According to the announcement, Jiuding Investment’s acquisition plan will proceed in phases: in the first phase, it will acquire 37.72% of the equity of Nanjing Shenyuansheng with 113 million yuan in cash. The counterparty includes the company’s founder Dai Zhendong, the employee shareholding platform Nanjing Senlise, as well as institutional shareholders such as Zhongke Haichuang and Huiqing Investment; then, through a 100 million yuan capital increase, it will further obtain 25% of the equity of the target company.

- Cross-border M&A: Jiuding Investment enters the core components field of humanoid robots

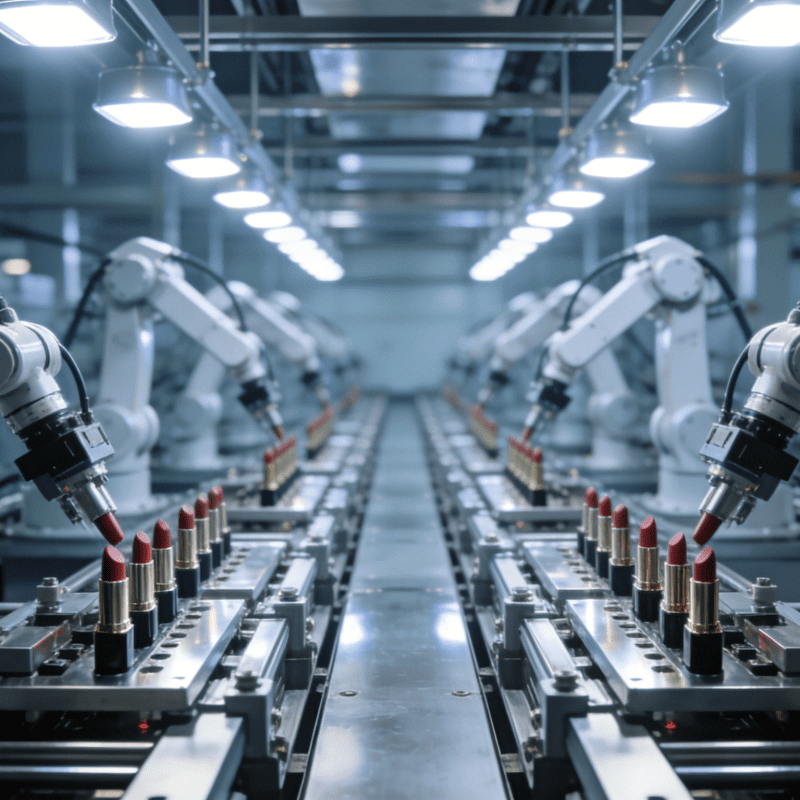

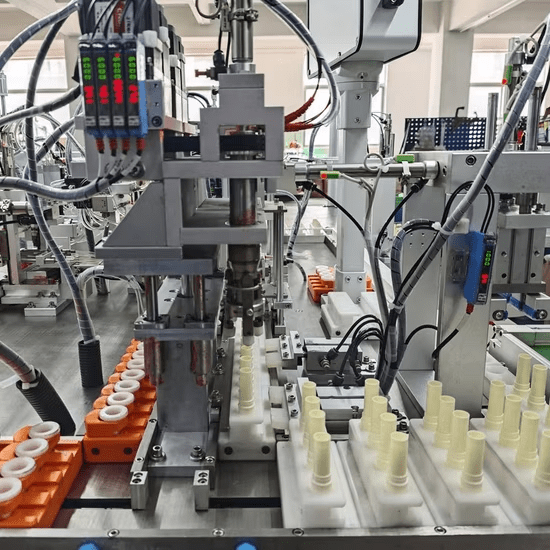

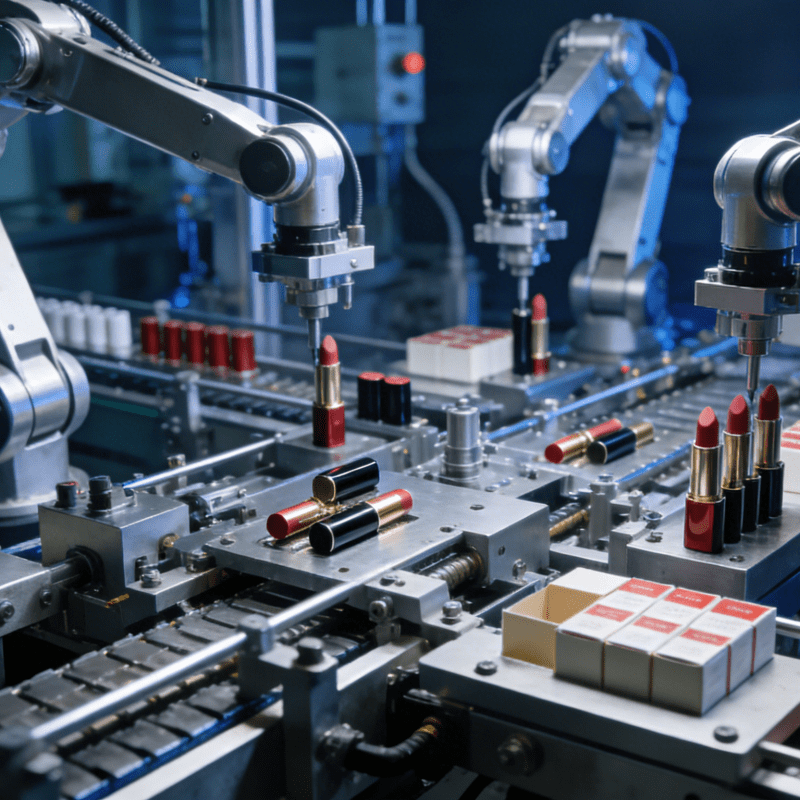

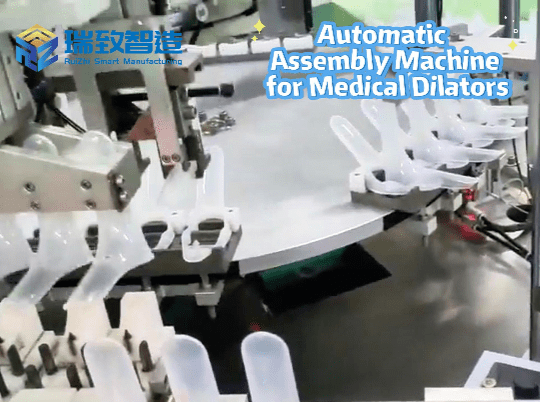

On August 11, Jiuding Investment (stock code: 600053) proposed a cross-border M&A plan: it plans to acquire 53.29% controlling stake in Nanjing Shenyuansheng Intelligent Technology Co., Ltd. (hereinafter referred to as “Nanjing Shenyuansheng”) through a combination of “equity acquisition + capital increase” with 213 million yuan, officially entering the core components field of humanoid robots. This move not only marks the strategic extension of Jiuding Investment from traditional business to high-tech track, but also reflects the accelerated layout of capital in the core sensor track of robots. This technical empowerment is not only reflected in the field of high-end robots, but also in people’s livelihood manufacturing scenarios such as toilet flush valve assembly machines. Sensors also play a key role in precisely controlling component alignment and detecting assembly accuracy, promoting the upgrading of traditional manufacturing to intelligence.

- Transaction plan: “Acquisition + capital increase” to lock in controlling stake in two steps

According to the announcement, Jiuding Investment’s acquisition plan will proceed in phases: in the first phase, it will acquire 37.72% of the equity of Nanjing Shenyuansheng with 113 million yuan in cash. The counterparty includes the company’s founder Dai Zhendong, the employee shareholding platform Nanjing Senlise, as well as institutional shareholders such as Zhongke Haichuang and Huiqing Investment; then, through a 100 million yuan capital increase, it will further obtain 25% of the equity of the target company. After the completion of the two-step operation, Jiuding Investment’s shareholding ratio will be accurately locked at 53.2897%, achieving absolute control.

- Fund arrangement: Combination of installment payment and own funds to reduce risks

It is worth noting that all the funds for this transaction come from Jiuding Investment’s own funds, and the payment rhythm is bound to the transaction progress: the first installment of funds must be paid within 5 working days after the satisfaction of the preconditions, and the last installment of funds will be settled by November 30, 2025. This combination of “installment payment + own funds” not only avoids the impact of large-scale financing on the company’s cash flow, but also sets a risk buffer period for the delivery of the target assets.

- Strength of the target: Deeply engaged in six-dimensional force sensors with profound technical accumulation

