Recently, Shanghai Starry Electrical Co., Ltd. (hereinafter referred to as “Starry”) announced that its application for the issuance of shares to specific objects in 2025 has been accepted by the Shenzhen Stock Exchange.

The announcement stated that the issuer of this share issuance to specific objects is the controlling shareholder Qingdao Haier CosmoPlat Industrial Intelligence Co., Ltd. (hereinafter referred to as “Haier CosmoPlat Industrial Intelligence”). It will subscribe for the shares issued this time in cash, with the number of shares being 152,504,097, the price being 7.99 yuan per share, and the total amount of funds to be raised being 1,218,507,700 yuan. Behind this series of capital moves, it is more like an “industrial puzzle”.

Spending 2.5 Billion, Haier Acquires Starry

In February this year, Haier announced that it would spend 2.5 billion yuan to acquire Starry.

Specifically, the three major shareholders of Starry, Ji Defa, Liu Liping, and Ji Yi, signed a package of agreements with Haier CosmoPlat Industrial Intelligence. The three transferred their 29,652,066 shares, 27,685,828 shares, and 8,968,235 shares of Starry to Haier CosmoPlat Industrial Intelligence respectively, and at the same time entrusted the voting rights of the remaining 127,583,569 shares of the listed company held by them in total to Haier CosmoPlat Industrial Intelligence for exercise, and the three have a concerted action relationship with Haier CosmoPlat Industrial Intelligence.

The transfer price of these shares is about 19.61 yuan per share, and the total transfer price reaches 1.3 billion yuan.

After the completion of the above share transfer, Haier CosmoPlat, with a total of 193,889,698 voting rights (accounting for 29.24% of the total share capital), officially became the controlling shareholder of Starry, and Haier Group also became the actual controller of Starry.

In addition, Haier CosmoPlat Industrial Intelligence also signed a conditional “Share Subscription Agreement” with Starry, agreeing that Haier CosmoPlat Industrial Intelligence intends to subscribe for 152,504,097 shares issued by the listed company to specific objects in cash at a price of 7.99 yuan per share, with a total raised capital of about 1.219 billion yuan.

If the private placement is successfully approved by the Shenzhen Stock Exchange and registered by the China Securities Regulatory Commission, the number of shares directly held by Haier CosmoPlat Industrial Intelligence in Starry will increase to 218,810,226, accounting for 26.83% of the total share capital of the listed company, and the voting right ratio will increase to 42.47%, further consolidating the control.

In June, with the completion of the delivery of the agreement transfer shares, Starry has officially become a “new member” of Haier CosmoPlat’s industrial internet ecosystem. In mid-July, after the re-election of Starry’s board of directors, 4 out of 9 directors have Haier backgrounds. The “Haier imprint” has been deeply integrated into corporate governance.

It is worth mentioning that the funds raised from this issuance of shares to specific objects, after deducting issuance expenses, are intended to be all used to supplement Starry’s working capital, which will provide sufficient operating funds for business operations, ease the pressure on working capital, and reduce the company’s asset-liability ratio, etc.

Then, what kind of “digital imprint” does Starry’s capital “account book” present?

Just looking at 2024, Starry achieved a total operating income of 3.357 billion yuan, a year-on-year decrease of 0.89%; the net profit attributable to the parent company was -288 million yuan, a year-on-year reduction of 24.00% in losses; the non-net profit was -339 million yuan, a year-on-year reduction of 35.39% in losses; the net cash flow from operating activities was 111 million yuan, a year-on-year decrease of 30.54%.

Calculated, Starry’s cumulative loss in three years exceeded 1.6 billion yuan, but the signal of “reducing losses” is already clear.

This positive momentum continued to ferment in the first half of 2025: the performance forecast showed that the company’s net profit attributable to shareholders of the listed company is expected to be 1.55 million yuan – 2.30 million yuan, compared with a loss of 18.7505 million yuan in the same period last year, successfully turning losses into profits; the net profit after deducting non-recurring gains and losses is expected to be a loss of 15.2535 million yuan – 16.0035 million yuan, a reduction of 50.49% – 52.81% compared with the loss of 32.3234 million yuan in the same period last year.

However, Starry’s 2024 annual report frankly stated that the overall asset-liability ratio is at a relatively high level. On the one hand, the company is a high-tech enterprise that needs continuous investment in research and development; on the other hand, the asset-liability ratio is relatively high due to industry characteristics.

China is the world’s largest robot market and has been the world’s largest industrial robot market for 12 consecutive years. However, in recent years, the market competition in this “sea area” has become increasingly fierce, the industry “involution” has continued to heat up, and some even show signs of saturation. According to the disclosure of the 2025 World Robot Conference, in 2024, China’s industrial robot sales reached 302,000 sets, and the output climbed to 556,000 sets. Behind the booming supply and demand, there is the realistic challenge of accelerated industry reshuffle.

Based on this, Haier has entered the market strongly with multiple advantages such as “real money”, scene resources, and customer ecology. This heavy “gift package” for Starry may be a “timely help” to solve the urgent need, or an “icing on the cake” to add development momentum. In any case, this will press the “accelerator button” for Starry’s development path and help it stand out in the fierce market competition.

How about the “chemical effect” of the collision of strong players?

