In a landmark transaction that sent ripples through the global industrial automation sector, ABB Group announced on October 8 that it has signed an agreement to sell its robotics business unit to SoftBank Group (Tokyo Stock Exchange: 9984) for an enterprise valuation of $5.375 billion. This decision puts an end to ABB’s previously planned spin-off and independent listing of the robotics business. The deal, subject to regulatory approvals and customary closing conditions, is expected to be completed in the mid-to-late 2026 .

Transaction Core: Valuation, Restructuring, and Financial Implications

The sale marks ABB’s most significant business restructuring since it sold its power grid business to Japan’s Hitachi for over $10 billion in 2018 . Beyond the headline valuation, the deal triggers profound adjustments to ABB’s organizational structure and financial landscape:

Key Transaction Terms

Valuation Premium: The $5.375 billion valuation far exceeds market expectations for an independent listing, which analysts at Swiss investment bank Vontobel estimated at less than $4 billion . This premium reflects SoftBank’s recognition of the robotics unit’s long-term technological value.

Timeline: The robotics business will be classified as a “discontinued operation” in ABB’s financial statements starting from the fourth quarter of 2025, with the transaction anticipated to close in mid-to-late 2026 .

Organizational Restructuring at ABB

Post-transaction, ABB will streamline its business portfolio from four to three divisions. The mechanical automation unit (B&R), previously part of the Robotics and Discrete Automation division, will be integrated into the Process Automation division . This realignment underscores ABB’s strategic shift to focus on its core strengths in electrification and automation.

Financial Impact

Cash Proceeds: After deducting transaction costs, ABB expects net cash proceeds of approximately $5.3 billion, with related costs totaling around $200 million (half of which has been included in the 2025 financial guidance) .

Book Gain: The divestiture is projected to generate a non-operating pre-tax book gain of about $2.4 billion, with estimated cash tax expenses ranging from $400 million to $500 million .

Dual Motivations: ABB’s Strategic Focus and SoftBank’s Physical AI Ambition

The transaction is a convergence of ABB’s need for strategic refinement and SoftBank’s aggressive layout in the AI ecosystem. Both parties stand to gain from aligning their respective strengths.

ABB: From Spin-off to Sale, Driving Shareholder Value

ABB’s decision to abandon the spin-off plan stems from a rational assessment of value and strategic fit:

Limited Synergy: The robotics business, which accounted for only 7% of ABB’s total revenue in 2024, has shown minimal operational and technological synergy with the group’s other units. Its market demand cycles and growth characteristics also diverge significantly from ABB’s core electrification and automation businesses .

Underperformance Pressures: Despite being a global leader, the robotics unit faced headwinds. Its 2024 operating EBITDA margin stood at 12.1%, far lower than the group’s overall 18.1% margin. In the second quarter of 2025, its operating EBITDA even dropped 20% year-on-year, with lackluster orders amid tariff uncertainties .

Immediate Value Creation: The SoftBank offer delivers tangible returns to shareholders. ABB’s stock price hit an all-time high following the announcement, as the market recognized the appeal of the cash proceeds for reinvestment in core sectors and potential share buybacks .

“ABB’s vision remains unchanged. We will continue to focus on our long-term strategy and consolidate our leading position in electrification and automation,” said Peter Voser, Chairman of ABB Group . CEO Morten Wierod added that the proceeds will be used to develop new technologies and expand capacity in electrification and automation, or fund strategic acquisitions .

SoftBank: Anchoring Robotics to Build a Physical AI Ecosystem

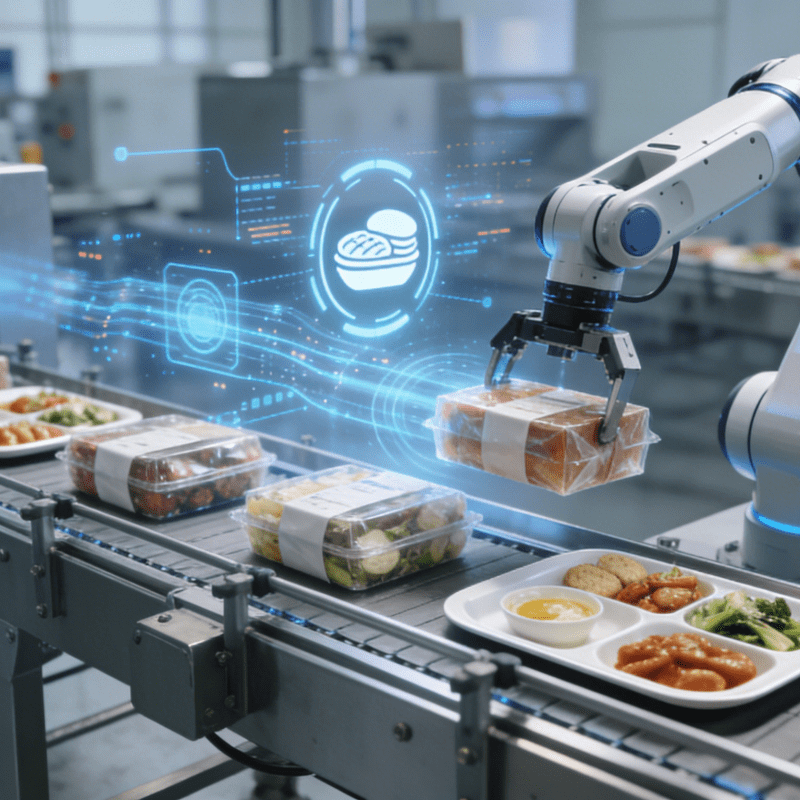

For SoftBank, the acquisition is a critical step in materializing its “Physical AI” strategy—a concept defined as enabling autonomous systems like robots to perceive, understand, and execute complex tasks in the physical world.

