Against the backdrop of a resurgent focus on the machinery and equipment sector, institutional investors have turned their spotlight to rubber & plastic machinery—a critical sub-sector—since early September. What stands out amid this research boom is the shifting investment logic: while operational fundamentals remain a priority, progress in robot-related businesses has become a key litmus test for evaluating long-term value of plastic machinery firms, driven by surging downstream demand and the broader intelligent manufacturing trend.

Key Players Unveil Robot Layouts Amid Institutional Queries

Major players in the plastic machinery space have faced intense questioning from institutions about their robot business strategies, with each disclosing targeted progress that aligns with their core competencies:

Yizumi: Robot Division Anchors “Turnkey Solutions”

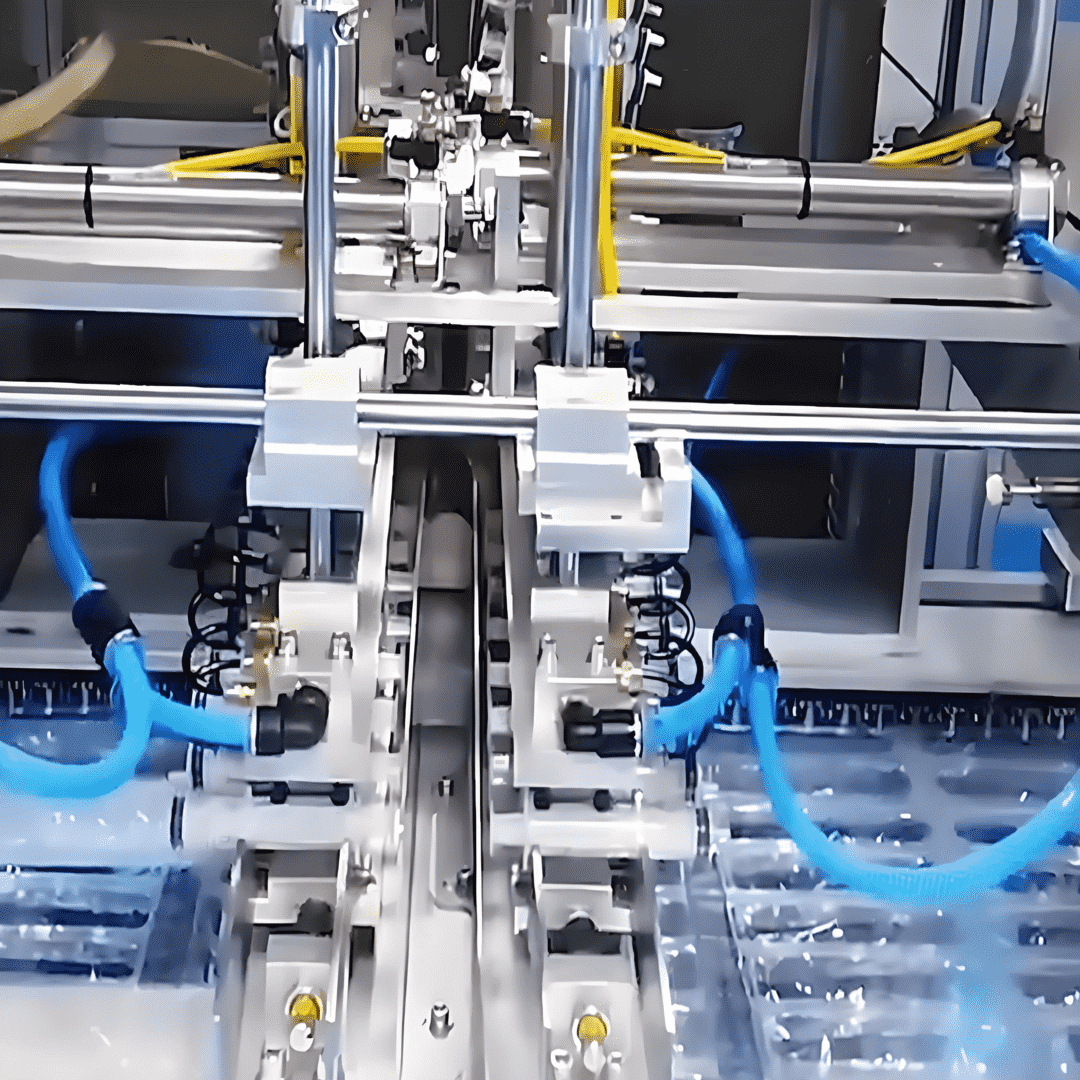

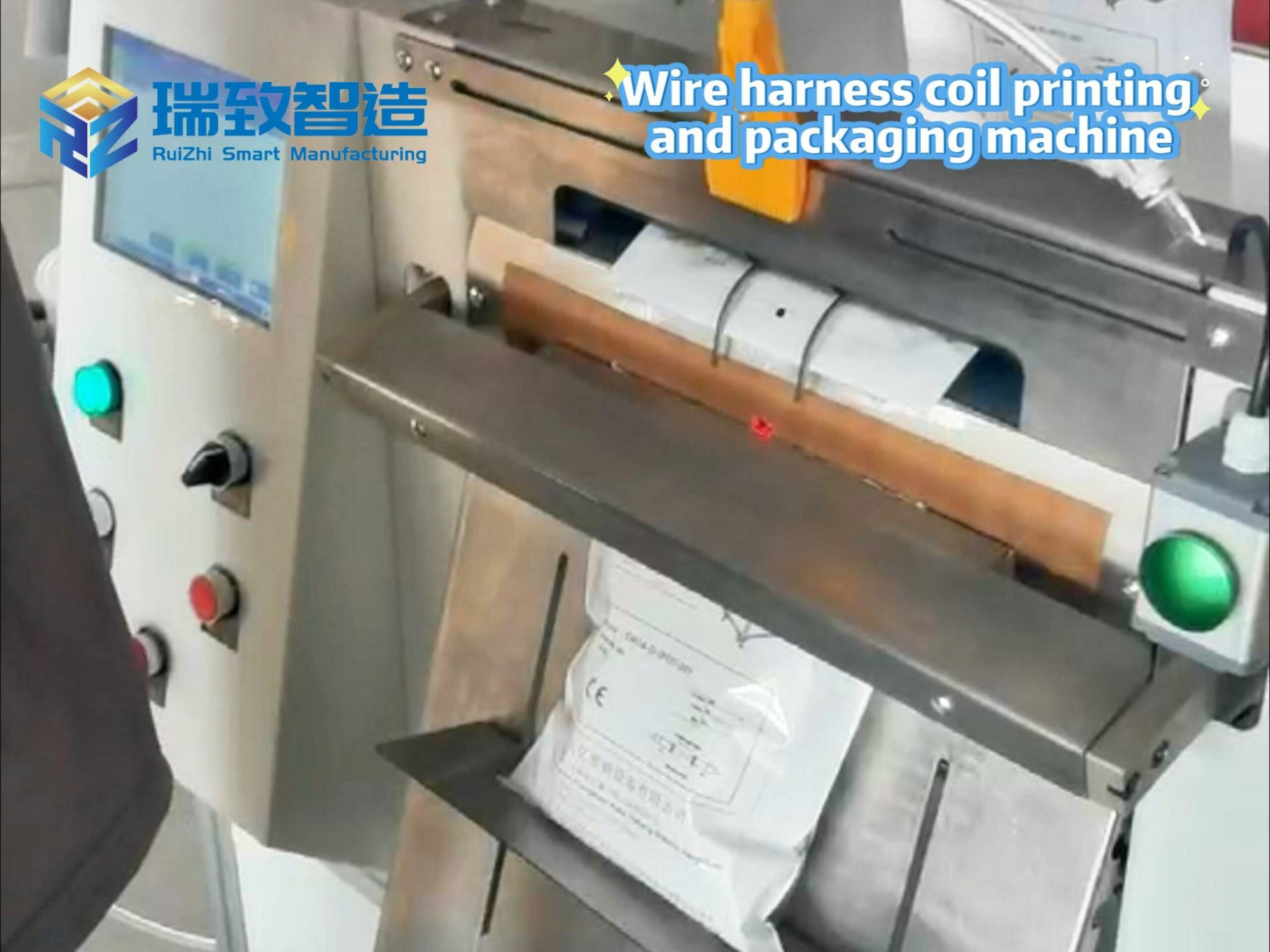

