Alibaba Group Holding (NYSE: BABA) has recently become the focus of the capital market due to the explosive growth of its cloud intelligence and artificial intelligence businesses — the cloud intelligence segment’s revenue surged 26% year-on-year, while AI-related products achieved triple-digit growth for the seventh consecutive quarter. This “dual-engine” driven performance not only dispels market concerns about sluggish growth but also directly led multiple analysts to upgrade their ratings. However, the accompanying valuation debate is prompting investors to reassess this stock, which has already soared 87% this year: Does the current stock price still have room to rise, or has it already future growth expectations?

Performance Is Not Just “Hype”: Cloud and AI Become New Growth Pillars

Unlike short-term concept speculation, Alibaba’s latest performance growth has solid business support. According to its fiscal year 2025 financial report, the group’s total revenue reached RMB 996.3 billion (approximately USD 137.3 billion), a year-on-year increase of 6%. The differentiated growth of its core businesses highlights structural bright spots:

Cloud Intelligence Becomes the Second Growth Curve

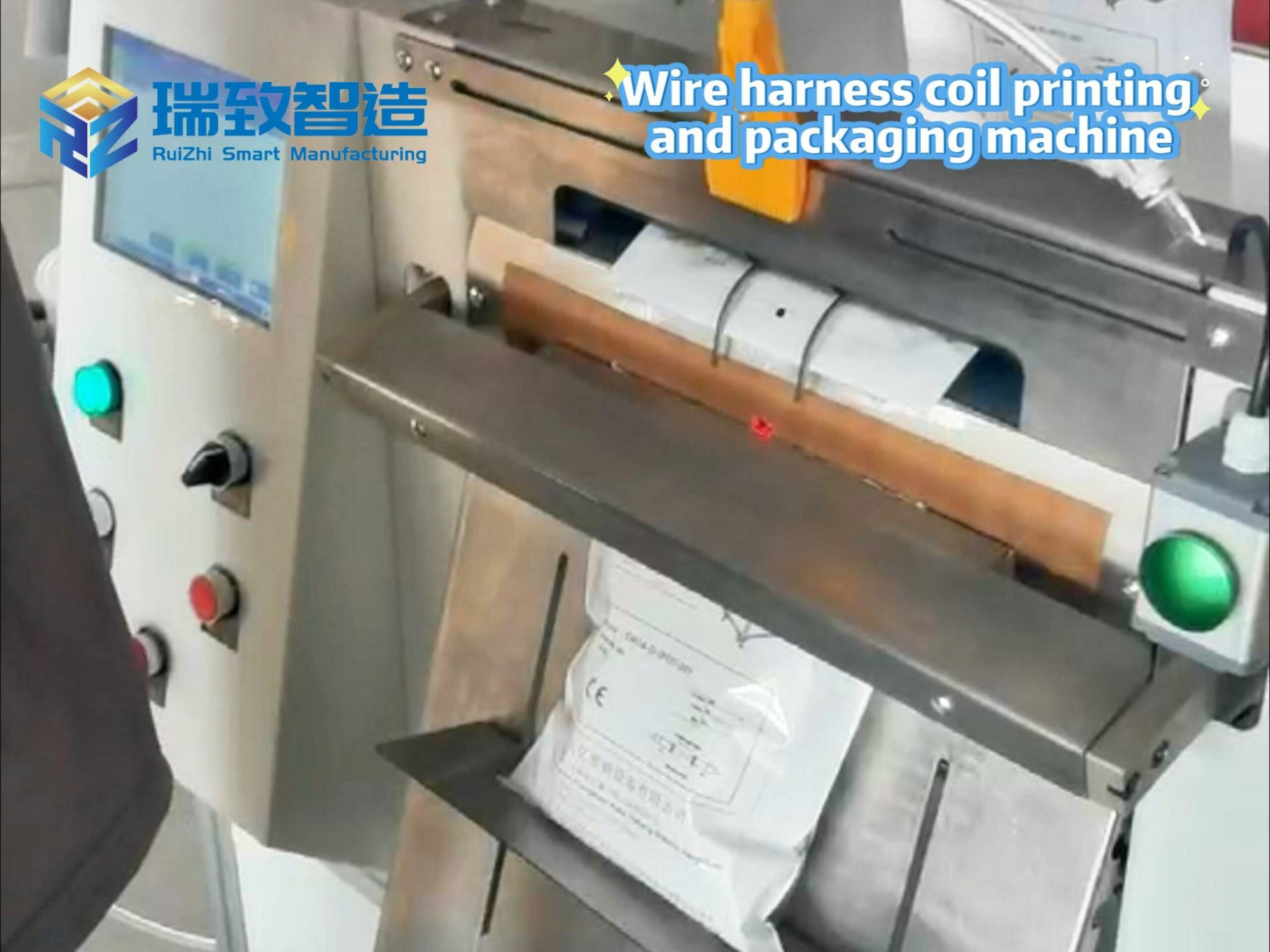

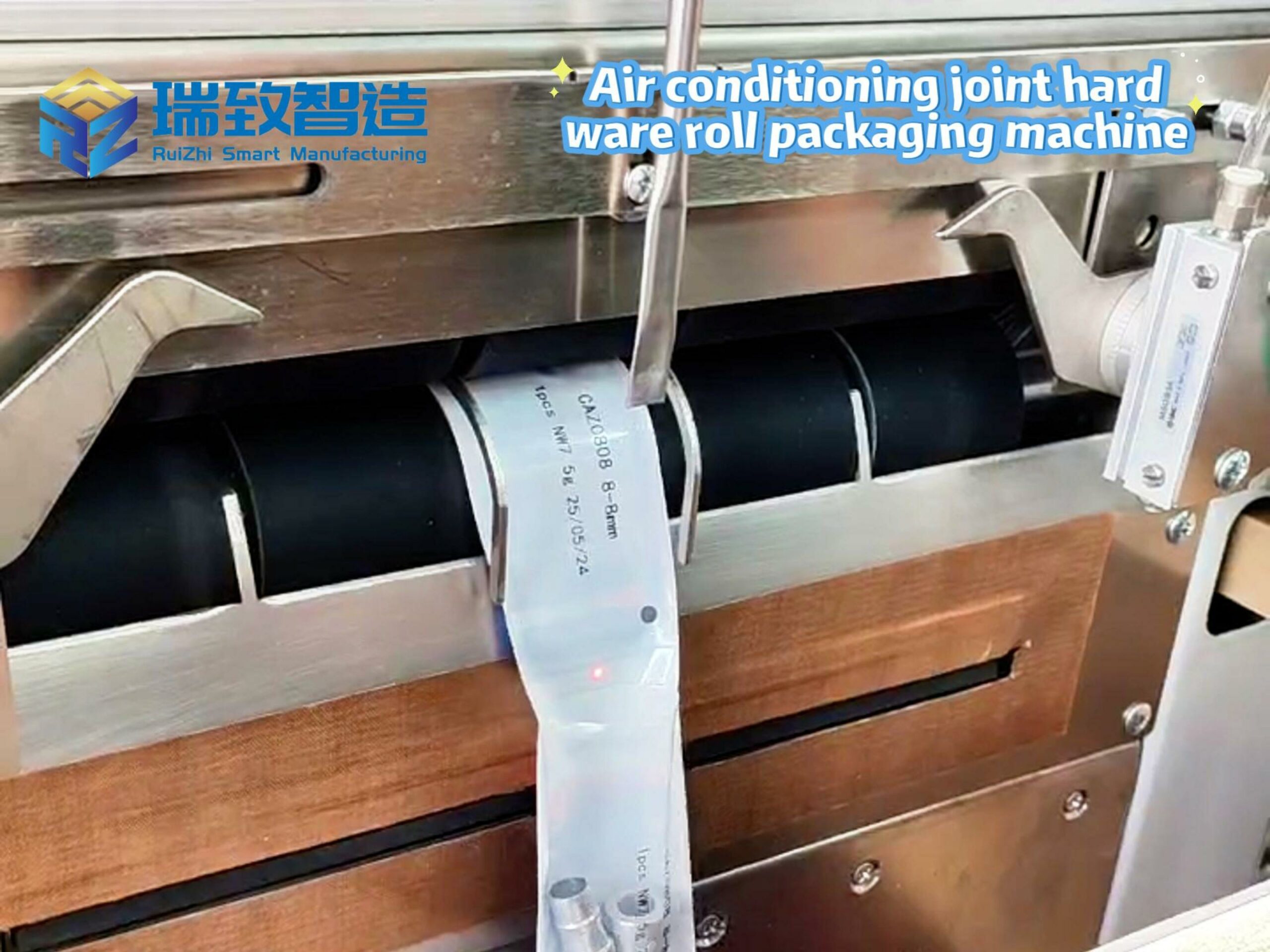

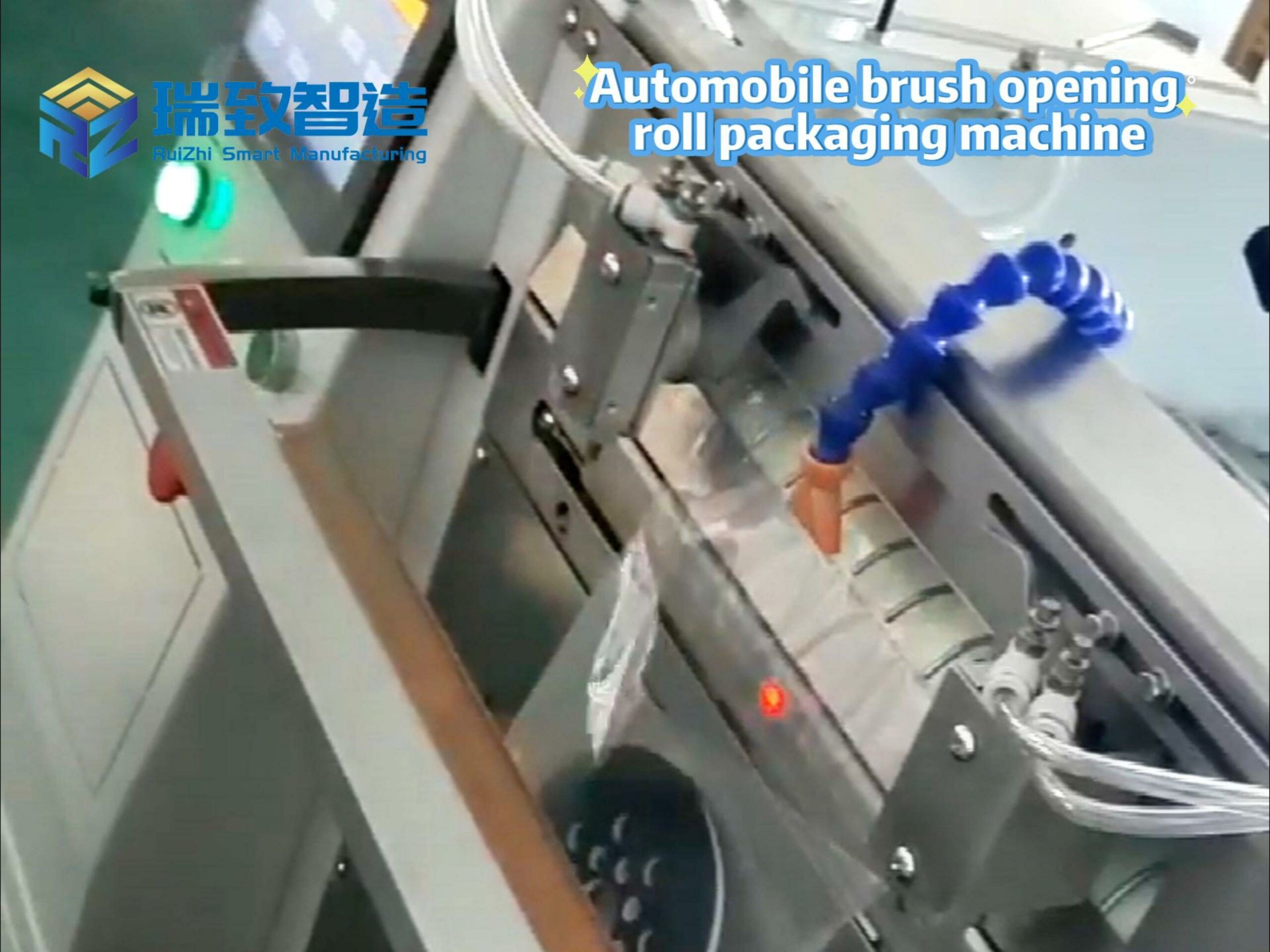

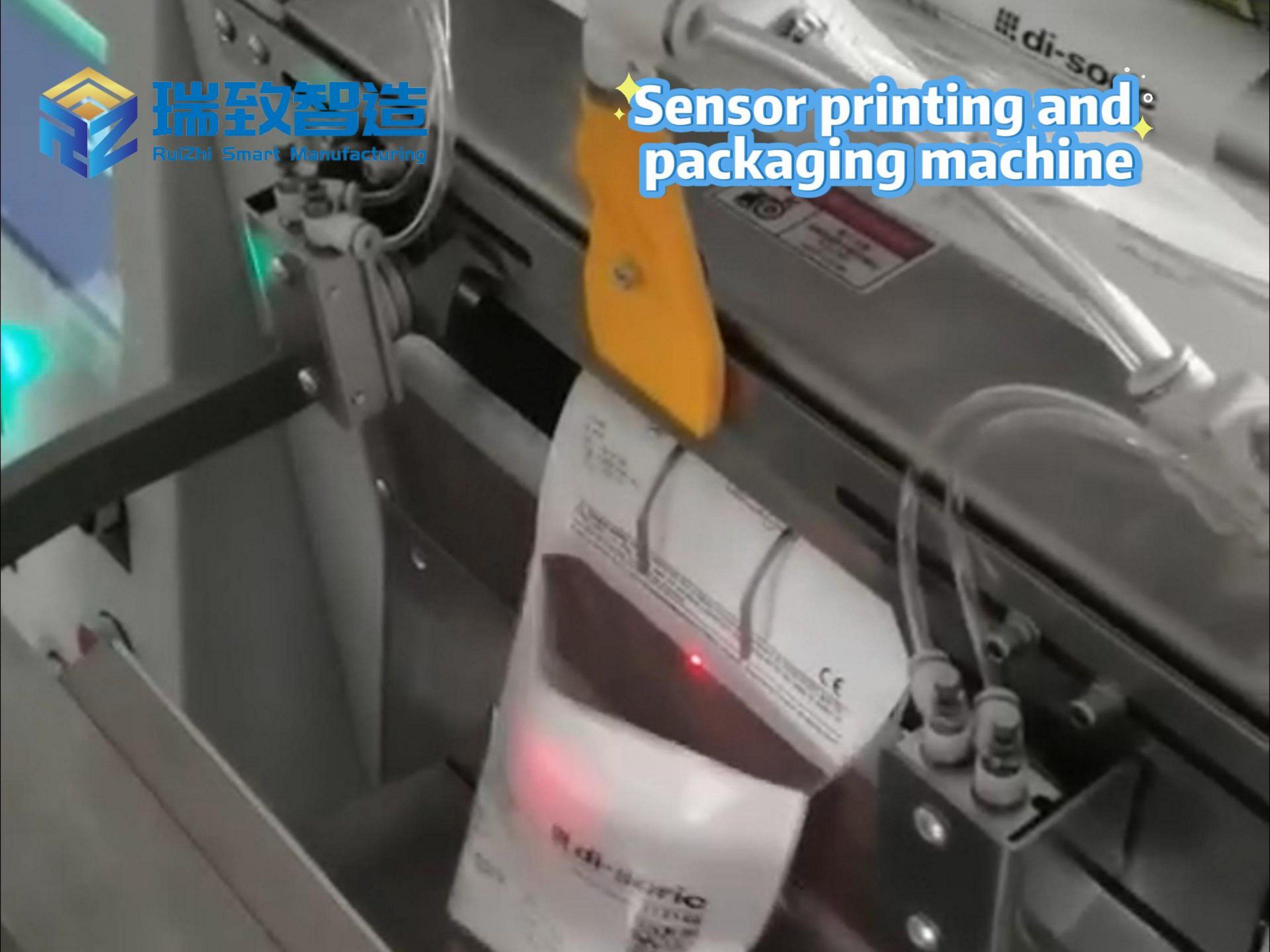

In addition to the 26% revenue growth rate, the cloud business has also made breakthroughs in government and enterprise digitalization, industrial internet, and other fields. For example, in precision manufacturing scenarios such as auto parts and electronic equipment, Alibaba Cloud can collect real-time operational data from the Automaattinen lukkorenkaan syöttöjärjestelmä (such as feeding accuracy, jamming frequency, and motor temperature), dynamically adjust the feeding rhythm through AI algorithms to reduce jamming errors by 15%-20%, predict the lifespan of vulnerable components (such as feeding rails and drive motors), trigger maintenance alerts in advance, and reduce unplanned downtime of the production line to below 2%, helping customers transform from “scale expansion” to “value deepening.”

