From January 6th to 9th (U.S. time), CES 2026, held at the Las Vegas Convention Center, once again became the epicenter of the global tech world. It attracted over 4,000 tech enterprises from more than 100 countries and regions worldwide, drawing nearly 150,000 attendees.

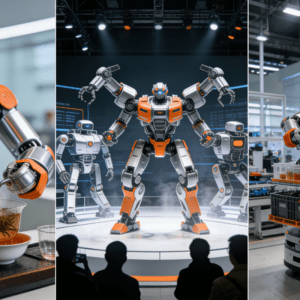

Inside the exhibition halls, a historic transformation was underway. Breaking free from the constraints of screens, AI was taking over the physical world on an unprecedented scale through running quadruped robots and humanoid robots with waving mechanical arms. Unlike previous editions, CES 2026 placed greater emphasis on practical applications. Global tech firms and tens of thousands of attendees bore witness together—the grand era of embodied intelligence was accelerating towards us right from this exhibition.

Collective Debut of Chinese Robots

According to public data, around 4,300 enterprises from over 100 countries participated in this year’s CES, a slight decrease from the approximately 4,800 exhibitors last year. Among them, the United States ranked first with 1,476 enterprises, followed by China with 942 (including Hong Kong, Macao and Taiwan), and South Korea with 853.

Despite the marginal decline in the total number of exhibitors, the scale of participation by Chinese embodied intelligence startups hit a record high in CES history. In the humanoid robot sector, Chinese enterprises demonstrated the highest concentration, with over 30 companies participating, including more than 10 complete machine manufacturers and over 20 component and supply chain enterprises. Chinese firms not only showcased numerical superiority; more crucially, their products have gradually moved beyond the proof-of-concept phase into real-world scenario applications, forming a complete industrial chain aggregation spanning from core components such as chips, sensors and dexterous hands to finished robot products.

Commercialization Breakthroughs by Complete Machine Manufacturers

Agibot showcased its full product line including the Lingxi X2 and Yuanzheng A2 at the LVCC North Hall. Notably, its exhibition focused on practical operations in unstructured factory environments rather than mere gait demonstrations. Thanks to the high integration of motion control and AI decision-making, Agibot’s products were cited as a typical case of “Physical AI” in NVIDIA’s keynote speech.

Unitree Robotics presented the mass-produced version of its G1 humanoid robot at the exhibition, staging thrilling boxing matches. Optimized for complex interactions and dynamic responses, the product demonstrated an extremely high degree of motion execution and once won the world’s first robot combat competition. Also on display were the entry-level R2 and the next-generation H2 models, forming a comprehensive product lineup covering different price points and application scenarios.

Fourier Intelligence launched its GR-3 humanoid robot, standing 165 cm tall and weighing 71 kg, equipped with 55 degrees of freedom across its body to support more human-like limb movements. During the live demonstration, the GR-3 not only made heart gestures with the audience but also played Tic-Tac-Toe against human participants, fully embodying its positioning as an interactive companion robot—the company refers to it as the “Care-bot” concept, emphasizing a people-oriented and warm-blooded robot.

The Beijing Humanoid Robot Innovation Center brought its Tiangong series robots. As reported, the Tiangong Ultra once claimed the title of the world’s first half-marathon champion robot, demonstrating its stability through prolonged running at CES. Meanwhile, the Tiangong 2.0, built on the Huisi Kaiwu platform, autonomously completed parts sorting tasks on-site, capable of performing the entire process of grasping, classifying and stacking independently.

Yinhe General Robotics still adhered to its general-purpose humanoid robot platform route. The Galbot focused on sorting operations on convenience store shelves, highlighting its motion stability and AI decision-making capabilities. Youliqi newly launched its Wanda 3.0 robot, which can brew Kung Fu tea and act as a cyber bartender, showcasing exquisite hand coordination and task planning skills.

DeepRobotics’ wheeled-legged robot Bobcat M20 Pro won the CES 2026 Innovation Award in the robotics category, becoming the only Chinese medium-sized wheeled-legged robot product to receive this honor. Equipped with the company’s self-developed “world model” navigation algorithm, this robot can operate normally in extreme environments such as deserts, wetlands and pools.

Zhongji Dynamics’ TRON 2 multi-form embodied robot offered a new development concept—a single body capable of free combination into three forms, providing a “one-stop” embodied development platform for VLA (Vision-Language-Action) research, mobile manipulation and full-body motion control.

