In the first three quarters of 2025, listed enterprises in the glass machinery industry showed a recovery trend of “low start and high end”, mainly driven by the end of the destocking cycle in the photovoltaic glass industry, the decline in raw material costs and the recovery of downstream demand. Taking enterprises such as Xinyi Solar and Flat Glass as examples, although their overall revenue in the first three quarters decreased year-on-year, their performance in the third quarter improved significantly.

From the perspective of segmented fields, high-end equipment manufacturers performed more prominently. For instance, the overseas business revenue of North Glass accounted for 47.5% in the first three quarters, a year-on-year increase of 45.53%, and the proportion of intelligent equipment orders rose to more than 60%. However, some enterprises in the industry still face pressures. Due to delayed technological upgrading and intensified homogeneous competition, small and medium-sized manufacturers generally suffer from profit margin pressure, and market share is further concentrated in leading enterprises.

Since 2025, the new developments and opportunities in the glass machinery field are mainly reflected in the following five aspects:

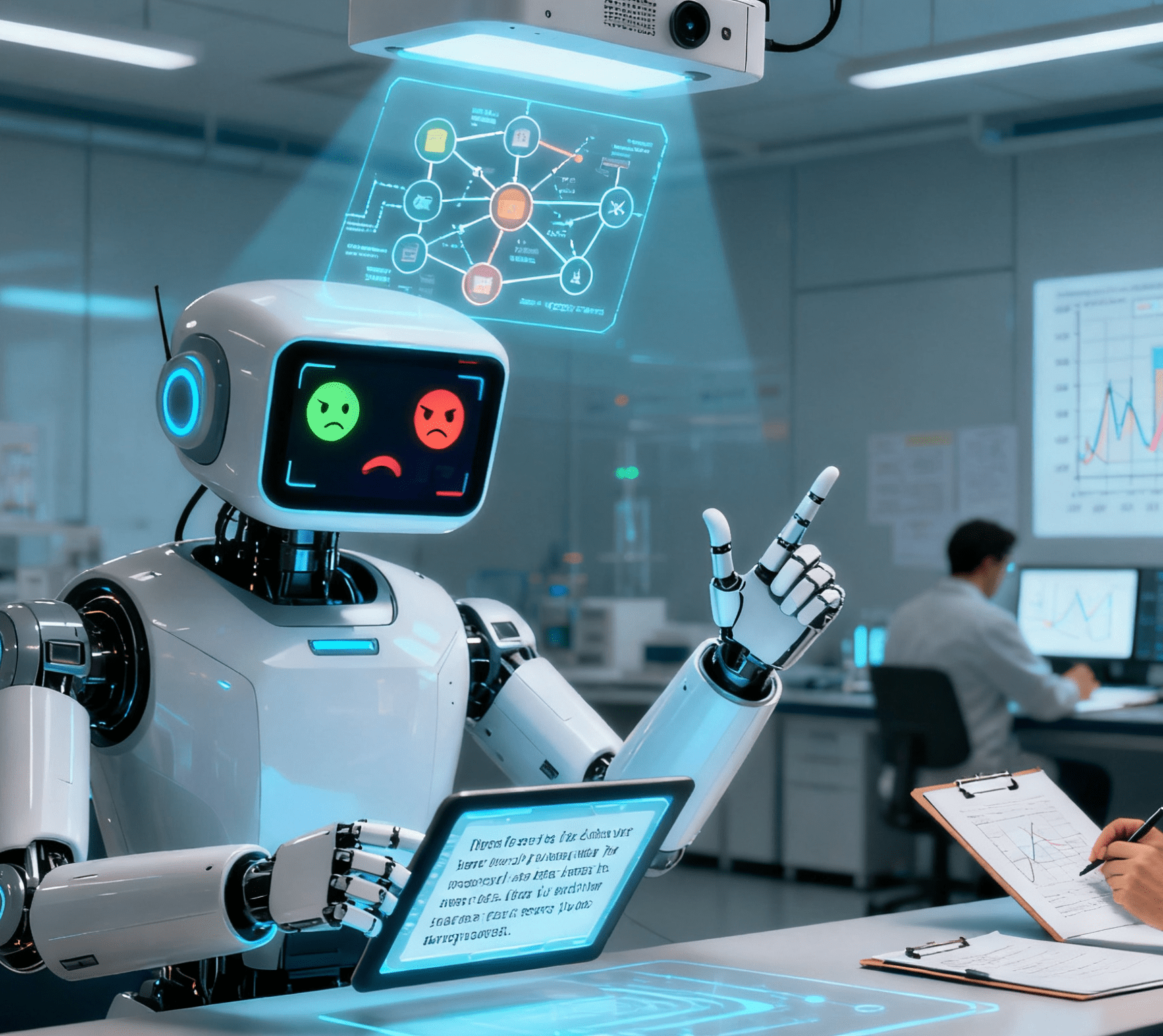

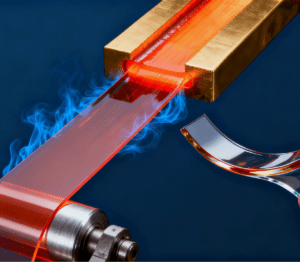

Accelerated Penetration of Technological Intelligence and Full-process Production Automation

With the advancement of Industry 4.0 and intelligent manufacturing policies, the glass machinery industry is undergoing an upgrade from “single-machine automation → production line intelligence → factory digitalization”.

