Since the day Horizon Robotics was founded, we have been determined to be the “brain of robots,” said Yu Kai, founder and CEO of Horizon Robotics, at the company’s first Technology Ecosystem Conference held recently.

However, affected by the industry environment and strategic adjustments, Horizon Robotics downsized its business scope in early 2019 and resolved to fully commit to autonomous driving research. Even so, Yu Kai admitted that the company’s dream of developing robots had never faded, and it had always kept a small team dedicated to this field.

It was not until early 2024 that Horizon Robotics spun off its robotics division to establish D-Robotics, which focuses on the underlying computing platform for robots, marking the company’s renewed charge into the robotics track.

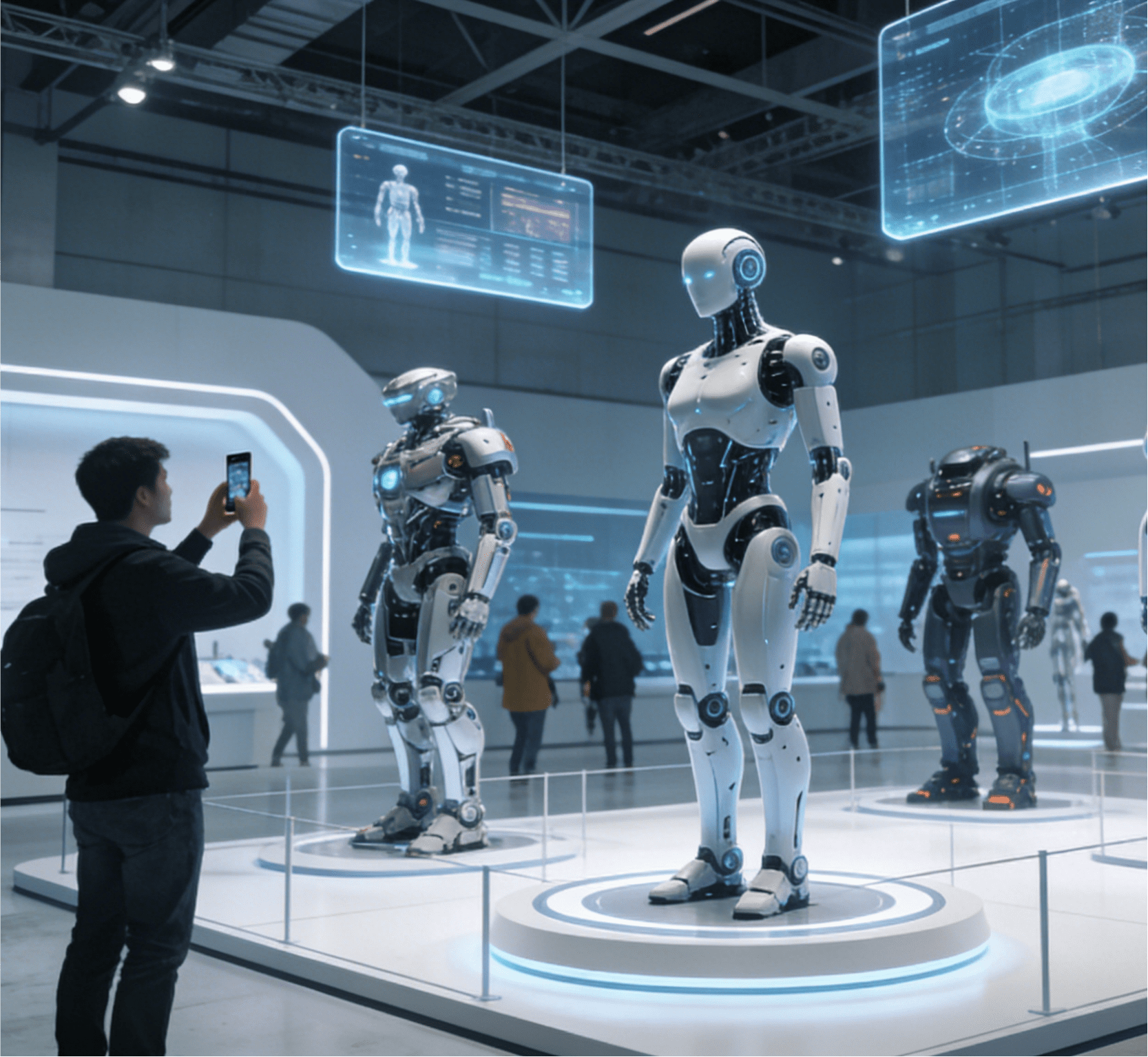

Horizon Robotics’ strategic expansion in the robotics sector is not an isolated case in the autonomous driving field. As embodied intelligent robots have increasingly replaced autonomous driving as the new highlight of the technology industry, a growing number of ADAS suppliers have begun to reorient their strategies, setting their sights on the robotics sector—a sea of potential—and striving to carve out a new growth curve.

