 2026. After the pains of overcapacity and price wars, the industry’s inventory cycle has hit bottom and entered a phase of prosperity driven by active inventory replenishment.

On the demand side, power batteries will maintain steady growth, benefiting from the increased energy load of passenger cars and the continuous expansion of new application scenarios; the energy storage market will see a resonance of domestic and international demand, driven by falling costs, policy support and scenarios such as AIDC (Artificial Intelligence Data Center). On the supply side, the industry’s motivation for capacity expansion is significantly insufficient due to the contraction of capital expenditure in the past two years and the current pressure on the profitability and cash flow of lithium battery enterprises. This will drive the industry to shift from a buyer-dominated market to a structural seller’s market shaped by supply-demand game. Tight supply is likely to emerge in key material sectors such as lithium iron phosphate and lithium hexafluorophosphate, with prices sustaining upward momentum.

As the lithium battery industry embraces value return, profit margins are expected to further recover. Statistics show that in the first three quarters of 2025, the median net profit margin of 105 listed companies in the Shenwan Secondary “Battery” Sector (excluding one fuel cell enterprise and mining enterprises) was only 2.78%, a further decline from the same period in 2024. This means more than half of the companies have meager profitability, making value revaluation and profit recovery an urgent imperative.

In 2026, the tight supply-demand pattern will fuel the rise of the contract manufacturing model. The contradiction between the capacity gap of leading enterprises and constraints on capacity expansion will intensify, while newly established small and medium-sized enterprises face idle production lines due to insufficient orders. This mismatch will trigger a race among leading enterprises to secure contract manufacturers.

- Energy Storage Leadership & Explosive Growth of Scenarios

If the past decade was defined by new energy vehicles dominating the battery industry, 2026 will be marked by scenario explosion—an accelerated shift from single-driver growth to multi-scenario resonance of power batteries + energy storage + low-altitude economy/humanoid robots.

New energy vehicles remain the cornerstone of battery demand. The China Association of Automobile Manufacturers forecasts that new energy vehicle sales will reach 19 million units in 2026, a year-on-year increase of 15.2%. Growth highlights will come from the commercial vehicle sector, especially new energy heavy-duty trucks. The national government has listed “promoting the large-scale application of new energy heavy-duty trucks” as a key task for 2026, which will effectively drive demand for high-energy-density batteries.

Energy storage will become the fastest-growing segment. SMM (Shanghai Metals Market) predicts that global demand for energy storage batteries will grow by about 50% in 2026, with its absolute increment potentially surpassing that of power batteries for the first time. The driving forces stem from the emerging economic inflection point of independent energy storage driven by domestic capacity electricity price policies and new increments from energy storage configuration for AIDCs. In terms of products, 314Ah battery cells remain the domestic mainstream, and the replacement cycle for larger-capacity cells is expected to start after 2027.

The low-altitude economy and humanoid robot sectors will gradually enter large-scale application, forcing battery technology to break through toward higher energy density, higher power and extreme safety. CALB (China Aviation Lithium Battery) has established a leading edge in this field: its Gen-9 high-nickel/silicon-based flight battery boasts an energy density of over 300Wh/kg and supports 6C fast charging, while its second-generation semi-solid-state large cylindrical battery reaches an energy density of 350Wh/kg. The supporting GAC GOVY AirCab has secured more than 1,000 intentional orders and is scheduled for mass production and delivery in the second half of 2026. This is expected to become another large-scale commercial case for CALB in the aviation-grade battery field, strengthening its position as a technological benchmark.

- Dual National Safety Standards Drive Industrial Upgrading

The overlapping implementation of several new battery policies in 2026 will profoundly reshape the lithium battery industry from three dimensions: safety technology, market competition and industrial chain synergy, bringing both challenges and opportunities for enterprises.

Safety Requirements for Power Batteries for Electric Vehicles (GB38031-2025) will take effect on July 1, 2026, for the first time incorporating the mandatory requirement of “no fire, no explosion” after thermal runaway. Technical Specifications for Safety of Electric Bicycles (GB 17761—2024) was implemented in December 2025, clarifying the bottom line for acupuncture safety. The Interim Measures for the Administration of Recycling and Comprehensive Utilization of Waste Power Batteries of New Energy Vehicles will be enforced on April 1, 2026, explicitly prohibiting the use of waste vehicle batteries in electric bicycles and other fields.

Under the combined effect of these policies, industry reshuffling will accelerate significantly. Taking the electric two-wheeler market as an example, the new national standard completely blocks the circulation of inferior batteries from the demand side, while the recycling ban eliminates the supply of non-compliant batteries from the source. This will directly create a huge stock replacement market, and enterprises with systematic safety design capabilities will seize the first-mover advantage.

