Table of Contents

ToggleTariff Turmoil Puts the Brakes on German Carmakers’ Growth Ambitions

Revised Opening: Automation Ambitions Stalled by Tariff Winds

As the European automotive market contracted and competition intensified in China, Volkswagen once assured investors that robust growth in the U.S. market—fueled by automatisation industrielle et automatisation intelligente upgrades—remained within reach. But Donald Trump’s aggressive tariff measures, including a 25% levy on car imports, have slammed the brakes on Europe’s largest automaker and its reliance on streamlined équipement d'automatisation-driven supply chains.

“Sustaining growth in the U.S. was predicated on optimizing automatisation industrielle in our Tennessee plant and scaling automatisation intelligente for EV production,” a VW executive admitted. “Now, tariffs threaten to derail those plans.”

Core Impact: Automation-Driven Supply Chains Under Siege

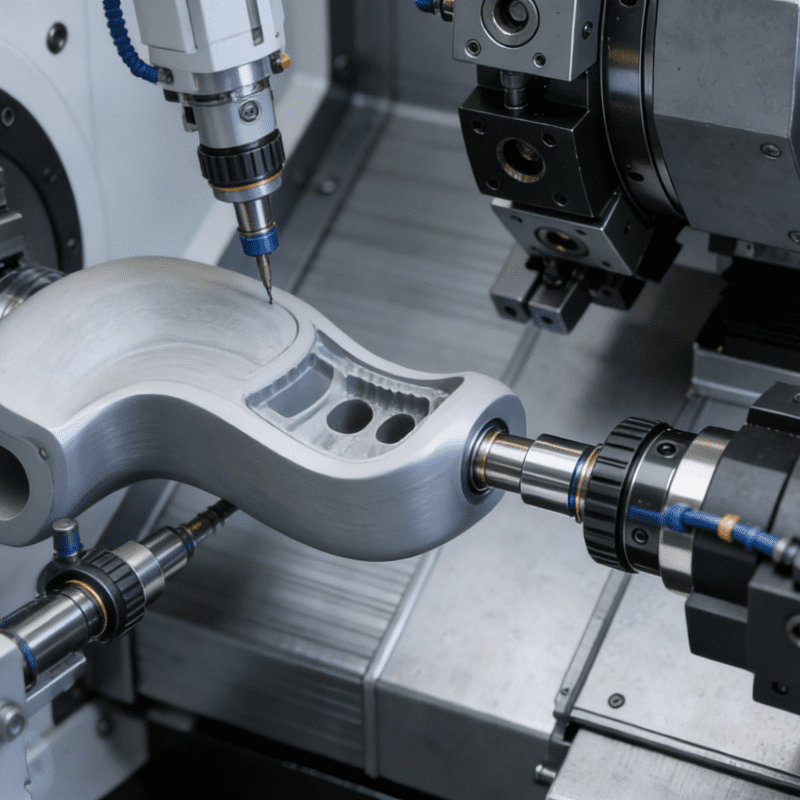

For German carmakers, the tariff war isn’t just a trade skirmish—it’s a direct assault on the équipement d'automatisation and just-in-time manufacturing networks that underpin their global competitiveness.

- Cost Pressures on Automation Infrastructure: S&P Global now projects 1.2 million fewer U.S. car sales in 2025 than previously forecast, a blow to companies like VW that invested in automatisation intelligenteto boost efficiency. Bernstein analysts warn German automakers could face $2–4 billion in annual tariff-related costs, funds that would otherwise finance automatisation industrielle upgrades or EV battery plants.

- Supply Chain Disruptions: Tariffs on imported parts—from Mexican-built engines to Chinese electronics—have disrupted équipement d'automatisation-reliant production lines. Mercedes-Benz CFO Harald Wilhelm noted that prolonged tariffs could erode the company’s sales margin by three percentage points, as équipement d'automatisationdowntime and retooling costs mount.

