In accordance with the requirements of eliminating the “base number” concept and breaking the rigid pattern of expenditures, the Department of Industry and Information Technology of Yunnan Province has innovated the methods of fiscal fund support, actively explored new paths for fiscal funds to boost industrial development, and established the Yunnan Advanced Manufacturing Industry Equity Investment Master Fund. This initiative advances the pilot work of zero-base budgeting in the field of industry and information technology, providing strong financial guarantees for promoting industrial transformation and upgrading.

Focus on Key Industries, Precise Allocation of Financial Resources

- Accurately Identify Characteristic and Advantageous Industries

Aligned with the requirements of zero-base budget reform, the Department focuses on precise industrial empowerment. By closely integrating Yunnan’s resource advantages and industrial foundation, it prioritizes support for characteristic and advantageous industries that bear Yunnan’s distinctive features and possess solid resource and industrial foundations.

- Clarify the Fund’s Investment Scope

Key areas of support include:

The deep processing industry of non-ferrous metals, with aluminum and copper as the core;

The new rare and precious metal material industry, focusing on indium, germanium, and platinum;

The new energy battery and fine phosphorus chemical industry, which realizes efficient and high-value utilization of phosphorus resources;

The biopharmaceutical industry (centered on deep processing of Chinese medicinal materials) and the deep processing industry of green food;

The export-oriented digital industry driven by the “Digital Information Corridor”;

