2025 marked a year of rapid development for humanoid robots

According to the latest statistics from IDC, global shipments of humanoid robots reached nearly 18,000 units last year, a year-on-year increase of about 508%, with sales revenue of approximately $440 million. In the same period, the cumulative orders for humanoid robots were estimated to exceed 35,000 units, laying a solid foundation for subsequent delivery and continuous market expansion.

One of the core drivers behind the rapid development of humanoid robots is undoubtedly the emerging startups represented by companies such as Agibot, Unitree, and Ubtech. However, it also relies heavily on the intensive layout and increased investment by listed companies.

With profound accumulation in capital, technology, large scale mass production, and operation management, numerous listed companies in automotive components and precision manufacturing are actively advancing their humanoid robot business layouts, becoming an indispensable force in the sector.

Major Players Enter Intensively, Each with Unique Strategies

On February 9, Minth Group announced a filing on the Hong Kong Stock Exchange, stating that it had reached a framework agreement with Green Drive Harmonic Drive on key terms for a proposed joint venture in the United States. According to the announcement, the joint venture will focus on the North American market, specializing in the design, manufacturing, and commercialization of joint module assemblies for humanoid robots, targeting the core links of the North American robotics industrial chain.

As a world leading automotive component supplier, Minth Group is mainly engaged in the R&D, production, and sales of automotive parts and tooling molds. Its core products include metal trims, plastic parts, aluminum parts, battery boxes, and more. It also has a complete global R&D, production, and sales network in many countries, with strong industrial capabilities and global operation experience.

On this basis, Minth has proactively laid out new tracks such as artificial intelligence, robotics, urban air mobility, and intelligent mobility, aiming to build a second growth curve based on its existing advantages. The joint venture with Green Drive Harmonic Drive is a key step for Minth to enter core components of humanoid robots.

As a leading enterprise in China’s harmonic reducer sector, Green Drive Harmonic Drive has profound expertise in precision transmission technology. It can highly complement Minth’s large scale production capacity, global supply chain management experience, and channel resources in the North American market, thus creating new revenue streams for both parties.

In the automotive components sector, Minth is only one of many listed companies actively entering the humanoid robot race. Previously, automotive component firms including Tuopu Group, Ningbo Huaxiang, Bethel Automotive, Joyson Electronics, Jingu Co., Ltd., and Zhongding Co., Ltd. have all expanded aggressively into humanoid robot businesses.

Among them, Ningbo Huaxiang established a subsidiary, Huaxiang Qiyuan, as early as June 2025 to deepen its robotics layout. In the same month, Huaxiang Qiyuan signed a Contract for Entrusted Production with Shanghai Agibot Technology Co., Ltd., agreeing to produce part of Agibot’s full size bipedal robot products over the next three years to meet Agibot’s capacity demand.

In addition to setting up a dedicated subsidiary, Ningbo Huaxiang, through Huaxiang Qiyuan, signed a Strategic Cooperation Agreement with DAI Robotics at the end of 2025 to enter the dexterous hand segment.

Bethel also targeted the humanoid robot business at an early stage. At the end of 2025, it announced plans to invest RMB 35 million in Moejia Robotics, a subsidiary of Chery, to enhance the company’s sustainable operation capabilities.

