What’s Driving the Autonomous Construction Equipment Market?

In the era of rapid technological evolution, intelligent automation has emerged as a transformative force reshaping multiple industries, and the construction sector is no exception. As industrial automation continues to advance, automation equipment is undergoing a revolutionary upgrade, with the autonomous construction equipment market at the forefront of this change. This market is expanding at an astonishing pace, fueled by remarkable advancements in artificial intelligence (AI) and automation technologies. Leading industry players like Caterpillar and Kubota are spearheading the charge, rolling out innovative autonomous models that promise to redefine efficiency, safety, and productivity on construction job sites. Amidst this growth, a fascinating interplay of technological, economic, and social factors is at play, driving the widespread adoption of these cutting-edge automation equipment solutions.

The Autonomy of Things, a concept coined by Patience Consulting, encapsulates the essence of automating tasks that are traditionally difficult, dangerous, or unappealing. This concept has found a significant manifestation in the realm of construction, where autonomous construction equipment is now revolutionizing every aspect of the industry, from task execution and machine operation to job site management and project completion. This year has witnessed construction machine manufacturers delving deeper into the autonomous technology space, introducing newer and more sophisticated models that showcase the remarkable potential of intelligent automation in construction.

At the Consumer Electronics Show (CES) held in January, several heavy machinery manufacturers introduced contractors to their autonomous rigs, highlighting the growing integration of AI and automation in construction equipment. Caterpillar, for instance, has been making concerted efforts to lead the charge toward autonomy in machine operations, particularly in mining sites. At this year’s CES, it was evident that the company’s top priorities lie in battery technology and electrification, as anything that can extend battery life is a crucial focus at present. Autonomous operation not only ensures an optimal cadence of material flow but also extends the time intervals between battery recharging, making it a key driver in the advancement of automation equipment in the construction and mining sectors.

As Sabbir Rangwala pointed out in a Forbes magazine article, “Apart from optimal workflow in a mining location, autonomy has other significant advantages.” The technology effectively addresses the acute shortage of skilled labor in remote locations, enhances safety measures, and improves preventive maintenance procedures. Additionally, it “allows trained human labor to control multiple pieces of moving equipment from remote locations,” further emphasizing the benefits of intelligent automation in construction operations.

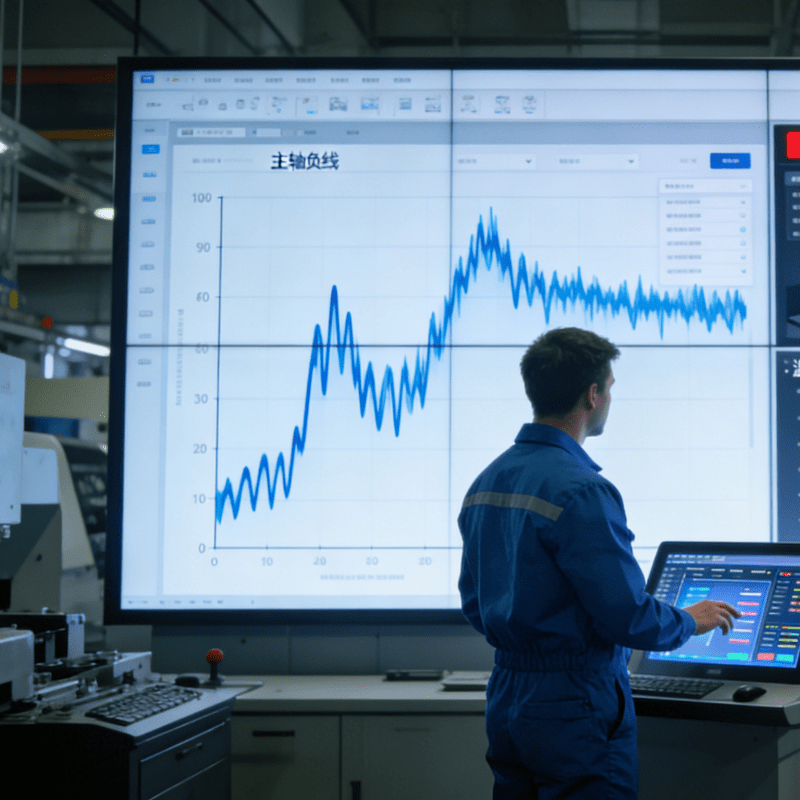

Caterpillar isn’t alone in catering to customers’ demands for streamlined sustainability in construction businesses. The autonomous construction equipment market sector is experiencing rapid expansion, as indicated by various market reports. SNS Insider, which closely tracks the demand for AI-powered innovations, efficiency, and electric-powered machines, forecasts that the sector will grow to a staggering $28 billion by 2032. From 2024 – 2032, the compound annual growth rate is projected to be 8.99 percent. SNS attributes this growth to the rapid technological advancements in automation and AI, coupled with a global shortage of skilled construction labor. These factors are compelling the industry to adopt autonomous machinery, leveraging intelligent automation to enhance overall efficiency, safety, and productivity on job sites.