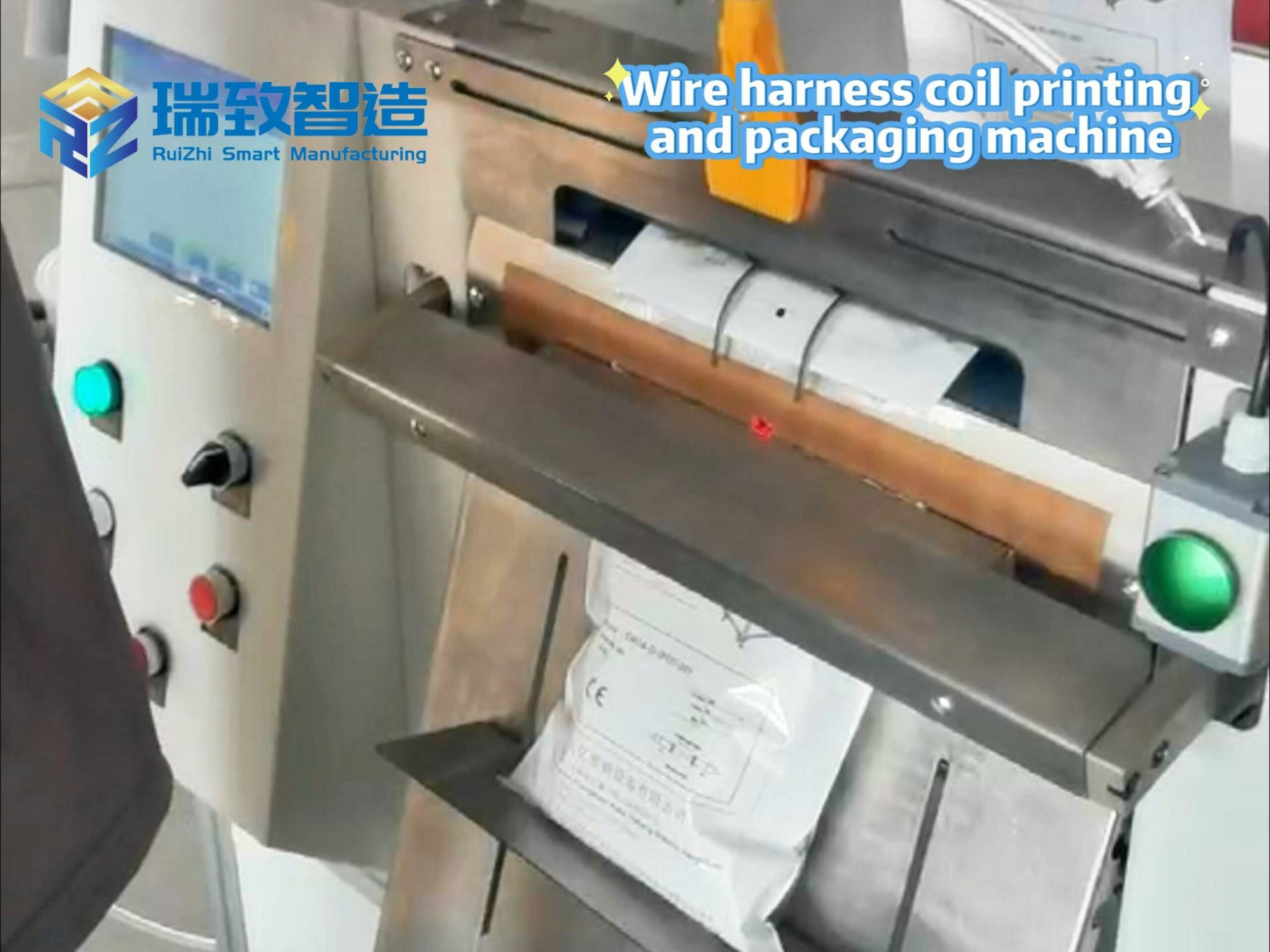

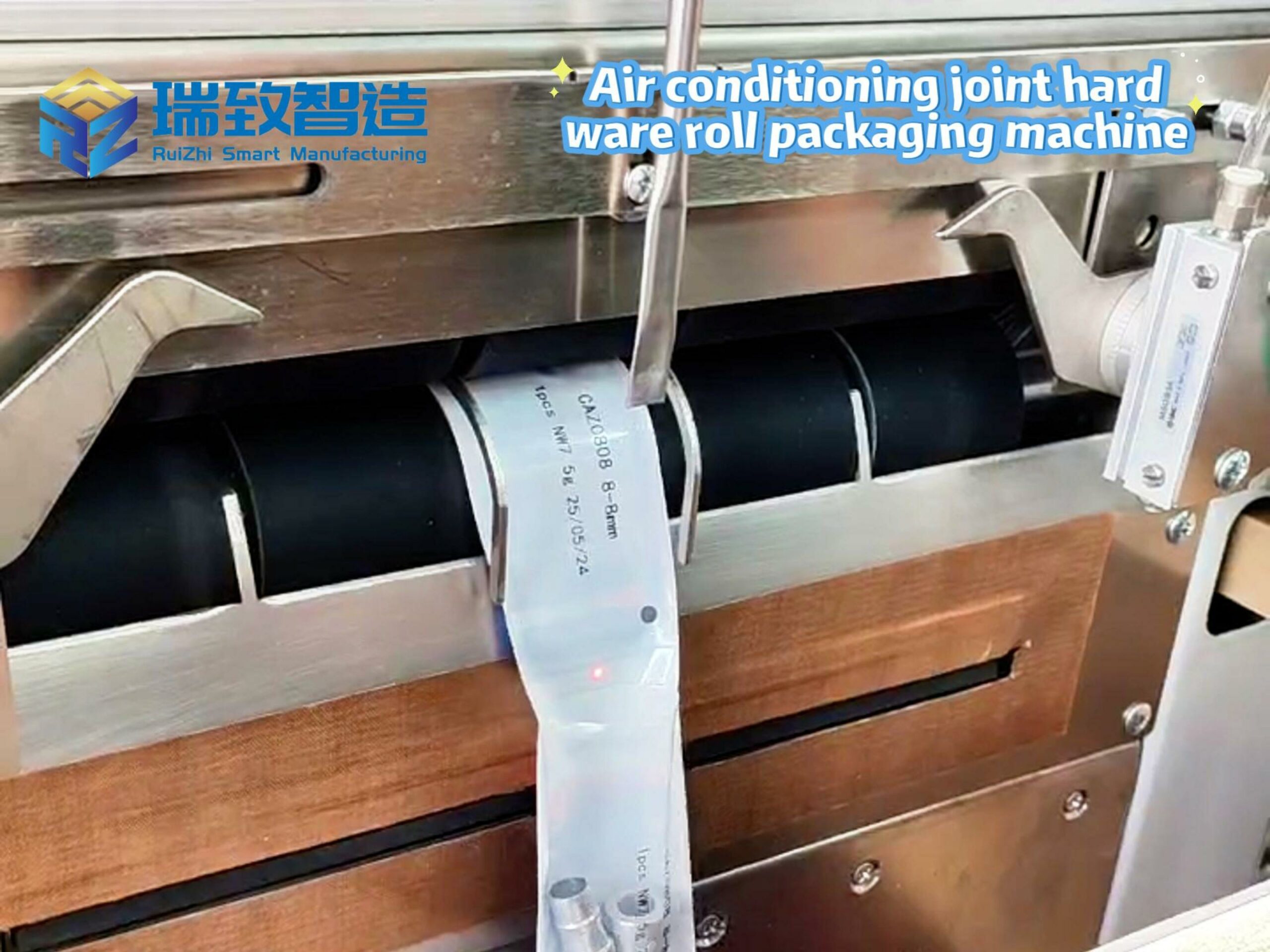

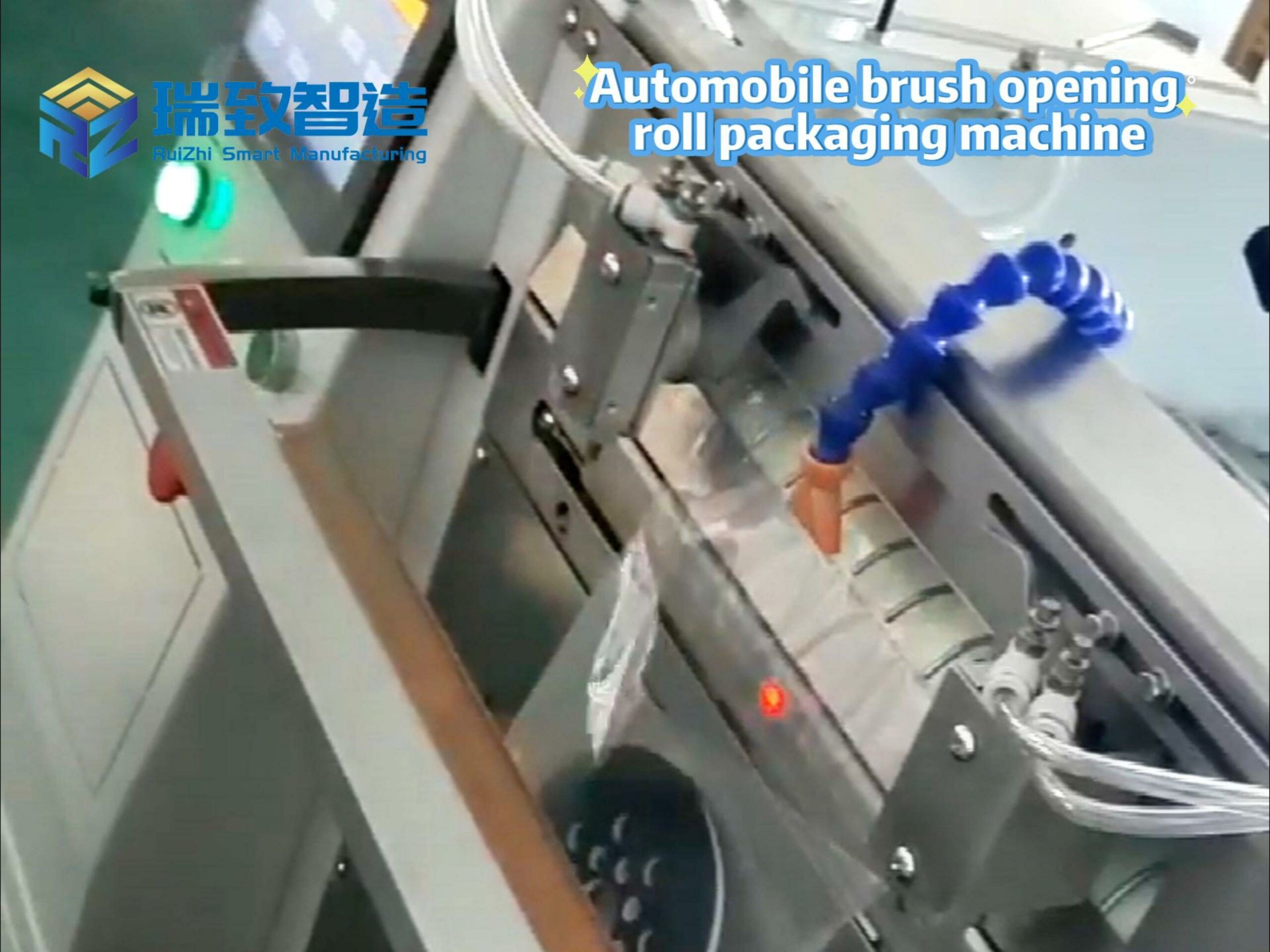

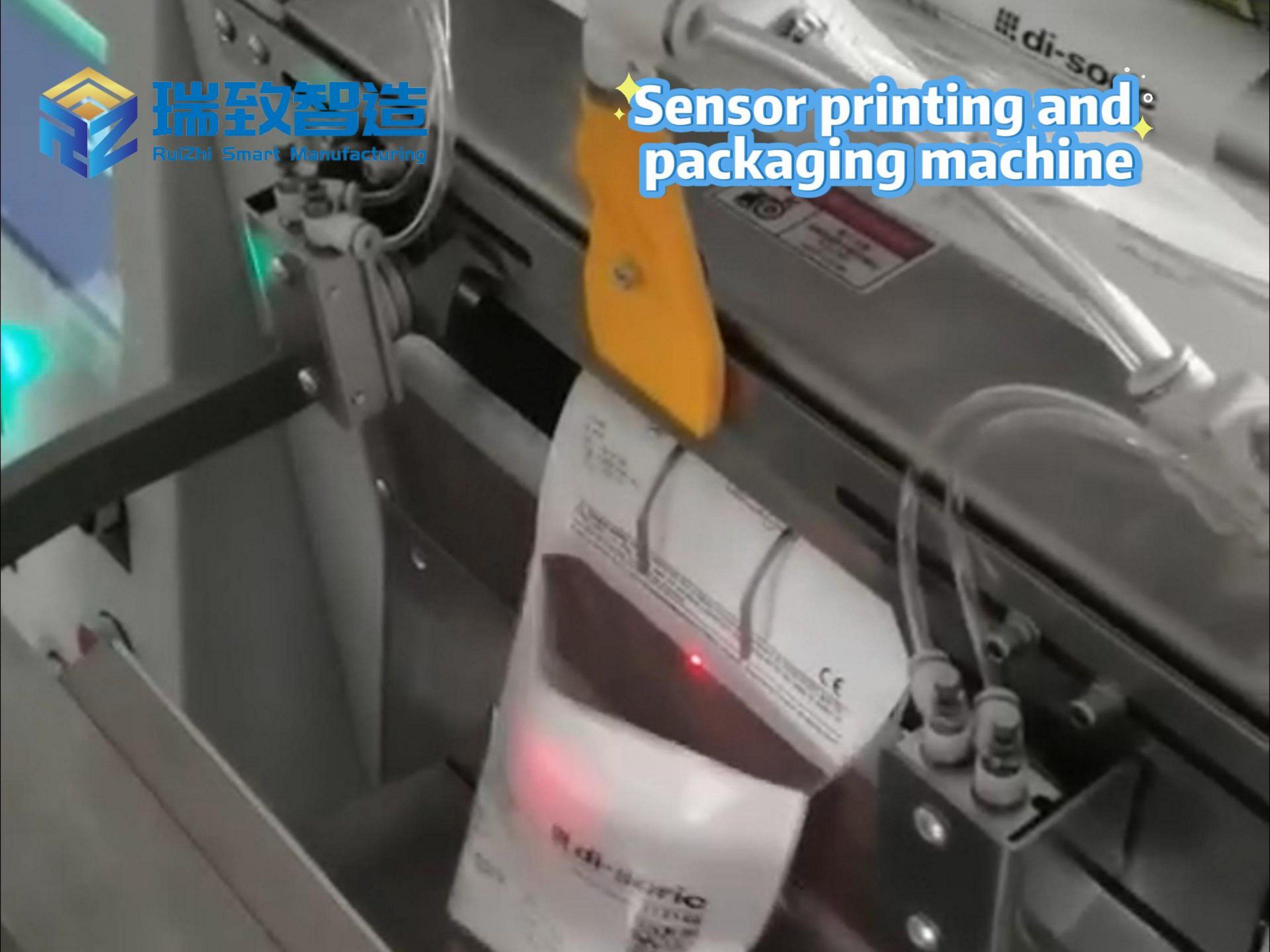

The cultivation of high-quality enterprises such as “single-item champions” and “little giants” (specialized, refined, distinctive, and innovative enterprises)—this includes backing enterprises engaged in the R&D and production of precision manufacturing equipment like tap control button assembly machines. These machines integrate automated component alignment, torque control, and quality inspection functions to ensure the assembly precision of faucet control buttons (a key part of sanitary ware), and the fund provides targeted financial support for such enterprises to optimize production technology, reduce manual dependence, and expand market supply, helping them become leaders in the specialized assembly equipment segment.

Notably, relying on Yunnan’s abundant non-ferrous metal resources such as copper and aluminum, the core components of these tap control button assembly machines (e.g., high-precision metal fixtures and transmission parts) have