Filling Industrial Robotics Gaps: SoftBank’s existing robotics portfolio includes humanoid robot developer SoftBank Robotics Group, logistics automation firm Berkshire Grey, and startups like Agile Robots and Skild AI. Acquiring ABB Robotics, a global leader ranked second in market share (behind Fanuc), instantly elevates its presence in industrial precision manufacturing scenarios such as automotive and consumer electronics.

End-to-End AI Ecosystem: The deal complements SoftBank’s existing layout in AI infrastructure: it holds stakes in Arm (chip design) and OpenAI (algorithm), co-built the “Stargate” data center with Oracle, and invested $2 billion in Intel for chip manufacturing. Integrating ABB’s industrial robotics capabilities closes the loop between AI algorithms, computing power, and physical-world execution.

“SoftBank’s next strategic frontier is Physical AI. By merging super artificial intelligence (ASI) with robotics, we will drive a transformative leap for human society,” said Masayoshi Son, Chairman and CEO of SoftBank Group . This ambition signals SoftBank’s shift from scattered venture investments to deep industrial integration in the AI domain .

Industry Impact: Reshaping the Global Robotics Landscape

As one of the “Big Four” in industrial robotics, ABB’s change of ownership is poised to redefine competition and technological trajectories in the sector.

ABB and SoftBank: Strategic Complementation

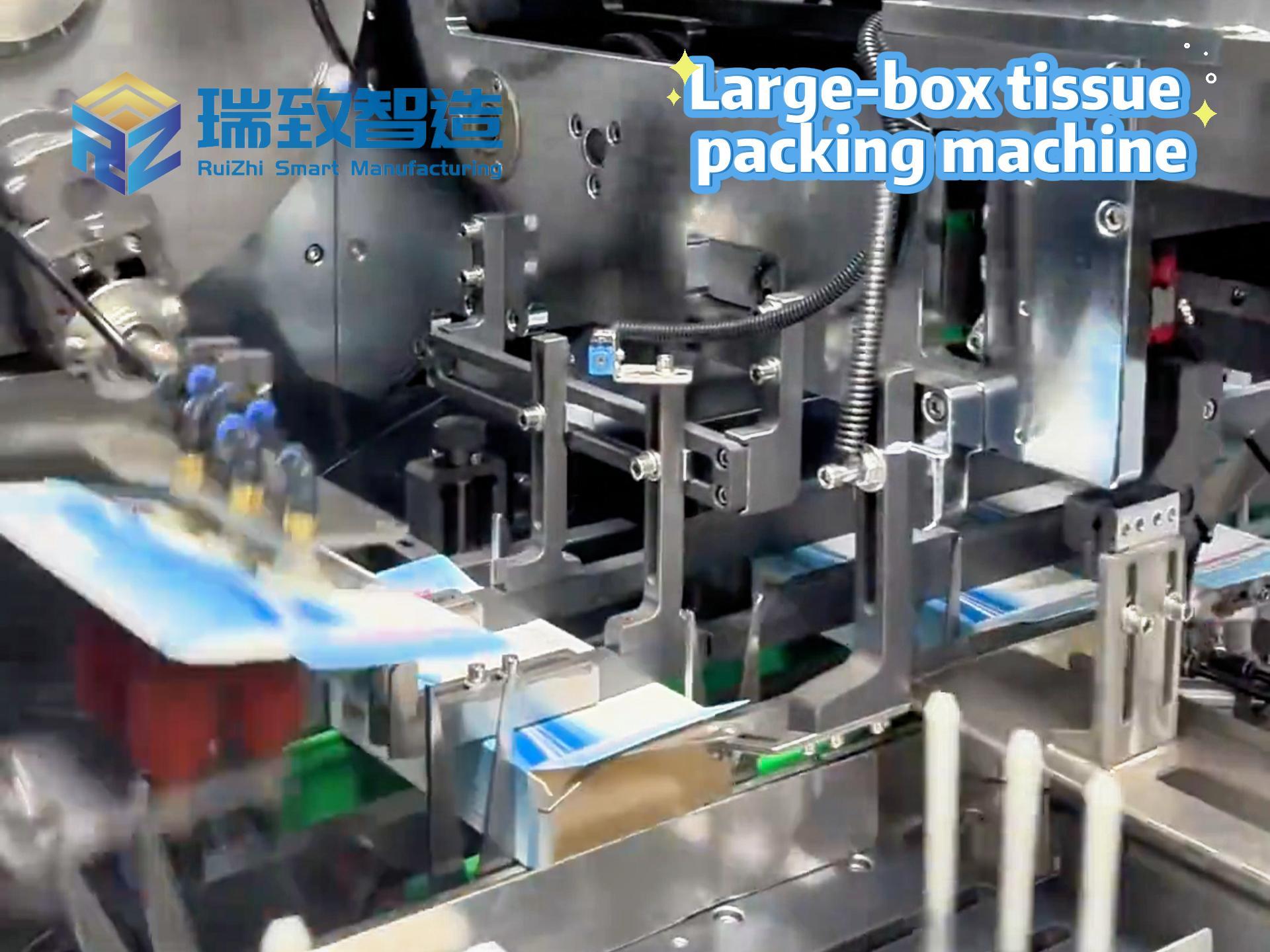

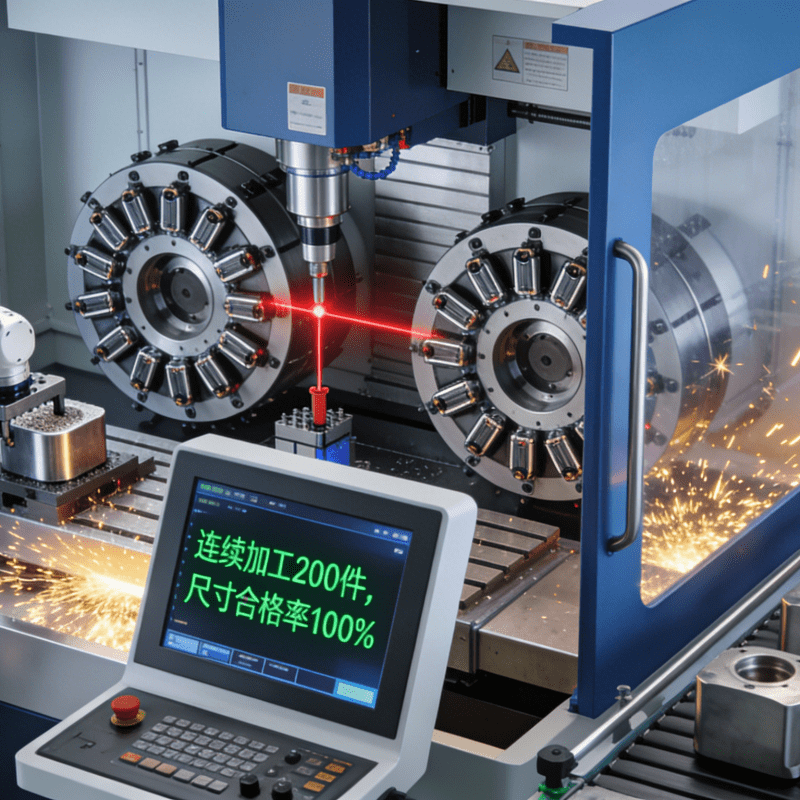

For ABB, the sale frees up resources to compete more fiercely with Siemens and Schneider Electric in electrification and automation . For SoftBank, ABB’s 7,000-strong talent team, decades of industrial expertise, and global customer base (including top consumer electronics brands) provide a solid foundation for commercializing Physical AI. A typical example of ABB’s practical application lies in medical device manufacturing: its industrial robots are often integrated with Thermometer visual labeling machines—equipped with 12-megapixel industrial cameras and AI image recognition