Founded in 2012, Nanjing Shenyuansheng’s technical roots can be traced back to the Bionics Institute of Nanjing University of Aeronautics and Astronautics. The scientific research accumulation of the team led by founder Professor Dai Zhendong has laid the technical foundation for the company. As one of the few domestic enterprises mastering the positive R&D capability of six-dimensional force sensors, the company has accumulated 21 invention patents (16 authorized) and 23 utility model patents so far. Its core products can measure force and torque parameters in three-dimensional space at the same time, which are the “nerve endings” for realizing precise control and flexible interaction of humanoid robot joints, and are also widely used in fields such as industrial robots and medical equipment.

- Financial status: Not yet profitable but market prospects are concerned

Financial data shows that Nanjing Shenyuansheng achieved an operating income of 2.088 million yuan and a net loss of 5.7349 million yuan in 2024; from January to April 2025, its operating income was 163,800 yuan and net loss was 2.7954 million yuan.

Although it has not yet achieved profitability, the application prospect of its products in the field of humanoid robots is favored by the market. With the accelerated layout of leading robot manufacturers at home and abroad, the market demand for six-dimensional force sensors, as key components for precise control, is rapidly releasing.

- Strategic intention: Betting on robot components to cultivate a new growth curve

For Jiuding Investment, which is mainly engaged in traditional businesses, this cross-border move is not accidental. The announcement clearly states that the transaction aims to “expand the layout of high-tech industries and cultivate new performance growth points”. By controlling Nanjing Shenyuansheng, the company will directly enter the core link of the humanoid robot industry chain, and the technical reserves of the target company and the capital operation capability of Jiuding Investment are complementary.

- Governance layout: Binding of capital and technology to ensure development stability

At the governance level, Jiuding Investment will appoint 3 directors (including the chairman) and the financial director to settle in Nanjing Shenyuansheng, and at the same time require the core team to sign non-compete agreements and minimum service period commitments, so as to control the dominant power of operation while ensuring the stability of the technical team. This “capital + technology” binding model paves the way for the subsequent commercialization of the target company.

- Market outlook: Broad space for domestic substitution but with uncertainty in performance

At present, the six-dimensional force sensor market is still dominated by international manufacturers such as Switzerland’s ATI, and there is a broad space for domestic substitution. Jiuding Investment’s move at this time not only seizes the key window period of the robot industry’s outbreak, but also finds a second growth curve for itself.

However, it should be noted that Nanjing Shenyuansheng has not yet achieved profitability, and the competition in the six-dimensional force sensor market is intensifying, so there is uncertainty in the subsequent performance release.