Guide: In July, the manufacturing Purchasing Managers’ Index (PMI) stood at 49.3%, down 0.4 percentage points from the previous month; the non-manufacturing business activity index and the composite PMI output index were 50.1% and 50.2% respectively, down 0.4 and 0.5 percentage points from the previous month. Both remained above the critical point, indicating that China’s overall economic output maintained expansion.

Manufacturing Purchasing Managers’ Index Fell in July

Non-Manufacturing Business Activity Index Remained in Expansion

——Interpretation by Zhao Qinghe, Senior Statistician, Service Industry Survey Center of the National Bureau of Statistics

China Purchasing Managers’ Index for July 2025

On July 31, 2025, the Service Industry Survey Center of the National Bureau of Statistics and the China Federation of Logistics and Purchasing released China’s Purchasing Managers’ Index. In this regard, Zhao Qinghe, senior statistician of the Service Industry Survey Center of the National Bureau of Statistics, made an interpretation.

In July, the manufacturing PMI was 49.3%, down 0.4 percentage points from the previous month; the non-manufacturing business activity index and the composite PMI output index were 50.1% and 50.2% respectively, down 0.4 and 0.5 percentage points from the previous month. Both remained above the critical point, showing that China’s overall economic output maintained expansion.

- The manufacturing Purchasing Managers’ Index fell

In July, affected by factors such as the manufacturing industry entering the traditional production off-season and high temperatures and rainstorm floods in some areas, the PMI dropped to 49.3%, and the manufacturing prosperity level declined from the previous month.

(1) The production index remained in expansion. The production index and new orders index were 50.5% and 49.4% respectively, down 0.5 and 0.8 percentage points from the previous month, indicating that manufacturing production activities continued to expand, while market demand slowed down. From the perspective of industries, the production index and new orders index of industries such as railway, ship, aerospace equipment, and computer, communication and electronic equipment remained in the expansion range, with both production and demand being active; the two indices of industries such as chemical raw materials and chemical products, and non-metallic mineral products remained below the critical point, with weak market supply and demand.

(2) The price index continued to rise. Affected by factors such as the recent rise in prices of some bulk commodities, the purchase price index of major raw materials and the ex-factory price index were 51.5% and 48.3% respectively, up 3.1 and 2.1 percentage points from the previous month. Among them, the purchase price index of major raw materials rose above the critical point for the first time since March this year, and the overall level of manufacturing market prices improved. From the industry perspective, the purchase price index of major raw materials and ex-factory price index of industries such as petroleum, coal and other fuel processing, and ferrous metal smelting and rolling processing rebounded significantly, and the market prices of related industries improved.

(3) Large enterprises continued to expand. The PMI of large enterprises was 50.3%, down 0.9 percentage points from the previous month. Their production index and new orders index were 52.1% and 50.7% respectively, both remaining in the expansion range for three consecutive months, indicating that large enterprises maintained a good production and operation situation; the PMI of medium-sized enterprises was 49.5%, up 0.9 percentage points from the previous month, with the prosperity level continuing to improve; the PMI of small enterprises was 46.4%, down 0.9 percentage points from the previous month.

(4) New drivers continued to grow. From the perspective of key industries, the PMI of equipment manufacturing and high-tech manufacturing was 50.3% and 50.6% respectively, both remaining above the critical point, indicating that high-end equipment manufacturing maintained expansion; the PMI of consumer goods industry was 49.5%, down 0.9 percentage points from the previous month; the PMI of high-energy-consuming industries was 48.0%, up 0.2 percentage points from the previous month, with the prosperity improving.

(5) Market expectations rebounded. The expected index of production and operation activities was 52.6%, up 0.6 percentage points from the previous month, indicating that manufacturing enterprises’ confidence in the recent market development has increased. From the industry perspective, the expected index of production and operation activities of industries such as automobile, railway, ship, aerospace equipment, and electrical machinery and equipment were all above 55.0% in a relatively high prosperity range, and relevant enterprises were more optimistic about the industry development.

- The non-manufacturing business activity index remained in expansion

In July, the non-manufacturing business activity index was 50.1%, down 0.4 percentage points from the previous month, but still above the critical point.

(1) The business activity index of the service industry was generally stable. The business activity index of the service industry was 50.0%, slightly down 0.1 percentage points from the previous month. From the industry perspective, driven by the summer holiday effect, the business activity index of industries related to residents’ travel and consumption, such as railway transportation, air transportation, postal services, culture, sports and entertainment, was in a high prosperity range above 60.0%, with rapid growth in business volume; the business activity index of industries such as leasing and business services, ecological protection and public facilities management remained in the expansion range, and the tourism-related industry market was relatively active; the business activity index of industries such as real estate and residential services were all below the critical point, with weak prosperity. From the market expectation perspective, the business activity expectation index was 56.6%, up 0.6 percentage points from the previous month, indicating that most service industry enterprises were relatively optimistic about the market expectation.

(2) The business activity index of the construction industry fell. Affected by adverse factors such as continuous high temperatures and rainstorm floods in some areas, construction work slowed down, and the business activity index was 50.6%, down 2.2 percentage points from the previous month. From the market expectation perspective, the business activity expectation index was 51.6%, down 2.3 percentage points from the previous month.

III. The expansion of the composite PMI output index slowed down

In July, the composite PMI output index was 50.2%, down 0.5 percentage points from the previous month, but still above the critical point, indicating that China’s overall enterprise production and operation activities maintained expansion. The manufacturing production index and non-manufacturing business activity index, which constitute the composite PMI output index, were 50.5% and 50.1% respectively.

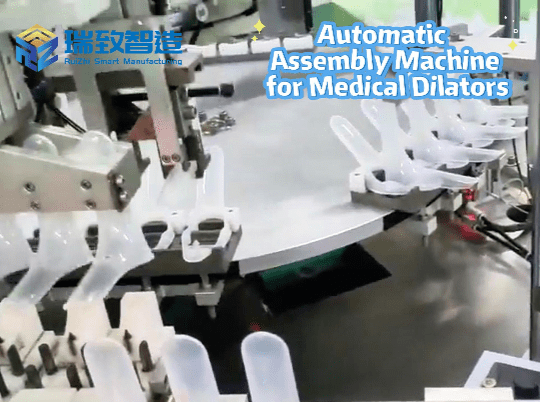

The production index of fuse assembly ted to expand.machines has star

What benefits has the expansion of the manufacturing industry brought to fuse assembly machines?