Replicating the Smart Automotive Ecosystem in the Robotics Track

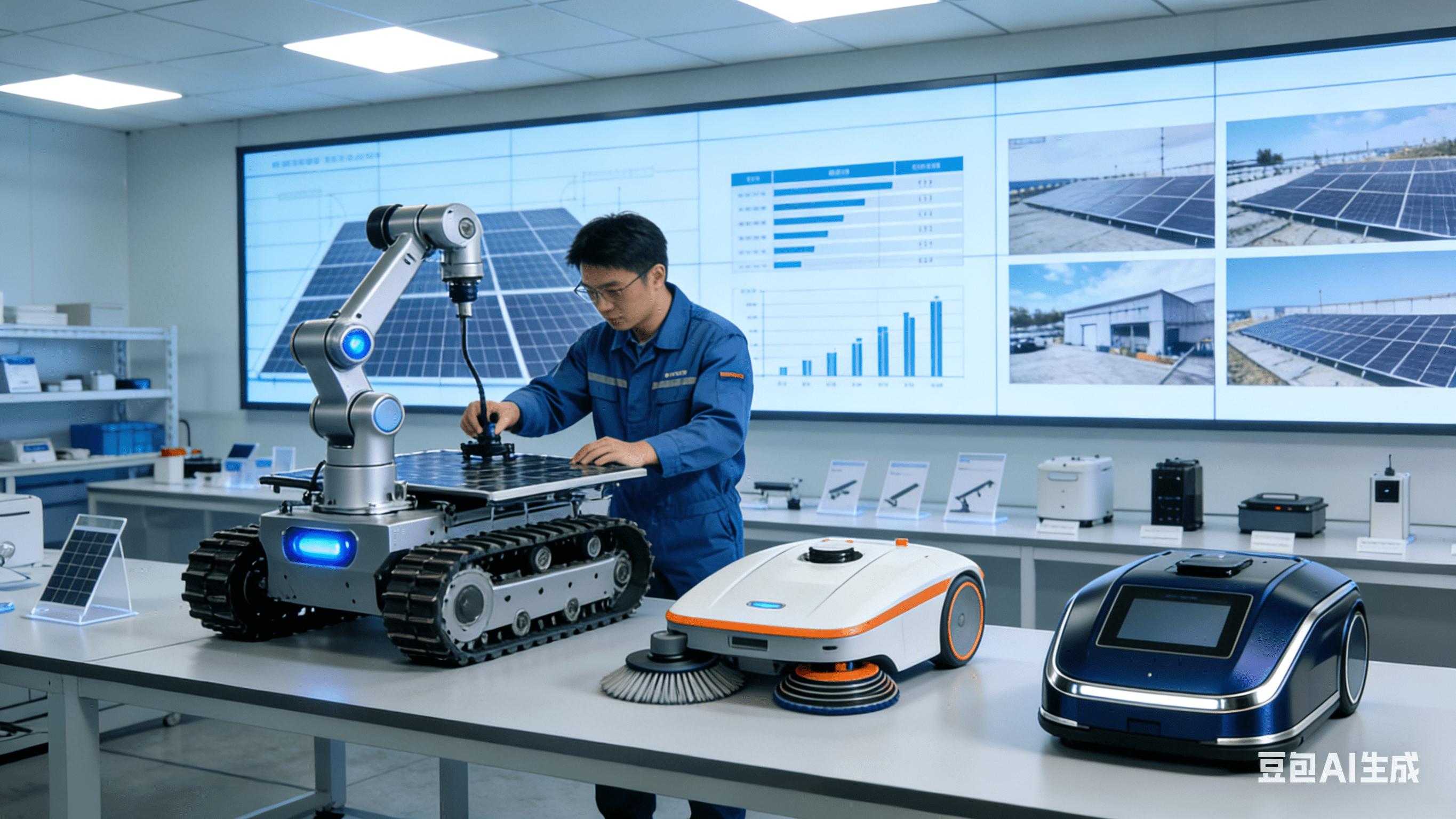

Similar to its ADAS business, Horizon Robotics has built a complete ecosystem in the robotics field, spanning from underlying computing to upper-layer applications.