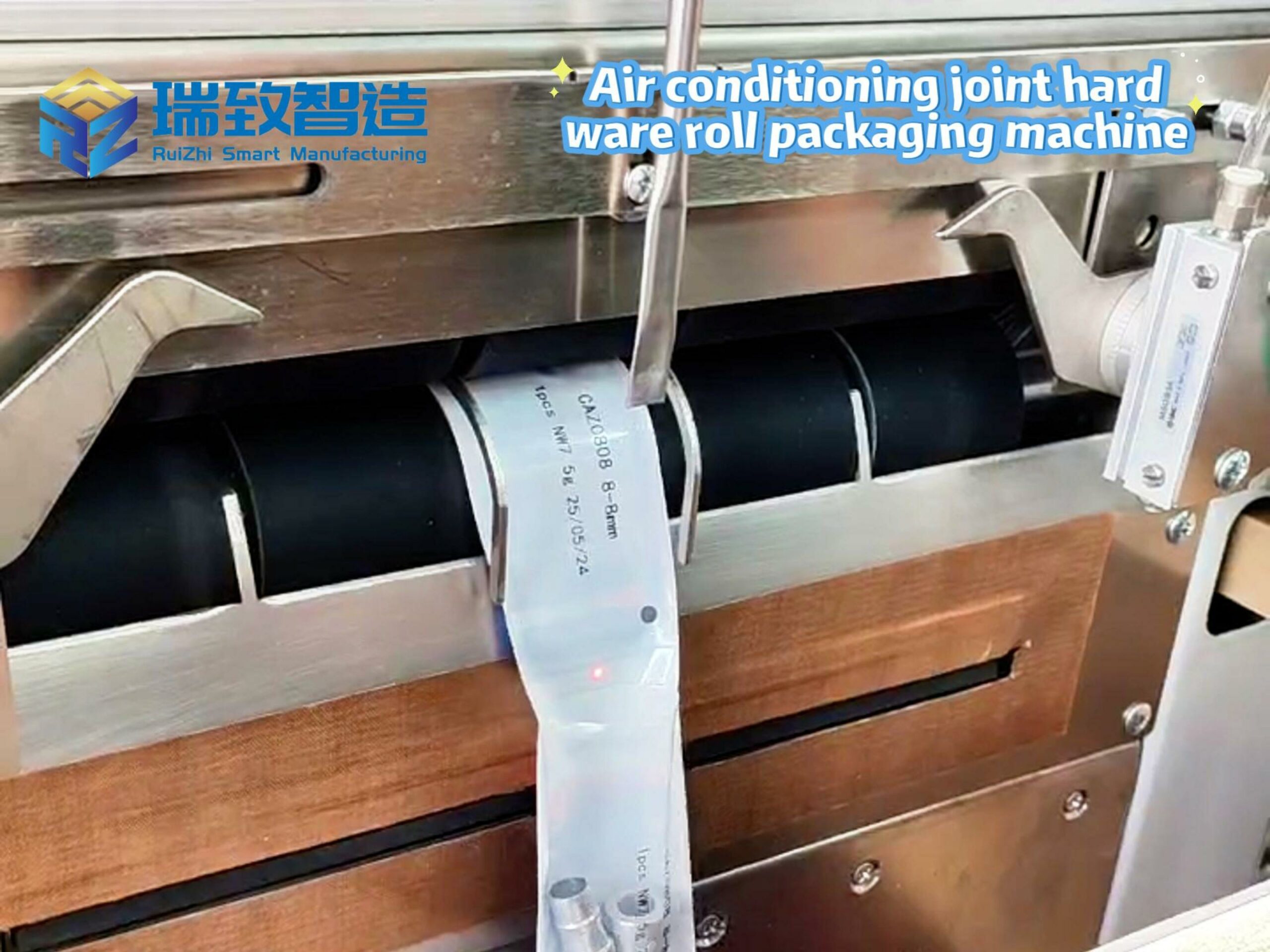

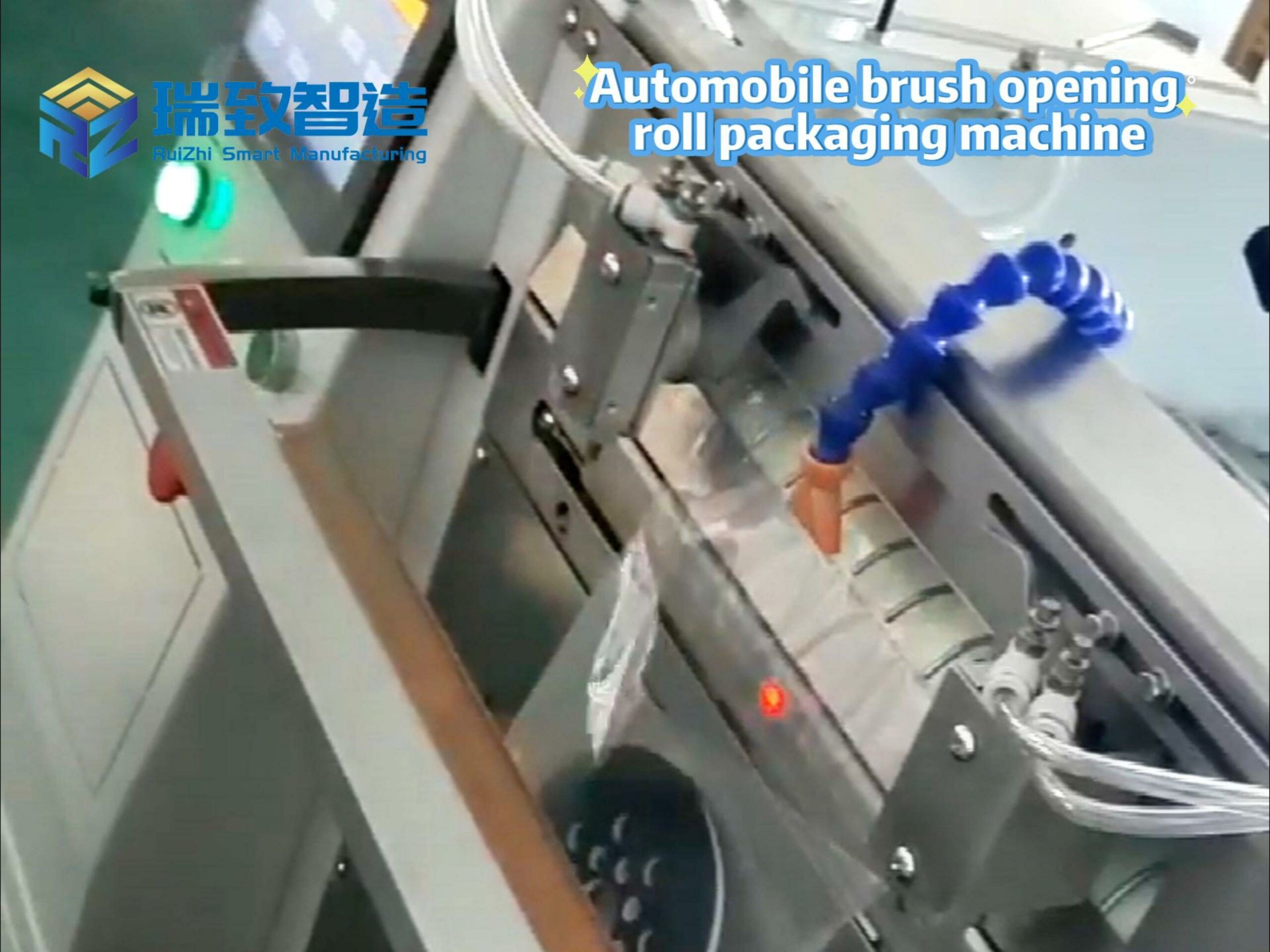

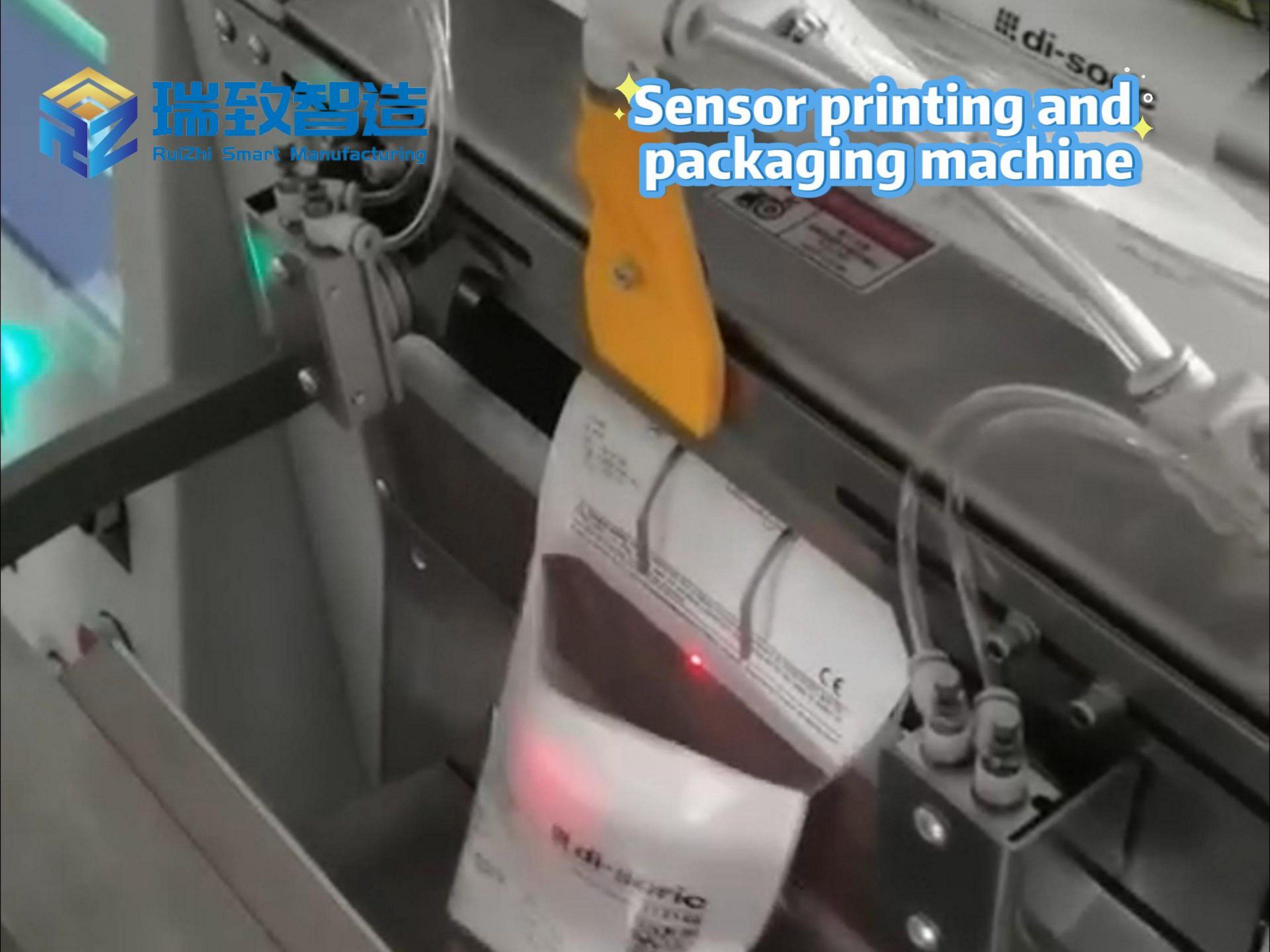

On September 19, during the 2025 Guangdong Listed Companies Mid-Year Performance Briefing, Yizumi fielded numerous investor questions on its robot business. The company affirmed that it has established a dedicated Robot Business Unit, which primarily serves two strategic goals: first, to provide matching automation solutions for its core plastic machinery (e.g., injection molding machines) to enhance integrated service capabilities; second, to develop customized turnkey solutions for downstream customers in sectors like packaging, automotive components, and medical device manufacturing (e.g., thermometer production). For instance, Yizumi has begun integrating AI-enabled Thermometer visual labeling machines into its service packages for medical clients—these machines combine high-precision computer vision with automated labeling systems to ensure accurate application of safety labels, batch codes, and compliance markings on plastic-cased thermometers, while enabling real-time defect detection to meet strict medical device quality standards. When asked about potential forays into humanoid robots via industrial funds, Yizumi stated it “will closely monitor market opportunities and make strategic adjustments based on industrial trends,” signaling flexibility in expanding its robot portfolio.

