Market Size and Growth Trend: Sustained Expansion, Set to Exceed $8 Billion by 2025

The global fully automated assembly machine market has entered a trajectory of stable growth. Driven by the steady release of automation demand across various industries, the market size has grown at a high compound annual growth rate (CAGR) since 2015, maintaining strong growth momentum:

Historical Growth Momentum

According to industry analysts, the global market achieved a 9% CAGR from 2015 to 2023. By 2023, the market size had surpassed $5.8 billion, doubling compared to 2015. This growth is underpinned by rigid automation demand—specifically, the “miniaturization and high-frequency iteration” trend in the electronics industry and the “new energy transition and mixed-model production” shift in the automotive industry.

Short-Term Growth Forecast

The market’s growth trend will persist until 2025, with experts projecting the global market size to exceed $8 billion by then. The annual growth rate between 2023 and 2025 will remain stable at 6%–8%. Although this rate is slightly lower than the high-growth period of 2015–2023, it still outpaces the global average growth rate of the manufacturing industry (approximately 3%–4%), reflecting the inherent rigid demand for fully automated assembly machines as “manufacturing infrastructure.”

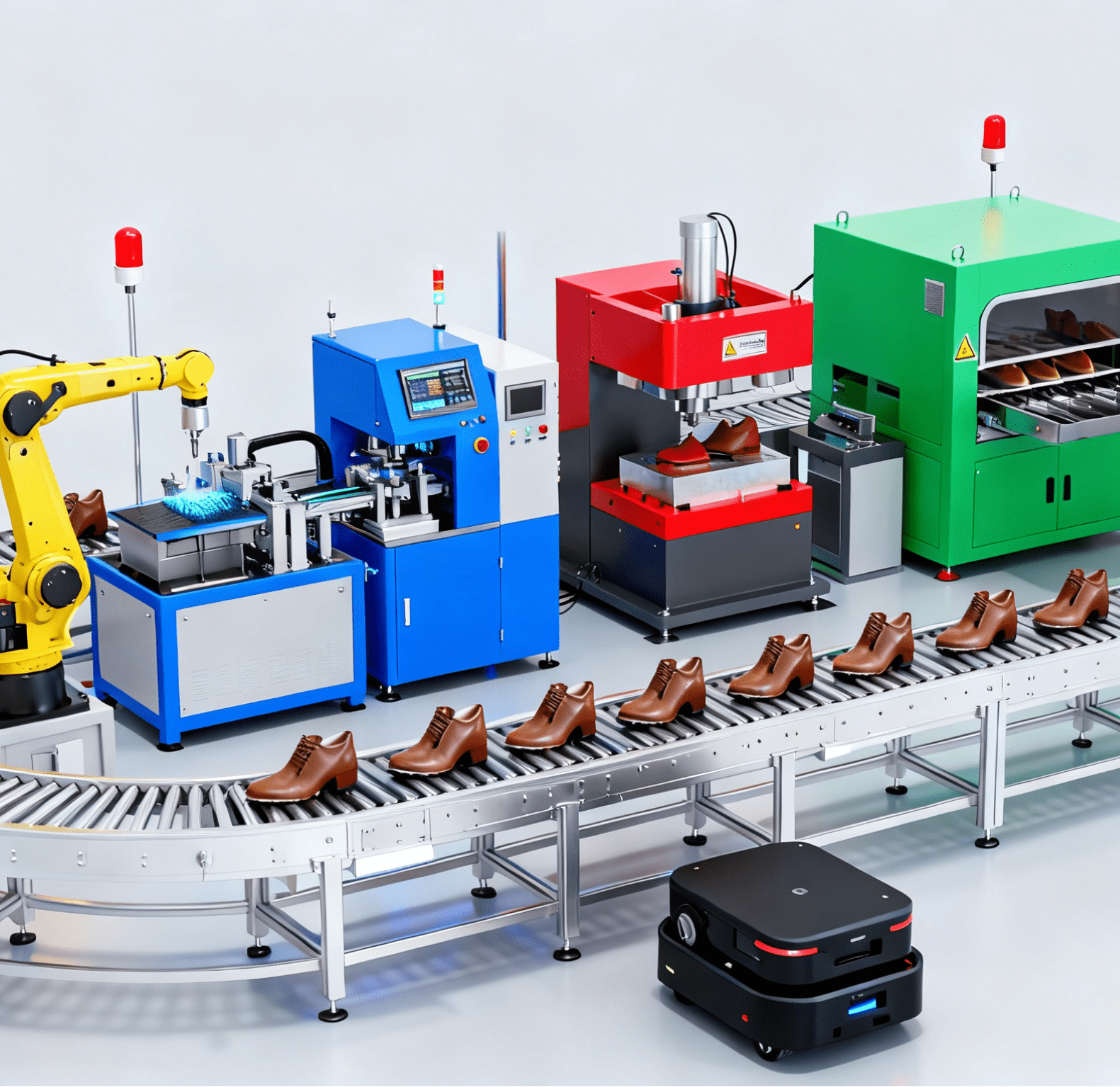

Core Driving End Markets: Electronics, Automotive, and Medical Sectors as the Three Major Growth Engines

Demand for fully automated assembly machines is highly concentrated in industries with strict requirements for “precision, efficiency, and compliance.” Among these, the electronics, automotive, and medical device sectors account for over 70% of market demand, with distinct demand drivers for each:

Electronics Industry: Miniaturization and High-Frequency Iteration Drive Automation Upgrades

The electronics industry is the largest end market for fully automated assembly machines. The production of smartphones, laptops, smart home appliances, and other electronic products imposes extremely high demands on “miniaturized component assembly precision” and “rapid model change capability,” making it a core driver of market demand:

Precision Demand: The assembly precision of electronic components (e.g., smartphone camera modules, chip connectors) must reach ±0.01mm–±0.005mm—standards that manual assembly cannot meet, and which rely on the servo drives and visual positioning systems of fully automated assembly machines. For instance, a smartphone manufacturer’s camera module assembly line uses fully automated equipment to execute the entire process of “lens bonding → motor assembly → airtightness testing,” achieving a qualification rate of over 99.8%—far higher than the 95% rate of manual assembly.