For various robotics application scenarios, D-Robotics not only provides underlying chips but also offers a comprehensive technical support system, including development toolchains, real-time operating systems, open-source code, one-stop development platforms, and foundation models. It is also actively fostering an open and collaborative developer ecosystem.

According to Hu Chunxu, Vice President of Developer Ecosystem at D-Robotics, the company is committed to becoming the “mother ecosystem of the upcoming robot era”.

Behind this layout lies Horizon Robotics’ unique business insight into the robotics industry: the robotics sector inherently features non-standardized attributes, with highly fragmented application scenarios and product forms, making it unlikely for an oligopolistic market structure to take shape.

Therefore, Horizon Robotics’ vision is not to develop an advanced robot on its own, but to refine the underlying technologies and become the unified intelligent cornerstone behind countless robots. “While this is just our stance, I believe that in the future, many companies in the robotics field will develop technologies independently, and many others will choose to partner with suppliers like D-Robotics,” said Wang Cong, CEO of D-Robotics.

Currently, the market has responded positively to D-Robotics. Statistics show that D-Robotics has launched more than 100 consumer intelligent products with partners, connecting over 100 upstream and downstream partners and more than 100,000 developers, including Narwal, VITAPOWER, Insta360, Fourier Intelligence, and Accelerated Evolution.

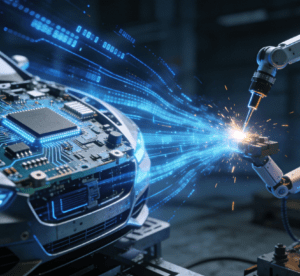

Two weeks before Horizon Robotics’ Technology Ecosystem Conference, Black Sesame Technologies, another chip-focused company, also announced its ambitious foray into the robotics business.

To this end, Black Sesame Technologies has launched SesameX™, a multi-dimensional embodied intelligent computing platform designed for the full-brain intelligence of robots, officially kicking off its new journey in the robotics sector.

It is reported that the underlying computing platform of SesameX™ can be adapted to three modules—Kalos, Aura, and Liora—for different application scenarios, supporting low-speed wheeled robots, quadruped robots, embodied intelligent humanoid robots, and other use cases.

Along with the release of the SesameX™ platform, Black Sesame Technologies also unveiled its robotics cooperation ecosystem and announced the first batch of partner companies, including CloudWalker, Fourier Intelligence, Independent Variable, Geek+, and DeepCourtyard. Some of these cooperative projects have already been commercially deployed.

In fact, besides chip manufacturers like Horizon Robotics and Black Sesame Technologies, LiDAR suppliers such as Hesai Technology and RoboSense, leveraging their profound experience in automotive LiDAR, have also made in-depth forays into the robotics business.

Hesai Technology has successfully deployed its XT series high-precision LiDAR on humanoid robots and quadruped robots of many brands, including Unitree Robotics, Magic Atom, and VITAPOWER. By the end of November, the shipment volume of its JT series 3D LiDAR had exceeded 200,000 units, which are widely used in lawn-mowing robots, handling robots, delivery robots, cleaning robots, and other fields.

RoboSense’s digital LiDAR products, the E1R and Airy, have been integrated into various products, such as the Zhiyuan Lingxi X2 and Pudu Robotics’ quadruped robot PUDU D5, and the company has also entered into partnerships with several leading lawn-mowing robot enterprises.

Notably, RoboSense is not only expanding the application of LiDAR in the robotics field horizontally but also focusing on the coordination of robots’ “hands, eyes, and brain” and vertically developing core technologies including the Active Camera integrated sensor system, VLA models, and dexterous hands to build a more complete ecosystem of robot perception and execution product lines.

At present, RoboSense’s AC1 has been installed on the Zhongqing Robot T800, which was officially launched and put on sale on December 2, with a pricing of 1… (Note: The original text has incomplete pricing information here).

