Table of Contents

ToggleDespite minor setbacks, the Chinese automotive industry may come out as a winner in the tariff war

As the U.S. and China remain locked in a tariff war standoff, the global automotive industry stands at a crossroads—with observers noting that the era of unfettered globalization may be nearing its end. Yet, beneath the tension lies a paradox: while tariffs disrupt traditional trade flows, they could inadvertently accelerate the rise of China’s automotive sector, particularly through its strategic embrace of intelligent automation and industrial automation technologies.

Introduction: Tariffs as Catalysts for Structural Shifts

The U.S.-China tariff war has cast a shadow over global automotive trade. Direct exports of Chinese finished vehicles to the U.S.—a market historically dominated by American brands—face significant headwinds. Currently, Chinese vehicles account for just 1.7% of China’s total global exports and 0.6% of U.S. annual sales, according to Roland Foch, Managing Director of the North American Vehicle Trade Association (NAVTA). Most vehicles exported to the U.S. from China are actually produced by U.S. brands like GM and Ford, which operate factories there—a dynamic that mutes the immediate impact of tariffs on Chinese OEMs.

But the ripple effects are undeniable. As the U.S. and allies like Canada impose barriers, Chinese automakers are pivoting to markets where their competitive edge—rooted in cost efficiency, electric vehicle (EV) innovation, and automation equipment integration—holds sway.

The Strategic Edge: Automation as a Growth Engine

Chinese automotive firms have long invested in industrial automation to streamline production, with robotic assembly lines and precision manufacturing becoming staples in their factories. This infrastructure has not only reduced labor costs but also enabled rapid scaling of EV production—a sector where China now leads globally. For instance, BYD and SAIC rely on advanced automation equipment to churn out millions of EVs annually, leveraging robotics for battery assembly, quality control, and logistics.

Yet the true differentiator lies in intelligent automation. Chinese companies are increasingly embedding AI-driven systems into both manufacturing and vehicle design. For example:

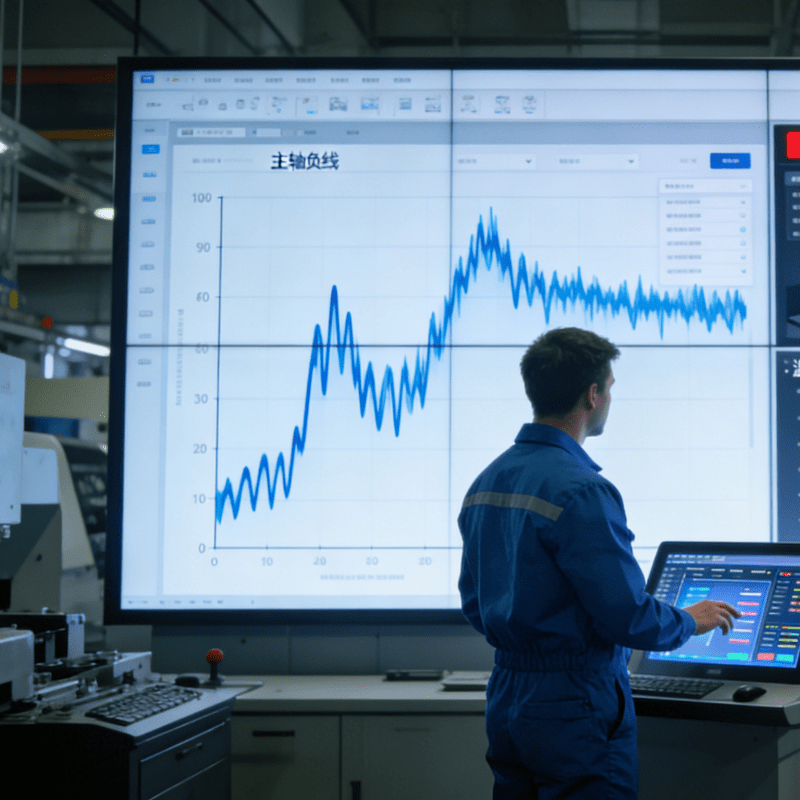

- Predictive Maintenance: AI algorithms monitor production lines in real time, reducing downtime and optimizing automation equipment

- Smart Supply Chains: Machine learning models forecast demand and manage inventory, allowing Chinese OEMs to adapt swiftly to global market shifts—including tariff-induced disruptions.

- Autonomous Vehicle Development: Companies like Baidu and XPeng are using AI to accelerate self-driving technology, positioning China as a leader in next-gen mobility.

Global Expansion Amid Tariff Headwinds

While North America remains a tough nut to crack, Chinese automakers are thriving elsewhere. In Europe, BYD has established factories in Hungary and Turkey, leveraging automation equipment to produce EVs at scale while complying with local sustainability standards. In Mexico, where tariffs are less restrictive, China exported 445,000 vehicles in 2024 (a 7% year-on-year increase), with models like the MG ZS gaining traction.

Crucially, intelligent automation allows Chinese firms to adapt to diverse regulatory landscapes. For example, in Africa, where demand for affordable vehicles is surging, Chinese automakers are deploying simplified, AI-optimized production lines to assemble badge-engineered cars tailored to local needs—all while keeping costs low.

Collateral Benefits: Weakened Competitors, Strengthened China

The tariff war has inadvertently weakened Chinese rivals. European automakers like Mercedes and Audi, burdened by U.S. tariffs, face squeezed profits and reduced R&D budgets—a handicap in the race for EV dominance. Meanwhile, Japanese and Korean brands, though partially shielded by U.S. manufacturing footprints, struggle to match China’s speed in adopting industrial automation and intelligent automation solutions.

“In many ways, the tariffs are a blessing in disguise,” notes Tyson Jominy of J.D. Power. “Chinese OEMs can now target markets where competitors are distracted by trade costs, using their automation-driven efficiency to undercut prices without sacrificing quality.”

Conclusion: A New Era of Automation-Driven Dominance

The tariff war may mark the end of globalization as we know it, but for China’s automotive industry, it could signal the dawn of a new era—one where intelligent automation and industrial automation define competitive success. By leveraging advanced automation equipment and AI-driven innovation, Chinese firms are not only weathering trade storms but also reshaping global supply chains, outpacing rivals in EV adoption, and securing footholds in emerging markets.

As Western automakers grapple with protectionism and electrification challenges, China’s strategic bet on automation could well make it the ultimate winner in this high-stakes tariff battle. The road ahead may be bumpy, but for Chinese OEMs, the future runs on algorithms, robotics, and the relentless drive to automate.