Model Change Demand: The iteration cycle of electronic products has shortened to 6–12 months (e.g., 2–3 generations of smartphones are launched annually). Traditional semi-automated equipment requires 2–3 days to switch between models, while fully automated assembly machines with modular designs can complete fixture and program adjustments within 1–2 hours to adapt to new product production. This advantage has become a key factor for electronics manufacturers when purchasing equipment.

Automotive Industry: New Energy Transition and Quality Control Drive Equipment Upgrades

Automotive industry demand for automation has shifted from “standardized assembly” for traditional fuel vehicles to “high-precision, high-reliability” assembly for new energy vehicles (EVs), further boosting demand for fully automated assembly machines:

Special Needs of New Energy Vehicles: The assembly precision of the battery pack, motor, and electronic control system (the “three-electric system”) directly impacts vehicle safety. For example, welding of battery tabs requires controlling the heat-affected zone to ≤0.1mm to avoid damaging battery cells— a task that depends on fully automated laser welding assembly machines. Meanwhile, the trend toward lightweight EV bodies (e.g., widespread use of thin aluminum alloy sheets and carbon fiber composite panels) has driven the adoption of sheet automatic loading robots. As core pre-process equipment for body assembly lines, these robots integrate 3D visual positioning, vacuum suction gripping, and servo drive systems. They can automatically identify the size, thickness, and placement angle of different sheet specifications (e.g., 1.2m×2.4m body outer panels, 0.8m×1.5m interior base panels), then complete precise gripping, alignment, and conveyance via path planning to directly connect with subsequent stamping or laser cutting processes. For example, after adopting sheet automatic loading robots in its body workshop, a Chinese NEV manufacturer reduced the time per batch of material loading from 15 minutes (manual) to 3 minutes—an efficiency increase of 400%. Additionally, pressure sensors control gripping force, lowering the sheet scratch rate from 5% (manual operation) to below 0.3%, perfectly adapting to the “rapid switching between multi-specification sheets” required for mixed-model vehicle production.

Quality Control Demand: The automotive industry’s requirement for “full-process traceability” (e.g., ISO/TS 16949 standard) has led automakers to purchase fully automated assembly machines with data recording functions. For example, an automaker’s transmission assembly line uses fully automated equipment to record the tightening torque and angle data of each screw, enabling traceability of quality issues and reducing recall risks.

