Alibaba is no longer content with being just a large model technology provider; it has officially joined the battle for C-end (consumer-end) AI entry points.

On November 17, Alibaba officially announced the launch of its “Qianwen” project. The public beta version of the Qianwen App was simultaneously released on major app stores, with web and PC versions also made available. This move signifies that Alibaba is no longer limiting itself to a technology provider role but is directly competing for a share in the AI application entry point market.

TechWeb discovered that the previously installed “Tongyi” App on mobile devices has been upgraded to become the “Qianwen” App.

From “Tongyi” to “Qianwen” (the Chinese name for Alibaba’s large model), Alibaba seemingly aims to extend the international recognition and influence of its Qwen large model to C-end AI applications. From a marketing perspective, this is undoubtedly a shrewd move.

In fact, according to the 2025 Q3 China AI Application Market Report released by QuestMobile, the monthly active users (MAU) of the Tongyi App stood at 3.06 million—far behind the leading players, Doubao (170 million) and DeepSeek (145 million).

Reports indicate that Alibaba’s core management views the Qianwen project as a “critical battle for the AI era.” Built on Qwen3, the world’s top-performing open-source model, this application adopts a free strategy and integrates with various daily life scenario ecosystems, directly competing with ChatGPT.

Whether the launch of the Qianwen App will drive a surge in user numbers—surpassing Doubao and DeepSeek domestically and competing with ChatGPT globally—ultimately depends on Qianwen’s actual capabilities.

Zhu Xiaohu, Managing Director of GSR Ventures, holds an optimistic view. He posted on social media, “Why can Qianwen compete head-on with ChatGPT? Because it combines three key elements: technology, products, and ecosystem.”

TechWeb’s Hands-On Test: Qianwen App Experiences Glitches in Special Effects Video Generation

According to official descriptions, the Qianwen App has a clear core positioning: it serves as Alibaba’s official AI assistant powered by its most advanced large model, leveraging cutting-edge model capabilities to create an AI personal assistant that “can chat and get things done.”

The Qianwen App offers two models for users to choose from, displayed at the top of the homepage:

Qwen-Qianwen Comprehensive AI Assistant: Provides comprehensive answers to various work, study, and daily life questions.

Qwen-Max: Focuses on solving problems related to reasoning, programming, and more complex tasks.

Above the Qianwen App’s chat interface, there are 14 functional entry points, including: In-depth Thinking, AI Image Editing, Translation, Video Calls, Real-Time Note-Taking, Photo-Based Problem Explanation, AI Video Generation, PPT Creation, AI Image Generation, In-Depth Research, Intelligent Writing, Document Reading, Voice Calls, and Audio/Video Speed Reading.

Nearly all these features were already available in the previous Tongyi App. For example, functions like Real-Time Note-Taking and Audio/Video Speed Reading were initially part of Alibaba’s Tongyi Tingwu (a speech-to-text and analysis tool) before being integrated into the efficiency module of the Tongyi App. These features have been refined through long-term user feedback.

In TechWeb’s hands-on test, the Qianwen App performed stably overall, except for a glitch encountered during the “AI Video Generation” function.

Strong Technical Foundation and Ecosystem: Qianwen App’s Core Advantages

Undoubtedly, the technical foundation is the Qianwen App’s greatest strength. The underlying Qwen open-source model ecosystem has become a core force in the global AI community.

According to public ranking data, Qwen3 has reached the same level as GPT-5 and Gemini 2.5 Pro, supporting 119 languages. Its global download volume has even surpassed Llama, making it the most relied-on open-source model among developers worldwide.

