Table of Contents

ToggleWhere AI and Blockchain Converge: Intelligent Automation Redefines Business Through Industrial Integration

The intersection of artificial intelligence and blockchain is not just a technological pairing—it’s the crucible where intelligent automation meets industrial automation to forge a new era of autonomous commerce. For years, Ethereum’s smart contracts have anchored blockchain’s role in business, yet their “intelligence” remained rooted in rigid “if-then” logic. Today, that’s changing: as AI systems grow more sophisticated, they’re merging with blockchain’s trust architecture to transform static contracts into dynamic, predictive entities. This convergence is particularly evident in how automation equipment—from supply chain robotics to AI-driven inventory systems—now operates within blockchain networks, turning data into actionable intelligence at scale.

We’ve had smart contracts for a long time.

Ethereum, the OG smart contract blockchain, is more than a decade old, but the intelligence in smart contracts has always been rather rudimentary. If this, then that. It works and, when carefully deployed, has created a lot of value. But what has long passed for “smart” in assets and contracts in the world of blockchain cannot compare with the accelerating intelligence of artificial intelligence systems.

In the coming years, we can expect to see both ecosystems continue to mature and accelerate, but they are also going to cross-pollinate. And the result is going to be an era of very smart contracts, assets and data.

Let’s start with the intelligence that is rapidly spreading across the world of business.

We’re increasingly seeing that AI systems lack moats, and their performance can be dramatically improved over time in ever smaller computational footprints. This may not be great for AI model makers, but it is a bonanza for everyone else since it means that we can increasingly deploy intelligence to the most remote corners of the business ecosystem.

Supply chain operations are an excellent example of where deploying intelligence can supercharge performance. Historically, most replenishment planning in retail stores is formula-driven. As stock falls below a required minimum, orders are placed. These formulas control minimums, maximums and economic order quantities. Sophisticated users are able to push extra stock for major promotions and events. It’s basic stuff, but it scales up nicely since no retail chain can afford to have an inventory analyst work on each product every week in every location for a customized forecast and plan.

Now they can. Winter storm forecast? Order extra hot chocolate. Summer heatwave? Extra cold drinks. News of a flu epidemic? More cold medicine. Local supplier out? Source from another store. Now do that for 31,000 offerings every week — the average number of items stocked in a U.S. grocery store. Impossible today. Routine tomorrow.

Pervasive intelligence requires quality data and it’s all useless without the ability to action.

The tamper-proof and universally synchronized nature of blockchain data means that we can build good outcomes on reliable information. And the smart contracts that reside on chain can be given the authority to do things like autonomously restock product based on AI-developed market plans.

Autonomous commerce means that assets can be smart on their own, deciding how to maximize their value and return on investment. Information itself can know where it is most valuable — and ask to be paid for access. And all of this can be executed at scale and with low costs.

The payoff for this future is not hard to grasp: stores that rarely run out of stock, supply chains that don’t clog up, and contracts that always get the best price. Individually each one of these is valuable, and together they can have an impressive multiplier effect. It’s not just about avoiding running out of product; it’s also about not spending on expediting logistics or having overstock sales. Profits that used to get lost at the margin can now be kept, all without raising prices.

Getting to this future will not be quick or easy.

Economic research shows that though new technologies can become pervasive very quickly, average levels of utilization are not very sophisticated. Robert Solow famously remarked in 1987 that he could see evidence of computers everywhere in the economy except the productivity statistics. The same happened with electricity.

It takes a long time for most firms to absorb technology and transform themselves. Tyler Cowen, a professor of economics at George Mason University, has similarly speculated that like early computers and electricity, the overall productivity takeoff for artificial intelligence will be relatively slow as firms and people take time to truly understand how to use it.

What economists don’t spend much time talking about, however, is that you don’t have to be the average person or the average firm.

Even as some firms are struggling to absorb new technology, there is tremendous advantage to be had for the pioneers. Nor is it a short-lived advantage. Early leaders in e-commerce, cloud computing, desktop operating systems and mobile devices have held on to their market leading positions for decades.