Kingming: Profit Growth Backed by Tech Advantages, Eyes Automation Synergies

Kingming, a leader in film extrusion equipment, hosted a collective investor meeting on September 15, attended by institutional investors including Guangzhou Industrial Investment Holdings Group. The company highlighted two key updates:

Operational Outperformance: In H1 2025, its net profit attributable to shareholders rose 12.11% year-on-year (YoY), outpacing the sector average, supported by strong demand for green packaging equipment.

Technological Leadership: Its multi-layer co-extrusion technology has attained “internationally leading and domestically advanced” standards, with ongoing R&D to expand applications in single-material PE packaging films—an area where automation (e.g., robotic film handling systems) is expected to create synergies. While Kingming did not announce new robot-specific initiatives, investors noted that its tech-driven product upgrades lay the groundwork for integrating automation solutions (including auxiliary equipment for downstream processes like labeling) in the future.

Tustar: Humanoid Robot Breakthroughs Steal the Show

Tustar, a front-runner in intelligent manufacturing for plastic machinery, drew 38 institutional investors (including Bosera Fund Management Co., Ltd. and Caitong Securities Co., Ltd.) for an on-site research visit on September 12. The company’s robot business updates became the focal point:

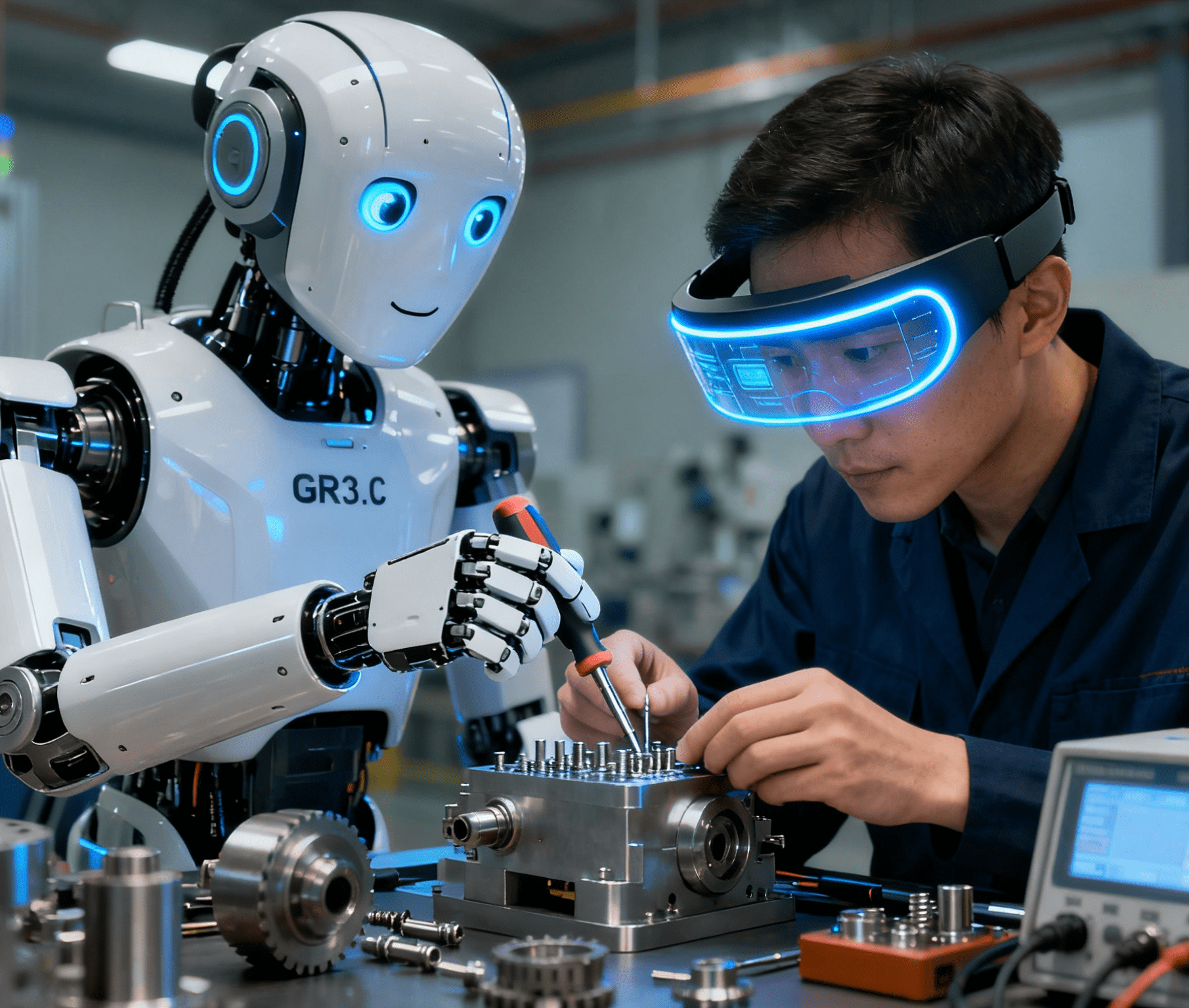

First Humanoid Robot “Xiaotu”: Developed in collaboration with Zhipu AI, “Xiaotu” leverages a jointly built embodied intelligence model to achieve autonomous reasoning and decision-making for complex tasks (e.g., precision assembly of plastic components)—a key differentiator from basic industrial robots.

Component Processing Advantages: Its DMU/GMU400 and GMU600 machining centers have demonstrated competitiveness in manufacturing high-precision parts for humanoid robots (e.g., joint components), with initial orders from domestic robot startups.

AI Integration: Tustar emphasized it is deepening partnerships with large AI model providers to upgrade robot algorithms, aiming to transform its robots from “task-executors” to “process-aware intelligences”—a shift designed to better serve downstream plastic processing clients’ demand for flexible production.

