Table of Contents

ToggleThe Future of Banking: Automation, AI, and Personalized Finance—Lessons from Automotive Innovation

When was the last time you walked into a bank? For most people, the answer is “I can’t even remember.” Gone are the days of waiting in line to deposit checks or apply for loans—just as the automotive industry has shifted from manual assembly lines to sleek, automated factories, banking is undergoing its own revolution. Just as automotive automation and advanced automated equipment have redefined manufacturing—speeding up production, enhancing precision, and lowering costs—banking is now being reshaped by automation, AI, and hyper-personalized finance.

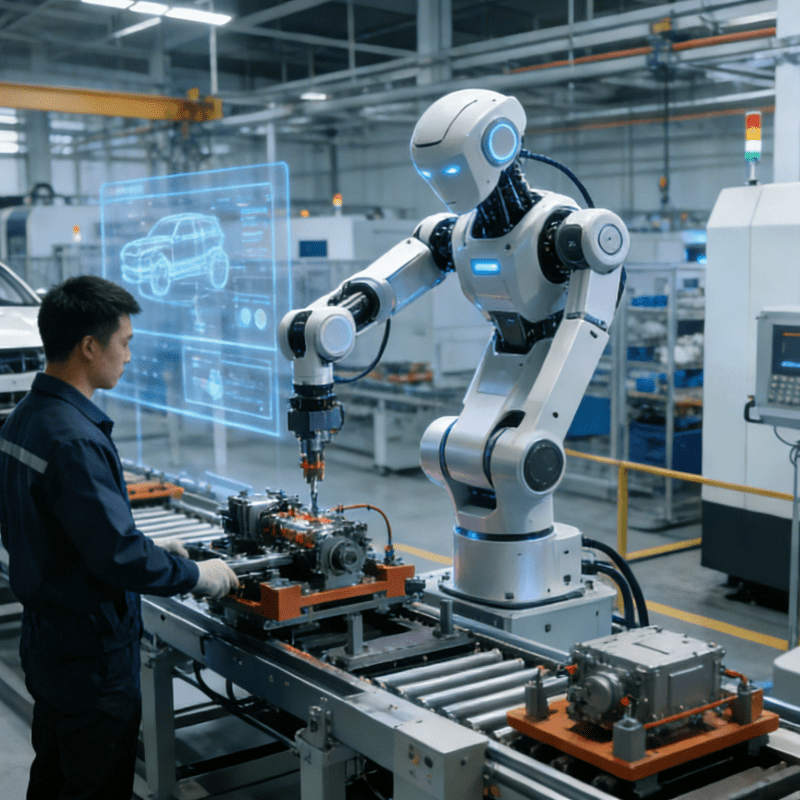

The parallel between banking’s digital transformation and the automotive industry’s leap into automation is striking. Decades ago, automotive manufacturers relied on human labor for every step of production. Today, automated equipment and AI-driven systems assemble cars with unprecedented speed and accuracy. Similarly, banks are moving from paper-based processes and teller-driven services to algorithm-powered solutions that streamline everything from loan approvals to customer service.

“Innovation in banking, much like in the automotive industry, is driven by the need to do more with less,” says John Smith, a fintech analyst. “Automotive automation taught us that efficiency doesn’t mean sacrificing quality—it means reimagining how things work. Banks are now applying that mindset to financial services.”

How AI and Automation Are Changing Banking: Taking Cues from Automotive Efficiency

For years, banks relied on tellers and paperwork to process transactions—akin to the early days of automotive manufacturing, where every bolt was tightened by hand. Now, algorithms are doing the heavy lifting, much like the robotic arms and AI-driven systems that dominate modern automotive factories. AI in banking can approve loans, detect fraud, and predict financial behavior—just as automotive AI optimizes supply chains and enhances self-driving capabilities.

One of the biggest changes is automated financial advice. Banks and fintech companies now use AI to suggest personalized budgeting tips, investment options, and credit-building strategies—similar to how automotive systems use data to optimize fuel efficiency or predict maintenance needs. Robo-advisors, for example, act as the “digital engineers” of finance, analyzing data to create custom investment portfolios, much like automotive engineers use data to design efficient engines.

