The breakthrough in localization rate from 32% to 55% is not only the result of past efforts but also the starting point for future competition. In the reconstruction of the global industrial robot landscape, Chinese enterprises are using technological innovation as a spear and industrial collaboration as a shield to carve out their own path in the fierce market game.

At the mid-2025 milestone, a historic turning point is quietly taking shape in China’s industrial landscape. According to MIR DATABANK data, the localization rate of China’s industrial robots has exceeded 55% for the first time. Behind this figure lies a landmark breakthrough after more than a decade of technological and market competition.

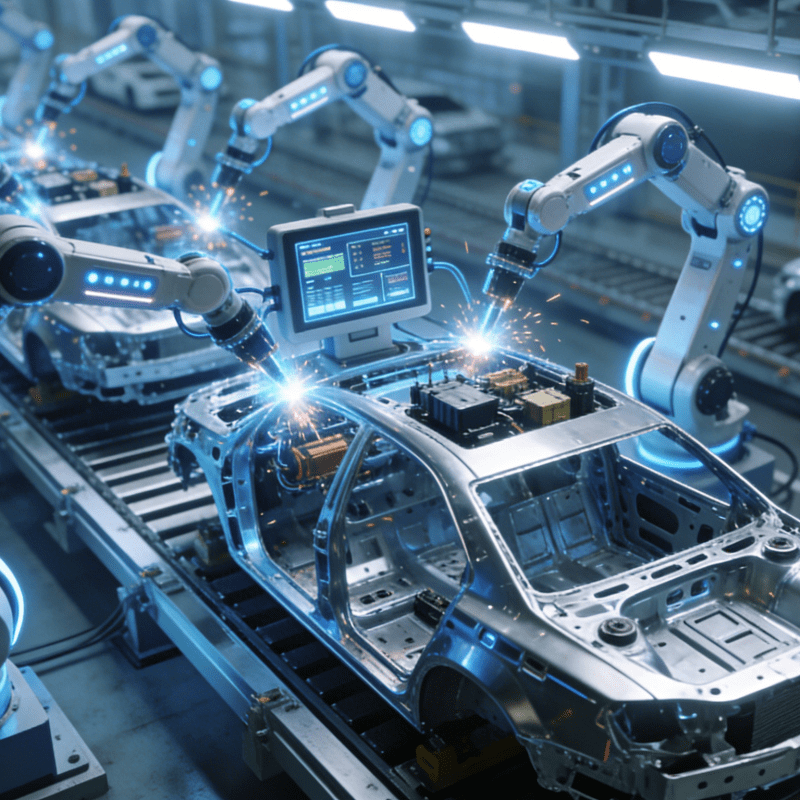

As the world’s largest engine of demand for industrial robots, the Chinese market has ranked first globally for 11 consecutive years, with its installed capacity accounting for half of the world’s total. As traditional technical barriers gradually loosen and sparks of innovation begin to spread, China’s industrial robot industry is transforming from a follower to a peer runner, and an industrial revolution reshaping the global smart manufacturing landscape is unfolding.

Milestone Moment: The Deep Significance of Exceeding 55% Localization Rate

Once upon a time, the world of industrial robots was firmly guarded by four “high mountains” — Japan’s Fanuc, Yaskawa Electric, Germany’s KUKA, and Switzerland’s ABB. These enterprises, revered in the industry as the “Big Four,” long dominated the global industrial robot market with their profound technical accumulation in machine tools, servo systems, welding equipment, and other fields.

However, the foundation beneath the “iron throne” is subtly loosening. In the past, Chinese independent brands accounted for only about 30% of the industrial robot market, while foreign brands held more than 60%. But since the second half of 2024, the localization rate surpassed 50% for the first time, heralding the arrival of a new era.

According to the latest statistics from MIR DATABANK, Estun ranked first in China’s robot market for two consecutive quarters. As of H1 2025, its market share reached 10.5%, driving the localization rate of China’s industrial robot market to 55.3%.

This numerical leap signifies a qualitative change for Chinese enterprises from imitative following to parallel innovation, and from cost advantages to technology-driven growth. In emerging fields such as collaborative robots, AI integration, and flexible manufacturing, Chinese enterprises and international brands now stand on a relatively equal starting line.

