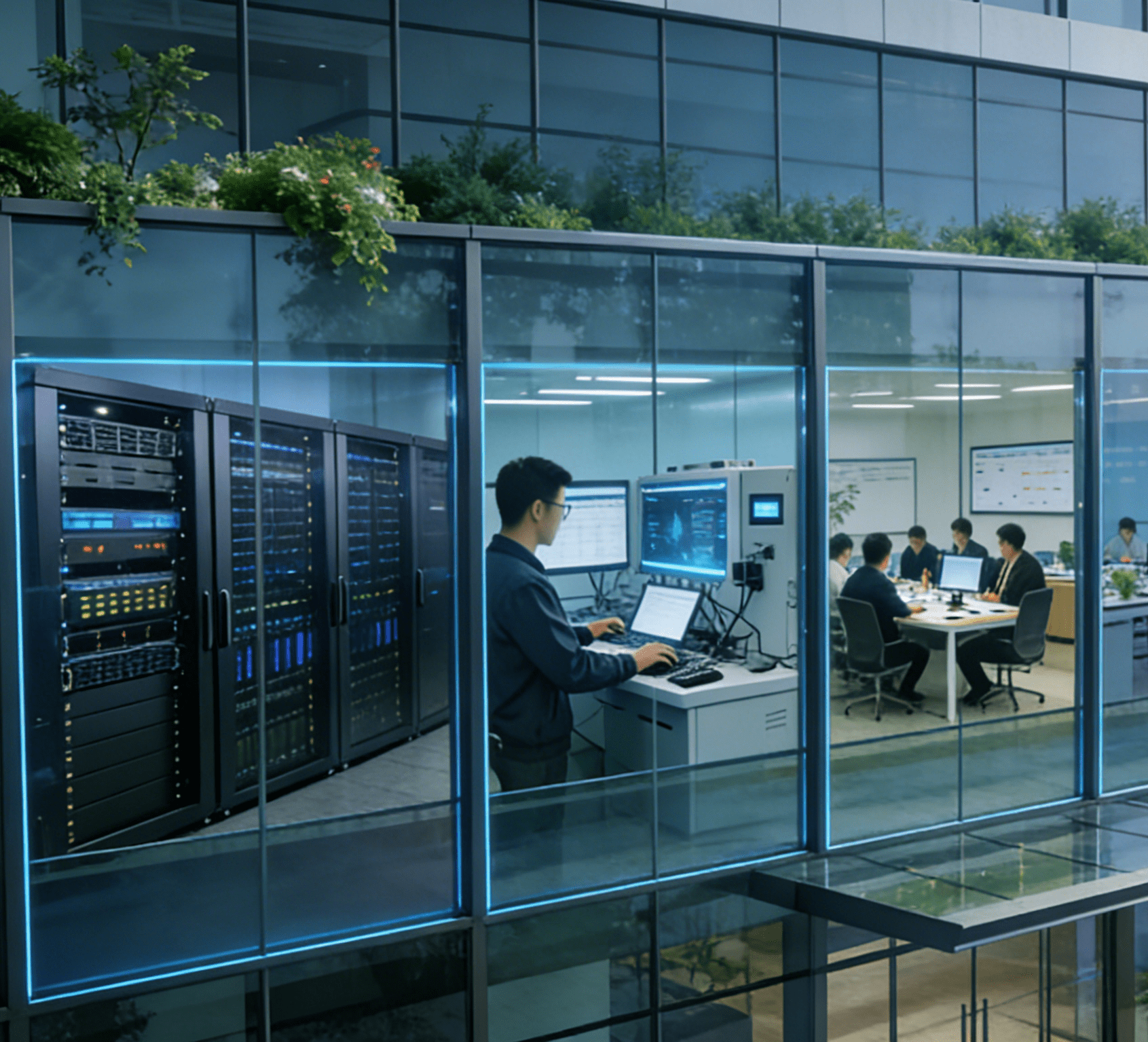

In the hinterland of the Qinghai-Tibet Plateau, within an ecological reserve far from the power grid, several devices equipped with high-definition cameras and intelligent algorithms stand quietly. The solar panels mounted on top of them glisten under the plateau sun, transmitting real-time footage of wildlife activities dozens of kilometers away to the monitoring center via 4G networks. This scene epitomizes a powerful trend sweeping the global security market—solar-powered 4G/5G surveillance cameras are rapidly evolving from a marginal supplementary solution to a mainstream choice for outdoor security, especially in remote and mobile scenarios.