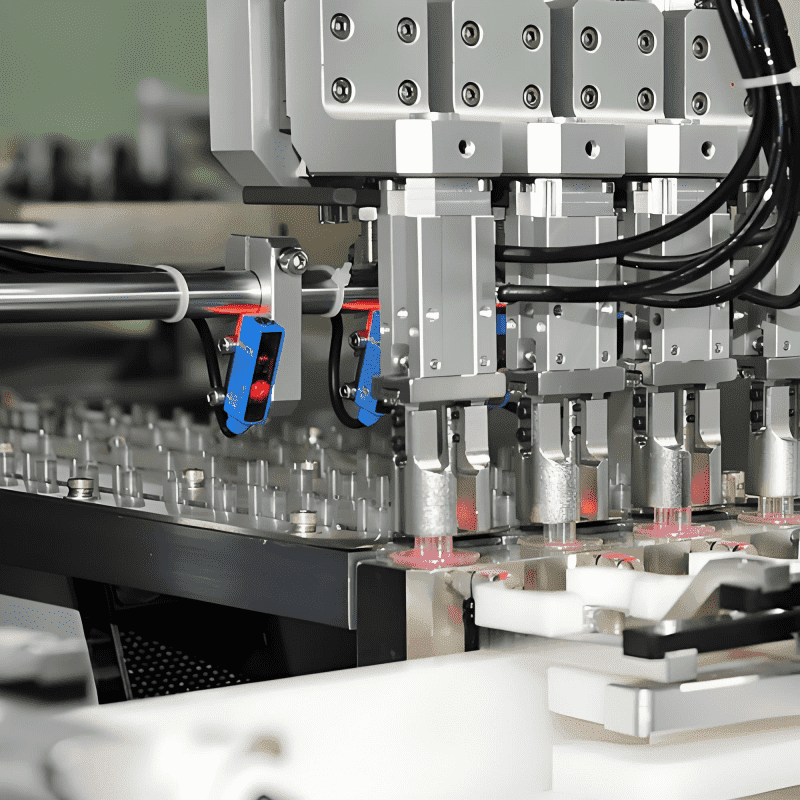

While automotive component listed companies are rushing to cross into humanoid robots, precision manufacturing giants in the consumer electronics sector have also entered the field on a large scale, launching a large scale “capability migration”: applying the ultra high precision, large scale production capacity, and global service capabilities forged through years of deep involvement in consumer electronics to the humanoid robot track, quickly seizing dominance in mass production.

The cooperation between Lingyi iTech and Magic Atom is a typical example of this model. Recently, Lingyi Robot, a subsidiary of Lingyi iTech, signed a strategic cooperation agreement with Magic Atom. The two parties plan to conduct in depth collaboration in robot manufacturing services, industrial implementation, production line expansion, and overseas development.

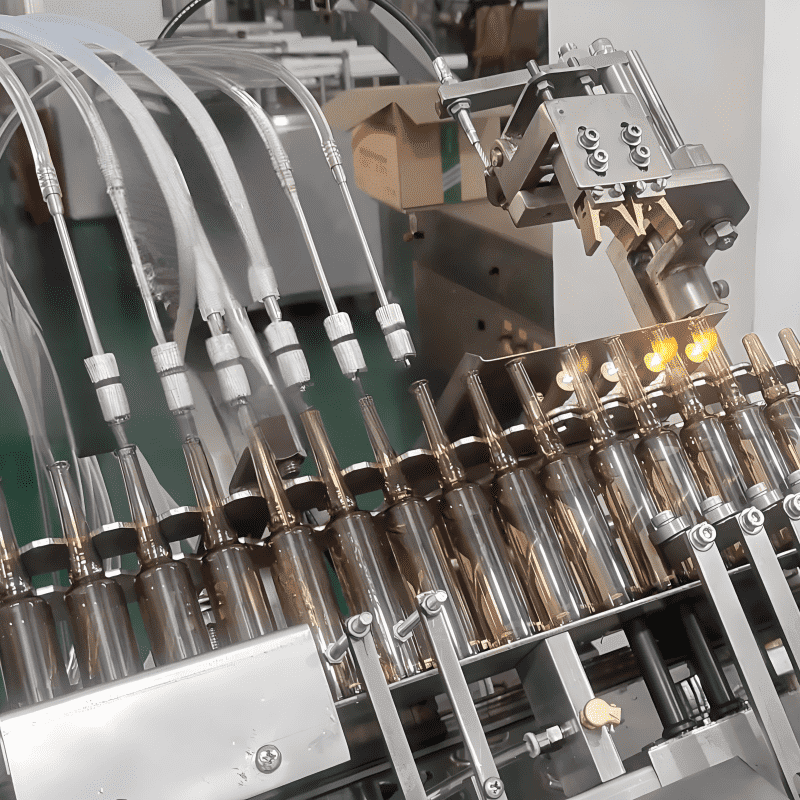

Specifically, Magic Atom will give priority to core components provided by Lingyi iTech, including body structural parts, servo motors, and reducers, as well as supporting solutions such as charging and thermal management, to reduce costs and improve efficiency. The two sides will also promote the co construction of industrial bases and overseas collaboration, leveraging Lingyi iTech’s 80 global production bases and delivery centers to drive Magic Atom’s “Embodied Intelligence + X” strategy globally.