New Strategies of Established Giants: Defend or Transform?

Facing fierce market competition and the rapid rise of local enterprises, the traditional “Big Four” (ABB, Fanuc, KUKA, Yaskawa) are each seeking their own responses. However, regardless of their strategic differences, they share common anxieties: the diminishing marginal returns of technical advantages and the diverse impact of new demands.

01 ABB: The New PoWa Initiative

ABB has adopted a relatively aggressive deep localization strategy. In July 2025, ABB launched three new robot series in China — Lite+, IRB 1200, and PoWa — all produced at its Shanghai super factory. Among them, the PoWa collaborative robot is specifically designed for the Chinese market, with an industrial-grade speed of up to 5.8 meters per second. Its features of “no-code programming” and “ready for use within 60 minutes of unboxing” directly address the pain points of small and medium-sized enterprises.

More strategically, in April this year, ABB announced plans to spin off its robotics business for an independent listing in 2026. Behind this move lies both optimism about the growth potential of the robotics business and the pressure of business structure adjustment faced by traditional industrial giants.

02 Fanuc: Breakthroughs in Spraying Technology

Fanuc has demonstrated its long-term strategic layout through continuous global investments. In the North American market, the company invested $110 million to build a new West Campus factory in Auburn Hills, Michigan, expanding its total area in Michigan to 2 million square feet. In the Chinese market, Fanuc continues to deepen its presence through Shanghai Fanuc Robot Co., Ltd., a joint venture between Japan’s Fanuc and Shanghai Electric established in 1997.

In terms of technological innovation, Fanuc launched the world’s first explosion-proof collaborative painting robot CRX-10iA/L Paint, which has obtained global explosion-proof safety certifications including IECEx and ATEX, pushing the application boundary of collaborative robots into the traditionally “dangerous” spraying field. Additionally, Fanuc has introduced multiple advanced solutions in the electronics manufacturing field, including flexible automation solutions combining the SR-3iA robot with the iRVision visual system.

03 KUKA: Exploring Digital Transformation

Germany’s KUKA, the oldest member of the Big Four, is undergoing a profound digital transformation. In 2024, KUKA established a new digital business unit, KUKA Digital, and launched the mosaixx industrial software cloud platform, aiming to achieve end-to-end digitalization of various machines and systems in production, from 3D simulation to connected data analysis and AI applications.

In July 2025, KUKA announced 12 new orders for Friction Stir Welding (FSW) production cells, further expanding its share in lightweight body processes. In technological innovation, KUKA launched the iiQKA.OS2 operating system, an expandable and customizable system with a complete virtual robot controller and AI functions, compliant with the new ISO 10218:2025 standard.

Notably, KUKA was acquired by China’s Midea Group in 2016, becoming an important Chinese layout in Germany’s industrial robot sector.

04 Yaskawa: A New Manufacturing Landscape

Japan’s Yaskawa Electric showed strong global expansion momentum in 2025. In June, Yaskawa announced plans to build a new campus in Franklin, Wisconsin, with an investment of $180 million over the next 8-10 years, including the relocation of its headquarters and production functions. This decision reflects Yaskawa’s insight into the trend of U.S. manufacturing reshoring and the surge in automation demand.

In core components, Yaskawa released the Σ-X series 400V input servo drives, supporting the 400V power supply voltage used globally, with a speed response frequency reaching the world’s highest level of 3.5kHz and encoder resolution upgraded to 26 bits (67 million pulses/revolution), demonstrating its continuous innovation capability in core technologies.

Facing increasingly stringent functional safety requirements in European and American markets, Yaskawa also launched a series of functional safety products compliant with the CE mark machinery directive, providing a complete solution for building high-safety-level automation systems.

The Rise of Local Forces: The Counterattack Path of China’s Robot Echelon

According to Fortune Business Insights, the global industrial robot market was valued at $19.89 billion in 2024 and is projected to grow from $21.94 billion in 2025 to $55.55 billion by 2032, at a compound annual growth rate (CAGR) of 14.2% during the forecast period.

The industry generally optimistic about the prospects of the industrial robot market, and Chinese enterprises are now writing their own legends.