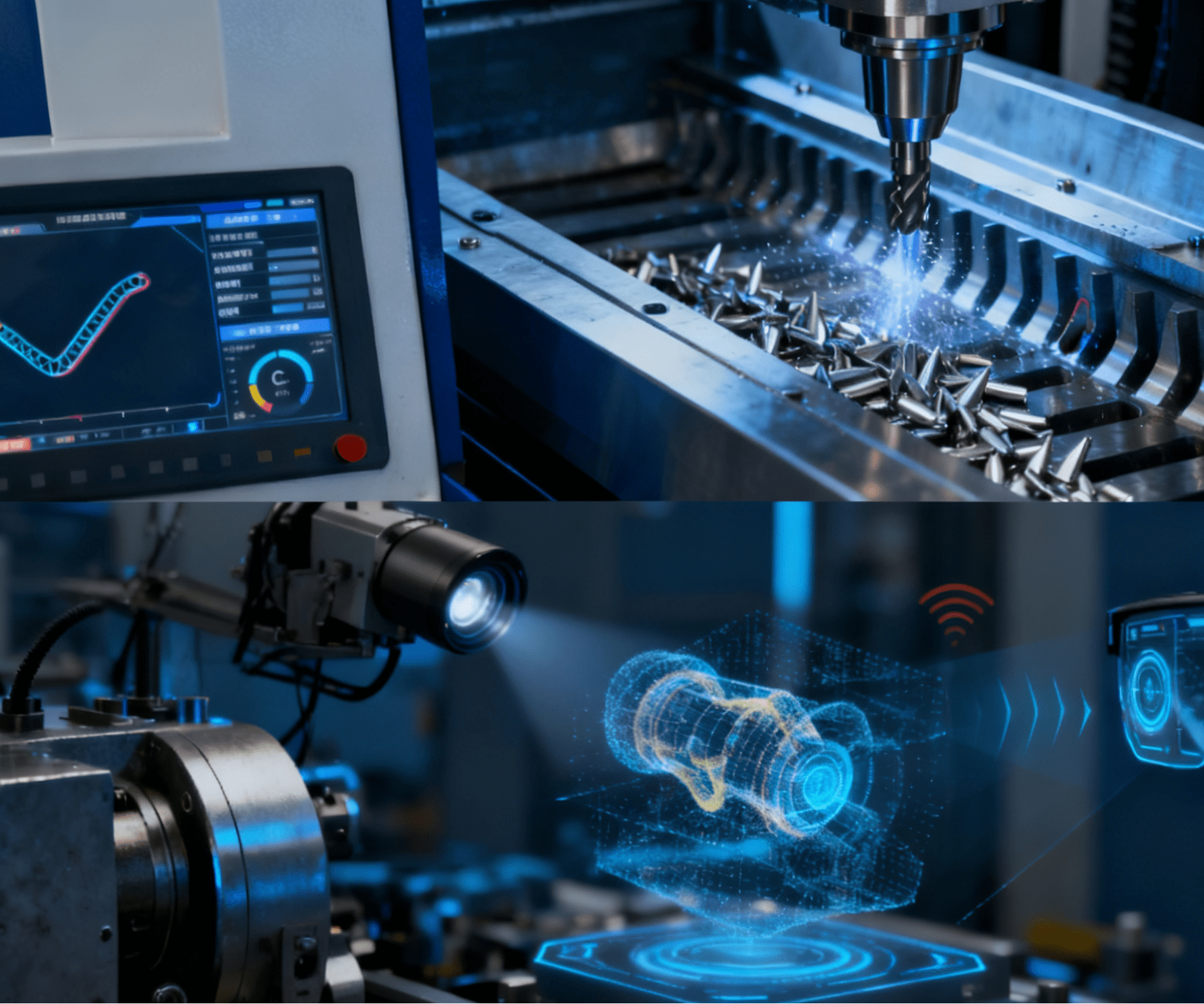

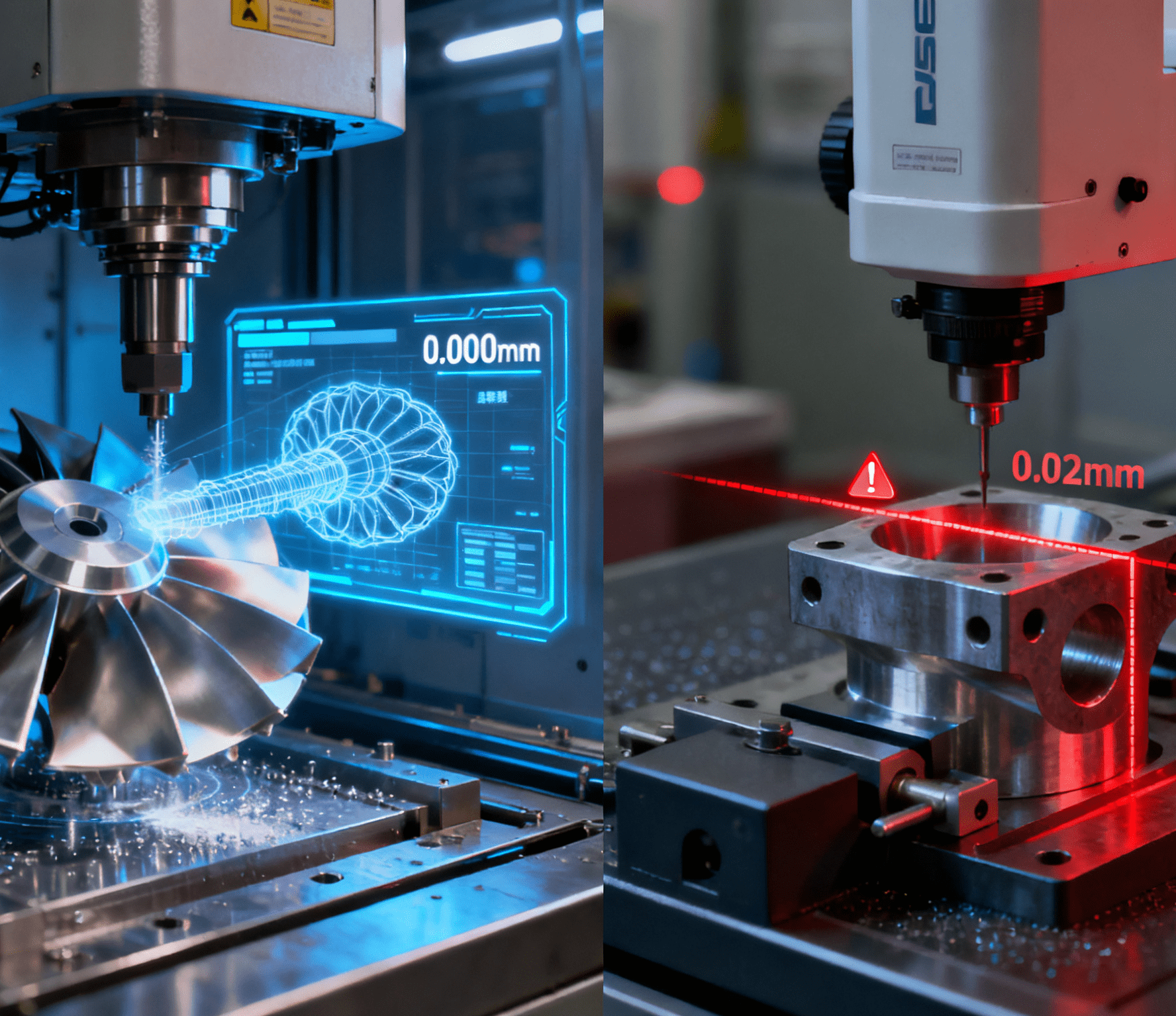

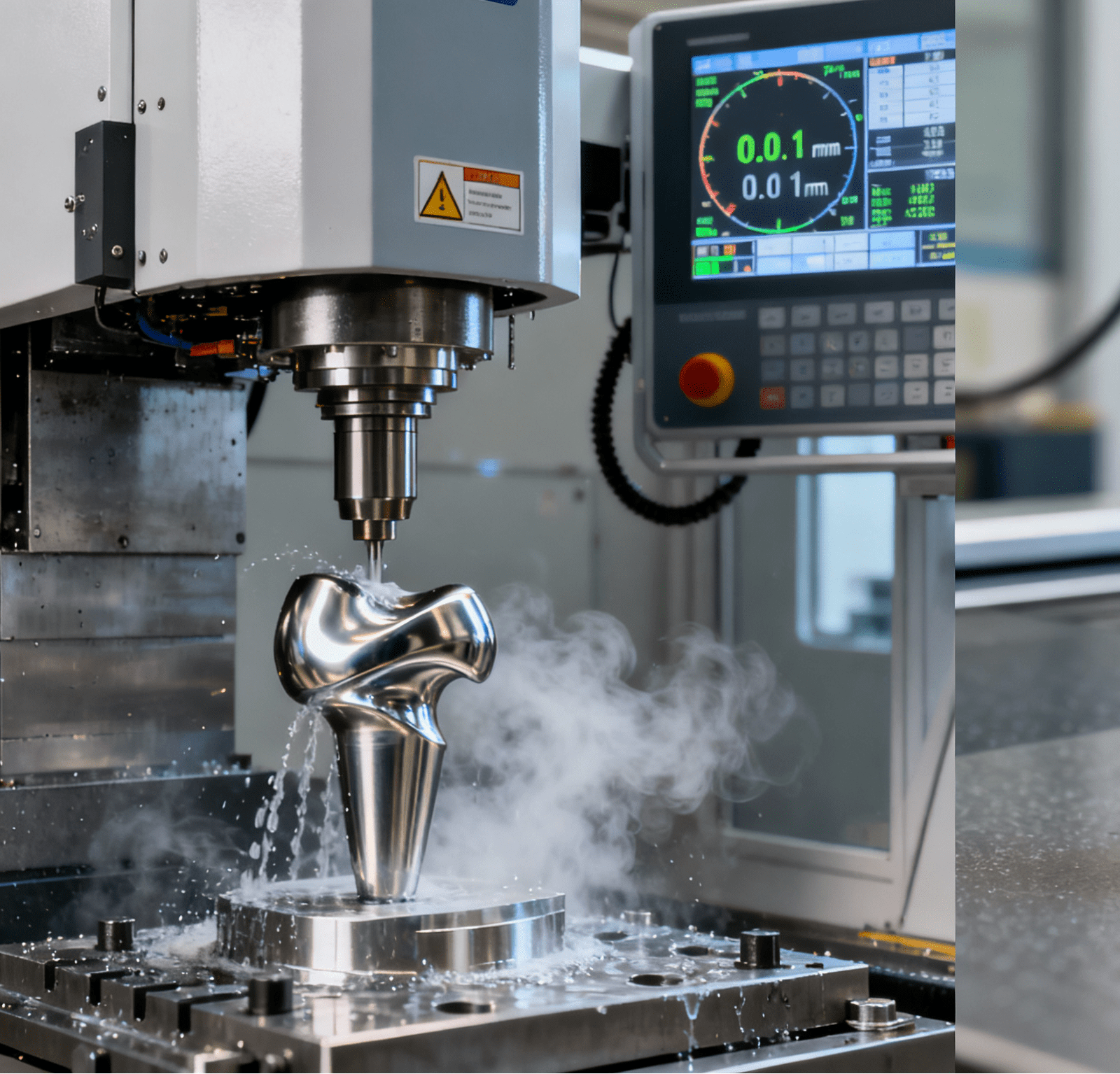

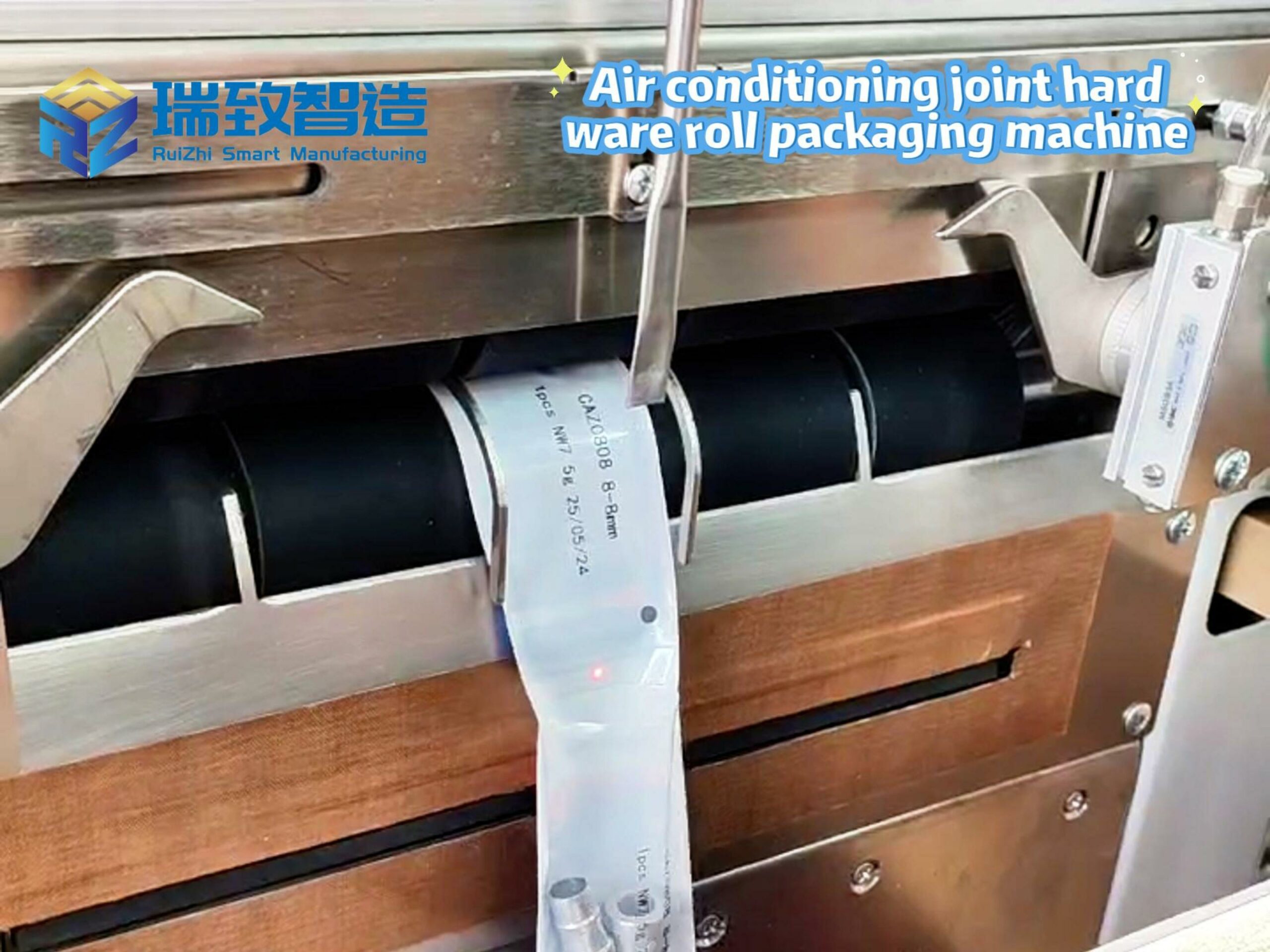

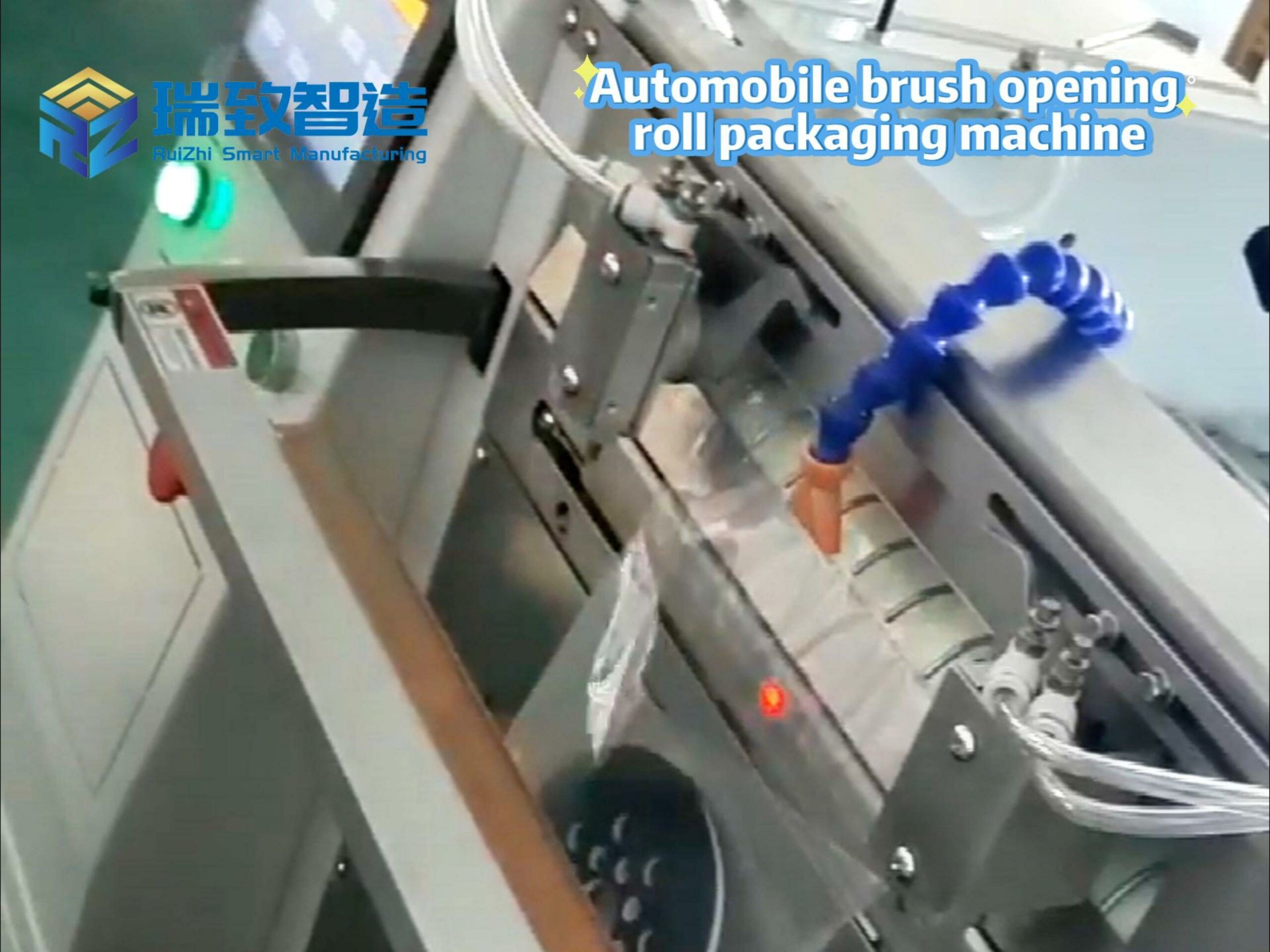

In addition, scenario-based implementation is another ace up the Qianwen App’s sleeve. Alibaba plans to integrate various daily life scenarios into the Qianwen App—including maps, food delivery, ticket booking, office work, learning, shopping, and healthcare—while also extending its reach to industrial automation scenarios. For instance, leveraging the Qwen large model’s powerful data analysis and real-time optimization capabilities, the Qianwen ecosystem can connect with automatic feeding equipment for small metal sheets (a key device in precision manufacturing), enabling intelligent