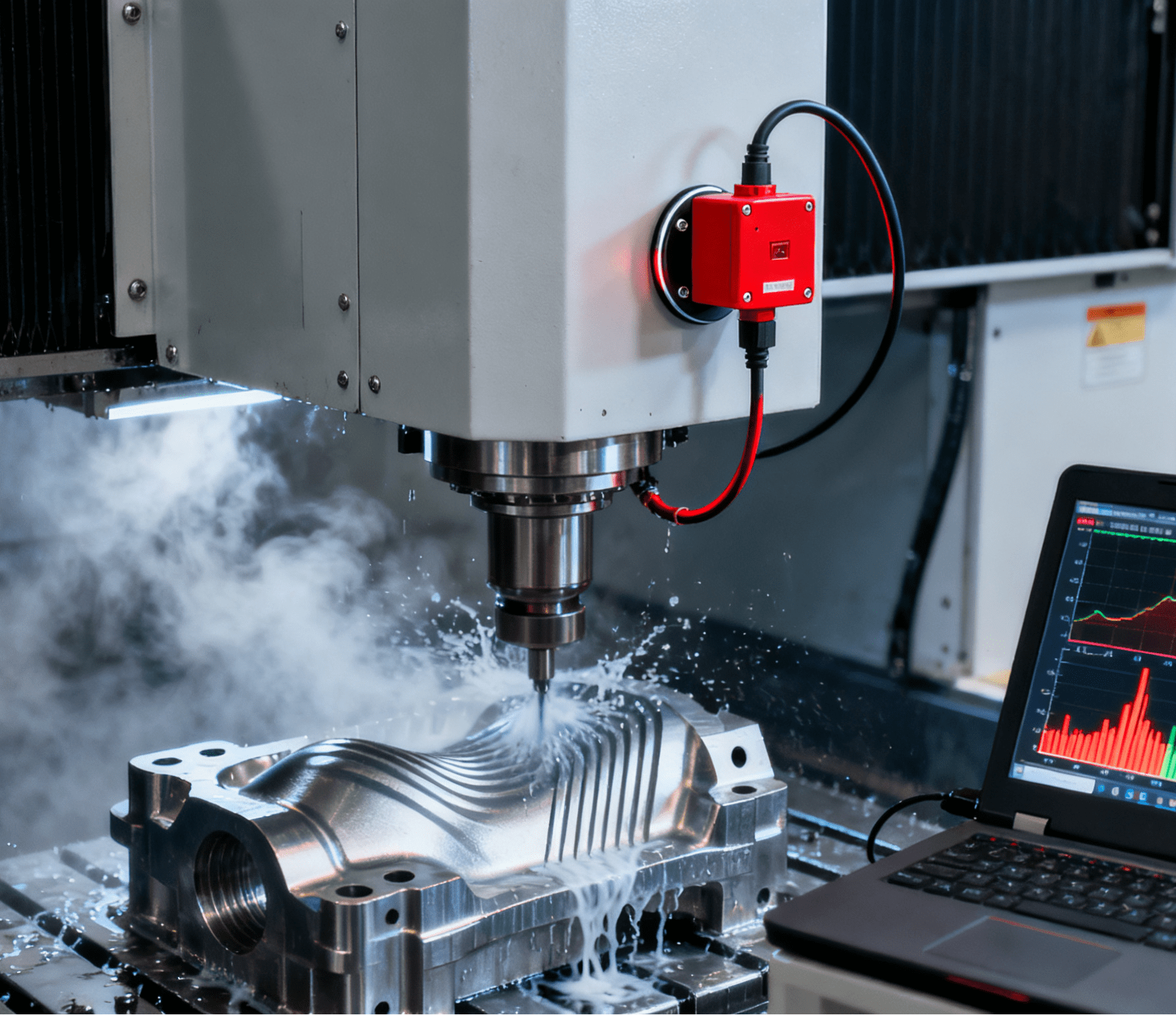

For example, Landglass launched the “Intelligent Connection · Smart Factory” solution. Through visual positioning, Industrial Internet of Things (IIoT) and AI quality inspection technology, it realizes seamless connection of processes such as cutting, edging and tempering, increasing processing efficiency by 3 times and reducing labor costs by 60%. The AI visual inspection system can identify micron-level defects on the glass surface at a speed of 2.5 meters per second, with a missed detection rate of less than 0.1%, significantly improving product yield.

In addition, a new generation of equipment with remote operation and maintenance, digital twin and process self-optimization functions has become mainstream. For high-end products such as smart glass and photovoltaic modules, automatic placement machines have become core supporting equipment—they rely on high-precision motion control and visual recognition technology to realize automatic placement of sensors, conductive films and other small components on glass surfaces, with placement accuracy controllable within ±0.02mm, reducing manual operation errors by over 85% and shortening the assembly cycle by 40%. For example, the number of patents applied by North Glass in 2025 increased by 191% year-on-year, focusing on the layout of intelligent diagnosis and predictive maintenance technologies.

Green and Low-Carbon Technologies Drive Equipment Iteration

The global “dual carbon” goals (carbon peaking and carbon neutrality) are promoting the transformation of glass machinery towards low energy consumption and high environmental protection. The application of new energy-saving furnace technologies (such as electric auxiliary melting) and waste heat recovery systems has reduced unit product energy consumption by more than 25% and carbon emissions by 18%. At the same time, the demand for green material processing equipment has surged. For example, the market scale of coating equipment used in the production of Low-E glass and self-cleaning glass increased by 12% year-on-year, while the order volume of waste glass recycling and reuse equipment increased by 20% annually.