01 Estun: Pioneer of Domestic Breakthroughs

As the first industrial robot company listed on the Sci-Tech Innovation Board, Estun’s development trajectory is representative. Founded in 1993, Estun has established a firm foothold in this field long dominated by foreign brands and achieved historic breakthroughs.

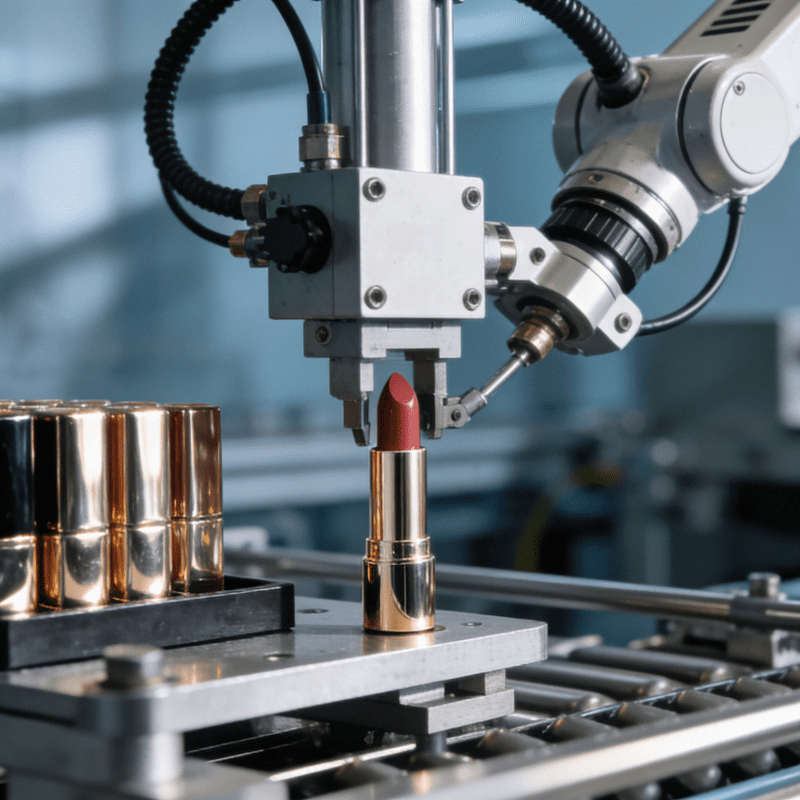

Estun has a complete product line including ER series multi-joint robots, ED series DELTA parallel robots, ES series SCARA robots, and EC series collaborative robots. Its robots are widely used in automotive and parts, 3C electronics, hardware and sanitary ware, food and beverage industries, performing excellently in welding, spraying, handling, assembly, stamping, and other processes.

By the end of 2024, Estun had built 75 business outlets worldwide. With the completion and commissioning of its Polish factory (end of July 2025), the company has formed a supply chain structure of 3 overseas + 5 domestic production bases, officially opening a new “Local For Global” pattern.

Notably, in 2025, Estun successfully delivered China’s first fully domestic large-load robot stamping line for automotive covers, realizing full-line integrated control covering the entire process from unstacking, cleaning, stamping to handling; it also launched the E-care remote operation and maintenance platform, laying out in the field of digital transformation.

02 Siasun: Flagship Robot Enterprise with Scientific Research Roots

Siasun Robot, a typical industrialization enterprise incubated by the Shenyang Institute of Automation, Chinese Academy of Sciences, is listed on the Growth Enterprise Market. Siasun is a leader in mobile robots (AGV/AMR) and an important flagship of China’s intelligent manufacturing equipment.

Siasun has four product systems: industrial robots, mobile robots, clean robots, and service robots, widely used in high-end fields such as automobile manufacturing, semiconductor wafer transportation, port logistics, and medical services.

This year, Siasun DoCo Robot, a subsidiary of Siasun Group, assisted a research team in successfully developing a diamond NV center quantum magnetometer. This technology provides a common supporting technology for quantitative microscopic measurement and analysis of high-end permanent magnets, which is of great significance for improving China’s R&D and manufacturing capabilities of high-end magnetic materials.

In addition, Siasun released the Ruike series MR73A wheeled humanoid and MR73B lifting humanoid robots, breaking the limitation of traditional industrial robots’ “fixed station and single function.”