AI Product Implementation Accelerates

From intelligent customer service and e-commerce personalized recommendations to industrial quality inspection, AI-related products have penetrated multiple business lines of the group. The triple-digit consecutive growth not only verifies the ability to commercialize technology but also indicates its future monetization potential in the To B field.

Core E-commerce Remains Stable

Taobao and Tmall’s customer management revenue increased 12% year-on-year. Against the backdrop of consumption recovery, they have maintained growth resilience through live streaming e-commerce and private domain operations, providing stable cash flow support for technological research and development.

Notably, even as Alibaba continues to increase R&D investment in cloud and AI (R&D expenses increased 15% year-on-year in fiscal 2025) and actively participates in industry technology summits and open-source community building, its net profit still achieved positive year-on-year growth. This means that business growth has entered a positive “input-output” cycle, rather than relying solely on cost control. The 87% increase in stock price this year reflects market recognition of this “high-quality growth,” forming a sharp contrast with the sluggish performance of previous years.

Valuation Debate Heats Up: “Overvalued by 52%” or “Reasonable Premium”?

As the stock price rises, the rationality of Alibaba’s valuation has become the core of the debate, with two opposing viewpoints in the market:

Viewpoint 1: Current Valuation Already Overestimates by 52%, Growth Potential Nearly Saturated

Proponents of this view focus on “fair value” calculations, believing that Alibaba’s current stock price already fully reflects recent performance highlights. Their core logic includes:

Profit forecasts have reached the upper limit: Although cloud and AI growth is strong, market forecasts for its fiscal 2026 revenue growth rate have been raised from 10% at the beginning of the year to 13%, leaving limited room for further surprises.

Industry competition suppresses premiums: The cloud business faces global competition from Amazon AWS and Microsoft Azure, while domestically, Huawei Cloud and Tencent Cloud are diverting government and enterprise orders; in the AI field, it must challenges from Baidu, ByteDance, and other companies in large models and industry applications, making it difficult to maintain “monopoly growth” for a long time.

Policy and macro risks not fully priced in: Geopolitical risks faced by cross-border e-commerce and uncertainties in domestic internet industry regulatory policies may become potential triggers for valuation corrections.

According to this view, Alibaba’s current P/E ratio (TTM) is about 22 times, 22% higher than its historical average (18 times). If combined with revised growth expectations, the fair value may be 52% lower than the current stock price.