In addition to Caterpillar, other key players in the market include Bobcat, CNH Industrial America, Komatsu, AB Volvo, Hitachi, SANY, Royal Truck, Topcon, and Deere. SNS noted that the semi-autonomous equipment segment currently dominates the market, holding a market share of more than 62 percent. This dominance can be largely attributed to the need for human supervision in critical tasks, although automation is increasingly being integrated into construction processes. Semi-autonomous excavators, loaders, dozers, and other machines significantly improve efficiency, safety, and precision, especially when operators can intervene as needed. Labor shortages, a surge in infrastructure projects, and the advent of AI-based control systems are all driving the escalating demand for such automation equipment. As the report states, “Semi-autonomous solutions provide a transition for contractors to build automation into their operations without completely supplanting human operators.”

The market can be segmented by types of equipment. In 2023, the earth-moving segment held the largest share, exceeding 32 percent. This category includes dozers, excavators, and loaders used for heavy-duty excavation, grading, and site preparation. The global demand for autonomous earth-moving machinery is an indirect result of the booming real estate and infrastructure development worldwide. Governments and private sectors are investing more heavily in construction projects that require well-organized, accurate, and automation-enabled processes, further fueling the growth of the autonomous construction equipment market.

The road construction segment also dominated the autonomous equipment market in 2023, accounting for more than 42 percent of the market share. This dominance is reinforced by the increasing international focus on infrastructure improvement, urbanization growth, and smart city projects. Common autonomous construction machinery, such as self-driving dozers, pavers, and rollers, is enhancing efficiency, reducing labor reliance, and ensuring accuracy in road construction. The heavy investments by global governments in highway expansion and roadway maintenance are accelerating the demand for such automation equipment. Technologies like AI, GPS, and IoT, which enhance safety and operational performance, have made autonomous road equipment the preferred choice in the industry.

In 2023, North America led the autonomous construction equipment market, with a market share of over 38 percent. The United States, in particular, is at the forefront of this expansion, thanks to its advanced technology infrastructure and significant investment in construction automation. This has enabled the rapid adoption of autonomous machinery across various projects. The early adoption of autonomous technologies, combined with the presence of numerous key manufacturers in the region, solidifies the U.S.’s leadership in the market. The rise of AI and robotics, along with a commitment to enhancing labor productivity, reducing costs, and improving safety, are the driving forces behind this leadership.

Caterpillar has closely monitored the progress of autonomous technology in the construction market and emphasizes the crucial role of site communications. As remote-controlled and autonomous construction equipment becomes more widely used, construction site communications will play a vital role. Vijay Ramamsamy, chief engineer of construction industries remote control and autonomy, believes that automated systems are on the verge of becoming standard on job sites. “Semi-autonomous systems will take over key tasks from human operators. Fully autonomous machines will complete tasks all on their own,” he said. The bottom line is that all these autonomous systems rely on data, specifically the connections both on and off the site. These equipment systems need to feed video and machine data to remote operators, communicate locations and status between machines, share bandwidth with subcontractors, and provide production information to the general contractor (GC), all in a reliable and largely instantaneous manner.

In terms of new product launches, Caterpillar introduced the Cat 775 off-highway truck this year at bauma. It is the company’s first next-generation off-highway truck design, engineered to be fully autonomous in the future and set to be launched in 2025. Tony Fassino, group president of construction industries, stated, “The design of the Next Gen 775 represents a significant leap forward in off-highway truck technology.” Caterpillar’s current autonomous hauling systems (AHS), Cat MineStar Command for hauling, are already in operation at mine sites worldwide. The company scaled the system to meet the specific needs of quarry operations, leveraging lessons learned from working with a truck customer.

At CES, Kubota unveiled a range of customer solutions and presented its vision for the future across its entire equipment portfolio, offering diverse powertrain options, seamless access to data and analytics, improved connectivity, and advanced automation. Equipment on display included KATR, Kubota’s four-wheeled all-terrain, multifunctional robot, which can work autonomously or remotely to handle construction applications. Electric vehicle news site Eletrek reported that Case brought a new electric wheel loader to bauma, designed for remote or autonomous operation. In the product concept stage, the cabin-less design of the Impact electric wheel loader enables operation in extreme environments and adverse weather. As Eletrek reported, “It also means that jobsite, disaster recovery or even rescue operations can continue 24/7, with operators in different time zones logging in for their shifts.” Case believes the Impact concept marks a significant advancement in accessibility, as “Operators with motor impairments and other disabilities can now operate the machine without physical limitations.”

The increasing use of driverless dozers, excavators, load carriers, and haul trucks on construction sites has raised concerns about job displacement. However, as steel bridge manufacturer U.S. Bridge explained in a blog post, these machines are typically controlled by an operator via remote control, and this innovation has allowed many construction projects to be completed with minimal safety issues and maximum efficiency. Contrary to initial concerns, studies have shown that the adoption of autonomous equipment may not have a negative impact on jobs. In fact, it could potentially create higher-paying jobs in the long run. While traditional operator roles will transition to remote operations, these remote operator positions will be in high demand, and the working conditions are expected to improve significantly.

Looking ahead, the autonomous construction equipment market is poised to continue its rapid growth, driven by the continuous evolution of intelligent automation, industrial automation, and automation equipment technologies. As the industry overcomes challenges related to data management, communication, and standardization, autonomous construction equipment will become an even more integral part of the construction landscape. This not only holds the promise of transforming individual construction projects but also has the potential to reshape the entire construction industry, leading to a more sustainable, efficient, and innovative future. The journey towards a fully automated construction industry is well underway, and the future of construction is undoubtedly intertwined with the advancements in autonomous technology and intelligent automation.