achieved localized procurement. This not only cuts the enterprises’ production costs by about 15% but also drives the demand for deep-processed non-ferrous metal products in Yunnan, forming a synergistic development effect between the precision equipment manufacturing industry and the local non-ferrous metal deep processing industry—fully reflecting the fund’s role in linking upstream and downstream industrial chains through precise investment.

Innovate Management Mechanisms to Achieve Synergy Between Government and Market

- Highlight Government Guidance and Policy-Oriented Positioning

Government investment funds are operated in a standardized manner in accordance with the principles of marketization, rule of law, and professionalism, promoting better integration of an “effective market” and an “capable government”.

- Establish a Management Model of “Government Departments Define Directions, Market Entities Manage Operations”

An Expert Advisory Committee is formed to research and put forward suggestions on industrial policy guidance. Meanwhile, observers are assigned to supervise the process of investment decision-making meetings. Fund management institutions independently make investment decisions within the scope of industrial policy guidance proposed by the Expert Advisory Committee and take full responsibility for the market-oriented operation of the fund.

- Build a Mechanism of “Government Guidance – Process Supervision – Independent Decision-Making”

This mechanism promotes the formation of a management system with clear rights and responsibilities and mutual checks and balances, realizing the organic unification of government guidance and market operation.

Strengthen Risk Prevention and Control to Ensure Safe and Efficient Use of Funds

- Competent Departments Select Custodian Banks and Track Investment Progress

Different from the conventional practice where master fund management institutions select custodian banks, the Department of Industry and Information Technology of Yunnan Province directly takes the lead in organizing open selection, formulates a scientific selection index system, and strengthens supervision over the flow of fiscal funds. At the same time, it uses fund custody as a lever to drive various financial services such as loans from financial institutions, investment-loan linkage, and project introduction.

- Establish an Interest-Binding Mechanism to Achieve In-Depth Binding Between Fund Managers and Projects

By stipulating the capital contribution ratio of master fund management institutions and sub-fund management institutions (including related parties) in the fund, the management team is closely linked to the fund’s interests. This effectively stimulates management efficiency, ensures that fund managers always align with the interests of investors, and jointly promotes the steady operation and value enhancement of the fund.

- Calculate Management Fees Based on Actual Investment Amount and Pay in Tiers According to Performance Evaluation Results

Moving away from the traditional model of calculating fees based on paid-in capital, management fees are now accrued based on the actual investment amount and paid in tiers according to performance evaluation results. This truly realizes “payment based on work and performance”, encouraging fund management institutions to improve investment efficiency.