adjustment of feeding speed, material alignment accuracy, and fault pre-diagnosis—effectively improving production efficiency for small and medium-sized manufacturing enterprises. This cross-scenario integration creates a universal app entry point that bridges consumer and industrial needs.

However, a key challenge for the Qianwen App lies in transforming the capabilities of a top-tier large model into user-friendly AI product features and truly retaining users.

Battle for AI Entry Points Among Tech Giants Heats Up

According to QuestMobile’s 2025 Q3 China AI Application Market Report, ByteDance’s Doubao, DeepSeek, and Tencent’s Yuanbao rank among the top players.

Only two apps have exceeded 100 million monthly active users:

ByteDance’s Doubao: 172 million MAU

DeepSeek: 145 million MAU

Tencent’s Yuanbao ranks third with 32.86 million MAU, a significant gap behind the top two.

Meanwhile, Baidu has integrated its AI capabilities into its search engine, enhancing the penetration of Baidu AI Search through AI application plug-ins. Baidu AI Search boasts a massive 382 million MAU, with an 18.63% quarter-on-quarter growth—it has also topped the monthly active rankings in China’s AI search sector for three consecutive quarters this year.

Doubao’s advantage stems from its strong ecosystem support. Its leading position is attributed to ByteDance’s “universal platform + vertical hit products” strategy. Doubao converts traffic from ByteDance’s ecosystems (such as Douyin and CapCut) into its own user base, while using the universal capabilities of its main app to support various vertical scenarios, forming an ecological cycle.

