Company Overview and Earnings Highlight

Rockwell Automation, Inc. (NYSE: ROK) recently announced impressive financial results for the third quarter of fiscal year 2025, with key metrics surpassing analysts’ expectations. Amidst escalating competition in the industrial automation sector, its growth trajectory and business expansion capabilities have drawn significant attention.

All-Round Positive Financial Data, with Revenue and Earnings Surpassing Expectations

In terms of revenue, the quarter reached $2.14 billion, exceeding analysts’ projections of $2.07 billion and marking a 5% year-over-year increase. Breaking down the growth, organic sales rose by over 4% year-on-year, while currency translation contributed less than 1% to total sales growth. Achieving such results is particularly noteworthy against the backdrop of a complex and volatile global economic environment and intensified industry competition.

On the earnings front, the company’s adjusted earnings per share (EPS) stood at $2.82, significantly higher than the consensus analyst estimate of $2.67 and up 4% from $2.71 in the third quarter of fiscal year 2024. Following the earnings release, Rockwell’s stock price edged up 0.3%, reflecting investors’ positive recognition of its outperformance and promising future prospects.

Divergent Performance Across Segments, with Software & Control Leading the Way

Within the company’s business structure, different segments showed varying growth trends. The Software & Control segment performed exceptionally strongly, with sales surging 23% to $629 million. The segment’s operating margin jumped significantly from 23.6% in the same period last year to 31.6%, driven by multiple factors. On one hand, continuous increased investment in research and development has led to the launch of innovative software and control solutions that meet market demands, attracting numerous industry clients. For instance, Rockwell provided an intelligent production control software system to a major automaker, enabling efficient production line scheduling and precise control, which significantly boosted productivity and prompted the client to increase investment in cooperation.

Meanwhile, the Intelligent Devices segment recorded a modest 1% sales growth. The Lifecycle Services segment, however, saw a 6% decline in sales, possibly due to changing market conditions and periodic adjustments to some service offerings. Overall, the company’s total segment operating margin improved from 20.8% in the prior-year period to 21.2%, primarily driven by positive factors such as productivity gains, price realization, and favorable product mix. For example, optimized internal production processes and the introduction of advanced production management concepts have greatly enhanced production efficiency, effectively reducing the unit cost of products. This growth was partially offset, though, by higher compensation costs and adverse currency impacts.

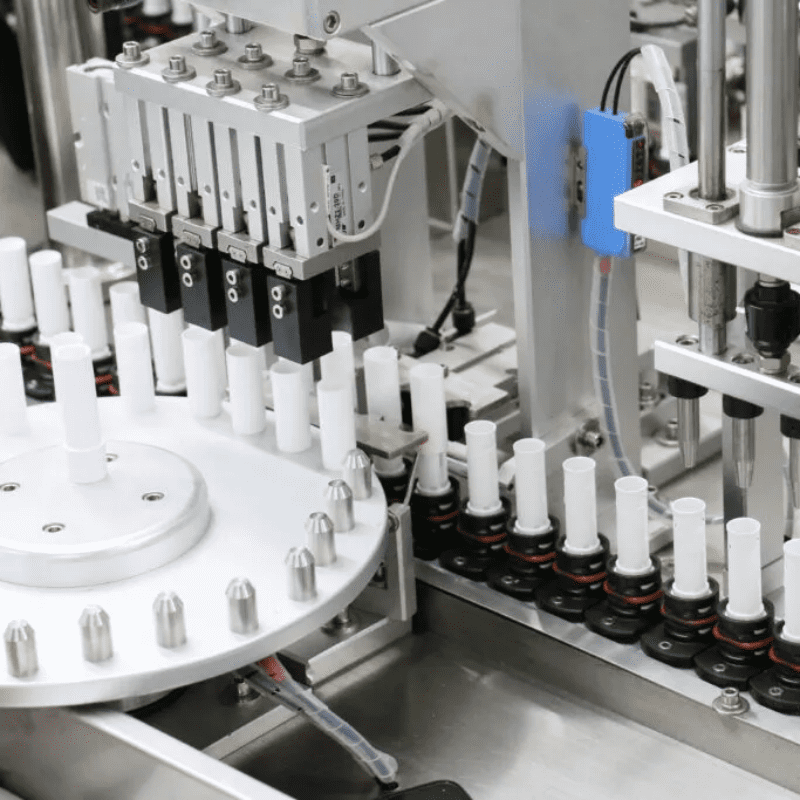

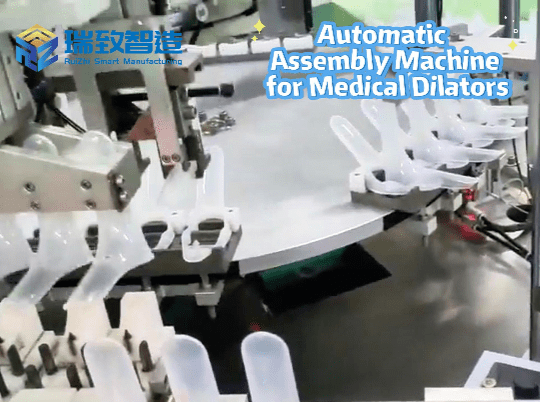

Application of Niche Automation Technologies: Automatic Buckle Feeding And Assembly

Notably, amid the ongoing innovation in industrial automation production processes, the importance of Automatische Schnallenzuführung und Montage technology has become increasingly prominent. Leveraging its profound technical expertise and rich project experience in automation, Rockwell Automation has made strides in applying this technology. In an automated production line upgrade project for a well-known home appliance manufacturer, it successfully integrated an advanced automatic buckle feeding and assembly system. This system can quickly and accurately complete automatic feeding and assembly of buckles for different product models, significantly improving production efficiency, reducing labor costs, and minimizing assembly errors caused by manual operations. It has helped enhance the client’s product quality, creating substantial value and reflecting Rockwell’s technical leadership in niche areas of industrial automation.

Updated Annual Guidance, Reflecting Confidence in Steady Development

Building on the strong Q3 performance and in-depth insights into market trends, the company has updated its fiscal year 2025 guidance. It now expects organic sales growth to range from -2% to 1%, with adjusted EPS between $9.80 and $10.20—up from the previous range of $9.20 to $10.20 and exceeding the consensus analyst estimate of $9.87. Additionally, annual recurring revenue grew 7% compared to the same period last year, and the company’s order-to-sales ratio was approximately 1.0, consistent with its normal historical range. These figures indicate that Rockwell Automation has a clear plan and strong control over its business development, demonstrating confidence and capability in maintaining steady growth amid a complex market environment.

What is the market price of a continuous motion multi-piece special-shaped machine?