Xinghai Tu released its dexterous hand Dexo and what it claims to be the world’s first “out-of-the-box” VLA all-in-one machine, aiming to achieve zero-shot object grasping through natural language commands and lower the development threshold.

Xingdong Epoch’s bipedal humanoid robot Xingdong L7 has already been deployed in warehousing and logistics scenarios. Its dexterous hand XHAND1 amazed the audience with the precision of its force and angle while giving massages on-site.

In addition, numerous other domestic humanoid robot-related manufacturers including Accelerated Evolution, Keenon Robotics, MirrorMind Technology, Yuejiang Technology, Dameng Robotics, Songyan Dynamics, Titanium Tiger Robotics, Magic Atom, Stardust Robotics, Reeman and Patriot also made appearances at CES, fully demonstrating the breakthrough achievements and technological level of Chinese enterprises in this track.

Core Components Supporting the Industrial Chain

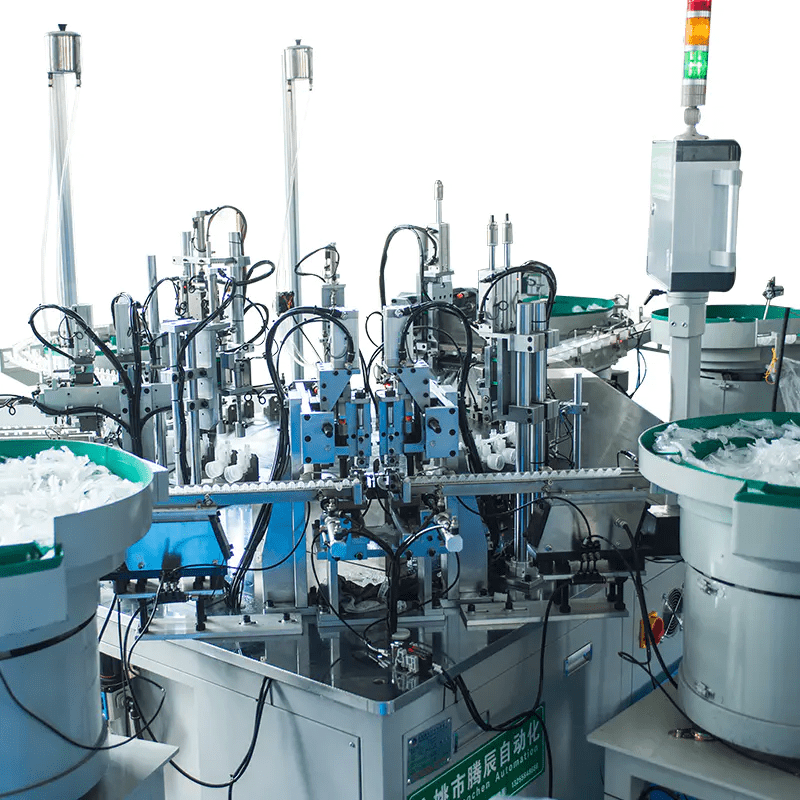

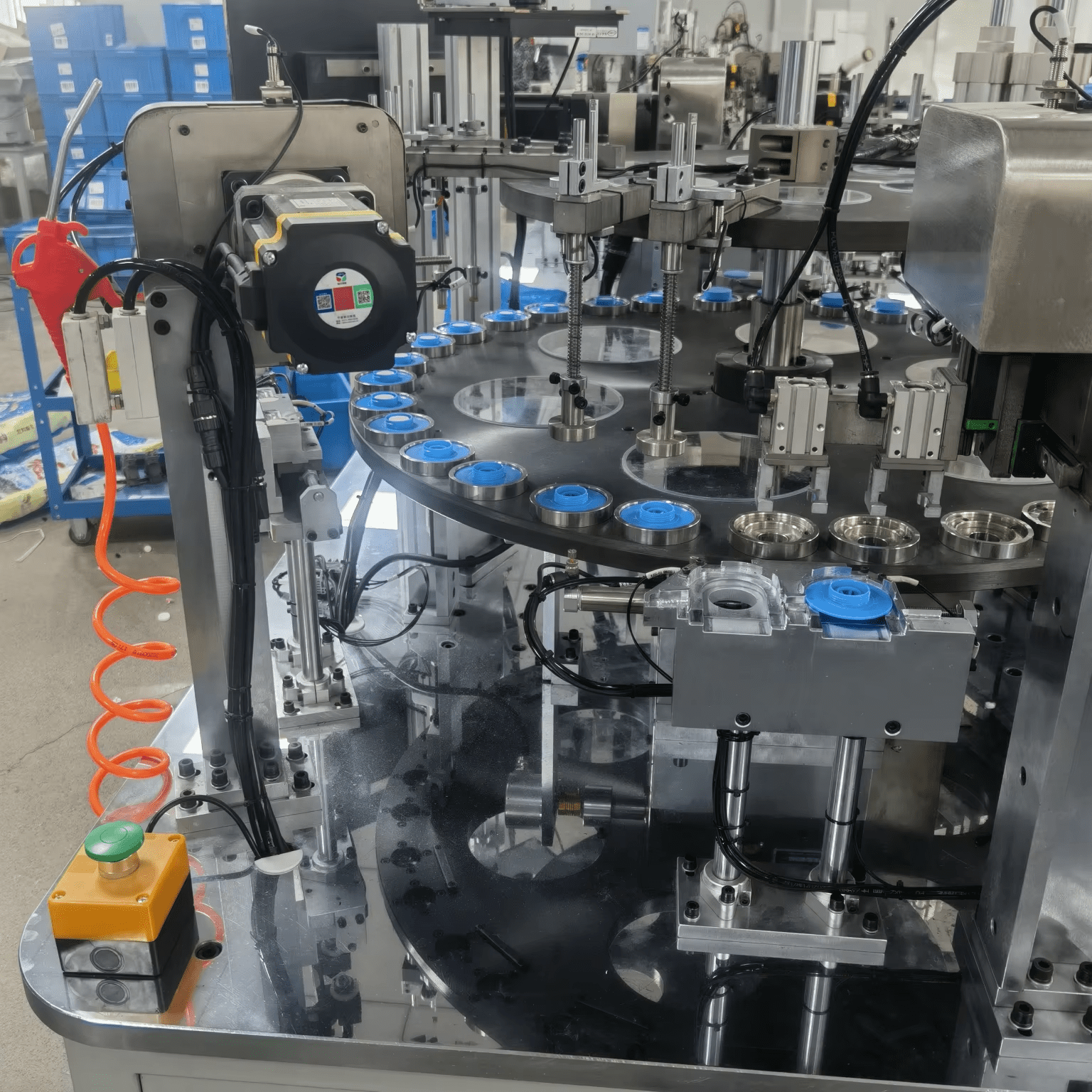

The ability of Chinese robot enterprises to make a clustered and high-density appearance is driven by the increasingly improved domestic supply chain of core components.

On the sensor front, Pasini Sensing Technology showcased a full-link tactile sensing solution, addressing the “tactile feedback” challenge faced by embodied intelligence in fine manipulation tasks. In the perception module field, RoboSense and Orbbec respectively launched lidar and 3D cameras optimized specifically for robot manipulation. Meanwhile, in terms of core actuators, enterprises such as Zhaowei Electromechanical provided micro-transmission systems, offering hardware support for the large-scale production of dexterous hands.

Supply chain and manufacturing capabilities have been elevated to a strategic level. Represented by listed company Lingyi Zhizao, manufacturing giants are comprehensively upgrading from precision manufacturing of consumer electronics to embodied intelligence hardware manufacturing platforms. At CES 2026, the company not only displayed core hardware such as complete machine frames, joint modules and dexterous hands supplied to multiple robot enterprises, but also demonstrated its profound understanding of complex industrial scenarios through dynamic presentations of its “multi-robot heterogeneous collaboration system”.

According to Lingyi Zhizao, its goal is to become one of the world’s top three embodied intelligence hardware manufacturers. Official data shows that as of the end of November 2025, the company has cumulatively completed assembly services for over 5,000 humanoid (embodied) robot hardware/complete machines.

The above facts reflect the important role of China’s supply chain in the large-scale manufacturing of robots. Crucially, the continuous reduction in the cost of core components and the ongoing improvement of the supply chain are eliminating the final obstacles to large-scale commercial application, making the mass production and deployment of robots a reality.

Differentiated Strategies of Overseas Giants

In contrast to the clustered participation of Chinese enterprises, overseas companies focused more on specific technological directions and commercialization progress.