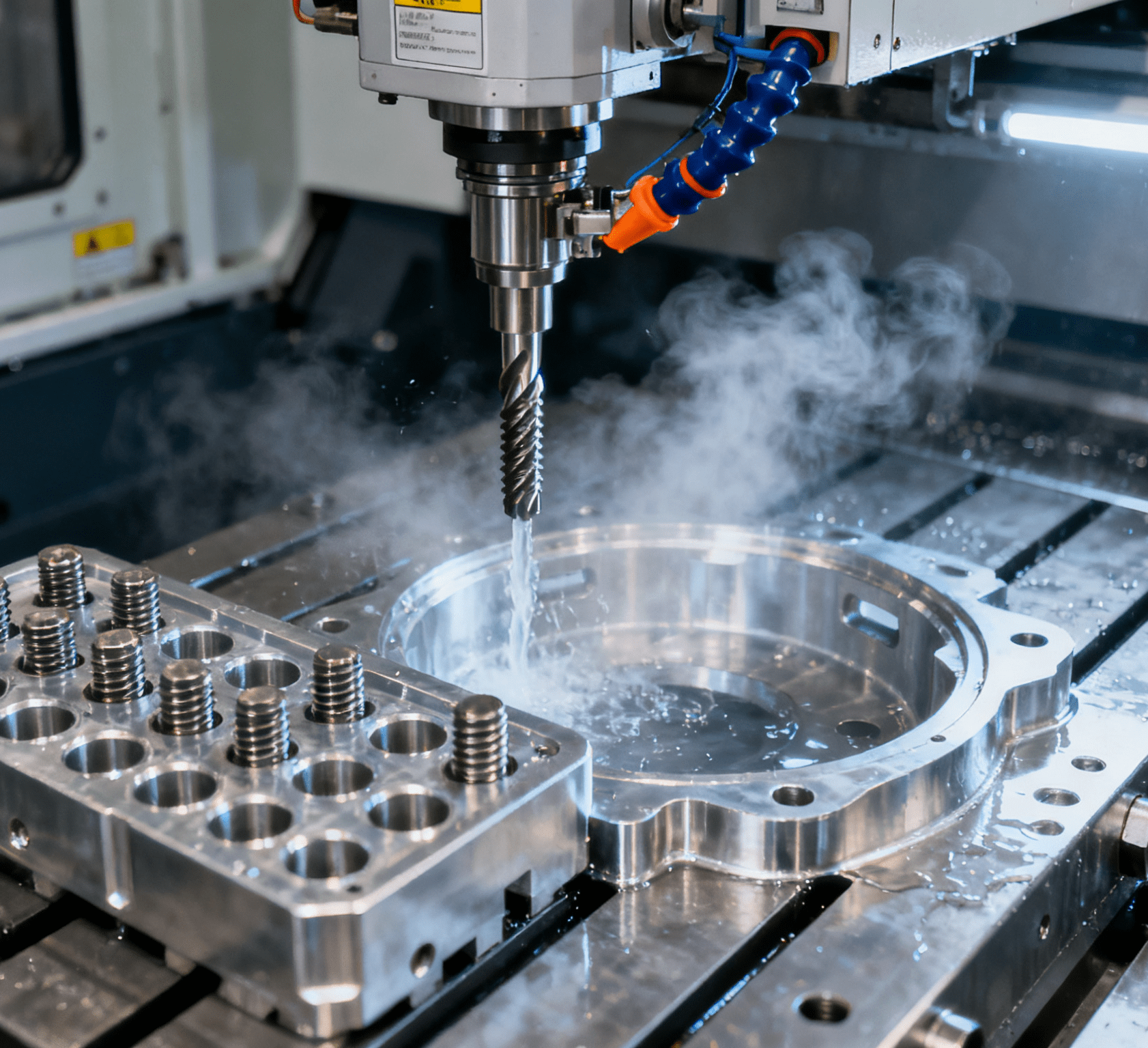

PV Glass Capacity Expansion and Technological Upgrading Spur New Equipment Demand

In 2025, the continuous growth of global photovoltaic installed capacity has promoted the capacity expansion and technological iteration of photovoltaic glass. Domestic leading enterprises plan to build new kilns in Indonesia, Vietnam and other places, driving the export demand for glass machinery. At the same time, photovoltaic glass is developing towards ultra-thinness (below 2.0mm) and large size, putting forward higher requirements for high-precision cutting and cleaning equipment. For example, the market growth rate of laser cutting equipment for 2.0mm thin glass reached 15%, with precision controllable within ±0.1mm. In addition, the order volume of extra-large size tempering equipment required for the production of photovoltaic double-glass modules increased by 27% year-on-year, with a single production line investment exceeding 85 million yuan.

Building Energy-Saving Policies and Consumption Upgrading Drive High-End Equipment Demand

The implementation of China’s Green Building Evaluation Standard (GB/T 50378-2024) requires the energy-saving rate of new buildings to be increased to 75%, directly promoting the production of high-performance products such as insulating glass and laminated glass. The market scale of construction glass machinery is expected to exceed 11 billion yuan in 2025, among which the demand for intelligent insulating glass production lines and high-precision edging machines will grow by more than 10%. At the same time, the popularization of smart homes has driven the growth of demand for home appliance glass. The order volume of curved glass and touch glass processing equipment increased by 12% annually. For related enterprises such as Lens Technology, 60% of its equipment purchases in 2025 will be used to introduce fully automatic strengthened glass production lines.

