Against the backdrop of the coordinated development of artificial intelligence and robotics technologies, machine vision is entering a new cycle of recovery and growth characterized by accelerated technological integration and expanding application boundaries.

According to research data from China Industrial Control Network, the Chinese machine vision market experienced a year-on-year decline of 3.7% in 2024. Despite the sustained growth in sectors such as semiconductors, automotive, and 3C electronics, the overall market demand continues to face downward pressure due to overcapacity in the new energy lithium battery and photovoltaic industries, as well as reduced investment in traditional industries.

In 2025, the Chinese machine vision industry gradually emerged from the adjustment phase, with overall demand showing signs of recovery. On the one hand, demand in traditional core sectors represented by 3C electronics and semiconductors has bottomed out and rebounded. On the other hand, demand for equipment in overseas markets has been continuously released, significantly driving the export of core visual devices. Driven by these factors, the recovery momentum of the core components market for machine vision has strengthened, and the downstream robotics sector has also rebounded simultaneously. It is expected that the market will achieve nearly double-digit growth throughout the year.

Driven by the recovery in demand, the current Chinese machine vision system and overall ecosystem remain active. Not only have a large number of system integrators and core component suppliers emerged, but also “vision + robotics” integrated enterprises have achieved rapid growth. Among foreign-funded brands, leading enterprises represented by Cognex and Keyence still maintain technological leadership and order growth in high-end 3D vision, intelligent code readers, and other fields, relying on their technological heritage.

Although some key devices such as high-end image sensors and core chips still rely on imports, the domestic localization rate of the industry is continuously improving, and the independent controllability of the industrial chain is gradually enhancing, laying a solid foundation for the long-term, healthy, and sustainable development of the industry. Among domestic brands, Hikrobot and Huari Technology are leading representatives. Relying on their advantages in localized rapid response services and comprehensive supply chain cost control capabilities, they have achieved double-digit annual growth and are continuously expanding their market share in the 2D vision and overall solution markets.

From “Seeing” to “Understanding”: New Breakthroughs in Visual Technology

The improvement of the industrial chain and the activity of the ecosystem provide a fertile ground for technological innovation. Machine vision is evolving from “accurate seeing” to “intelligent understanding,” showing a multi-dimensional integration trend of “deepening 2D vision + AI, scaling 3D vision applications, and empowering with large models.” This trend is driving the reduction of application thresholds and the expansion of the boundaries of solution capabilities.

2D Vision + AI: Reducing Application Thresholds

By introducing deep learning algorithms, the accuracy and generalization capabilities of 2D vision in scenarios such as complex defect detection and precision measurement have been significantly improved, enabling it to play an important role in new energy vehicle component testing, PCB board microstructure detection, and other applications. For example, Hikrobot’s SC2023X intelligent camera, equipped with built-in AI algorithms, does not require a large number of training samples to be prepared in the cloud or internal servers. Users can directly train AI models within the camera. By registering only 1 to 5 sample images, the AI can automatically extract differential features for distinction, greatly reducing the application threshold of AI-powered vision.