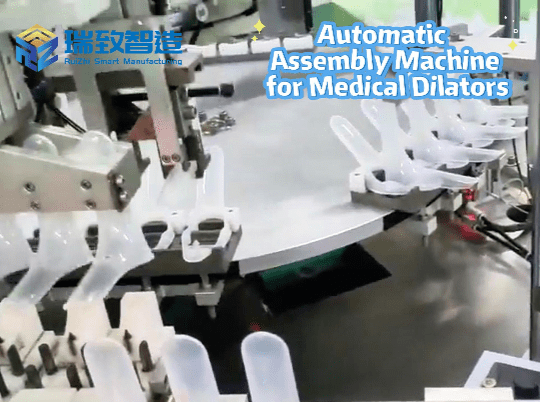

In fact, the “fate” between the two has long been foreshadowed: in 2020, the air-conditioning bottom plate intelligent manufacturing production line delivered by Starry was put into operation in Haier’s Jiaozhou factory in Qingdao, becoming Haier’s first domestic robot production line. Among them, the 4 – Axis Robotic Tray Loading System independently developed by Starry plays a core role in the production line. Through four-axis collaboration, it realizes the precise grasping and pallet stacking of air-conditioning bottom plate components. Cooperating with Haier’s intelligent scheduling system, the production line’s takt efficiency is increased by 30%, and the labor cost is reduced by 40%, demonstrating its hard strength in the field of industrial automation.

Behind this “two-way rush” is the “temptation” of each other’s core advantages.

As a white goods giant, Haier has 40 years of intelligent manufacturing experience and is fully deploying three ecosystems: smart housing, big health, and digital economy. Under the dilemma of “increasing revenue without increasing profits” in the home appliance industry, entering the robot track across borders has become one of the choices. After all, its old rival Midea has already spent 30 billion yuan to acquire 94.55% of KUKA’s shares, trying to get a share.

And Haier’s cooperation with Starry, which has strong strength in the OT layer such as industrial control and robot research and development, may be a “stable move”.

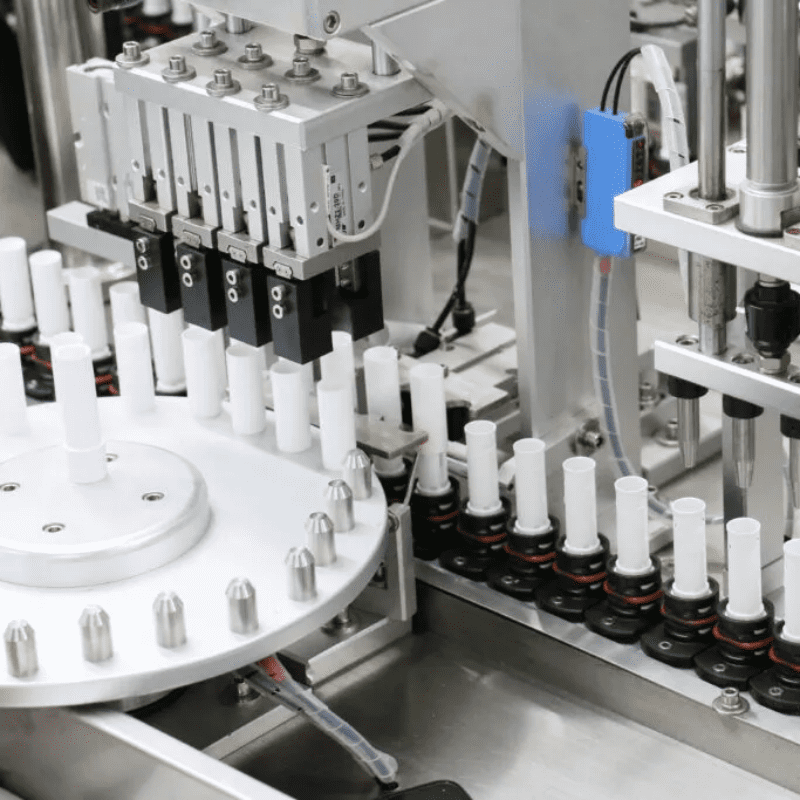

Since its establishment in 1995, Starry has taken algorithms and software as its core, and its business covers three major sectors: control and drive products and systems, robot products and systems, and elevator control products and systems.

In the robot field, it has delivered impressive results: according to mir data, in the first half of 2024, Starry’s industrial robot sales ranked fourth in China and tenth in the world, among which SCARA robots ranked second in China and fourth in the world.

Technical “hard power” is Starry’s confidence. In the field of core components, Starry fully masters 100% of key technologies such as robot controllers, servo drives, and system software, as well as the controllers of industrial robots and servo drives in servo systems.

In 2015, it integrated the servo drive and control in the servo system, and pioneered the use of “drive-control integration” technology in the industry for the first time.

In terms of robot ontology, Starry is one of the few manufacturers that cut into the robot ontology through controllers. Its subsidiary Zowee’s first-generation SCARA robot was launched in 2008, making it one of the earliest domestic robot manufacturers to industrialize.

In the field of semiconductor robots, Starry, aiming at industry pain points, after three years of continuous investment, has launched a leading domestic product matrix of semiconductor wafer transfer robots.

Under the wave of embodied intelligence, Starry has clarified its future development direction based on the understanding of “brain” and drive, and plans to launch embodied intelligence/humanoid robots in 2025.

Behind these is inseparable from Starry’s investment of a large amount of resources in research and development, which has invested more than 200 million yuan in research and development for many consecutive years.

In terms of production and manufacturing, Starry has 3 main production bases, among which the robot super demonstration factory in Jiading, Shanghai has a strong production capacity of over 10,000 robots per year, providing a solid guarantee for large-scale product delivery.

With the “golden key” of core technologies and the “strong bond” of Haier’s ecosystem, this industry leader with 30 years of experience is ushering in new opportunities under the east wind of policies and technologies.

In the future, the industrial robot track will continue to witness fierce competition and changes driven by both technological innovation and market expansion.