Diversified Exploration in the United States

This year, Boston Dynamics publicly demonstrated its brand-new next-generation electric Atlas for the first time, boasting 56 degrees of freedom. The company has reached a deployment agreement with Hyundai Motor, planning to have Atlas perform parts sorting tasks in U.S. factories by 2028 and expand to more complex component assembly by 2030. Richtech Robotics’ mobile humanoid robot DEX has been deployed in real working environments with over 450 units in operation, becoming a pioneer in large-scale commercial deployment in the industry. Agility Robotics’ Digit robot is specially developed for commercial warehousing scenarios. Figure AI continues to promote the application of AI-driven general-purpose humanoid robots in vertical fields such as logistics and warehousing.

Systematic Advancement at the National Strategic Level in South Korea

South Korea demonstrated systematic promotion at the national strategic level. LG launched its CLOiD humanoid robot, equipped with two 7-degree-of-freedom robotic arms and five-fingered dexterous hands, as well as an autonomous navigation system. Focusing on household scenario applications, it can perform housework tasks such as laundry and cooking. Hyundai Motor Group, which controls Boston Dynamics, also plans to build a robot factory in the United States with an annual production capacity of 30,000 units. It is reported that the South Korean government has invested 770 million US dollars to support the K-Humanoid Alliance, aiming to become a global leader in humanoid robots by 2030. Alliance members include top universities such as KAIST and POSTECH, as well as enterprises like Doosan Robotics and Rainbow Robotics.

Traditional Advantages in Precision Manufacturing and Vertical Segments in Europe

European enterprises maintained their traditional advantages in precision manufacturing and vertical segments. Germany’s Neura Robotics exhibited its industrial collaborative robot 4NE-1 equipped with the AURA AI system. Norway’s 1X Technologies launched its bipedal robot NEO, demonstrating smooth movement capabilities in performing daily household chores. Sweden’s Hexagon Robotics’ AEON robot integrates bipedal and wheeled locomotion, enabling flexible and fast movement with hot-swappable battery support. The UK’s Humanoid showcased its HMND 01 Alpha robot, focusing on industrial manufacturing applications. France’s Enchanted Tools introduced its uniquely designed Morikai robot. In addition, Realbotix’s Aria robot made delicate micro-expressions through facial motors, while Singapore’s Sharpa robot staged a table tennis match performance.

Furthermore, a new highlight of the exhibition was the participation of Vietnamese enterprises. Vietnam’s cartoon-shaped companion robots provide basic emotional support functions, equipped with dedicated low-latency interaction chips that compress dialogue response time to the millisecond level, eliminating the “robotic feel” and delayed pauses in human-machine communication.

New Wave in the Consumer-Grade Market

Notably, beyond the industrial-grade track, a more universal market is emerging. At this year’s CES, Chinese enterprises shone brightly in the consumer-grade companion and educational robot sectors. A total of 17 Chinese enterprises exhibited companion robots and educational robots, with their product design concepts showing a clear trend of differentiation.

From a hardware architecture perspective, enterprises adopted two distinct strategies. One group of enterprises followed the “integrated” design concept, equipped with complete perception-decision-execution systems; the other group adopted a “modular” design concept, outsourcing some functions to existing terminal devices. For example, Keyi Technology’s Loona DeskMate adopted a modular architecture, decoupling interaction capabilities by coupling with iPhones, allowing the robot body to focus on physical interaction.

In terms of interaction paradigms, products also showed differentiation. Some products were based on the “cognitive interaction” model, achieving advanced semantic interaction through AI technologies such as visual recognition and speech understanding. Machine Lingdong’s Nuobao Robie realized dynamic feedback through facial recognition and emotion analysis. Others adopted the “perceptual interaction” model, establishing human-machine connections through simplified, non-semantic signal systems. For instance, Ludengsi Intelligence’s Cocomo conveyed emotions through primitive expressions such as sounds and movements, a design concept reflecting a re-understanding of the essence of companionship.

In terms of product positioning, enterprises also showed a shift from “generalization” to “scenario-specificity”. Some products adopted a high degree of functional modularization, supporting multi-role and multi-scenario adaptation, such as Fuzhi Technology’s Enabot multi-role switching mechanism; others adopted specialized scenario positioning, such as Lingdong Future’s Huahuatang focusing on portable companion scenarios.