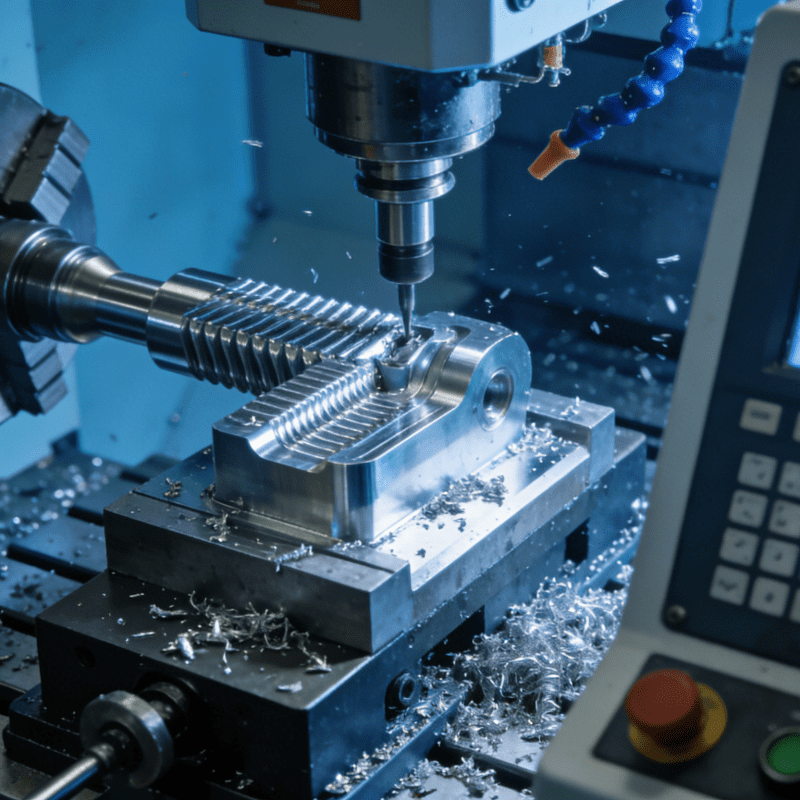

3D Vision: Moving Towards Scale Application

3D vision technology is widely used in robot grasping, navigation and positioning, spatial measurement, and other fields, effectively enhancing the environmental understanding and spatial perception capabilities of industries such as logistics, manufacturing, and assembly. In scenarios such as logistics palletizing, automotive component loading and unloading, and battery electrode sheet online measurement, 3D laser profilers, line laser sensors, and other devices have achieved large-scale applications. Technologies such as structured light, time-of-flight (ToF), and laser triangulation are continuously iterating, and high-end technologies such as confocal microscopy and multi-focus surface superposition have been applied in semiconductor manufacturing to detect nanometer-level surface roughness.

Currently, numerous enterprises have launched targeted solutions to facilitate the large-scale penetration of 3D vision. For instance, Huari Technology’s 3D high-precision line laser profiler sensor features a collection frame rate of up to 20KHz and can achieve high-speed and high-density precision measurement with 3200-point profile data. LMI’s Gocator series sensors can achieve sub-micron-level measurement accuracy at the highest, ensuring the precise capture of minute defects. Combined with AI tools, the 3D data collected by Gocator can easily cope with variations in weld seam position and defect morphology.

At the same time, the adaptability of software algorithms has become a key support for the implementation of 3D vision technology. Teledyne Dalsa’s products cover a comprehensive range of hardware products including line scanning, infrared, microwave, and X-ray technologies. Its Sherlock 8 vision platform integrates decades of accumulated traditional algorithms and the latest 3D and AI algorithms, making it adaptable to the technical needs of multiple scenarios.

AI Large Models and Embodied Intelligence: A Testbed for Machine Vision

Currently, the application of AI visual technology in industrial scenarios mainly follows three paths: first, small-sample data training; second, sample-set AI; and third, AI large model solutions, which form basic capabilities through pre-training with massive general data. Among these, large model technology is mainly based on Transformer-based deep learning technology. From the perspective of future technological development, AI large models are expected to accumulate specialized data in various industrial product segments. When these vertical domain large models are integrated, they will form a powerful common platform for machine vision, significantly improving cross-scenario adaptability efficiency.

This integration trend has spawned many corporate practices. For example, Hikrobot has developed an industrial visual large model. It not only has developed general-purpose task large models such as image segmentation, object detection, OCR, and code reading based on the characteristics of machine vision applications, but also built industry-specific scenario large models tailored to specific industries and scenarios. At the same time, it has developed supporting algorithms such as edge learning classification, edge learning detection, and edge learning OCR, forming full-stack technical support.

In the lithium battery testing field, Lingyun Guang has built an end-to-end intelligent detection system based on “Vision + AI” for key processes such as material, electrode sheet, burr, tab, and square appearance. It can stably output high-quality image data in complex scenarios such as high-speed disturbance, strong reflection, and multi-layer structures.

Notably, the integration of AI and machine vision is also extending into the field of embodied intelligence, and their in-depth combination is driving new industry transformations. Currently, Chinese robot enterprises are accelerating the layout of the “AI + perception + control” technical system, promoting the upgrading of industrial robots towards embodied intelligence. By integrating advanced visual decision-making algorithms into the system, they can realize complex functions such as path planning, dynamic obstacle avoidance, and flexible grasping.

Typical enterprises include Opto, which provides end-to-end visual solutions covering the “head – hand – waist” and integrates 3D environmental perception, real-time target recognition, and dynamic path planning to build an integrated “perception – decision – execution” capability for humanoid robots. Mekamon, on the other hand, empowers intelligent robots with “AI brain + 3D vision” as the core, which is widely used in multiple scenarios such as logistics, automotive, and home appliances, achieving large-scale applications such as workpiece loading and unloading, carton/turnover box/packaging film palletizing, and high-precision positioning/assembly.

