During midday trading on Tuesday (February 3), shares of U.S. retail giant Walmart surged against the market trend, with the company’s market capitalization historically surpassing $1 trillion and joining the “Trillion-Dollar Club” dominated by tech firms.

Stock Surge and Trillion-Dollar Valuation

According to market data, Walmart’s stock rose approximately 2.4% intraday, hitting a peak of $127.04. Year-to-date, the stock has gained over 14%, significantly outperforming the S&P 500 index, which has risen less than 1.3% during the same period. Today, it has become one of the few non-tech companies with a market capitalization exceeding $1 trillion, joining the ranks of Berkshire Hathaway and Saudi Aramco. In the S&P 500 Consumer Staples Index, Walmart ranks first by market capitalization, followed by Costco, Procter & Gamble, and Coca-Cola.

The Driving Force Behind Valuation Growth

This retail behemoth has long been favored by cost-conscious consumers. Leveraging its massive scale advantage and robust supplier network, Walmart has been able to keep prices low while consistently gaining market share across different income brackets. While maintaining its appeal to value-conscious households, its online business has also attracted more high-income consumers seeking convenience.

Eric Clark, Chief Investment Officer at Accuvest Global Advisors, stated: “Over the past few years, Walmart has undergone a massive digital transformation. It has evolved from a traditional brick-and-mortar retailer to a company leveraging technology to enhance customer engagement.” Analysts believe that Walmart’s recent investments in artificial intelligence have further accelerated its stock price gains. The company is driving the adoption of AI across various operations, currently using the technology to improve scheduling, supply chain management, and other operational efficiencies.

Earlier this year, the company announced a partnership with Alphabet to deliver AI-enhanced shopping experiences on Google’s Gemini platform. More recently, it joined forces with OpenAI, allowing consumers to browse and purchase Walmart products directly through ChatGPT. Last month, Walmart was included in the Nasdaq 100 Index, highlighting external recognition of its tech strategy. Analysts remain bullish overall, with data showing the stock has received 47 “Buy” ratings, 3 “Hold” ratings, and only 1 “Sell” rating.

Walmart now sells a wide range of products, from collectible cards to pre-owned Chanel bags, and continues to shorten its online delivery times. Its advertising and other non-retail businesses are also driving profit growth. New CEO John Furner took over on February 1, with the task of sustaining this growth momentum and further advancing AI applications.

Outlook for Future Growth

However, competitive pressures on the company remain intense: Amazon, Aldi, and others continue to strengthen their low-price strategies, while Target attempts to reverse its year-long slump through more fashionable merchandise and enhanced store experiences. The strong stock performance has also led some investors to question whether there is limited room for further gains. Walmart’s average target price for the next 12 months is $124.37, close to its Monday closing price. The stock’s forward P/E ratio exceeds 42 times, near historical highs.

Last November, after reporting third-quarter results that exceeded expectations, Walmart raised its full-year sales and profit guidance, which somewhat alleviated some concerns. The company is scheduled to release its fourth-quarter earnings report on February 19. Jefferies analyst Corey Tarlowe noted that the conservative guidance has created room for continued outperformance in the future.

“Overall, we believe Walmart will continue to compete for market share through price investments in 2026, while the company’s forward-looking prospects may still be relatively conservative.”