Tencent’s Yuanbao has taken a different approach: leveraging Tencent’s cross-domain ecological traffic pool to launch large-scale user acquisition campaigns. According to AppGrowning statistics, after integrating the “full-capacity” DeepSeek-R1 model in early 2025, Tencent Yuanbao adopted an aggressive promotion strategy.

Baidu AI Search maintains its leading MAU thanks to its traditional advantages in the search sector and continuous investment in AI technology. Additionally, Baidu’s MCP (Model-as-a-Service) platform has onboarded over 18,000 high-quality service providers, covering scenarios such as daily life, finance, and e-commerce.

The Qianwen App’s greatest advantages lie in its robust technical foundation and comprehensive ecosystem. Alibaba possesses an end-to-end capability system covering underlying computing power, model systems, and application ecosystems.

From “Technology Experiment” to “Commercial Implementation”: The New Phase of AI Competition

Judging from the focus of major tech giants, competition in the large model industry is gradually shifting from the “technology experiment” phase to the “commercial implementation” phase. Developing unique competitive advantages and establishing viable AI business models have become the key factors determining market rankings.

Just like in the internet and mobile internet eras, owning an AI entry point in the AI era means owning users, data, and future growth opportunities.

At a time when model capabilities are still evolving rapidly and AI commercialization paths are still being explored, all participants dare not slack off—because this battle is crucial to their survival and standing in the AI era.

Alibaba’s launch of the Qianwen App is just a new milestone in this battle for AI entry points. As technology advances and user needs evolve, the competition will only grow more intense.

Supplementary Terminology Explanation:

Automatic feeding equipment for small metal sheets: A precision automation device designed to continuously and accurately transport small metal sheet components (common in electronics, automotive parts, and hardware manufacturing) to assembly lines or processing stations. When integrated with AI systems like Qianwen, it can achieve data-driven intelligent operation and maintenance, reducing manual intervention and improving production stability.