Medical Device Industry: Compliance and Aseptic Requirements Drive Automation Penetration

While the medical device industry’s market size is smaller than that of the electronics and automotive industries, it has significant growth potential. Its core demand drivers are the replacement of manual assembly with “aseptic production” and “strict compliance”:

Aseptic Requirements: Medical products such as syringes, surgical instruments, and diagnostic reagent cards require assembly in GMP clean environments (Class 1000–Class 10000). Manual operations are prone to contamination, whereas fully automated assembly machines use stainless steel bodies, HEPA filtration systems, and aseptic lubricants to meet clean production standards. For example, a medical device manufacturer’s syringe assembly line uses fully automated equipment to implement “needle feeding → plunger assembly → aseptic packaging,” achieving a 100% aseptic qualification rate and meeting FDA and CE certification requirements.

Compliance and Traceability: The medical industry has far stricter product traceability requirements than other sectors (e.g., each syringe must be traceable to its specific production batch, equipment number, and operator). The IoT modules of fully automated assembly machines can record production data in real time to form complete traceability files, making them a “must-have configuration” for medical device manufacturers.

Regional Market Pattern: Asia Dominates Production and Consumption; Europe and North America Focus on High-End Demand

The global fully automated assembly machine market exhibits significant regional differentiation. Asia serves as the core production and consumption base, while Europe and North America leverage high-end demand and technological innovation as their key competitive advantages—with distinct market dynamics across regions:

Asia: Accounts for Over 60% of Global Production Capacity; China Becomes the Core Growth Driver

Asia is the “manufacturing hub” and “consumption hub” for global fully automated assembly machines. China, Japan, and South Korea collectively account for over 60% of the world’s manufacturing capacity and contribute more than 50% of market demand:

Production-Side Advantages: Supported by a complete supply chain system (e.g., Japanese servo motors, Chinese mechanical structural parts, South Korean visual systems) and cost advantages, Asia has become the world’s primary production base for fully automated assembly machines. For example, Japan’s FANUC and China’s Midea hold 15% and 20% of global production capacity in the high-end and mid-to-low-end fully automated assembly machine markets, respectively.

Consumption-Side Demand: As major export centers for electronics and automotive products (e.g., China is the world’s largest producer of smartphones and NEVs; Japan and South Korea are leading exporters of high-end electronic components), Asia maintains strong demand for fully automated assembly machines. The Southeast Asian market (Vietnam, Indonesia, Thailand) has emerged as a new growth point: benefiting from the global shift of manufacturing to Southeast Asia (e.g., Apple and Samsung establishing factories in Vietnam), demand for fully automated assembly machines in the region has grown at 15%–20%—higher than the global average.

Chinese Market: Set to Reach $2.1 Billion in 2024; Domestic Enterprises Rise

China is the core growth engine of the Asian market. Driven by “endogenous demand” for manufacturing automation transformation and technological breakthroughs by domestic enterprises, it has become a key variable in the global market:

Market Size: It is estimated that China’s fully automated assembly machine market will reach $2.1 billion in 2024, accounting for over 1/3 of Asia’s total demand and 10% of global demand. The annual growth rate between 2020 and 2024 will hit 12%–15%, far exceeding the global average. This growth stems from Chinese factories’ urgent need to “reduce costs and improve efficiency.” For example, after introducing a fully automated assembly line, a home appliance enterprise cut labor costs by 40% and increased production capacity by 35%.

Competitiveness of Domestic Enterprises: Domestic companies such as Midea, Estun, and Leadman have grown rapidly through “cost-effectiveness + localized services.” For instance, Midea’s fully automated screw assembly machines are 20%–30% cheaper than imported brands and offer on-site operation and maintenance services within 48 hours, capturing over 30% of the domestic mid-to-low-end market share. Meanwhile, domestic enterprises have achieved technological breakthroughs in NEV battery assembly equipment, with some products reaching the same precision level as imported alternatives.

Europe and North America: Dominated by High-End Demand; Collaborative Robots as a Differentiated Advantage

While Europe and North America are not major production bases, they have become important import markets for fully automated assembly machines due to “high labor costs” and “high-end manufacturing demand.” The combined market size of the two regions reached $1.8 billion in 2023:

Demand Drivers: The manufacturing industries in Europe and North America face high labor costs (e.g., the average hourly wage in German manufacturing is approximately €40, and in the U.S. it is around $35), making automation an inevitable choice for cost reduction. For example, after introducing fully automated assembly machines, a German automotive component factory reduced the number of operators per production line from 8 to 2, saving over €500,000 in annual labor costs.