The Pervasive Power of Orchestrated Intelligence

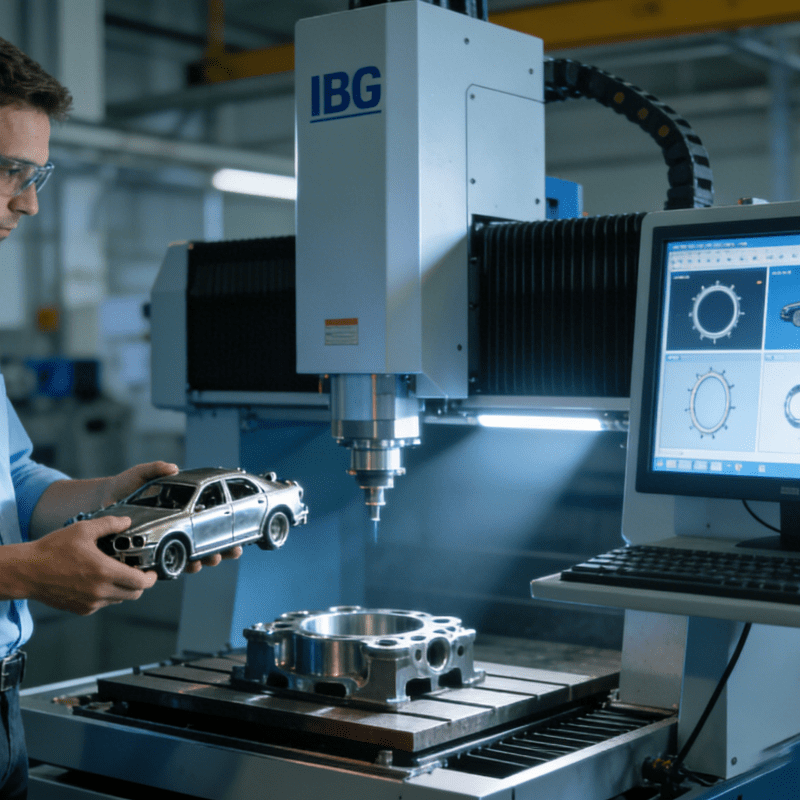

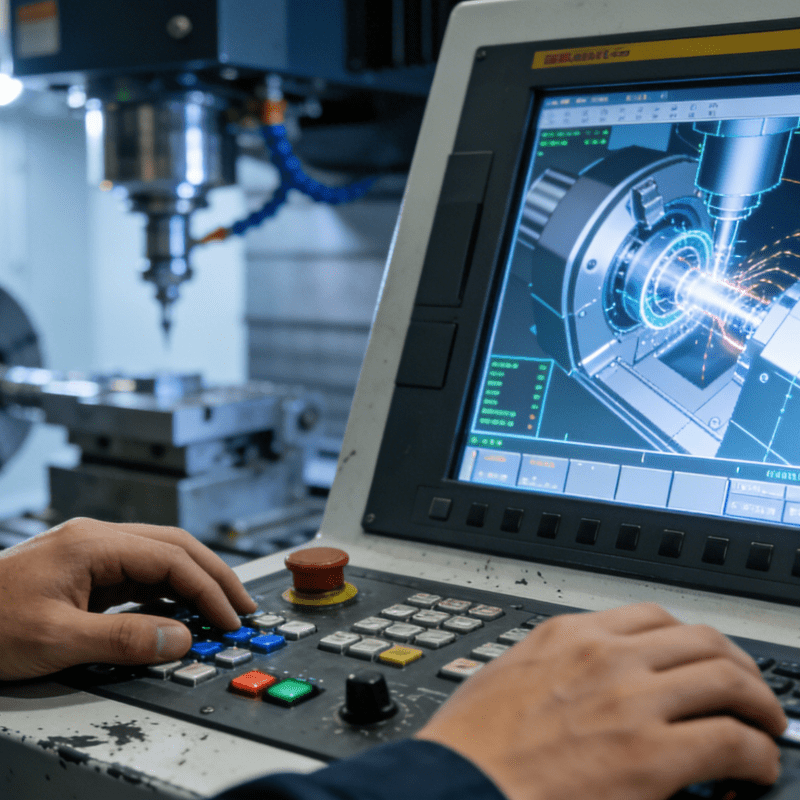

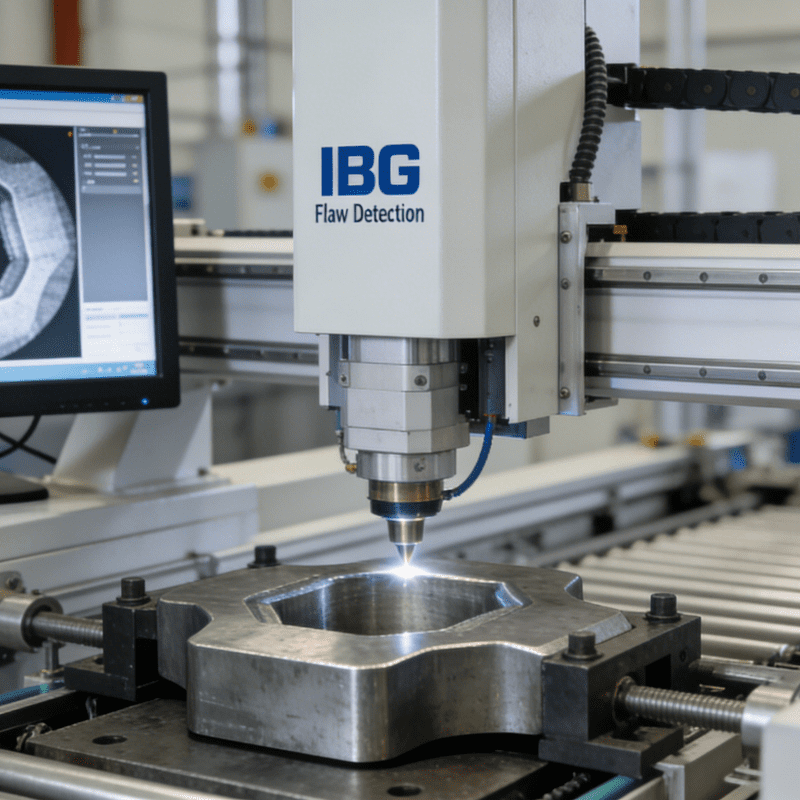

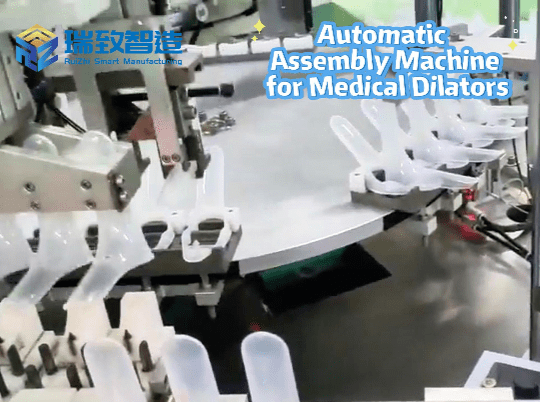

As AI and blockchain blend, the line between intelligent automation and industrial automation dissolves. Automation equipment—whether factory robots adjusting to real-time supply chain data or AI agents negotiating contracts on blockchain—becomes the physical manifestation of this union. The result? A future where:

- Intelligent automationdrives predictive restocking via AI, while blockchain ensures tamper-proof transaction records for industrial automation systems.

- Automation equipment in warehouses communicates directly with smart contracts, triggering orders based on AI-forecasted demand spikes—no human intervention needed.

Economists may debate the pace of adoption, but the pioneers are already reaping rewards. Early movers in e-commerce and cloud computing dominated markets for decades; similarly, those who integrate AI, blockchain, and automation equipment today will define the next industrial revolution. The era of truly smart contracts, assets, and data is upon us—not as a distant vision, but as a tangible reality shaped by those who see intelligent automation not as a tool, but as the backbone of digital transformation. The choice is clear: lead the convergence, or be left behind.