Behind these series of changes lies a deeper shift in market perception. The consumer-grade robot market is evolving from a single demand for “general companionship” into a diversified market targeting different user groups, different life scenarios and different emotional needs. Different age groups have inherently different definitions of companionship: the child stage emphasizes cognition and personality shaping, the elderly stage emphasizes emotional monitoring and health management, while young people emphasize emotional regulation and stress relief. Market segmentation reflects the maturity of the industry—enterprises no longer pursue the concept of “all-purpose robots”, but instead deeply understand the specific needs of users, and meet the companionship needs of specific groups in specific scenarios through focused product design.

Industrial Chain Transformation: Signals of “Qualitative Change” from 2024 to 2026

According to data from the International Federation of Robotics (IFR) and multiple industry research institutions, the global robot market size has reached nearly 100 billion US dollars, maintaining a double-digit compound annual growth rate, and is expected to grow several times in the next decade.

At the same time, the competitive landscape is undergoing profound changes. The main battlefield is shifting from simply competing on algorithm models or hardware parameters to a comprehensive contest of “system integration capabilities, mass production engineering capabilities and continuous operation and maintenance capabilities”. Supply chain management, cost control, quality systems and development ecosystems have become new dividing lines.

Many participating enterprises stated frankly that their primary goals for attending the exhibition were brand exposure, securing orders and exploring overseas landing scenarios. For example, Accelerated Evolution received orders for dozens of robots on the first day of the exhibition, while companies such as Magic Atom revealed that overseas revenue accounted for over 60% of their total robot product revenue.

It is worth noting that early industry discussions on embodied intelligence mostly focused on “AI model capabilities”—parameter scale and reasoning ability. However, at CES 2026, enterprises’ focus clearly shifted to “how to effectively integrate these capabilities into a complete robotic system”, involving multiple dimensions such as mechanical structure, sensor networks, motion control, real-time decision-making and human-robot collaboration. For instance, Xinghai Tu’s VLA all-in-one machine, Zhongji Dynamics’ TRON 2 and Xingdong Epoch’s L7 series demonstrated system engineering capabilities, not only effectively utilizing the latest AI models but also conducting in-depth optimization across hardware, software and control layers.

In addition, localization and regionalization of supply chains have become strategic priorities. Chinese enterprises are localizing the production of core components, while Hyundai Motor plans to build a robot factory in the United States with an annual output of 30,000 units, a move driven not only by supply chain resilience considerations but also reflecting the impact of geopolitical realities on industrial layout.

Global Industrial Pattern Presents a “Multi-Polar Competition” Landscape

CES 2026 clearly outlined the competitive map of the global embodied intelligence industry:

United States: The high ground of algorithms and cognition. Represented by Tesla Optimus and Figure AI, U.S. enterprises still maintain a leading position in the deep integration of general-purpose AI large models and robots. NVIDIA’s proposed “Physical AI” architecture is providing a underlying development paradigm for global embodied intelligence.

South Korea: Systematic entry with national-level strength. Through the K-Humanoid Alliance linking research institutions and large conglomerates, and planning to build a robot factory in the United States with an annual production capacity of 30,000 units, Hyundai Motor Group demonstrated its ambition in capital operation and global layout.

Europe: The moat of precision manufacturing and vertical segmentation. Enterprises in Germany and Norway maintain traditional advantages in medical care, industrial collaboration and open-source platforms, but their response speed in the consumer-grade market is slightly lagging.

China: Supply chain redundancy and engineering efficiency. The core advantages of Chinese enterprises lie in their rapid iteration capabilities and low-cost large-scale mass production capabilities. China already accounts for 54% of the world’s new industrial robot installations, and its huge existing market provides the best testing ground for the scenario migration of humanoid robots.

Conclusion

CES 2026 clearly demonstrated the current development status and competitive landscape of the global robot industry. Through complete industrial chain layout, optimized engineering processes and rapid commercial iteration, Chinese enterprises have established significant advantages in the first round of industrialization competition.

The exhibition booths will eventually close, but the deep integration of robots with the physical world has become an inevitable direction of industrial development. In the future, the focus of industrial competition will gradually shift from technical parameters and algorithm innovation to a comprehensive contest of system integration capabilities, mass production engineering capabilities and continuous operation and maintenance capabilities. In the long-term industrial competition, those who can maintain endurance in continuous investment in engineering verification and achieve breakthroughs in the detailed optimization of scenario applications will ultimately gain competitive advantages.