Overall Industry Trend: Stable and Positive Growth, Remarkable Achievements in Innovation and Green Transformation

The general machinery industry maintained stable and positive operation, with key indicators such as revenue and profits achieving year-on-year (YoY) growth. Exports exceeded expectations, and significant progress was made in adjusting the industry’s industrial structure driven by innovation and green transformation, leading to continuous improvement in the industry’s economic performance.

Macroeconomic Background: National GDP Grew by 5.3%, Providing Resilient Support for the Industry

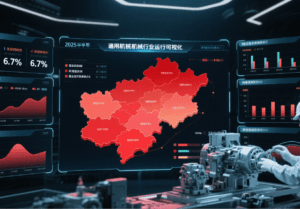

In H1 2025, China’s macroeconomy demonstrated strong resilience and vitality amid a complex and severe external environment. The GDP grew by 5.3% YoY, 0.3 percentage points higher than the same period last year and the full-year growth of last year. Against this backdrop, the general machinery industry operated stably and positively: revenue, profits and other key indicators all registered YoY growth, exports exceeded expectations, and the industry’s industrial structure adjustment, driven by innovation and green transformation, yielded remarkable results, further improving the industry’s economic operation.

Industry Economic Operation – Overall Performance: Dual Growth in Revenue and Profits, YoY Increase in Product Output

[Overall Operation Remains Stable and Positive]

In H1, the general machinery industry maintained stable and positive overall operation. Driven by the combined effects of existing policies and the expanded scope of the new round of “Two New” (new infrastructure, new-type urbanization) and “Two Major” (major strategic projects, major livelihood projects) policies, domestic market demand improved, driving the industry’s overall development to outperform the same period last year. Revenue, profits and output of major products in the general machinery industry all achieved YoY growth.

According to data from the National Bureau of Statistics, 8,842 large-scale industrial enterprises in the industry achieved operating revenue of 521.815 billion yuan, a YoY increase of 4.45% – 1.95 percentage points lower than that of national industry and 3.35 percentage points lower than that of the machinery industry. The total profit reached 36.598 billion yuan, a YoY increase of 5.75 percentage points higher than that of national industry but 5.45 percentage points lower than that of the machinery industry. The industry’s revenue growth rate was higher than the same period last year and the full-year level of last year. After reversing the YoY decline in Q1 this year, the total profit continued to grow in Q2, with the growth rate slightly accelerating compared with the end of Q1.

In terms of product output, data from the National Bureau of Statistics showed that in H1, the output of 6 key products in the general machinery industry – pumps, fans, gas compressors, valves, gas separation and liquefaction equipment, and speed reducers – all achieved YoY growth. However, the growth rate dropped significantly compared with the end of Q1: in Q1, the output of 5 products (pumps, fans, gas compressors, gas separation and liquefaction equipment, and speed reducers) achieved double-digit YoY growth; by the end of Q2, only the output growth rates of gas separation and liquefaction equipment and blowers exceeded double digits, while the output growth rates of other key products fell to less than 10%.

Industry Economic Operation – Comparison with National Industry and Machinery Industry: Machinery Industry Leads in Growth, the Industry Still Has Room to Catch Up

Situation of national industry and machinery industry: According to the National Bureau of Statistics, in H1, the added value of large-scale national industries increased by 6.4% YoY. Among them, the added value of the mining industry increased by 6.0% YoY, the manufacturing industry by 7.0% YoY, and the production and supply of electricity, heat, gas and water by 1.9% YoY. The added value of the equipment manufacturing industry increased by 10.2% YoY, and that of the high-tech manufacturing industry by 9.5% YoY. The operating revenue of large-scale national industrial enterprises increased by 2.5% YoY, while the total profit decreased by 1.8% YoY.

For the machinery industry, the added value of large-scale enterprises increased by 9.0% YoY, 3 percentage points higher than the same period last year; operating revenue increased by 7.8% YoY, 6.8 percentage points higher than the same period last year; total profit increased by 9.4% YoY, 13.1 percentage points higher than the same period last year.