Even customer service has evolved. Just as automotive brands use AI chatbots to assist with vehicle diagnostics, banks now deploy AI-powered chatbots to answer queries, assist with transactions, and spot unusual spending patterns. These tools aren’t perfect, but they’re improving rapidly—mirroring the automotive industry’s gradual refinement of autonomous driving features, from basic lane assist to advanced self-parking.

The Rise of Hyper-Personalized Finance: Tailoring Experiences Like Custom Cars

Imagine walking into a coffee shop and being handed a drink you didn’t even order—yet it’s exactly what you wanted. That’s where banking is headed, taking a page from the automotive industry’s playbook of personalized design. Just as car manufacturers offer custom interiors, tech packages, and even AI-driven driver profiles, banks are using AI and big data to create hyper-personalized financial experiences.

Banks now track spending habits, savings goals, and lifestyle choices to make tailored recommendations. For example, if you frequently book flights, your bank might offer a travel-focused savings account with exclusive perks—much like an automotive brand offering a “road trip” package with upgraded GPS and fuel efficiency features. If AI detects you’re struggling with late fees, it might suggest automatic bill payments, similar to how automotive systems remind drivers of maintenance schedules.

Credit scoring is also being reimagined, much like how automotive insurance now uses real-time driving data to calculate premiums. Traditional credit reports are giving way to AI analyses of real-time financial behavior—such as subscription management, spending patterns, and account balances. Some banks even use alternative scoring models to help individuals with limited credit histories, mirroring how automotive financing has expanded to serve buyers with non-traditional credit profiles.

Challenges and Ethical Concerns: Navigating Risks in an Automated Era

Just as the automotive industry faced backlash over early autonomous driving accidents and data privacy concerns, banking’s shift to AI and automation isn’t without challenges. Algorithms, like automotive AI, can inherit biases from their training data. For example, a lending algorithm trained on historically biased financial data might unfairly deny loans to certain groups, just as early automotive safety tests were criticized for not accounting for diverse body types.

Trust is another hurdle. Many still prefer human advisors for major financial decisions, just as some drivers remain skeptical of fully autonomous cars. Additionally, cybersecurity risks grow as banks rely more on digital systems—much like automotive networks face increasing threats from hackers targeting connected cars.

“The key, as seen in automotive, is to balance innovation with accountability,” says Sarah Johnson, a banking ethics expert. “Automakers didn’t abandon safety standards for speed; banks must not abandon transparency and fairness for efficiency.”

The Future: Banking as a Smart, Adaptive Ecosystem—Inspired by Automotive Innovation

The future of banking will be as automated and AI-driven as the automotive industry’s vision of a fully autonomous future. Here’s what to expect:

- Biometric and Voice-Activated Banking: Just as cars now recognize drivers via fingerprint or voice commands, banks will offer seamless, secure login through biometrics.

- AI Financial Assistants: These will handle budgeting, investing, and bill payments, much like automotive AI assistants manage navigation and climate control.

- Real-Time Loan Approvals: Using instant financial data analysis, similar to how automotive financing now offers on-the-spot approvals using real-time credit checks.

- Enhanced Cybersecurity: Banks will invest in AI-driven fraud detection, mirroring automotive advancements in cyber-resilient connected systems.

- Regulatory Safeguards: Governments will likely introduce rules to prevent AI bias and protect privacy, just as automotive regulations now mandate safety standards for autonomous vehicles.

Will traditional banks survive? Yes—but only if they adapt, much like legacy automakers that embraced electric vehicles and automation to compete with startups. Customers now expect the same speed, convenience, and personalization in banking that they enjoy in their cars.

For consumers, the future means less waiting, lower fees, and more control over finances—just as automotive automation has brought faster production, better fuel efficiency, and personalized driving experiences. The shift will require trust in AI, but the benefits—efficiency, accessibility, and tailored solutions—are undeniable.

Just as the automotive industry evolved from horse-drawn carriages to smart, connected vehicles, banking is leaving behind the era of manual processes and generic services. The road ahead is digital, adaptive, and undeniably intelligent—and it’s paved with lessons from industries that have already mastered the art of automation. Buckle up: the future of banking is here, and it’s driving faster than ever.