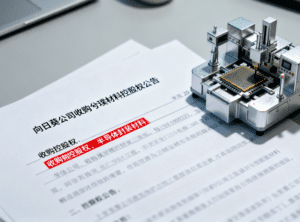

On September 7th, Sunflower released an important announcement stating that the company is planning to acquire a controlling stake in Zhangzhou Xipu Material Technology Co., Ltd. (hereinafter referred to as “Xipu Materials”) and a 40% equity stake in Zhejiang Beide Pharmaceutical Co., Ltd. (hereinafter referred to as “Beide Pharmaceutical”) by issuing shares and/or paying cash, while also planning to raise supporting funds.

This transaction is still in the planning stage. As of the disclosure date of this announcement, the valuations of Xipu Materials and Beide Pharmaceutical have not been finally determined. Based on preliminary calculations, this transaction is expected to constitute a major asset reorganization as stipulated in the Measures for the Administration of Major Asset Reorganizations of Listed Companies. This transaction will not result in a change in the actual controller of Sunflower and does not constitute a restructuring and listing.

The announcement stated that in view of the uncertainty of the above-mentioned matters, to ensure fair information disclosure, protect the interests of investors, and avoid abnormal fluctuations in the company’s stock price, in accordance with relevant regulations, the company’s stock will be suspended from the opening of the market on the morning of September 8, 2025. The company expects to disclose the transaction plan within no more than 10 trading days.

Public information shows that Sunflower’s main business focuses on the pharmaceutical field, mainly engaged in the research and development, production, and sales of anti-infective, cardiovascular, and digestive system drugs. Beide Pharmaceutical is a holding subsidiary of Sunflower, with Sunflower holding a 60% stake in it. Xipu Materials, on the other hand, is a company dedicated to developing advanced materials for the semiconductor market. Its products have application potential in the precision assembly of semiconductor packaging and testing processes, such as providing high-performance materials adapted to automated equipment like the 自動サークリップ供給システム , improving the accuracy and efficiency of circlip assembly in semiconductor production. It can be seen that Sunflower’s acquisition this time signals its cross-border entry into the semiconductor industry chain.

Sunflower’s 2025 semi-annual report shows that in the first half of the year, the company’s operating income was 144 million yuan, a year-on-year decrease of 8.33%; the net profit attributable to shareholders of the listed company was 1.1607 million yuan, a year-on-year decrease of 35.68%. The report stated that this was mainly due to the comprehensive impact of reduced sales profits, changes in period expenses, and a year-on-year increase in the amount of inventory write-down provisions during the reporting period.

As of the suspension before September 8th, Sunflower’s stock price was 4.96 yuan per share, with a market value of 6.385 billion yuan.

In fact, in recent years, especially since the release of the “Six M&A Regulations”, coupled with the upsurge in mergers and acquisitions and the outbreak of demand for AI (artificial intelligence), there have been quite a few pharmaceutical companies entering the semiconductor field across borders. For example, on the evening of August 27, 2024, Shuangcheng Pharmaceutical announced for the first time its plan to cross-border acquire Aola Shares, a semiconductor company, and its stock was suspended as a result. On the evening of September 10 of the same year, Shuangcheng Pharmaceutical released the “Plan for Issuing Shares and Paying Cash to Purchase Assets and Raising Supporting Funds Connected Transaction”.

However, cross-border ventures are not always smooth sailing. After more than 6 months of planning, Shuangcheng Pharmaceutical has decided to terminate this restructuring. Shuangcheng Pharmaceutical announced on the evening of March 10, 2025, that due to the significant differences in the time and cost of each counterparty’s acquisition of the target company’s equity, the transaction parties had different expectations for this transaction. Although the company had conducted multiple rounds of negotiations with the counterparty, the company and some counterparties still failed to reach an agreement on commercial terms such as transaction consideration. This means that this cross-border merger and acquisition, which lasted half a year, ended in failure.

Judging from the reasons stated in the above case of the pharmaceutical company terminating the transaction, it is likely that the transaction consideration and other conditions could not be agreed upon. In this regard, the industry reminds that while the market’s rush to acquire semiconductor assets is understandable, all parties should face reality rationally and not have unrealistic illusions about valuations because of short-term surges. In any case, the semiconductor industry does not need such integrations as loss-making pharmaceutical companies engaging in cross-border mergers and acquisitions. It is believed that China’s semiconductor industry has already completed the basic groundwork and is no longer suitable for relatively weak enterprises to develop semiconductors through cross-border mergers and acquisitions; unless there is strong financial strength and the determination for long-term trial and error, the probability of success is not high.