For instance, Star Power, a long-term player in the light vehicle battery sector, has a technical route highly aligned with the high-safety policy direction. On January 22, the company held the 2026 Electric Motorcycle Technology New Product Launch, unveiling the new GT-Force High Conductivity & Long Range Technology and supporting products. Through material and structural innovation, this technology increases the pack rate by 33%, supports 5C discharge, delivers a cruising range of over 100 kilometers and meets automotive-grade safety standards. The new “Polaris” battery cell product equipped with this technology covers a capacity range of 32-50Ah, adapting to all scenarios of 1-15 kWh power demand. The packaged FAR Ranger series lithium batteries for electric motorcycles offer 74V50Ah and 100Ah super large single-cell configurations in the domestic market, while the overseas “Ranger Series” adapts to global models with specifications such as “Double 80” and “Double 100”, fully demonstrating the company’s systematic capabilities in high safety, strong power and wide adaptability in technology and products.

- Solid-State Battery Industrialization Enters a Critical Phase

2026 will be a critical transition year for China’s solid-state battery industry from engineering verification to the “eve of large-scale mass production”, laying the foundation for commercial scale application from 2027 to 2030.

Policy drive is clear: the national government has listed “accelerating the breakthrough of all-solid-state battery technology” as a key task for 2026, serving as the strongest guide for industrial development.

Industrialization is advancing intensively, marked by “pilot line verification” and “first vehicle loading”. Major automakers including GAC Group, Dongfeng Motor, Changan Automobile and FAW Hongqi plan to conduct prototype testing or small-batch loading verification of semi-solid-state or all-solid-state batteries in 2026. Battery enterprises such as Sunwoda completed the technological iteration from semi-solid-state to all-solid-state batteries in 2025; its “Xin·Bixiao” polymer all-solid-state battery has an energy density exceeding 400Wh/kg, a cycle life of over 1,200 cycles, and passed the 200℃ hot box safety test. The company will continue to innovate toward a 520Wh/kg lithium metal super battery in the future.

Engineering has become the focus: the technological core of all-solid-state batteries is shifting from “materials science” to “production engineering”. Sulfide electrolytes are widely regarded as the mainstream technical route, yet engineering bottlenecks such as chemical stability, cost and solid-solid interface impedance remain core challenges. The industry consensus is that large-scale application of all-solid-state batteries is expected in 2028-2030.

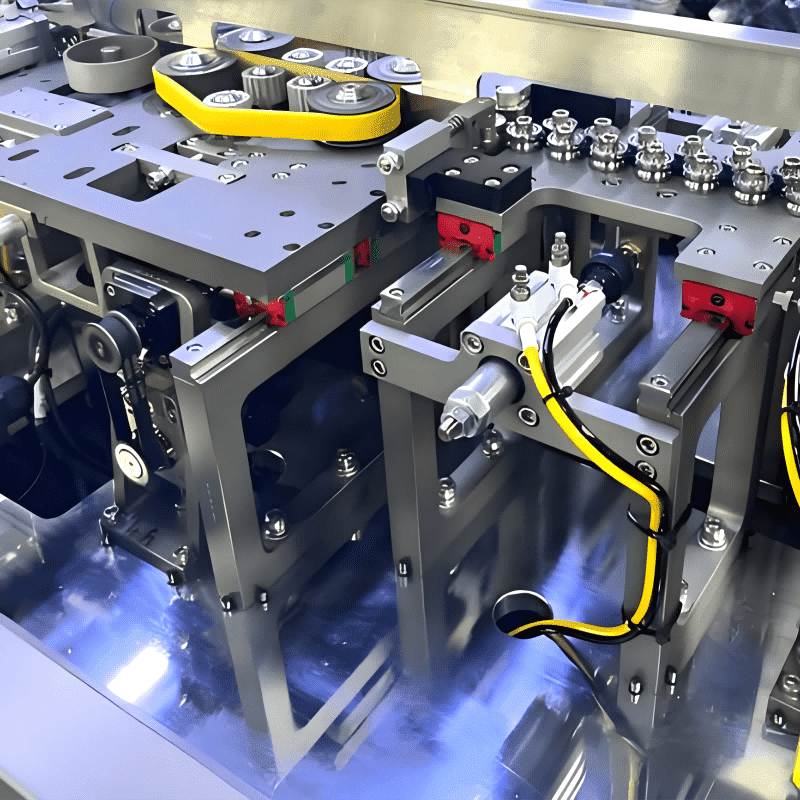

Equipment and processes are the first to benefit: the manufacturing of all-solid-state batteries requires new processes such as dry electrode production, isostatic pressing, laser welding and pressure fusion welding, bringing first-mover opportunities for equipment enterprises. For example, Gonow Digital Manufacturing’s first dry electrode pilot line covers seven core processes, realizing one-stop production from “raw material input to finished pole piece output”, adapting to 100MW-level dry electrode pilot demand and supporting large-scale processing of cathode, anode and electrolyte materials with a monthly capacity of 24,000-30,000 square meters of pole pieces. Crowncom Intelligent has achieved high-speed (>30m/min), wide-width (≥500mm) double-sided composite film formation in dry processes, and assisted a customer in putting a 0.2GWh polymer all-dry production line into operation. Carovid’s pressure fusion welding technology has passed tests by many leading battery enterprises and been applied in mass production lines, thanks to its advantage of completing the welding of over 100 layers of metal current collectors and composite current collectors within 100 layers in one step with a yield rate of over 99.9%.