Market Data Reveals a Growth Surge: From Niche to Mainstream

According to the latest report by Fortune Business Insights, the global solar panel camera market size reached $1.12 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 10.4%, hitting $2.73 billion by 2032. Market Research Future, another authoritative institution, offers an even more optimistic forecast, predicting a CAGR of approximately 13.5% during the 2023–2032 period. This rapid growth is by no means groundless; it stems from the inherent limitations of traditional wired surveillance solutions in vast “off-grid and network-free” scenarios, coupled with the confluence of mature solar energy, wireless communication, and Internet of Things (IoT) technologies.

From a regional perspective, North America and Europe constitute the current core markets, thanks to their mature consumer bases, extensive agricultural and pastoral lands, and strong environmental awareness. However, the Asia-Pacific region is emerging as an undisputed growth engine. Behind this lies the hundreds-of-billions-yuan market opportunity brought by China’s “Rural Revitalization” and “Safe Rural Areas” initiatives. Across China’s vast rural and suburban regions, solar-powered 4G cameras—eliminating the need for complex wiring—have become the most cost-effective solution for public security coverage, farmland and fishpond monitoring, and courtyard anti-theft, spurring massive deployment demand.

Technology Integration and Cost Reduction: The Twin Engines Driving Market Explosion

The market boom is first fueled by the maturity and integration of core technologies. Advances in photovoltaic technology have enabled the development of compact, high-efficiency solar panels capable of powering cameras round the clock. Meanwhile, the popularization and cost reduction of lithium battery energy storage technology have resolved the power supply challenge during nights and consecutive rainy days. More importantly, the widespread coverage and falling tariffs of 4G/5G networks have provided a stable, high-speed, and manageable channel for data transmission, completely lifting the geographical constraints on device deployment.

This integrated “solar power supply + wireless transmission + intelligent analysis” model delivers significant Total Cost of Ownership (TCO) advantages. Take a remote pasture monitoring project as an example: traditional wired solutions require trench excavation, laying kilometers of cables, and applying for grid connection, entailing huge upfront investment and lengthy construction periods. In contrast, solar-powered wireless solutions enable “plug-and-play” deployment, with only minimal subsequent costs for network traffic and occasional remote maintenance. This disruptive cost structure has made it the only viable option for scenarios such as smart agriculture, border patrol, oil pipeline monitoring, and temporary construction site management.