As a global precision manufacturing leader, Lingyi iTech provides global robot customers with one stop solutions ranging from process processing and core components to OEM/ODM complete machines. As of November 2025, it had completed hardware and complete machine assembly services for more than 5,000 sets of humanoid robots, serving over 20 leading enterprises and well known North American AI customers. Its products cover complete machines, dexterous hands, joint modules, and other key areas.

Changying Precision, another consumer electronics precision manufacturing giant, also achieved a major leap in its humanoid robot layout in 2025. Its precision component business for humanoid robots advanced rapidly, achieving annual revenue of approximately RMB 100 million, mainly from overseas customers. In terms of shipment volume, it delivered a total of about 690,000 precision components for humanoid robots in 2025, with overseas customers accounting for around 80%.

In addition, “Apple supply chain” companies such as Lens Technology, Luxshare Precision, and Goertek are also accelerating their penetration into the humanoid robot sector. Relying on their core capabilities in precision manufacturing, supply chain management, and large scale production, they aim to replicate or even surpass past successes in this new industrial revolution.

Positioning for the Future: An Ecological War No One Can Afford to Lose

Overall, automotive component companies focus more on the reuse of automotive grade development experience and technology in their humanoid robot layouts, while consumer electronics precision manufacturers mainly emphasize the replication and migration of precision manufacturing capabilities and production capacity.

Despite different paths, all companies share the same core logic: when traditional businesses face growth bottlenecks, they seek and position themselves in the next potential trillion dollar market, and open up a new growth curve using existing competitive advantages.

The golden decade of consumer electronics has passed, and the wave of automotive electrification is gradually slowing down. In contrast, humanoid robots, with their disruptive reshaping of human production and lifestyles, are widely regarded as the next generation of disruptive terminals after PCs, smartphones, and smart electric vehicles, with enormous market potential.

According to the latest forecast by Morgan Stanley, China’s humanoid robot sales are expected to grow by 133% year on year in 2026 to reach 28,000 units, double the previous forecast of 14,000 units. Afterwards, sales will continue exponential growth, reaching an estimated 262,000 units by 2030 and further rising to 2.6 million units by 2035.

In the longer term, Morgan Stanley and Citigroup estimate that humanoid robots could create a market value of $5–7 trillion.

Against this vast market space, the rush of listed companies to lay out humanoid robots is not merely a business expansion, but a critical move to seize the entrance to the trillion dollar track and lock in future growth.

However, despite the huge market potential, the risks of cross industry entry cannot be ignored.

The greatest uncertainty lies in the market itself: when humanoid robots will cross the gap between cost and application scenarios to achieve large scale commercialization remains unknown. This means that massive current investments may face a long payback period.

A more practical challenge comes from internal competition. As many industry giants enter with similar logic, structural parts, basic transmission components, and other fields are likely to quickly fall into homogeneous competition.

The National Development and Reform Commission has clearly stated that with the accelerated entry of emerging capital, China now has more than 150 humanoid robot companies, and the number is still growing. While this is positive for innovation, risks such as over concentration of highly repetitive products and compressed R&D space must be guarded against.

Moreover, drawing on the development experience of smart electric vehicles, the ultimate barrier of the humanoid robot industry may not be hardware. As manufacturing becomes increasingly standardized, the core of competition may shift to software algorithms, data accumulation, and ecosystem construction — a completely new test for manufacturing giants accustomed to hardware centric thinking.

Therefore, the current cross border boom led by listed companies has far reaching significance beyond simply opening a new business line. It is essentially an active “value re evaluation” and “capability liberation” of a mature industrial system at the turning point of a technological cycle. In the short term, it is a story of growth anxiety and strategic positioning; in the long run, it may be an ecological competition over the dominance of the future industrial chain.

Conclusion

The race in the humanoid robot sector is essentially a marathon.

The collective entry of listed companies has brought capital, technology, and large scale manufacturing capabilities, which are expected to greatly accelerate product iteration and application implementation. However, this does not mean the finish line is near — on the contrary, it may mark the beginning of even fiercer competition.