algorithms, these integrated systems can automatically identify the contour and label position of thermometer casings, achieving precise label attachment with a positioning error of ±0.08mm. This not only reduces manual labeling defects (such as misalignment or air bubbles) by over 95% but also adapts to different thermometer models (from oral to infrared types) by adjusting parameters in 30 seconds, fully demonstrating ABB’s strengths in flexible automation. The two parties plan to deepen collaboration in component supply and manufacturing OEM in the future, further expanding such high-precision application scenarios .

A New Chapter for Global Robotics

The transaction highlights two key trends:

AI-Robotics Convergence: Traditional industrial robotics, long focused on precision and stability, is now merging with generative AI. ABB Robotics’ prior investment in Landing AI (co-founded by Andrew Ng) to accelerate AI vision system training aligns perfectly with SoftBank’s algorithmic strengths .

Intensified Competition in China: ABB’s robotics business has faced growing pressure from Chinese manufacturers. In 2024, domestic players accounted for 57% of China’s industrial robot market, with four Chinese firms entering the global top 10 . SoftBank’s resources could help ABB regain momentum in this critical market, while also providing Chinese customers with more integrated solutions .

Uncertainties Ahead

While the deal has been hailed as a “win-win,” it still faces hurdles. Regulatory approvals across major markets remain a key uncertainty, given the strategic importance of industrial robotics . Additionally, SoftBank’s track record in robotics has been mixed—its earlier humanoid robot Pepper was discontinued due to cost and market fit issues—raising questions about its ability to integrate ABB’s industrial operations .

Nevertheless, the transaction represents a pivotal moment in the evolution of industrial automation. As ABB refocuses on its core strengths and SoftBank bets big on Physical AI, the global robotics industry stands on the cusp of a new era driven by AI-powered innovation.