Industry Economic Operation – Export Situation: Breaking Through Tariff Suppression, Significant Growth in Trade Surplus

[Export Performance Exceeds Expectations]

In H1, amid the context of responding to the U.S. tariff war, the general machinery industry achieved YoY growth in exports, imports and trade surplus. Export performance exceeded expectations, with the growth rates of export value and trade surplus significantly accelerating compared with the same period last year. The industry successfully broke through the suppression of the new round of U.S. “tariff war,” further enhancing the resilience of foreign trade.

According to customs data, in H1, the total import and export volume of 47 key products in the general machinery industry reached 27.31 billion U.S. dollars, a YoY increase of 15.13%. Among them, imports were 7.158 billion U.S. dollars (YoY +4.16%), exports were 20.152 billion U.S. dollars (YoY +19.6%), and the import-export surplus was 12.994 billion U.S. dollars (YoY +30.23%).

Industry Economic Operation – Export Regional Distribution: Exports to the U.S. Decline, Strong Demand from Central Asia and ASEAN

The top 10 countries/regions in terms of export value of key products in the general machinery industry are: the United States, Russia, Indonesia, Vietnam, Japan, South Korea, Germany, India, the United Arab Emirates, and Thailand. Among them, exports to the United States decreased by 3.89% YoY (compared with an 8.33% YoY increase at the end of Q1); exports to Russia increased by 15.69% YoY; exports to Indonesia increased by 13.04% YoY.

By region, in H1, exports to the 10 ASEAN countries increased by 17.26% YoY; exports to the 27 EU countries increased by 7.47% YoY; exports to the 5 Central Asian countries increased by 45.16% YoY.

VII. Industry Economic Operation – Import Regional Distribution: Germany, Japan and the U.S. as Major Sources, Import Growth Rate from the U.S. Rebounds

The top 10 countries/regions in terms of import value are: Germany, Japan, the United States, Italy, South Korea, Switzerland, France, Sweden, the United Kingdom, and Malaysia. Among them, imports from Germany increased by 0.71% YoY; imports from Japan increased by 12.87% YoY; imports from the United States increased by 8.5% YoY (compared with an 11.73% YoY increase at the end of Q1), while in the same period last year, imports from the U.S. decreased by 5.17% YoY.

Industry Economic Operation – Performance of Key Enterprises: Revenue and Profit Growth Rates Lower Than Industry Average, Obvious Enterprise Differentiation

[Revenue and Profit Growth Rates of Key Contact Enterprises Lower Than Industry Average]

According to statistics from China General Machinery Industry Association on 210 key contact member enterprises, in H1, these enterprises achieved a total industrial output value of 68.614 billion yuan, a YoY decrease of 3.01%; operating revenue of 62.321 billion yuan, a YoY increase of 0.8%; total profit of 5.744 billion yuan, a YoY decrease of 3.81%. The revenue and total profit growth rates of key contact enterprises were lower than the industry average.

There was obvious differentiation in the operation of the key contact enterprises surveyed: about 49% of the enterprises achieved YoY revenue growth, about 43% achieved YoY profit growth, and about 78% were profitable.