Viewpoint 2: Horizontal Comparison Shows Advantages, Valuation Premium Is Justified

The other perspective defends Alibaba’s valuation through “industry horizontal comparison,” believing that the premium is reasonable:

P/E ratio is better than retail and technology peers: Although Alibaba’s P/E ratio (22 times) is higher than global e-commerce giant Amazon (19 times), it is lower than domestic internet companies Tencent (25 times) and Baidu (28 times); if focusing on the cloud business, its cloud segment valuation (3 times price-to-sales ratio) is also lower than Microsoft Azure (4 times), leaving room for catch-up growth.

Business synergy not fully priced in: The synergy between cloud and AI is being released — for example, providing e-commerce merchants with an end-to-end “cloud + AI” digital solution not only increases cloud business stickiness but also drives e-commerce revenue growth. This “1+1>2” synergy value has not yet been fully reflected in the stock price.

Cash flow supports high dividends: Alibaba’s free cash flow reached RMB 150 billion in fiscal 2025, with a dividend rate maintained above 30%. Stable cash flow provides a “safety cushion” for valuation and reduces short-term volatility risks.

The divergence between the two views essentially reflects different judgments on the “sustainability of cloud and AI growth” — if AI commercialization accelerates beyond expectations in future quarters and the cloud business breaks into overseas markets, the current valuation may still have room for improvement; conversely, if growth slows, correction pressure will emerge.

Investor Action Guide: From “Focusing on Valuation” to “Layout the Track”

Faced with the valuation debate, investors do not need to fall into an “either/or” judgment and can develop strategies from the following dimensions:

Track Core Indicators and Dynamically Adjust Expectations

In the short term, monitor high-frequency data: pay attention to monthly cloud business orders (especially AI transformation orders in manufacturing, such as automatic circlip feeding systems and cloud-connected transformation projects for industrial robots) and the number of paid AI product customers (especially in manufacturing and finance). If these data continue to grow, it can verify growth resilience.

In the medium term, watch policy signals: relaxation of domestic internet regulatory policies and preferential cross-border e-commerce tariffs may become catalysts for valuation repair; conversely, escalation of geopolitical tensions and intensified industry competition require vigilance.

Look Beyond Alibaba: Explore Industry Chain Opportunities

If you recognize that “cloud and AI are long-term tracks,” expand your investment perspective:

Undervalued cash flow targets: Screen low P/E companies in cloud computing infrastructure (such as servers and data centers) and AI computing power (such as GPUs and AI chips), which often benefit from Alibaba’s technological investment but have not been fully hyped.

Potential AI application layer stocks: Focus on small and medium-sized enterprises that provide Alibaba with AI training data and industry solutions, as they may grow faster in vertical fields (such as medical AI and industrial quality inspection).

Cross-border e-commerce synergy targets: The recovery of Alibaba’s core e-commerce business will drive growth in logistics, payment, SaaS services, and other industry chain enterprises, which can be captured through “correlation screening.”

Prioritize Risk Control: Avoid Single Bets

Given the significant valuation debate, it is recommended that investors reduce risk through “diversified allocation” — for example, controlling Alibaba’s position within 10% of the portfolio while matching it with undervalued consumer and new energy sectors to balance growth and value attributes.

Conclusion: Behind the Valuation Debate Is Long-Term Confidence in “Technological Transformation”

The valuation debate surrounding Alibaba essentially reflects the capital market’s divergent attitudes toward the “transformation of a traditional e-commerce giant into a technology company.” In the short term, the stock price may fluctuate due to performance expectation games; but in the long run, the quality of cloud and AI business growth and the ability to commercialize technology are the core determinants of its valuation ceiling. For investors, instead of obsessing over “whether it’s overvalued,” it’s better to focus on “whether the business continues to evolve” — if Alibaba can continue to make breakthroughs in AI large models and overseas cloud markets, the current valuation debate may just be a “short-term interlude” in the long-term upward journey.

Would you like me to create a condensed version of this translation for quick reading, or perhaps highlight the key investment points for easier reference?