Strategic Shifts: Rethinking Automation Investments

Facing uncertainty, German carmakers are recalibrating their équipement d'automatisation-driven strategies:

- Localization Over Efficiency: BMW, which operates the U.S.’s largest automotive exporter (Spartanburg plant), now prioritizes local sourcing over automatisation industrielle-optimized global supply chains. “Our $14 billion U.S. investment was built on free trade,” CEO Oliver Zipse said. “Tariffs force us to choose between automation efficiency and tariff avoidance.”

- Paused AI and Robotics Rollouts: Audi, which relies entirely on imports for U.S. sales, has delayed plans to integrate automatisation intelligentefor autonomous vehicle testing. “Every dollar diverted to tariff compliance is a dollar not spent on next-gen équipement d'automatisation,” a senior engineer noted.

Broader Implications: Automation Ambitions vs. Protectionism

The crisis underscores a stark reality: Industrial automation et automatisation intelligente thrive on open borders, but protectionism punishes scale.

- Europe’s Recessionary Pressure: Germany’s Ifo Institute warns U.S. tariffs have “stifled nascent recovery” in its automotive sector, where équipement d'automatisationsuppliers like Siemens and Bosch now face reduced orders.

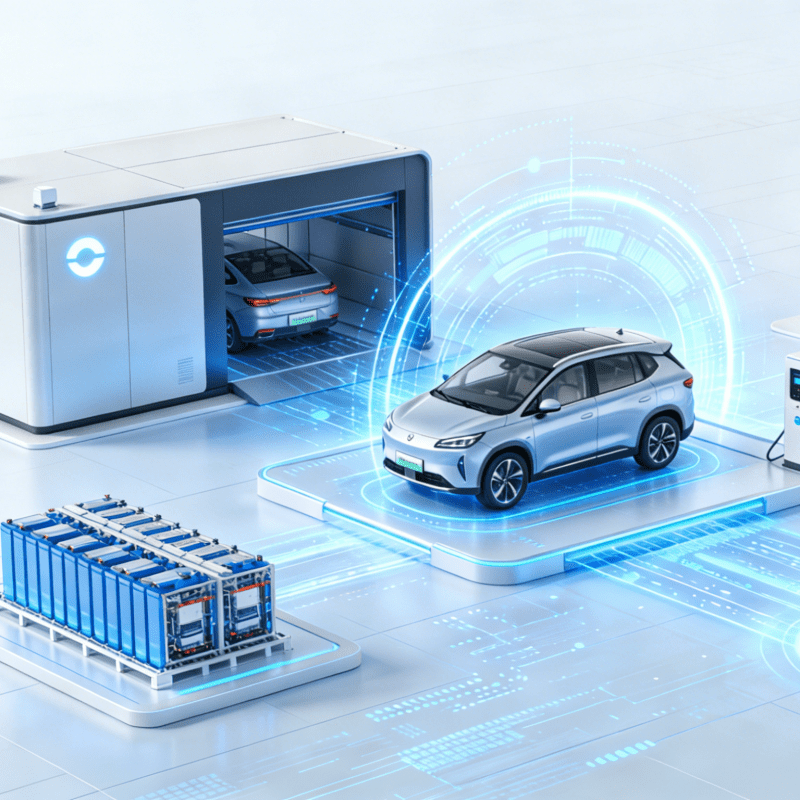

- EV Transition at Risk: The costly shift to electric vehicles—heavily reliant on automatisation intelligentefor battery production and software integration—now competes with tariff-driven cost pressures. Mercedes-Benz’s 41% Q1 EBIT drop reflects this squeeze.

Revised Closing: The High Cost of Disconnected Automation

As VW, BMW, and Mercedes-Benz lobby Washington for tariff relief, the industry’s predicament lays bare a critical truth: Industrial automation et automatisation intelligente are global by design, and walls—whether physical or tariff-induced—break the systems they rely on.

“Thirty years of building équipement d'automatisation-integrated supply chains could be undone by a few policy strokes,” a BMW executive lamented. “If the U.S. market closes, so does the case for investing in the next generation of automotive automation.”

For German carmakers, the tariff war isn’t just about trade—it’s a referendum on whether automatisation intelligente et automatisation industrielle can survive in a world retreating from globalization. The answer will shape the industry’s ability to innovate, compete, and drive forward.