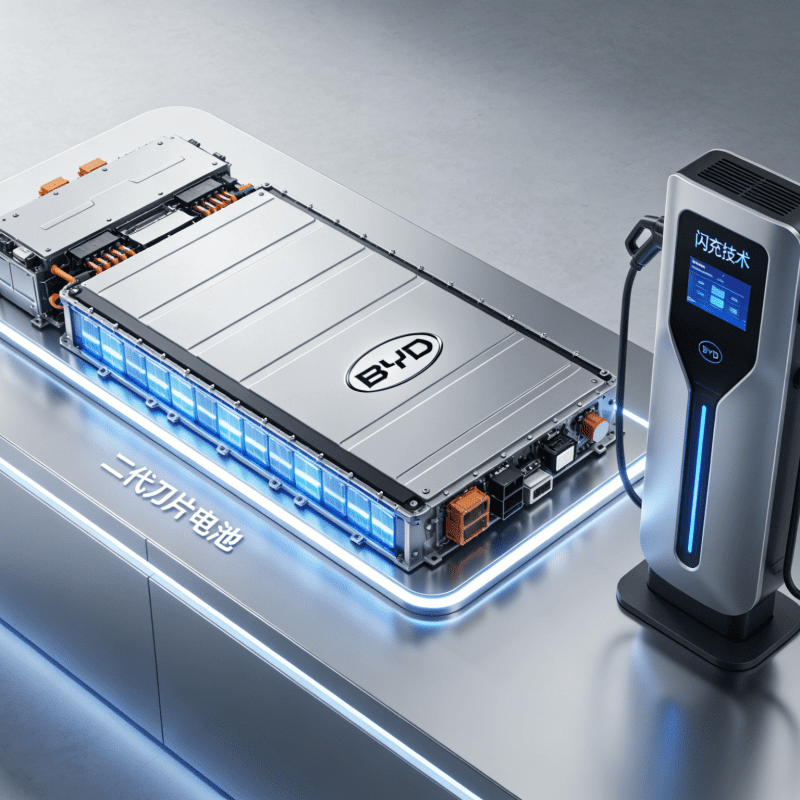

Industry Economic Operation – Innovation Achievements: Breakthroughs in Nuclear Power and Energy Storage Sectors, Multiple Technologies Certified

[Fruitful Results Driven by Innovation]