Shifting Capital Trends Reshape Strategic Narratives

This shift in capital trends has also profoundly influenced the strategic narratives of enterprises. For ADAS suppliers, especially start-ups in need of financing, simply promoting autonomous driving technologies is no longer appealing to investors. Entering the robotics sector and embracing embodied intelligence have become crucial strategic moves to reignite capital interest and map out new growth prospects.

Cross-Border Breakthrough: A Gamble Worth Taking?

Despite ADAS suppliers’ strong confidence in their cross-border expansion and their advantages in technology, industry resources, and capital, there are still many uncertainties as to whether embodied intelligence can truly become their second growth curve.

The current embodied intelligence market is still in the nurturing stage. While its long-term prospects are promising, short-term challenges such as technological gaps and fierce competition mean that it will not be easy for ADAS suppliers to reap substantial profits in the robotics field.

Technological differences pose the first major obstacle for ADAS suppliers venturing into robotics. Although autonomous driving and robotics share the same technical roots, their application scenarios vary significantly, resulting in distinct requirements for computing architecture, power consumption control, and perception accuracy. In particular, robots need to move in a three-dimensional space and interact complexly with the physical world, which demands much higher spatial perception accuracy than that required for autonomous driving.

Yu Kai pointed out that compared with autonomous driving, embodied intelligence is still in an earlier developmental stage. In terms of model architecture, the focus in the short term will certainly be on optimizing VLA and action modeling; in the long run, however, the industry should shift toward self-game and reinforcement learning based on simulation and a true WorldModel.

Building a genuine WorldModel is no easy task. The current concept of WorldModel held by many is one-sided, as it only covers texture, shape, and 3D visual models based on vision. A real WorldModel should also include physical properties such as friction, dynamic models, materials, weather, and wind resistance, which makes it an extremely complex undertaking. In terms of training paradigms, the industry currently relies on traditional data-driven learning, but robots of the future should be equipped with lifelong learning capabilities, Yu Kai added.

All these factors indicate that there is still a long way to go before the industry can develop a fully functional WorldModel.

Furthermore, breakthroughs in robot intelligence are highly dependent on high-quality, large-scale real-world interaction data. The scope and depth of data collection, in turn, are directly constrained by the maturity and cost of robot hardware. As Jin Rong, Investment Director at Legend Capital, put it, “The key to achieving embodied intelligence lies in breakthroughs in intelligence, which are rooted in data. However, data cannot be generated out of thin air; there must be sufficiently optimized robot hardware”.

Given this, many industry experts hold a cautiously optimistic attitude toward the implementation path of embodied intelligence. They generally believe that in the short to medium and long term, human-robot collaboration will become the mainstream model, where robots and humans complement each other and work in tandem, rather than robots completely replacing humans.

This view of gradual scenario implementation suggests that large-scale market take-off is still some way off, and industry participants need to maintain sufficient strategic patience.

For ADAS suppliers, the challenges go beyond technology and extend to the reconstruction of mindset and business models. Unlike the hierarchical and well-standardized automotive supply chain, the robotics industry is characterized by diverse product forms, lack of standards, and fragmented demands, which places high demands on enterprises’ ability to respond flexibly, iterate quickly, and provide customized solutions.

The competitive landscape in the embodied intelligence sector is also grim. The robotics field is already dominated by powerful players, including long-established enterprises like Ubtech Robotics, tech giants such as Tesla and Figure AI, and numerous specialized robot companies that have established technological barriers in vertical sectors. ADAS suppliers are entering a fiercely competitive red ocean market.

What is more alarming is that the robotics sector has shown signs of a price war similar to that in the automotive industry. This suggests that even if the market expands significantly in the future, profit margins across the industrial chain may be continuously squeezed.

In summary, ADAS suppliers aiming to build a second growth curve in the robotics sector are destined to face a challenging journey.

Conclusion

The collective transformation of China’s ADAS supply chain—from enabling automotive intelligence to creating robotic “life”—is not only an extension of technological confidence but also an inevitable choice amid market pressures.

However, the rules of this new frontier are vastly different from those of the traditional automotive sector. Higher intelligence barriers, more complex physical interactions, fragmented scenario demands, and intense competition all indicate that this cross-border expedition will not be smooth sailing.

This bold shift from “building cars” to “building humans” will not only determine the fate of a number of ADAS companies but also, to a certain extent, reshape China’s global standing in the competition for next-generation general-purpose intelligent agents.

The bugle call for this expedition has been sounded, and the new chapter of ADAS suppliers is just beginning to be written.