Diversified Application Scenarios: Expanding Boundaries from Security to IoT

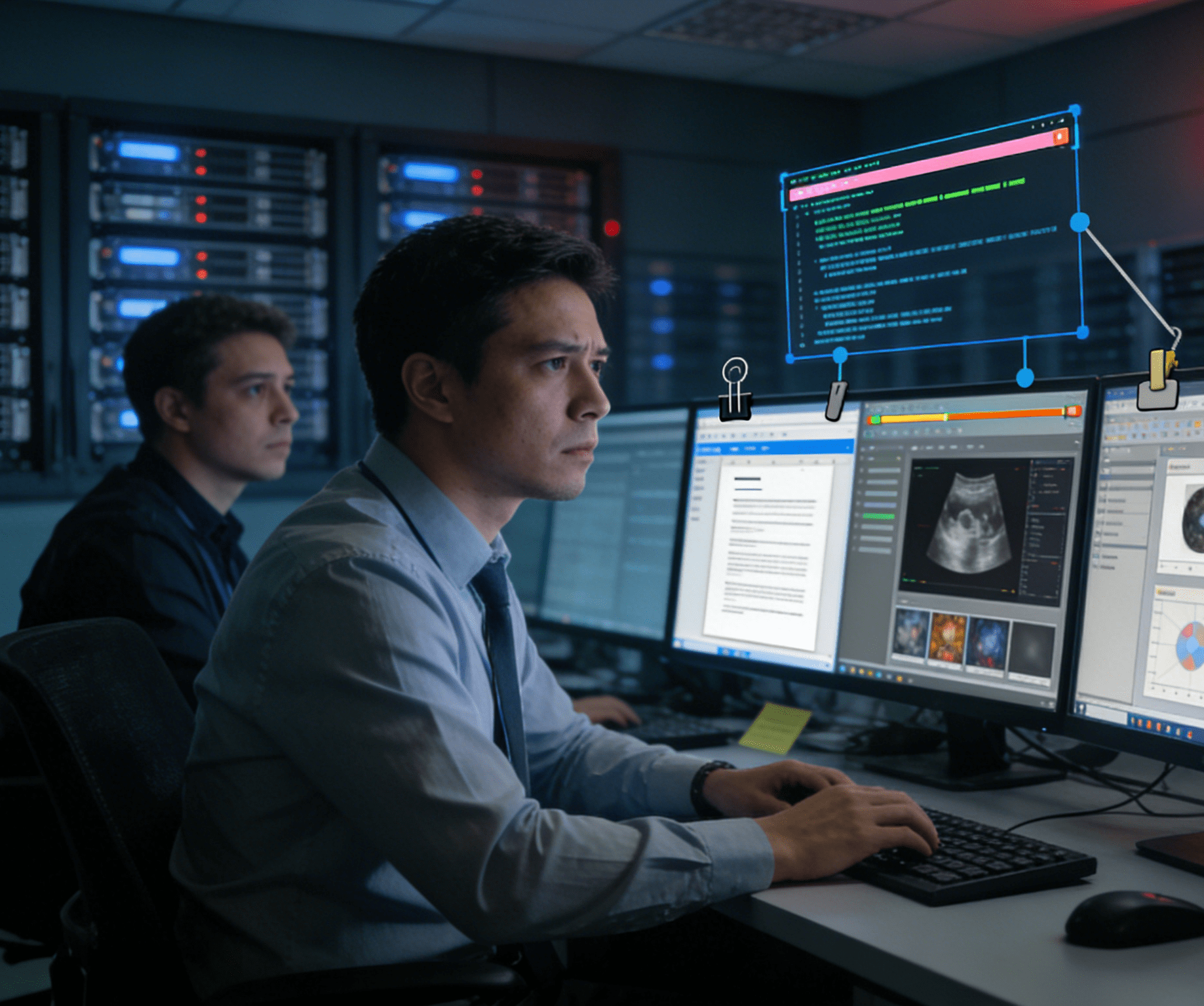

The role of solar-powered surveillance cameras has long transcended traditional “monitoring” and “anti-theft” functions. They are evolving into multifunctional IoT nodes that integrate video capture, data collection, and transmission capabilities.