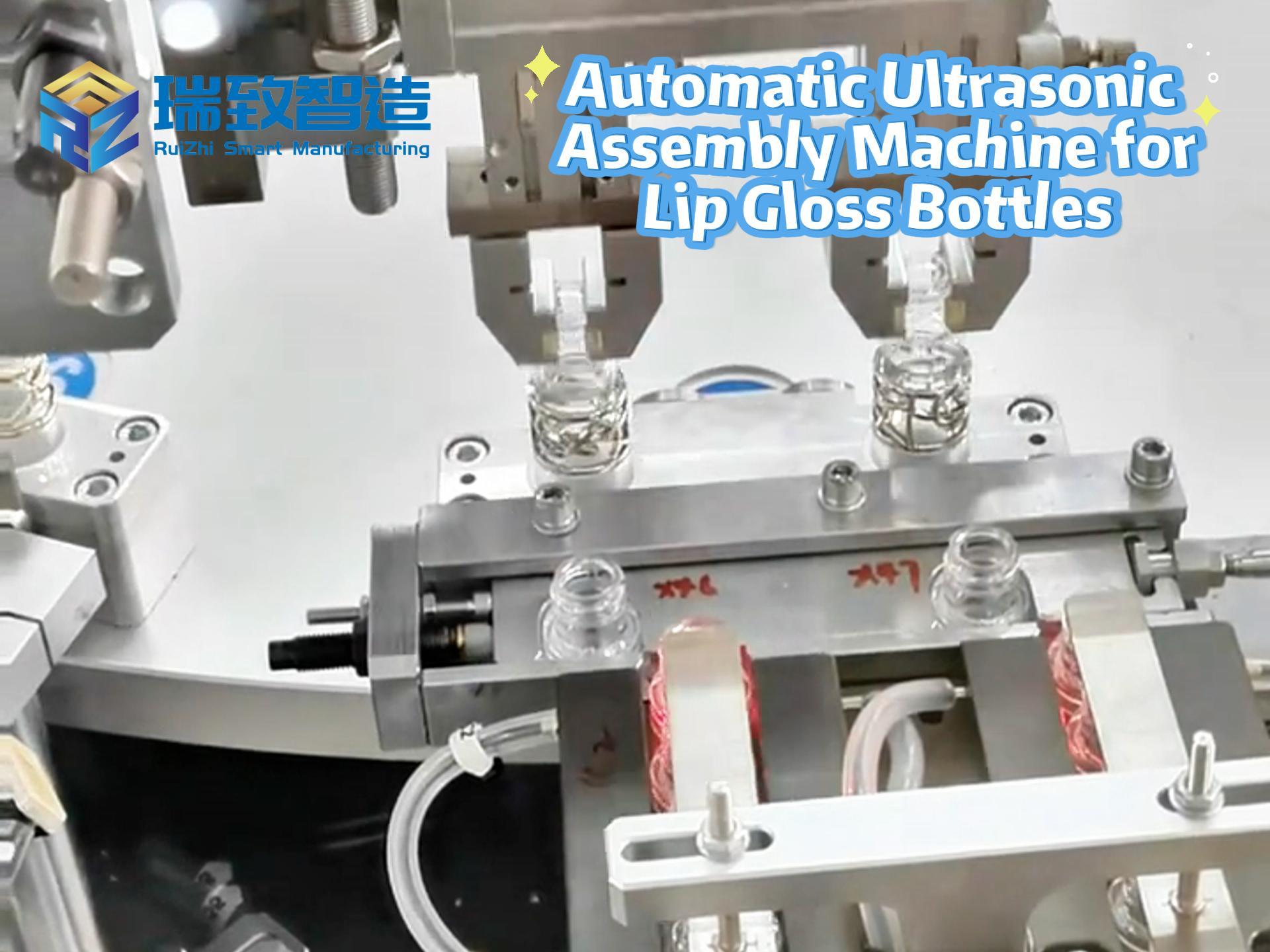

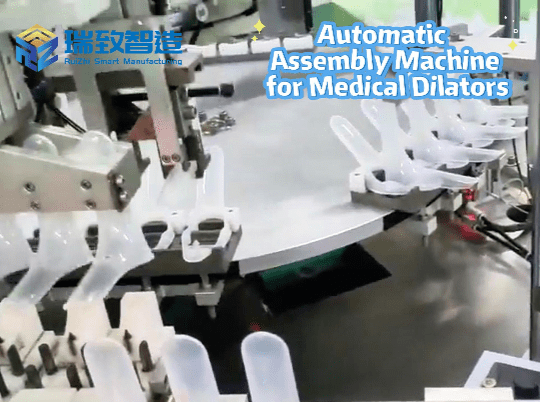

The industry has vigorously promoted scientific and technological innovation, with continuous emergence of scientific and technological achievements and accelerated transformation and application. Particularly in the fields of nuclear power and energy storage, a number of important new products and technologies have been developed. At the same time, in niche application scenarios of general machinery, demand for automation equipment has gradually been released. For example, the Bathroom shower base assembling machine for the bathroom manufacturing sector has realized automated positioning and assembly of components such as shower base frames, anti-slip mats, and drainage parts. By integrating high-precision sensing and servo control technologies, it effectively reduces manual operation errors, improves the assembly efficiency and consistency of bathroom products, and becomes an important supporting equipment for the intelligent upgrading of home furnishing manufacturing enterprises.

The “Guohe-2” shielded motor main pump developed by Shenyang Blower Works Group successfully passed the engineering test assessment at one time, with core indicators such as hydraulic performance and coast-down performance meeting the design requirements. Two sets of methanation waste heat recoverers independently developed and manufactured by Tianhua Institute for a 5.5 billion standard cubic meters/year coal-to-natural gas project were successfully commissioned at one time and operated stably. The LNG cryogenic reliquefaction unit skid for LNG carriers, manufactured by Shanghai Marine Diesel Engine Research Institute (711 Institute) of CSSC, was successfully built and entered the final verification stage.

In addition, multiple scientific and technological achievements have passed certification, including the main steam safety valve for HPR1000 nuclear power units, the prototype of the shaft-sealed reactor coolant pump (Huabeng-1) for 1 million-kilowatt nuclear power plants, molten salt pumps for solar thermal power generation and energy storage, multi-stage integral high-speed gearboxes for supercritical carbon dioxide energy storage compressors, multi-stage liquid ring shielded TEG exhaust gas compressor units, and low-energy-consumption four-tower radial bed pressure swing adsorption oxygen generation equipment.