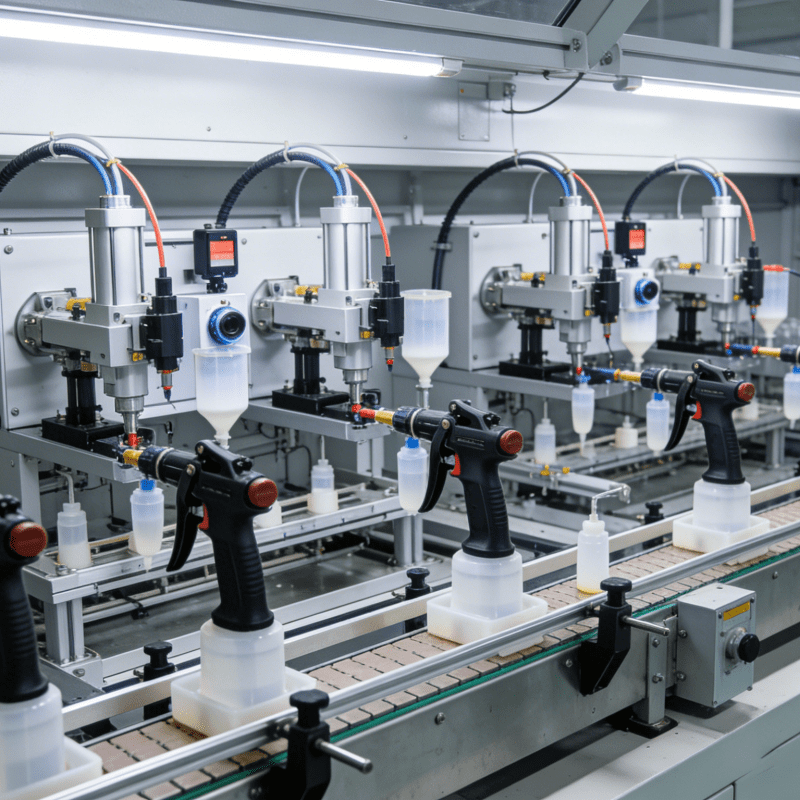

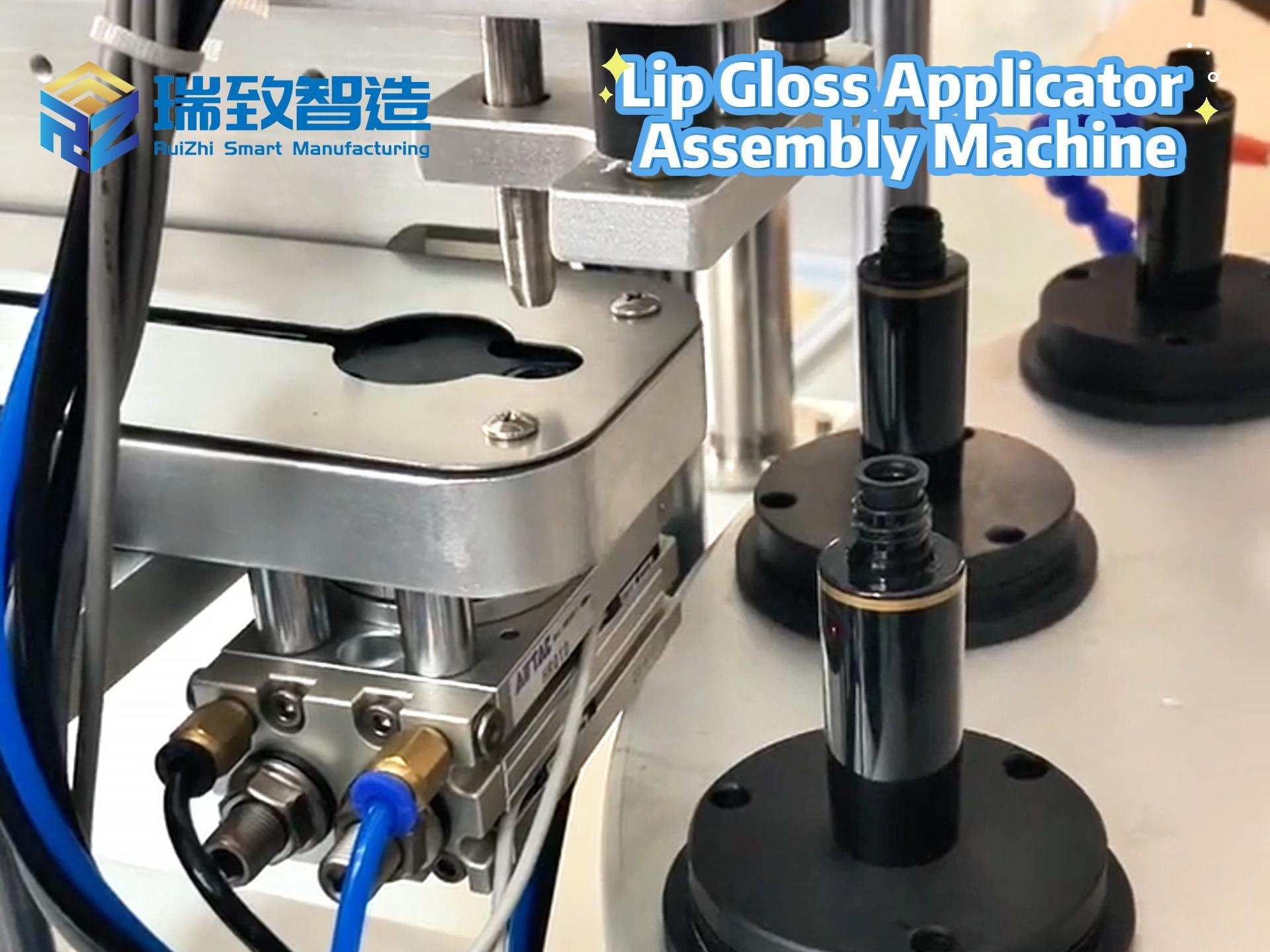

Automated assembly mechanical connection equipment

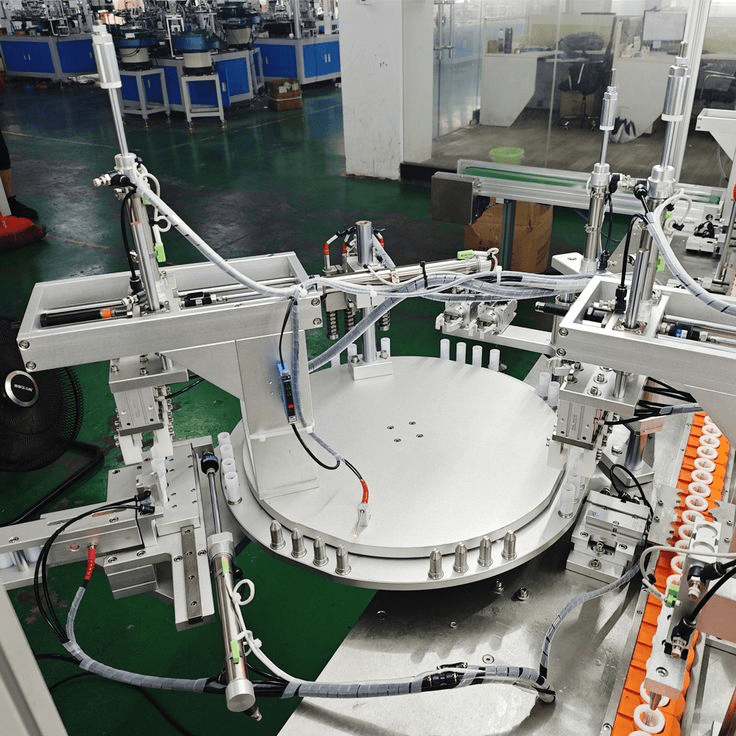

Artificial intelligence automated assembly mechanical connection robot