Technology Advantages: European enterprises (e.g., KUKA, ABB, Komar) focus on high-end collaborative assembly solutions and hold over 70% of the global collaborative robot market through “human-robot collaboration” technology. Such equipment does not require expensive safety fences and can work in close proximity to workers (e.g., workers handle part feeding, while robots perform precision assembly), adapting to the “small-batch, multi-variety” production needs of small and medium-sized manufacturers in Europe and North America.

Collaborative Robots: A New Engine for Niche Markets, Empowering Automation for Small and Medium-Sized Manufacturers

As a niche category of fully automated assembly machines, collaborative robots (Cobots) have become the fastest-growing segment in the market in recent years. Their advantages of “low cost, easy deployment, and high flexibility” have made them particularly popular among small and medium-sized manufacturers:

Core Advantages

Compared with traditional industrial robots, collaborative robots have a 30%–50% lower purchase cost (basic models range from $25,000 to $50,000) and do not require workshop layout modifications (no safety fences needed). Their deployment cycle is shortened from 3–6 months (traditional equipment) to 1–2 weeks. Additionally, collaborative robots support “drag-and-teach programming”—where workers manually guide the robot to complete movements to generate programs—eliminating the need for professional programmers and lowering the threshold for small and medium-sized manufacturers to adopt automation.

Market Performance

Denmark’s Universal Robots, a pioneer in the collaborative robot field, has achieved an annual order growth rate of over 40% in recent years with its cost-effective products. In Europe and North America, approximately 60% of small and medium-sized electronics and hardware manufacturers have purchased collaborative robots for simple assembly tasks (e.g., screw tightening, part handling), realizing low-investment, quick-return automation upgrades.

Future Potential

As collaborative robots continue to break through limitations in load capacity (increased from 5kg to 16kg) and precision (improved from ±0.1mm to ±0.05mm), their application scenarios will expand from “simple assembly” to complex tasks such as “precision welding and inspection.” It is expected that the share of collaborative robots in the fully automated assembly machine market will rise from 15% to 25% between 2023 and 2025.

Future Growth Drivers: AI and 5G Technologies Reshape the Boundaries of Automation

The long-term growth of the fully automated assembly machine market will depend on the integrated application of transformative technologies such as AI and 5G, driving equipment upgrades from “automation” to “intelligence” and further expanding application boundaries:

Empowerment by AI Technology

AI algorithms will enhance the “autonomous decision-making” capabilities of equipment. For example, by analyzing the force-displacement curve during assembly via machine learning, equipment can independently identify part assembly deviations (e.g., screw stripping) and adjust tightening parameters in real time. Meanwhile, AI visual systems can enable “unsupervised defect detection”—identifying abnormalities such as scratches and deformations on part surfaces without manual labeling of defect samples—achieving a detection accuracy of over 99.5%.

Support from 5G Technology

The low latency (<10ms) and high bandwidth of 5G will enable “remote control and collaborative operations” of fully automated assembly machines. For example, an automotive group can remotely monitor the operation of assembly lines in factories worldwide via a 5G network and even debug equipment programs remotely. Additionally, multiple robots can achieve real-time data interconnection through 5G to collaboratively complete complex assembly tasks (e.g., multi-station welding of automotive bodies), improving efficiency by over 20%.

Conclusion: The Global Market Enters a New Cycle of “Technology-Driven + Regional Differentiation”

The global fully automated assembly machine market has moved beyond the “universal growth” stage and entered a new cycle of “technological competition + regional deep cultivation.” The Asian market will remain the core of global demand, leveraging its manufacturing scale advantages, while domestic enterprises will further expand their share in the mid-to-low-end market. Europe and North America will focus on high-end collaborative solutions and technological innovation to maintain their competitiveness in the high-end market. The integration of AI and 5G technologies will be a key driver of market growth over the next 3–5 years, transforming fully automated assembly machines from “production tools” to “intelligent production units” and providing stronger support for the efficient, high-quality development of the manufacturing industry.