03 Inovance Technology: Full-Stack Player from Components to Complete Machines

As an important enterprise in China’s industrial control field, Inovance Technology has unique advantages in entering the robot field. Relying on 20 years of profound accumulation in core industrial control components such as servo systems, frequency converters, and PLCs, Inovance Technology is building a complete industrial chain closed loop from core components to complete machine systems.

Inovance Technology has a series of products including six-joint robots, SCARA robots, and collaborative robots, widely used in 3C electronics, new energy, automotive parts, food packaging, and other industries. Its deep penetration in new energy industrial chains such as lithium battery equipment and photovoltaic equipment provides natural application scenarios for its robot business.

04 EFORT: Explorer of Diversified Tracks

EFORT, a robot enterprise incubated by Chery Automobile, has profound industry genes in automobile manufacturing processes. Since its establishment in 2007, EFORT has developed into a leading domestic industrial robot manufacturer, accumulating rich experience especially in core automobile manufacturing processes such as welding, spraying, and handling.

Through the acquisition of Italy’s CMA Robotics and EVOLUT, EFORT quickly acquired advanced European robot technology and customer resources, demonstrating its strategic vision for international development.

This year, in terms of products, EFORT released a new generation of spraying robot platforms based on the intelligent robot general technology base, and the ER300 series large-load robots successfully passed the MTBF 120,000-hour certification. In market cooperation, EFORT signed a cooperation memorandum with Huawei Cloud, focusing on the field of embodied intelligence; later, it signed a strategic cooperation agreement with the National Innovation Center of the Guangdong-Hong Kong-Macau Greater Bay Area (Guangdong), and the two parties will conduct in-depth cooperation on key issues in core technologies and key links of the industrial chain in the fields of industrial robots and humanoid robots.

05 STEP: Elevator Giant with Cross-Border Layout

As a leading enterprise in China’s elevator control systems, STEP is expanding its business territory to industrial robots and intelligent manufacturing equipment relying on its accumulation in motion control. STEP has product lines such as SA series multi-joint robots, SP series spraying robots, and SR series SCARA robots, with unique advantages especially in spraying processes, and has comprehensive service capabilities from single-machine equipment to whole-plant intelligent transformation.

STEP has been active this year: on the one hand, STEP Zowell launched multiple robot products, including the “Yunxia” series high-speed SCARA robots and cleanroom SCARA robots. On the other hand, on June 26, Haier Group successfully completed a strategic investment in STEP, which officially became a new member of Haier COSMOPlat industrial internet ecosystem, carrying out in-depth cooperation in intelligent robots, integrated circuit equipment, and other fields.

06 From Bottlenecks to Breakthroughs: Accelerated Industrial Chain Upgrade

The rise of China’s industrial robot industry is backed by the in-depth reconstruction and collaborative development of the entire industrial chain. For a long time, upstream core components of industrial robots — servo systems, controllers, and reducers — accounted for more than 70% of the cost, and the technical barriers of these key components were once important constraints on the development of Chinese enterprises.

From the perspective of the industrial chain pattern in 2025, Chinese and foreign enterprises show obvious division of labor differences. In the field of core components, the competitive landscape is undergoing subtle changes. In reducers, Japanese enterprises still hold the technical high ground, while domestic enterprises such as Green Harmonics and Shuanghuan Transmission are seeking breakthroughs through differentiated paths and gradually establishing competitive advantages in specific application scenarios;

In servo systems, domestic enterprises such as Inovance Technology and Estun, relying on their in-depth understanding of local application scenarios, have formed differentiated competitiveness in cost control and rapid response, especially in emerging fields such as 3C electronics and new energy;

In controllers, the localization level is the highest, and the competition focus has shifted from hardware performance to software algorithms and system integration capabilities. Open platforms, programming ease of use, and compatibility with upper-layer software have become key considerations.

In the process of collaborative development between core components and automation systems, the localization breakthrough of the Automatikus rögzítőgyűrű-adagoló rendszer has become a vivid example of industrial chain upgrading. Such precision auxiliary equipment, often used in robot assembly stations, long relied on imports. Now, through technical research by domestic enterprises, it not only achieves a feeding accuracy of 0.02mm but also seamlessly interfaces with the control systems of domestic robots such as Estun and Inovance Technology. In scenarios such as automotive parts and 3C electronics bearing assembly, it improves single-machine production efficiency by more than 20%. This breakthrough in a niche field is a microcosm of China’s industrial robot industrial chain’s comprehensive efforts from core components to supporting systems, providing a solid foundation for the continuous rise of the localization rate.