Stepping Out of the “Comfort Zone”: Machine Vision Deepening into Emerging “Territories”

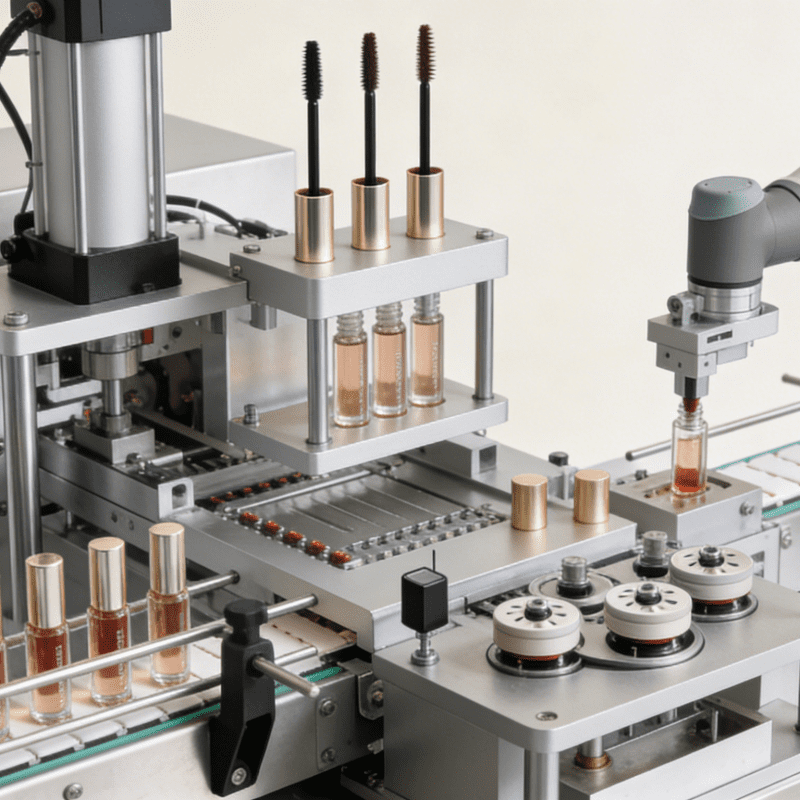

As technology matures, machine vision is expanding from traditional industrial core fields to diverse scenarios such as medical care and intelligent transportation. In terms of market size, it is expected that by 2030, the global machine vision market will grow from 15.83 billion US dollars in 2025 to 23.63 billion US dollars, with a compound annual growth rate of 8.3%. Currently, China’s industrial machine vision is mainly concentrated in several major fields such as 3C electronics, semiconductors, automotive, photovoltaic, and lithium battery. Among them, the automotive/new energy industry has the highest penetration rate, thanks to the high degree of industry automation and standardization, which makes visual technology easy to integrate. In contrast, the penetration rate in traditional industries such as food and textiles is relatively low, mainly constrained by factors such as complex detection scenarios and strong demand personalization.

The ultimate value of technological innovation lies in its ability to be effectively implemented and solve practical problems in the industry. The continuous development of machine vision technology is driving its application scenarios to accelerate penetration into diverse fields such as medical care, intelligent transportation, and AR/VR, forming a development pattern of “led by high-end manufacturing and empowered by emerging scenarios.”

In addition to industrial core scenarios, in the medical field, machine vision technology is accelerating the empowerment of AI-assisted diagnosis and minimally invasive surgical navigation, improving the accuracy and safety of diagnosis and treatment. In the field of intelligent transportation, by integrating with multi-sensors to build urban-level visual networks, machine vision has become a key infrastructure for autonomous driving and smart city construction. In the fields of the metaverse, AR/VR, etc., frontline engineers can wear AR glasses to automatically identify the corresponding workpiece types and positions through 3D reconstruction technology, and combine gesture interaction to guide assembly and maintenance.

At present, the downstream application industries show a diversified development and differentiation characteristics, with growth momentum mainly driven by high-tech barriers and high prosperity industries:

l High-Growth Fields: Double Engines of Technological Drive and Industrial Upgrading

Fields such as 3C electronics/electrical engineering, semiconductors, new energy vehicles/batteries, medical/biotechnology, aerospace/aviation, and artificial intelligence and AR/VR are the core growth poles of current machine vision demand. The growth momentum stems from new scenarios brought about by technological breakthroughs, equipment demand accelerated by the domesticization process, and the rapid penetration of emerging applications. In particular, the semiconductor industry, one of the fields with the highest precision requirements for machine vision, has seen a significant increase in demand for machine vision in links such as wafer defect detection and chip packaging positioning with the expansion of wafer fabs and breakthroughs in advanced processes.

l Flat/Mild Growth Fields: Stable Market of Stock Upgrading and Segmental Penetration

The demand for machine vision in fields such as industrial automation, food and beverage packaging, IoT/warehousing logistics, and environmental monitoring remains stable or grows moderately. The core reason is the maturity of the industry, with new demand mainly coming from stock equipment upgrading and segmental scenario penetration.

l Pressure-Bearing Fields: Transformation Pains Under Weak Demand and Cost Pressure

The demand for machine vision in traditional fields such as printing/packaging, textiles, and transportation/rail transit has declined or grown sluggishly, mainly constrained by factors such as weak demand in downstream industries and cost pressure transmission.