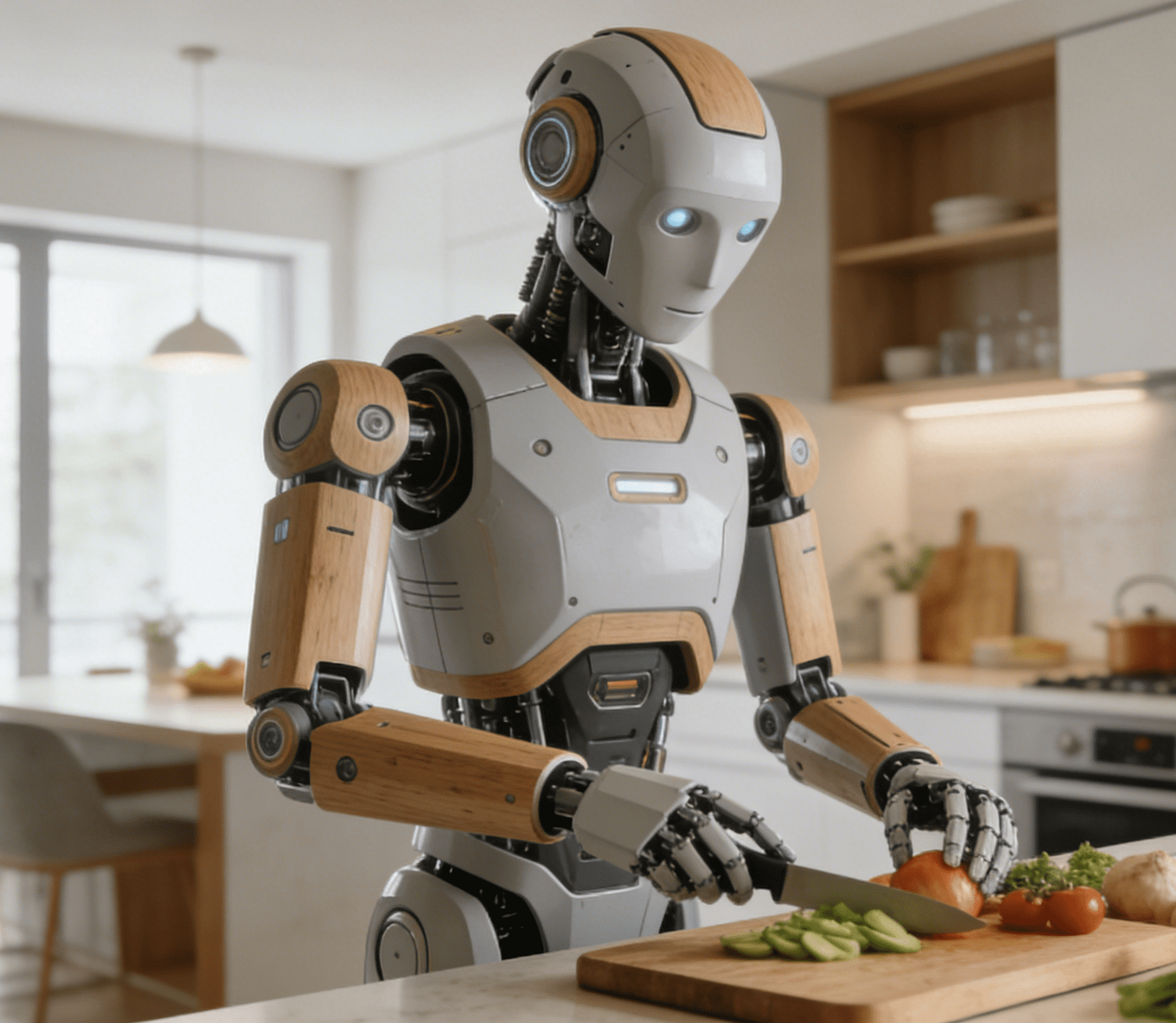

In the field of smart agriculture, many large-scale Australian farmers use these cameras not only to prevent theft but also to integrate soil moisture and meteorological sensors, enabling intelligent linkage of irrigation systems and disaster early warning. In environmental protection and scientific research, as exemplified by the Qinghai case mentioned earlier, these devices play an irreplaceable role in protecting endangered species and monitoring forest fire risks. In infrastructure construction and operation—such as China’s “West-East Power Transmission” ultra-high-voltage project—solar-powered surveillance points deployed along the route serve as the “eyes in the sky” safeguarding grid security. In industrial manufacturing scenarios, these solar-powered cameras also provide reliable monitoring support for automated production equipment; for instance, they can real-time track the operational status of Roboti nägemise positsioneerimise automaatne kileaplikaatori masins, synchronize visual data to the control center, and assist in detecting film application deviations or equipment malfunctions promptly. Additionally, in the consumer DIY security market, products from brands like Reolink and Eufy have maintained strong sales on e-commerce platforms, testifying to their broad appeal among ordinary users.

Policy Support and Green Wave: Catalysts Accelerating Market Adoption

Global “dual carbon” (carbon peaking and carbon neutrality) goals and green development agendas have created favorable policy conditions for solar-powered surveillance products. Initiatives such as the European Union’s Green Deal and China’s “Dual Carbon” Strategy are indirectly driving public and private sectors to prioritize the procurement of low-energy-consumption solutions utilizing renewable energy. Many countries and regions offer subsidies or tax incentives for solar products, further lowering the barriers to adoption for users.

At the same time, rising global public security investment, the advancement of rural revitalization strategies, and telecom operators’ active promotion of IoT services have jointly fostered an optimal market environment. For instance, in some Southeast Asian and African countries, governments have partnered with telecom operators to promote solar-powered surveillance as a core smart city service, achieving leapfrog development in security infrastructure.

Challenges and Future Trends: Toward Greater Intelligence and Integration

Despite its promising outlook, the market still faces practical challenges: extreme cold or severely insufficient sunlight in certain regions imposes stringent requirements on battery performance and system energy management; upfront device costs remain higher than those of traditional wired cameras; and wireless transmission raises concerns regarding data security and privacy protection.

Looking ahead, the industry will witness three key trends:

In-depth Intelligent Integration: AI capabilities will be further embedded at the device end, enabling more accurate classification of humans and vehicles as well as behavior analysis—reducing data traffic while improving response speed.

Refined Energy Management: AI algorithms will be leveraged to predict weather conditions and intelligently adjust device operating modes (e.g., scheduled hibernation, motion detection wake-up), achieving adaptive energy optimization and enhancing endurance in rainy and overcast environments.

Platformization and Ecologization: Devices will no longer operate as isolated nodes but will be deeply integrated into smart city, smart agriculture, and industrial IoT platforms. As data entry points, they will interconnect with drones, sensor networks, and business management systems, creating value that extends far beyond basic security functions.

Conclusion

The rise of solar-powered 4G/5G surveillance cameras represents an industrial transformation driven by technological maturity, market demand, policy support, and global sustainable development concepts. It perfectly demonstrates how technology integration can turn long-standing industry pain points into enormous market opportunities. As technology continues to evolve and costs decline further, this “green security revolution” will permeate more corners of the world—moving from the margins to the center of the global stage and reshaping the landscape of outdoor security and IoT sensing markets. For security enterprises, this is not merely an expansion of product lines, but a strategic opportunity to build a next-generation solution ecosystem centered on new energy and wireless IoT for the future.

What is the market price of a continuous motion multi-piece special-shaped machine?