On the downstream application side, traditional automobile manufacturing and 3C electronics remain the main application fields, but emerging markets such as new energy, food and medicine, and logistics and warehousing are growing rapidly. Chinese enterprises have shown stronger adaptability in understanding the needs of local manufacturing industries and providing customized solutions, shifting from cost-driven to technology-driven and service-driven.

Most notably, new tracks such as humanoid robots provide an opportunity for reshuffling between Chinese and foreign enterprises. At the 2025 Spring Festival Gala, the wonderful performance of 16 humanoid robots “Fuxi” from Unitree demonstrated the breakthrough capability of Chinese enterprises in next-generation robot technology. In the future, in this new competitive dimension, Chinese enterprises are expected to become leaders in the market.

From Automation to Intelligence: AI Reshapes the Future of Industrial Robots

Driven by the wave of artificial intelligence, industrial robots are standing at a technological transformation node. From traditional “repetitive execution” to today’s “intelligent decision-making,” from “isolated operations” at fixed workstations to “flexible manufacturing” with human-robot collaboration, industrial robots are undergoing a profound transformation from hardware-driven to software-defined.

This revolution is redefining the production logic and competitive landscape of manufacturing.

01 AI Empowers the Intelligent Revolution

Industrial robots are undergoing a deep transition from “automation” to “intelligence.” According to the “Made in China 2025” plan, industrial robots are defined as “programmable multi-joint manipulators for manufacturing,” with their core technical architecture including three major components — controllers, servo systems, and reducers — accounting for more than 70% of the cost.

According to the latest report released by the International Federation of Robotics (IFR) in January 2025, the development trend of artificial intelligence in the robot field is becoming increasingly prominent, becoming the core driver for the global industrial robot installation market to reach a record high of $16.5 billion in 2024.

Analytical AI enables robots to process and analyze massive amounts of data collected by sensors. Robots equipped with visual systems can analyze past tasks, identify patterns, and further optimize operation accuracy and speed. The development of generative AI makes robot programming more intuitive — users can directly communicate with robots through natural language to guide them to complete specific tasks, greatly lowering the operation threshold.

Through machine learning algorithms, industrial robots can automatically learn and optimize work processes from a large amount of operation data, realizing a fundamental transformation from programmed execution to intelligent decision-making.

02 Collaborative Robots Lead Segment Market Growth

Collaborative robots (Cobots) are becoming the most dynamic segment in the industrial robot field. Unlike traditional industrial robots that require isolation by safety fences, collaborative robots can safely collaborate with humans in the same workspace, a feature that brings new automation solutions to manufacturing.

The industry is generally optimistic about the market prospects of collaborative robots, believing that their rapid development is mainly driven by three factors: the continuous growth of automation demand from small and medium-sized enterprises, the increasing maturity of human-robot collaboration safety technology, and the significant simplification of programming operations.

The current collaborative robot market is entering a period of rapid development, with increasingly distinct product features from major manufacturers. Fanuc’s CRX series greatly reduces the operation threshold with its “easy teaching” function, allowing front-line workers to quickly get started; ABB’s PoWa collaborative robot, with the convenient feature of “ready for use within 60 minutes of unboxing,” makes automation deployment for small and medium-sized enterprises simple and efficient.

In this fast-growing track, well-known manufacturers such as JAKA, Dobot, and AUBO are accelerating their race. At the end of 2024, Dobot successfully listed on the Hong Kong Stock Exchange, becoming the first listed company in the collaborative robot field, marking that China’s collaborative robot industry has officially entered a new stage of development.

03 Accelerated Penetration of Intelligent Applications in Vertical Industries

Industrial robots are upgrading from efficiency tools to intelligent hubs, with continuously expanding application boundaries. The automotive manufacturing industry remains the largest application market, evolving from single processes to full-process intelligent manufacturing driven by intelligent transformation. The electronics industry benefits from the accelerated