Why Robot Business Has Become a “Must-Check” for Investors

Institutional research notes reveal three core reasons behind the heightened focus on robot businesses:

Downstream Demand Pull: Major clients of plastic machinery (e.g., packaging, automotive, consumer electronics, and medical device firms) are accelerating automation to cut costs and improve efficiency. This has created direct demand for integrated solutions that combine plastic machinery with robots—and supporting equipment like Thermometer visual labeling machines—turning comprehensive automation capabilities into a key competitive edge for machinery makers.

New Growth Curve: As traditional plastic machinery markets mature, robot businesses (especially humanoid robots and industrial automation) offer a high-growth track. Investors see this as a critical factor in assessing whether firms can break free from cyclical pressure.

Valuation Re-Rating Potential: Companies with proven robot business progress are more likely to attract “intelligent manufacturing” premium valuations. For example, Tustar’s stock has seen increased institutional holdings since it disclosed its humanoid robot R&D progress, reflecting market optimism about its diversified growth.

Industry Outlook: Robot Progress to Define Long-Term Investment Value

Industry insiders predict that as the humanoid robot and industrial automation markets expand (GGII forecasts the Chinese industrial robot market to exceed RMB 150 billion by 2027), plastic machinery firms’ robot capabilities—along with their ability to integrate complementary automation tools like specialized labeling equipment—will increasingly become a “differentiator” in investment decisions.

“For plastic machinery companies, robot business is no longer a ‘side project’ but a strategic layout to capture the intelligent manufacturing trend,” said an analyst from a leading securities firm. “In the next 2–3 years, investors will focus not only on short-term order growth but also on whether firms can build sustainable advantages in robot-machinery integration—this will be the key to determining long-term investment value.”

For players like Yizumi, Kingming, and Tustar, the next phase of competition will center on aligning robot R&D with their core machinery strengths, turning institutional attention into tangible market share and revenue growth.