Difficulties and Challenges Facing Industry Development – Market Demand: Growth Rate Slows in Q2, Pressure Remains in H2

[Market Still Faces Pressure of Insufficient Demand]

Driven by a series of national policies, market demand for the general machinery industry improved significantly in H1, with the output of 6 key products (pumps including vacuum pumps, fans including blowers, gas compressors, valves, gas separation and liquefaction equipment, and speed reducers) all achieving YoY growth. However, the growth rate of product output slowed down in Q2, and the industry’s revenue growth rate also slowed down compared with Q1. According to the association’s statistics on 210 key contact enterprises, about 51% of the enterprises achieved YoY growth in cumulative orders in H1, while about 49% saw a YoY decline. The industry will still face pressure of insufficient demand in H2.

Difficulties and Challenges Facing Industry Development – Industry Competition: Severe Homogeneity in Mid-to-Low-End Market, Squeezing Profit and Innovation Space

[Intensified “Involutionary” Competition in the Industry]

The general machinery industry is plagued by severe “involutionary” competition. Homogeneous competition in mid-to-low-end products has led to fierce price wars, seriously compressing enterprises’ profit margins. The industry’s profit rate remains at a low level, and R&D investment is eroded by price wars, inhibiting innovation momentum. It is urgent to study ways to strengthen industry self-discipline, standardize enterprise behavior, and maintain a fair market competition environment.

Difficulties and Challenges Facing Industry Development – Foreign Trade Environment: Rising Trade Protectionism, Increased Uncertainties

[Great Uncertainties Remain in Foreign Trade Market]

Against the current backdrop of an increasingly severe and complex external environment, rising global trade protectionism, and escalating China-U.S. trade frictions, uncertainties in the foreign trade market have increased. Industry enterprises should pay close attention to the impact of the U.S. “tariff war” trend on the world economy and global industrial chain, and formulate appropriate response measures.

Development Expectations – Policy Support: Coordinated Efforts of Fiscal and Monetary Policies, Special Plans to Be Launched Soon

2025 is the final year of the “14th Five-Year Plan.” In H1, the national economy overcame difficulties and maintained stable and positive growth, with new drivers growing stronger and high-quality development making new progress, laying a solid foundation for a good start of the “15th Five-Year Plan” next year.

In H1, the state implemented a more proactive fiscal policy and a moderately loose monetary policy, and introduced a series of stable growth policies. More funds were invested to support the implementation of the “Two Major” and “Two New” strategies, expanding domestic demand and boosting consumption. These policies cover key areas such as major infrastructure, major water conservancy projects, and new urban infrastructure construction.

The Political Bureau of the CPC Central Committee held a meeting in July this year to study the current economic situation, emphasizing that macro policies should continue to exert force and be strengthened in a timely manner. It is required to make good use of various structural monetary policy tools to strengthen support for scientific and technological innovation, consumption promotion, and the development of small and micro enterprises. In addition, efforts will be made to regulate disorderly competition among enterprises in accordance with laws and regulations and promote capacity governance in key industries. Recently, the Ministry of Industry and Information Technology will also issue special work plans for stabilizing growth in industries such as machinery, focusing on improving high-quality supply capacity, optimizing the industry development environment, and promoting the industry to achieve effective improvement in quality and reasonable growth in quantity.

Development Expectations – Industry Prospects: Policy Implementation to Sustain Positive Trend, Supporting the Successful Conclusion of the “14th Five-Year Plan”

With the implementation and in-depth advancement of national policies for stabilizing the economy and promoting growth, it is expected that the industry will continue its stable and positive development trend in H2, ensuring the successful conclusion of the “14th Five-Year Plan.”

Component assembly robot

What benefits does artificial intelligence bring to component assembly machines?