- Rising Concentration & Win-Win Development of the Industrial Chain

In 2026, the battery industry’s pattern of leading enterprises taking the helm and multiple strong players advancing together will become more distinct. CATL and BYD, the two giants, continue to lead the way; second-tier enterprises accelerate the building of differentiated advantages in segmented scenarios through technological or market features; while small and medium-sized enterprises lacking core technologies and scale effects will be increasingly marginalized. Industry competition has fully shifted from “scale expansion” to “value creation”.

Competition among enterprises will further evolve into a contest of industrial chain ecology. Leading enterprises will pay more attention to supply chain resilience, locking in key resources and production capacity through long-term orders, strategic cooperation, joint ventures and even vertical integration. A typical example is CATL’s intensive layout in January 2026: it locked in a five-year supply of 3.05 million tons of lithium iron phosphate with Ronbay Technology, subscribed for 233 million shares of Fulin Precision with 3.175 billion yuan, and agreed to purchase no less than 3 million tons of lithium iron phosphate products from the latter in the next three years.

- Deepening of the Anti-Involution Drive

The anti-involution drive will remain the core theme of China’s battery industry development in 2026. This trend has evolved from an initial industry initiative into systematic policy regulation and industry self-regulation. In January 2026, four ministries and commissions including the Ministry of Industry and Information Technology jointly held an industry forum, clarifying that they will regulate competition order by strengthening cost investigations and price monitoring, enhancing production consistency inspections, and reinforcing the leading role of standards, guiding the construction of a market order of high quality for high price and fair competition.

Driven by both policies and the market, the phase-out of low-end production capacity will accelerate, and industry competition will undergo profound changes. Enterprises will focus more on building differentiated advantages through technological innovation, high-quality overseas expansion and the development of high-value-added segmented markets.

CALB’s market layout is a typical embodiment of this trend: among its supporting models, the entry-level market below 100,000 yuan accounts for only 12.7%, while the mainstream market of 100,000-200,000 yuan with greater value potential accounts for as high as 64.7%, the 200,000-300,000 yuan segment for 16.9%, and the company is actively laying out in the 300,000-400,000 yuan and above range. This reflects its differentiated strategy of avoiding the red sea of competition and focusing on value creation.

- Globalization: From “Policy Dependence” to “Global Rooting”

2026 will be a key watershed in the globalization of China’s battery industry. On January 8, the Ministry of Finance and the State Taxation Administration jointly issued an announcement, clarifying that the VAT export rebate rate for battery products will be reduced from 9% to 6% starting April 1, 2026, and cancelled in 2027. This policy, combined with the Ministry of Industry and Information Technology’s guidance on rational, orderly and safe overseas layout, marks that the government is using the “visible hand” to force industrial upgrading, driving the industry to completely bid farewell to “low-price involution” and move toward high-quality development.

Against this backdrop, the overseas development model of Chinese battery enterprises will undergo a fundamental restructuring. The efficiency of the simple 1.0 model of “Made in China, Sold to the World” will decline, replaced by the 2.0 model centered on overseas factory construction and local operation, and even the higher-level 3.0 model of localization and ecological construction.

In general, the cancellation of tax rebate incentives will directly squeeze the profits of enterprises relying solely on price advantages for exports in the short term, and may push up raw material demand due to “rush exports”. In the long run, it will accelerate industry differentiation: leading enterprises that have completed or accelerated overseas capacity layout will suffer the least impact, and their first-mover advantages will be further expanded, ultimately forging world-class battery enterprises with truly sustainable global competitiveness.

Large-Scale Commercialization of Sodium-Ion Batteries Begins

In 2026, sodium-ion batteries will officially move from the initial stage of industrialization to large-scale commercialization, driven by their prominent resource endowment and cost advantages.

In terms of market penetration, the energy storage sector—with high requirements for safety and cycle life—will be the first market for sodium-ion batteries to break through; the automotive start-stop market has commercial feasibility due to the need to replace lead-acid batteries and the significant low-temperature performance advantages of sodium-ion batteries; the light vehicle market such as electric two-wheelers will become a potential growth space for sodium-ion batteries driven by the new national standard.

In terms of technological routes, the cathode materials of sodium-ion batteries will form a tripartite pattern of layered oxides, polyanion-type and Prussian blue-type, while anode materials will be upgraded from hard carbon to soft carbon-hard carbon composite materials.

Leading enterprises are stepping up layout: CATL has announced that its “Na New” battery will be applied on a large scale in four fields—battery swapping, passenger cars, commercial vehicles and energy storage—in 2026; Zhongke Haina and other enterprises have built GWh-level production lines and obtained bulk orders; EVE Energy launched the construction of a sodium battery headquarters at the end of 2025, focusing on AIDC scenarios with a total investment of about 1 billion yuan and a planned annual capacity of 2GWh.