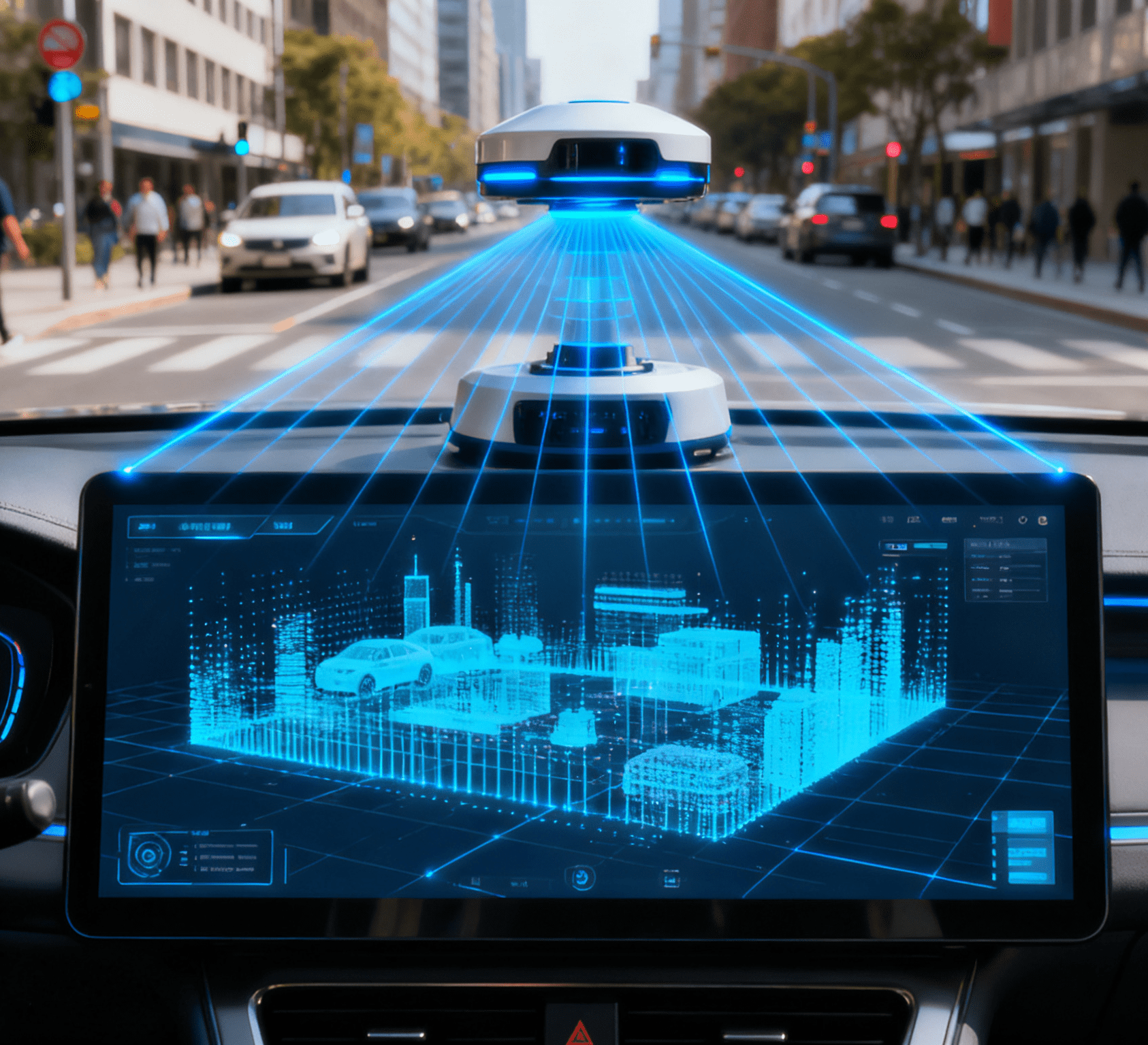

Global Layout and Emerging Market Expansion

Domestic glass machinery enterprises are accelerating their “going global” pace, seizing the international market through technology export and localized services. For example, North Glass products have covered more than 110 countries, with revenue from the “Belt and Road” countries accounting for more than 80%. Emerging markets such as Southeast Asia and the Middle East have become growth highlights. In 2025, China’s export volume of glass straight edge and bevel grinding machines to Southeast Asia increased by 15% year-on-year, replacing some European brands with cost-performance advantages. In addition, the European Carbon Border Adjustment Mechanism (CBAM) has forced local enterprises to upgrade equipment, and the penetration rate of China’s energy-saving glass machinery in the EU market has increased from 18% in 2020 to 35% in 2025.

In summary, driven by technological innovation, policy support and globalization dividends, the glass machinery industry is facing structural opportunities in 2025. Enterprises need to focus on intelligence, greenization and high-endization, consolidate their competitive advantages through technological R&D and market expansion, while paying attention to challenges brought by fluctuations in raw material prices and changes in the international trade environment.